- Home

- »

- Specialty Polymers

- »

-

Agricultural Fumigants Market Size, Industry Report, 2030GVR Report cover

![Agricultural Fumigants Market Size, Share & Trends Report]()

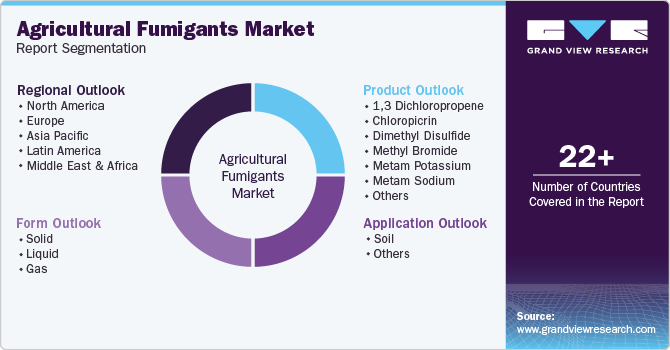

Agricultural Fumigants Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (1,3 Dichloropropene, Chloropicrin, Phosphine), By Application (Soil), By Form (Solid, Liquid, Gas), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-003-3

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Fumigants Market Summary

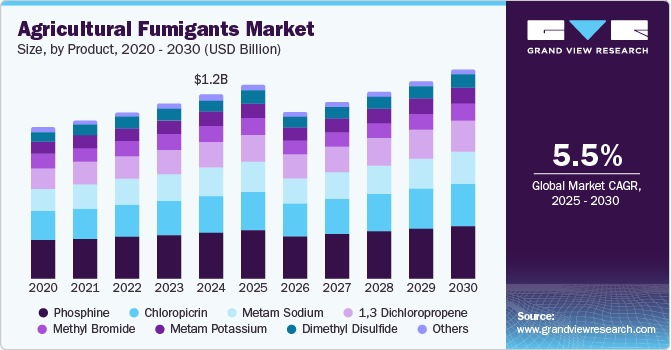

The global agricultural fumigants market size was estimated at USD 1.21 billion in 2024 and is projected to reach USD 1.65 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. Evolving requirements pertaining to crop protection techniques and post-harvest practices are driving the growth.

Key Market Trends & Insights

- The North America dominated the global market, with the largest revenue share of 31.2% in 2024.

- The U.S. dominated in North America and accounted for the largest revenue share in 2024.

- Based on product, phosphine segment dominated the market and accounted for the largest revenue share of 25.9% in 2024.

- Based on application, the soil segment held the largest revenue share of 75.1% in 2024.

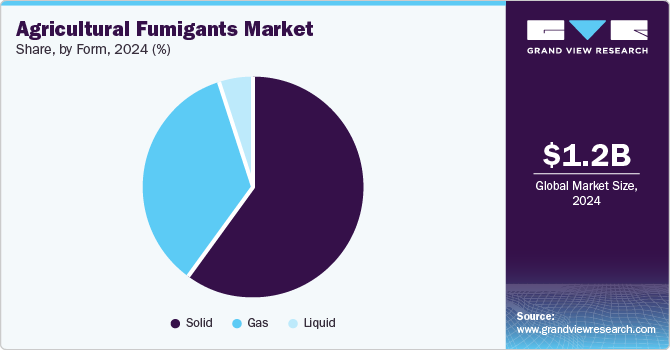

- Based on form, liquid segment dominated the market and accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.21 Billion

- 2030 Projected Market Size: USD 1.65 Billion

- CAGR (2025 to 2030): 5.5%

- North America: Largest market in 2024

- Middle East & Africa: Fastest growing market

Phosphine is the most dominant product, which is extensively used in closed warehouses to protect the harvested crops from insects and other pest attacks. They can diffuse easily and penetrate bulks of stored grains as well as actively perform fumigation activity for more than a week, post-application.

The post-harvest phase for a large number of cereals and grains has been gaining importance as the losses resulting from improper storage have been witnessing a significant rise. Every year, around 14% of food is lost between harvest and retail, with a significant amount also being discarded at the retail and consumer levels. According to the study, if only a quarter of the food that is lost or wasted was recovered, it would be sufficient to eradicate global hunger, which further gives rise to preventive measures such as agricultural fumigants.

Reducing the aforementioned losses may lower the pressure on the agriculture industry to meet the dietary requirements of a growing population. Moreover, it is also expected to reduce the exploitation of other sustainable natural resources. The problem is more pronounced in developing countries where farmers' access to proper storage information is limited, which results in increased crop losses in the post-harvest stage.

The increased demand for infrastructure has resulted in an encroachment of agricultural lands thus adding to the problem of food supply. The reduction in agricultural lands has exerted increased pressure on the existing natural resources. Earlier, there were two options to meet the growing food demand - increase the area under cultivation or boost the agricultural productivity. Although both these options seem feasible, the nature of the solution varies depending on the location of cultivation. Tackling the problem by increasing agricultural productivity is being perceived as the way to go ahead. In developing countries, educational programs are being conducted to keep farmers informed about the various practices globally that aid productivity. Fumigants are also used to prevent losses due to infestation.

Product Insights

Phosphine dominated the agricultural fumigants market and accounted for the largest revenue share of 25.9% in 2024. It is extensively used in closed warehouses to protect harvested crops from insects and other pest attacks. Phosphine can diffuse easily and penetrate bulks of stored grains, and it can actively perform fumigation activity for more than a week post-application. It is used for the disinfestation of legumes, cereal grains, dried fruits, durable food items, and processed foods.

The 1,3 dichloropropene segment is expected to grow at the fastest CAGR of 2.6% over the forecast period. 1,3-dichloropropene is an essential fumigant and is considered a feasible substitute for Bromomethane (MeBr). 1,3-dichloropropene contains lower vapor pressure and uh, higher degradation rates, and a higher level of sorption coefficients than bromomethane, which enables the compound to be more persistent in soil.

Application Insights

The soil segment held the largest revenue share of 75.1% in 2024. Soil fumigation is a technique of pre-plant treatment of soil using chemicals to control crop infections affected by nematodes, rodents, weeds, and insects. All fumigants that are applied to plants are phytotoxic; thus, they should dissipate from the soil before seeding or transplanting to avoid crop damage. The application to soil largely depends on a broad spectrum of factors, including crop type, soil type, crop texture, local moisture content, airspace, and temperature.

Agricultural fumigants are also used in other applications, mainly warehouses and transport ships. The type of warehouse and storage fumigation depends on the duration of storage, the covering of commodities, and the type of room. Most companies prefer methyl bromide fumigation, wherein the stored grains are supposed to be shipped quickly.

Form Insights

Agricultural fumigants in liquid form dominated the market and accounted for the largest revenue share in 2024. The liquid form includes soluble products used to eliminate molds, insects, and pests, among other things. They are sprayed over the desired land area using typical sprayers. This form of fumigation is usually considered the safest when performed in enclosed chambers or completely open outdoor areas. Liquid agricultural fumigants are used for pre-plant pest control in crops such as potatoes, tomatoes, strawberries, peppers, and carrots and in nurseries for fruit trees, nut trees, and grapevines. Global strawberry demand is rising, with the U.S., China, and Egypt being the top producers. In 2024, China produced 3,336,690 tons of strawberries and has held the top spot in production since 1994, according to FAO data.

The demand for gas agricultural fumigants is expected to grow at a significant CAGR over the forecast period. The gaseous form is typically applied in enclosed chambers, which also have a gas-proof covering to avoid gas leakage into the environment. It is also known as space fumigation and is carried out with precaution to restrict gaseous dispersion into the environment as it contains substances, such as methyl bromide, that cause ozone depletion. These effectively eliminate insects, nematodes, termites, and weeds.

Regional Insights

North America agricultural fumigants market dominated the global market, with the largest revenue share of 31.2% in 2024. Multiple conservancies in North America, such as The Nature Conservancy, are working with farmers to scientifically derive strategies for boosting the growth of agricultural products by reducing nutrient run-off by around 20% and simultaneously educating farmers about sustainable grazing methods. The USDA predicts that farmers will plant 94 million acres of corn in 2025, an increase of 3.4 million acres from 2024, which will further contribute to the growth of the agricultural fumigants industry.

U.S. Agricultural Fumigants Market Trends

The U.S. dominated the agricultural fumigants market in North America and accounted for the largest revenue share in 2024. In 2024, the U.S. planted 90.7 million acres of corn. Meanwhile, soybean planting rose by 3.5 million acres, reaching a total of 87.1 million acres in 2024. Furthermore, the corn crop is expected to reach a record 15.6 billion bushels, marking a 5% increase from 2024. The demand for methyl bromide in the country is generated majorly from the cultivation of corn, strawberries, and tomatoes. These chemicals are widely injected into the soil during strawberry production, as their residual leftovers are minimal.

Middle East & Africa Agricultural Fumigants Market Trends

The Middle East & African agricultural fumigants market is expected to grow at the fastest CAGR of 9.1% in terms of revenue over the forecast period. In Saudi Arabia, the agricultural sector accounted for 3.2% of the economy, whereas Egypt’s agricultural sector accounted for 15% in 2022. Key crops such as corn, lentils, chickpeas, rice, fruits, and vegetables are widely produced in Tunisia, Saudi Arabia, Egypt, Jordan, and Morocco. Agricultural production is vital for countries such as Tunisia, which focuses on grains and olive oil, driving demand for agricultural fumigants in the region.

The agricultural fumigants market in the UAE led the Middle East & Africa regional market with the largest revenue share in 2024. The UAE Ministry of Industry and Advanced Technology introduced the "National Emirates Sustainable Agriculture Label" in 2024 to promote adherence to sustainable practices in farming, agriculture, and related economic activities. This label ensures the use of eco-friendly resources, aligns with local and international standards, and helps open new export markets for sustainable agricultural products. It encourages farm owners to enhance efficiency, reduce waste, and optimize the use of resources, including water and energy, supporting environmentally responsible farming practices.

Asia Pacific Agricultural Fumigants Market Trends

Asia Pacific agricultural fumigants market accounted for a substantial market share in 2024. The demand for rice, maize, and wheat has quadrupled in the past decade, leading to increased consumption of fertilizers, fumigants, and pesticides for securing cultivated crops and safely storing the produce in warehouses. The region's central role in global grain production, particularly rice with a 90% share, underscores the increasing need for agricultural fumigants to boost productivity and ensure effective crop protection.

The agricultural fumigants market in China accounted for the largest revenue share in 2024. China represents 7% of the world's total agricultural land while feeding 22% of the global population. It is the leading producer of various crops, including cotton, rice, potatoes, and a wide range of vegetables. Since the introduction of the pilot policy for the resource utilization of agricultural wastes (RUAW) in 2016, China has focused on implementing policies and measures to manage agricultural waste, driving the demand for agricultural fumigants to address waste management challenges and improve crop productivity.

Key Agricultural Fumigants Company Insights

Some of the major agricultural fumigants industry players are Dow, Bayer AG, Arkema, and AMVAC Chemical Corporation. These companies stay competitive by investing in product innovation and focusing on eco-friendly and efficient solutions. They ensure compliance with global regulations, expand into emerging markets, and form strategic partnerships.

-

Dow specializes in manufacturing chemicals, materials science, and agricultural products. Dow provides agricultural fumigants used to protect crops from pests, diseases, and soil-borne pathogens. These chemicals help enhance crop yield and quality by ensuring healthier soil and preventing damage.

-

Bayer AG offers agricultural fumigants to protect crops from pests, diseases, and soil-borne threats. Its fumigant solutions enhance soil health, boost crop productivity, and support sustainable farming practices.

Key Agricultural Fumigants Companies:

The following are the leading companies in the agricultural fumigants market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Bayer AG

- Arkema

- AMVAC Chemical Corporation

- Syngenta

- LANXESS

- BASF

- Trinity Manufacturing, Inc.

- Arysta LifeScience Corporation

- Novozymes A/S, part of Novonesis Group

Recent Developments

-

In March 2025, Agmatix, an AI-powered agronomic solutions provider, partnered with BASF to develop a digital solution for detecting and predicting soybean cyst nematode (SCN) presence. Initiated through BASF’s AgroStart platform, the collaboration aims to equip soybean growers with real-time, scalable insights to reduce yield losses from SCN, one of the most harmful and often unseen pests in soybean cultivation.

-

In November 2024, Orbia Netafim and Bayer expanded their collaboration to provide digital farming solutions for fruit and vegetable growers. Their new platform, HortiView, simplifies data collection, enabling tailored recommendations for crop management and irrigation.

-

In April 2024, Draslovka a.s. consolidated its agricultural solutions into a standalone business under the INTRESO brand. This new entity will focus on expanding the market rollout of Draslovka's next-generation fumigants and biocides, offering environmentally sustainable alternatives such as Ethanedinitrile (EDN), BLUEFUME, and eFUME. INTRESO aims to partner with industry players to reduce emissions from fumigation.

Agricultural Fumigants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.26 billion

Revenue forecast in 2030

USD 1.65 billion

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, form, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; UAE

Key companies profiled

Dow; Bayer AG; Arkema; AMVAC Chemical Corporation; Syngenta; LANXESS; BASF; Trinity Manufacturing, Inc.; Arysta LifeScience Corporation; Novozymes A/S, part of Novonesis Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Fumigants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural fumigants market report based on product, application, form, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

1,3 Dichloropropene

-

Chloropicrin

-

Dimethyl Disulfide

-

Methyl Bromide

-

Metam Potassium

-

Metam Sodium

-

Phosphine

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Soil

-

Others

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

Gas

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global agricultural fumigants market size was estimated at USD 1.21 billion in 2024 and is expected to grow at CAGR of 5.5% from 2025 to 2030.

b. The global agricultural fumigants market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 1.65 billion by 2030

b. North America dominated the agricultural fumigants market with a share of over 30% in 2024. This is attributable to rising focus on sustainability and optimization of the yield.

b. Some key players operating in the agricultural fumigants market include Bayer CropScience AG; The Dow Chemical Company; Great Lakes Solutions; Arkema; AMVAC Chemical Corporation; Syngenta AG; Chemtura Corporation; BASF SE; Trinity Manufacturing, Inc.; Arysta LifeScience Limited; and Novozymes.

b. Key factors that are driving the market growth include ability of the prduct to reduce post-harvest losses, increasing focus on improving agricultural productivity, and increase in insect population due to climatic changes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.