- Home

- »

- Electronic & Electrical

- »

-

Air Cooler Market Size And Share, Industry Report, 2030GVR Report cover

![Air Cooler Market Size, Share & Trends Report]()

Air Cooler Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Tower Coolers, Desert Coolers, Others), By Application (Residential, Commercial), By Region (North America, Europe, Asia Pacific, Middle East And Africa), And Segment Forecasts

- Report ID: GVR-3-68038-187-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Cooler Market Summary

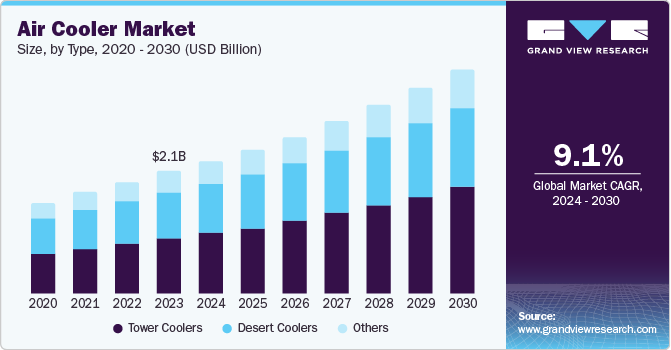

The global air cooler market size was valued at USD 2.14 billion in 2023 and is projected to reach USD 3.92 billion by 2030, growing at a CAGR of 9.1% from 2024 to 2030. The market expansion is driven by increasing demand for energy-efficient and cost-effective cooling solutions, especially in emerging economies facing rising temperatures and electricity costs.

Key Market Trends & Insights

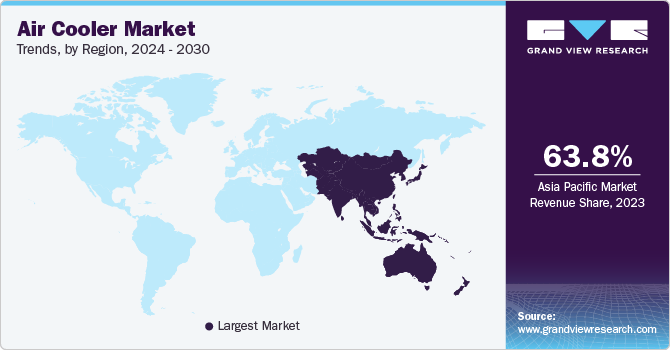

- Asia Pacific dominated the global market in 2023, accounting for 63.8% of revenue.

- North America is expected to register the fastest growth rate during the forecast period.

- By type, tower coolers held the largest share at 45.3% in 2023.

- By type, desert coolers are expected to exhibit the highest CAGR through 2030.

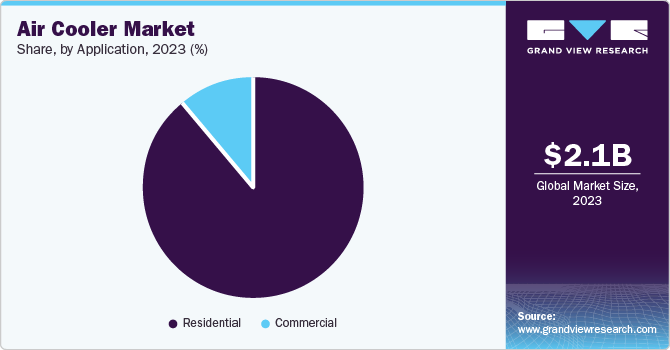

- By application, residential usage dominated the market and is projected to grow fastest over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2.14 Billion

- 2030 Projected Market Size: USD 3.92 Billion

- CAGR (2024–2030): 9.1%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

Air coolers, which operate on the principle of evaporative cooling, consume significantly less power compared to traditional air conditioners. This makes them an attractive option for consumers looking to reduce their electricity bills and minimize their carbon footprint.

In addition, compared to air conditioners that use refrigerants such as CFCs HCFCs, and hydrofluorocarbons which are harmful to the ozone layer, air coolers use water as a cooling agent, making them an eco-friendly option. This aligns with the growing global emphasis on reducing greenhouse gas emissions and adopting greener technologies. Additionally, air coolers do not dry out the air, maintaining indoor humidity levels, which is beneficial for health, especially in dry climates. They lower approximately 80% - 90% of the electricity bill as compared to ACs, thus making them economical and energy-efficient in the longer run.

Furthermore, the rising temperatures and increasing frequency of heatwaves across the globe have contributed to the surge in demand for air coolers. Regions experiencing extreme heat, such as parts of Asia, Africa, and the Middle East, have witnessed higher adoption rates of air coolers as they provide a cost-effective solution to combat heat. Moreover, the affordability of air coolers compared to air conditioners makes them accessible to a broader demographic, including the middle-class population in developing countries.

Additionally, manufacturers have increasingly focused on developing air coolers that are more efficient, aesthetically pleasing, and compact. Innovations such as remote-controlled operations, smart connectivity, and enhanced cooling pads have made air coolers more user-friendly and effective. The integration of IoT and smart home technologies allows users to control their air coolers remotely, adding convenience and improving the overall user experience. Moreover, easy installation and portability over AC have boosted the demand for air coolers. Air coolers cost 80% - 85% less than AC, which makes them more affordable and adaptable to the growing middle-class population across the globe.

Type Insights

Tower coolers dominated the market with a share of 45.3% in 2023. These coolers, known for their sleek and compact design, have gained significant popularity due to their space-saving nature and aesthetic appeal. Tower coolers are particularly favored in urban settings with limited space. Their vertical design allows them to fit into tight spaces, making them ideal for small apartments and offices. Such appliances consume less power compared to traditional air conditioners, which makes them a cost-effective option for consumers looking to reduce their electricity bills. Additionally, their portability and ease of installation make them a convenient choice for users who need flexible cooling solutions. The ability to move tower coolers from one room to another without much hassle adds to their appeal, especially in households and small businesses.

Desert coolers are projected to boost as the fastest-growing segment over the forecast period owing to their high cooling capacity and suitability for large spaces, particularly in regions with extremely hot and dry climates. The increasing demand for efficient and powerful cooling solutions in areas experiencing high temperatures has been a major market driver. Desert coolers are designed to provide effective cooling in large rooms and open spaces, making them ideal for residential and commercial applications. Additionally, these coolers use water as a cooling agent, which is more environmentally friendly compared to the refrigerants used in air conditioners.

Application Insights

Residential application secured the dominant market share in 2023 and is projected to witness the fastest growth over the forecast period. The rising global temperatures and the increasing frequency of heatwaves have contributed to the surge in demand for residential air coolers. As climate change continues to impact weather patterns, more households have increasingly sought effective cooling solutions to maintain comfortable indoor environments. Air coolers, which use water as a cooling agent, provide a more sustainable and eco-friendly alternative to air conditioners that rely on harmful refrigerants. Additionally, Rising income among the rural population has increased the adoption of air coolers as they are more economical and consume less power.

The commercial segment is expected to emerge at a CAGR of 6.3% over the forecast period owing to the increasing demand for energy-efficient cooling systems. Air coolers consume significantly less power compared to traditional air conditioners, which makes them an attractive option for businesses looking to reduce operational costs. This is particularly important in commercial spaces such as offices, factories, and retail stores where cooling needs are substantial and continuous. Moreover, modern air coolers equipped with features such as remote control operation, smart connectivity, and advanced cooling pads, have been increasingly adopted for their efficiency and user experience.

Regional Insights

The Asia Pacific air coolers market accounted for the dominant market share of 63.8% in 2023 and is projected to retain its dominance over the forecast period. The rising temperatures and increasing frequency of heat waves in APAC have heightened the need for effective cooling solutions. Countries such as India, China, and Australia have experienced record-breaking temperatures, leading to a surge in demand for air coolers as individuals and businesses seek relief from excessive heat. This trend is particularly pronounced in Southeast Asian countries, where high humidity levels further exacerbate the need for efficient cooling.

U.S. Air Coolers Market Trends

The U.S. air coolers market is expected to be driven by technological advancements and product innovations over the forecast period. Manufacturers have increasingly focused on developing air coolers with advanced features such as remote control operation, smart connectivity, and enhanced cooling pads. These innovations improve the efficiency of air coolers and make them more user-friendly and appealing to tech-savvy consumers. In addition, rising disposable incomes have significantly contributed to the market growth.

Key Air Cooler Company Insights

The global air coolers market is highly competitive. Key players including Symphony Limited, Bajaj Electricals Limited, Havels India Limited, and others have strategized to expand globally by entering into niche markets through mergers and acquisitions and joint ventures. They have increasingly focused on R&D efforts to improve air cooler usability and affordability.

-

Symphony Limited is an Indian multinational company specializing in the manufacturing of air coolers. It is renowned for its innovative and energy-efficient products, which cater to residential and industrial needs. Symphony’s product portfolio includes a wide range of air coolers designed to provide optimal cooling performance while minimizing energy consumption.

Key Air Cooler Companies:

The following are the leading companies in the air cooler market. These companies collectively hold the largest market share and dictate industry trends.

- Symphony

- Bajaj Electricals India

- Havells India Ltd

- Honeywell International Inc.

- Seeley International

- Fujian Jinghui Environmental Technology Co., Ltd.

- De’ Longhi Appliances S.r.l.

- NewAir

Recent Developments

-

In April 2023, Voltas launched a new range of FreshAir Coolers. These coolers come packed with features such as a smart controller for optimal humidity levels, 4-sided padding for superior cooling, a mosquito repellent, a 7-hour timer for unhindered sleep, and energy-efficient operation with turbo air cooling.

Air Cooler Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.33 billion

Revenue forecast in 2030

USD 3.92 billion

Growth Rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., UK, Germany, China, India, Brazil, Nigeria

Key companies profiled

Symphony; Bajaj Electricals India; Havells India Ltd; Honeywell International Inc.; Seeley International; Fujian Jinghui Environmental Technology Co., Ltd.; De’ Longhi Appliances S.r.l.; NewAir

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

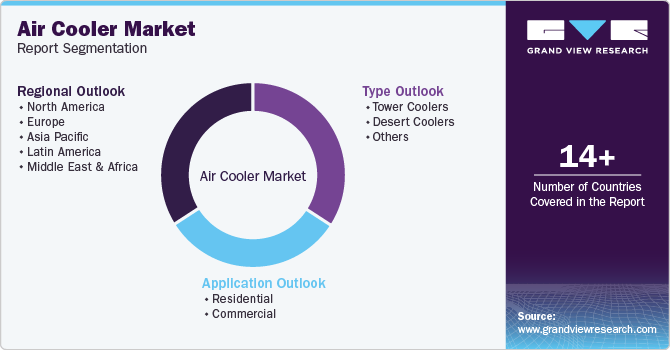

Global Air Cooler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air cooler market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tower Coolers

-

Desert Coolers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Nigeria

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.