- Home

- »

- Electronic Security

- »

-

Airborne Radars Market Size & Share, Industry Report, 2030GVR Report cover

![Airborne Radars Market Size, Share & Trends Report]()

Airborne Radars Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Antennas, Receivers), By Mode, By Dimension, By Range, By Frequency Band, By Installation Type, By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-271-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Airborne Radars Market Size & Trends

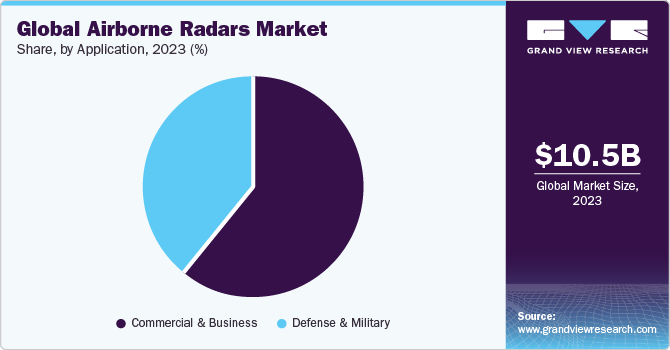

The global airborne radars market size was estimated at USD 10.54 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030. The proliferation of unmanned aerial vehicles (UAVs) and the integration of radar systems on these platforms drive market growth. UAVs equipped with radar systems play crucial roles in surveillance, reconnaissance, border patrol, and other applications. The demand for compact, lightweight, and efficient radar solutions suitable for UAVs drives innovation in the global market, meeting the requirements of unmanned aerial systems across military, civil, and commercial sectors.

Increasing investments in defense and aerospace modernization programs globally contribute to market growth. Governments and defense organizations allocate budgets for upgrading their airborne platforms with state-of-the-art radar systems to maintain a technological edge and ensure national security. The continuous development and procurement of new manned and unmanned aircraft propel the demand for advanced airborne radar systems, fostering market expansion.

In February 2024, The Defence Acquisition Council (DAC) has greenlit contracts valued at around Rs 84,560 crore (USD 10.18 billion) to strengthen India's defense capabilities and infrastructure. The sanctioned acquisitions encompass various essentials, including weaponry, armored vehicles, advanced communication systems, and essential surveillance equipment. In addition, the DAC has acquired the Air Defence Tactical Control Radar under the Buy (Indian-IDDM) category. This strategic move aims to strengthen air defense systems, particularly in identifying slow, small, and low-flying targets. The radar system is expected to play a pivotal role in surveillance, detecting, and tracking various targets, enhancing the overall security apparatus.

Growing demand for advanced surveillance and reconnaissance capabilities is driving the market growth. Modern airborne radar systems play a crucial role in providing real-time situational awareness, detecting and tracking targets, and conducting intelligence, surveillance, and reconnaissance (ISR) missions. The increasing need for effective monitoring across diverse environments, including land, air, and maritime domains, drives the demand for airborne radar systems that offer enhanced detection, imaging, and target identification capabilities.

Increasing global security threats drive market growth. Airborne radar systems, with advanced features such as electronic scanning, multi-mode operation, and target discrimination, are essential for military forces and defense organizations. Their ability to provide early warning, track multiple targets simultaneously, and operate in complex electronic warfare environments addresses the evolving threat scenarios.

The increasing utilization of airborne radar for civilian and commercial applications also propels market growth. Beyond military use, airborne radar finds applications in areas such as weather monitoring, disaster management, and environmental monitoring. The versatility of airborne radar systems to provide valuable data for various non-military purposes drives adoption in civil aviation, meteorology, and scientific research, expanding the market beyond defense applications.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. Global efforts toward border security and maritime surveillance contribute to the demand for airborne radar systems. Coastal and border surveillance applications necessitate radar systems monitoring vast areas for potential threats, including illegal activities and intrusions. With its ability to cover large expanses and detect low-profile targets, airborne radar plays a crucial role in supporting these surveillance efforts.

The industry is fragmented, featuring several global and regional players. The market players are investing in research and development (R&D) to develop advanced solutions and gain a competitive edge in the market. Moreover, they are entering into partnerships, mergers, and acquisitions as the market is characterized by innovation, disruption, and rapid change.

In February 2023, HENSOLDT launched an airborne multi-mission surveillance radar called PrecISR 1000, designed to enhance the military's situational awareness and response capabilities. The radar is recognized for its software-defined technology, providing functionalities such as ISAR, Air-to-Air, Maritime Search, and Ground Moving Target Indicator/Surface moving target indication modes. The radar has various features, including a GaN-based active electronically scanned array antenna, multichannel processing, and an optimized compact and light design, ensuring minimal power consumption.

Government initiatives and investments are influencing the market growth. Governments across the globe have implemented strategies to encourage research and innovation in airborne radar development, often involving funding, collaborations, and regulatory frameworks that foster partnerships between government bodies, industry, and academia.

In July 2023, The National Science Foundation granted funding of USD 91.8 million for developing a next-generation airborne radar by the National Center for Atmospheric Research, with contributions from CSU towards its research and development. The airborne phased array radar (APAR) aims to enhance current radar capabilities, enabling scientists to sample the atmosphere with higher spatial resolution and deeper penetration into storms. The comprehensive data generated by APAR will provide forecasters with crucial information to improve predictions of various high-impact climate circumstances, including cyclones, atmospheric rivers, tornadoes, and derechos.

Component Insights

Based on components, the antennas segment led the market with the largest revenue share of 23.2% in 2023 and is expected to continue to dominate the industry over the forecast period. The advent of phased-array antennas and electronically scanned arrays (ESAs) contributed significantly to the enhanced performance of airborne radar systems. Phased-array antennas enable rapid and precise beam steering, allowing for quick target acquisition and tracking.

The demand for multi-function antennas (MFAs) is driving market growth. MFAs can perform various functions simultaneously, including surveillance, tracking, and communication. The integration of advanced MFAs enhances the versatility of airborne radar systems, allowing them to be applied in the military and defense.

The graphical user interfaces (GUI) segment is anticipated to witness at the fastest CAGR during the forecast period. The segment growth can be attributed to the need for increased situational awareness. Modern airborne radar systems generate vast datasets with information about air and ground targets, environmental conditions, and electronic warfare threats. The GUI segment addresses the challenge of presenting this information in an understandable format, enabling operators to make informed decisions rapidly. Intuitive graphical representations and interactive features facilitate quick data assimilation, contributing to heightened situational awareness for military, defense, and surveillance applications.

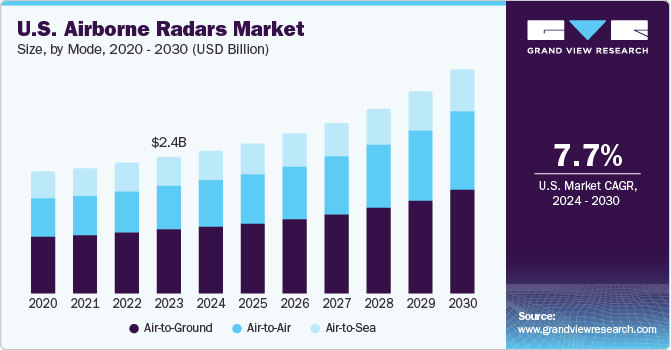

Mode Insights

Based on mode, the air-to-ground segment held the market with the largest revenue share of 46.2% in 2023. Increasing demand for integrated multi-role aircraft further propels the air-to-ground segment. Modern military aircraft are often equipped with versatile radar systems capable of performing various functions, including air-to-ground missions. This multi-role capability enables military forces to optimize their aerial assets, providing flexibility and adaptability in different operational scenarios. The versatility of air-to-ground radar systems is essential in the procurement decisions of defense organizations, supporting the overall market growth.

The air-to-air segment is expected to witness at the fastest CAGR during the forecast period. The increasing emphasis on fifth-generation fighter aircraft further propels the air-to-air segment. Modern fighter jets, including fifth-generation platforms, are equipped with advanced radar systems that offer superior performance in terms of range, stealth detection, and target engagement. The integration of highly capable air-to-air radar systems is a critical factor in the overall effectiveness of these advanced fighter aircraft, supporting their role in air dominance and ensuring the success of air-to-air missions.

Dimension Insights

Based on dimension, the 2D segment led the market with the largest revenue share of 55.2% in 2023. The civilian sector benefits from 2D radar technology in air traffic control (ATC) and maritime surveillance. In air traffic control, 2D radar systems are employed to monitor the movement of aircraft, ensuring safe and efficient air travel. Similarly, these radar systems in maritime applications help monitor vessel movements, enhance navigation safety, and support search and rescue operations. The adaptability of 2D radar meets the diverse surveillance needs of military and civilian users.

The 3D segment is expected to witness at the fastest CAGR during the forecast period. The military sector relies heavily on 3D radar technology for air defense, early warning, and target tracking applications. 3D radar systems provide a more comprehensive understanding of the airspace by accurately determining the altitude of detected targets. This capability is crucial for identifying and tracking aircraft, drones, and missiles, particularly in scenarios where threats may approach from different altitudes. The ability to operate in three dimensions enhances the effectiveness of military operations, ensuring timely and precise responses to potential threats.

Range Insights

Based on range, the long-range segment held the market with the largest revenue share of 31.2% in 2023. The growing need for early warning and monitoring in the face of emerging security challenges also influences the demand for long-range radar systems. Detecting and tracking potential threats from a considerable distance allows military and security forces to respond proactively, contributing to overall defense and security strategies.

The medium-range segment is anticipated to grow at the fastest CAGR during the forecast period. Medium-range radar systems are designed to provide adequate surveillance capabilities within a moderate range, making them versatile for various military and civilian applications. These radar systems play a crucial role in scenarios requiring a combination of coverage and detailed target information. The medium-range airborne radar balances long-range detection and close-proximity target resolution, catering to diverse operational needs.

Frequency Band Insights

Based on the frequency band, the X-band segment led the market with the largest revenue share of 19.3% in 2023. The X-band's advantages in weather penetration further enhance its significance. The X-band is less affected by adverse weather conditions, including rain and atmospheric interference, than lower-frequency radar bands. This weather penetration capability makes X-band radar systems reliable in various environmental conditions, ensuring consistent performance and operational effectiveness during adverse weather situations. This aspect is particularly crucial for military and civilian applications, where the ability to operate in challenging weather environments is paramount.

The multi-band airborne radar is expected to witness at the fastest CAGR during the forecast period. Improved resistance to electronic countermeasures (ECM) is driving the adoption of multi-band radar systems. These radar systems exhibit increased resilience against electronic warfare tactics, such as simultaneously jamming and spoofing using multiple bands. This resistance ensures that the radar remains effective in the face of evolving electronic threats, contributing to the overall survivability of airborne platforms. Moreover, image synthesis is also being used to develop more realistic and immersive virtual worlds for entertainment and gaming purposes.

Installation Type Insights

Based on installation type, the retrofit segment held the market in 2023 with the largest revenue share of 67.2%. Cybersecurity enhancements are becoming increasingly important in the retrofit segment. As digital connectivity and data-sharing capabilities become integral to modern radar systems, retrofitting allows for incorporating robust cybersecurity features. Upgraded radar systems can be equipped with advanced cybersecurity measures to protect against cyber threats, ensuring the integrity and confidentiality of critical mission data.

The new installation segment is expected to witness at the fastest CAGR during the forecast period. Government initiatives and defense modernization programs contribute to the new installation segment by fostering the adoption of advanced radar systems across military aircraft fleets. Governments and defense agencies worldwide are investing in upgrading their airborne capabilities to address emerging threats and challenges. These initiatives involve acquiring new aircraft or modernizing existing fleets, creating opportunities for installing state-of-the-art radar systems that align with the objectives of enhanced situational awareness, target identification, and overall mission success. For instance, in August 2023, Brazil announced an investment of 52.8 billion reals (USD 10.6 billion) towards military initiatives, encompassing research, development, and equipment acquisition. It includes a significant expansion of the Gripen fighter fleet, with plans to nearly double its current size. The government aims to invest 27.8 billion reals by 2026, followed by an additional 25 billion reals in subsequent periods. The investment plan involves producing and procuring 34 F-39 Gripen fighters for Brazilian air forces, resulting in a substantial increase in the country's fighter aircraft fleet.

Technology Insights

Based on technology, the active electronically scanned array (AESA) segment led the market with the largest revenue share of 24.4% in 2023. The military sector benefits significantly from AESA radar technology, especially in air-to-air and air-to-ground operations. AESA radars contribute to enhanced detection, identification, and engagement of targets, providing a decisive advantage in combat scenarios. The ability to operate with high precision and immunity to jamming makes AESA radar systems indispensable for modern military aircraft and missile defense platforms.

The digital beamforming segment is expected to witness at the fastest CAGR during the forecast period. The rise of network-centric warfare and the need for interoperability between different defense systems influence the adoption of digital beamforming technology. The ability of digital beamforming radar systems to seamlessly integrate into broader command and control networks enhances collaborative efforts among various defense assets. This interoperability is crucial for achieving a unified defense and surveillance approach.

Application Insights

Based on application, the commercial and business segment led the market with the largest revenue share of 61.3% in 2023. Another significant driver is integrating radar technology in unmanned aerial vehicles (UAVs) for commercial and business applications. UAVs are increasingly utilized for aerial surveillance, mapping, and cargo delivery tasks. Airborne radar systems enhance the capabilities of UAVs by providing obstacle detection, collision avoidance, and terrain mapping, enabling safe and efficient autonomous operations. The growth of the UAV market in industries such as agriculture, infrastructure inspection, and logistics amplifies the demand for radar systems tailored to the specific needs of commercial and business applications.

The defense and military segment is expected to witness at the fastest CAGR during the forecast period. Global geopolitical dynamics and new security challenges contribute significantly to the demand for advanced radar systems in the defense and military segment. Nations are investing in sophisticated airborne radar technologies to strengthen their defense capabilities, particularly in response to regional conflicts, geopolitical tensions, and the evolving nature of modern warfare. The need for robust radar systems operating in complex and contested environments is paramount, driving continuous research and development efforts.

Regional Insights

North America dominated the airborne radars market with a revenue share of 32.8% in 2023 and is projected to grow at the fastest CAGR over the forecast period. The growing demand for intelligence, surveillance, reconnaissance (ISR), and border surveillance capabilities contributes to the momentum of the market growth in North America. The need to monitor vast territorial borders, coastal areas, and maritime domains prompts investments in radar systems that offer long-range detection, tracking, and identification capabilities. This requirement addresses security challenges, including illicit trafficking, smuggling, and unauthorized border crossings.

U.S. Airborne Radars Market Trends

The airborne radars market in the U.S. accounted for a revenue share of nearly 23% in 2023 and is expected to grow at a significant CAGR over the forecast period. The U.S. military's focus on achieving multi-domain dominance further propels the demand for advanced airborne radar systems. These radar systems contribute to integrated air and missile defense, providing comprehensive situational awareness across land, air, sea, and space domains. The pursuit of interoperable and network-centric capabilities strengthens the role of airborne radar as a force multiplier, supporting joint military operations and enhancing the effectiveness of U.S. defense forces.

Asia Pacific Airborne Radars Market Trends

The airborne radars market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. The modernization and expansion of military capabilities among several countries in the Asia-Pacific contribute to the rising demand for advanced airborne radar systems. Nations are investing heavily in upgrading their defense infrastructure, explicitly focusing on acquiring state-of-the-art technologies to maintain a competitive edge.

The China airborne radars market dominated the Asia Pacific region in 2023. The integration of airborne radar into China's broader military strategy, including developing sophisticated fighter aircraft and naval vessels, further drives the demand for advanced radar systems.

The airborne radars market in India is expected to grow at a significant CAGR over the forecast period. The persistent focus on border security and the need for continuous monitoring along India's extensive land and maritime borders further fuel the demand for advanced airborne radar systems.

Middle East & Africa Airborne Radars Market Trends

The airborne radars market in Middle East & Africa is expected to grow at a significant CAGR over the forecast period. Climate change and natural disasters have become additional drivers influencing market growth in the MEA region, which is prone to natural disasters such as floods, earthquakes, and droughts. Airborne radar systems equipped with synthetic aperture radar (SAR) and ground-penetrating capabilities are crucial for disaster management and relief efforts.

The Saudi Arabia airborne radars market dominated the Middle East & Africa region in 2023. Saudi Arabia's engagement in the market is influenced by its participation in coalition operations and the increasing role of technology in modern warfare.

Key Airborne Radars Company Insights

Some of the key players operating in the global market include Lockheed Martin Corporation; Thales, Leonardo S.p.A.; and Hensoldt.

-

Lockheed Martin Corporation is a global aerospace and defense company. Lockheed Martin has expertise in developing advanced radar systems for military aircraft, helicopters, and unmanned aerial vehicles (UAVs). The company has various products in its airborne radar portfolio, such as the AN/APG-81 active electronically scanned array (AESA) radar. The company provides radar solutions for multiple platforms, including airborne early warning and control (AEW&C) aircraft, maritime patrol aircraft, and helicopter systems. For example, the AN/APS-147 Multi-Mode Radar is utilized on maritime patrol aircraft for anti-submarine warfare and surface surveillance applications

-

Leonardo S.p.A. is an Italian multinational aerospace, defense, and security company. Their portfolio includes various radar systems, such as surveillance radars, fire control radars, and weather radars. The company consistently invests in research and development to pioneer cutting-edge technologies in airborne radar systems. By emphasizing the development of advanced radar solutions, such as AESA technology, Leonardo aims to provide its customers with state-of-the-art capabilities, including enhanced target detection, tracking accuracy, and resistance to electronic warfare

OPTIMARE Systems GmbH and Echodyne Corp. are some of the other market participants in the global market.

-

OPTIMARE Systems GmbH is a German company specializing in developing and manufacturing airborne and maritime surveillance solutions, including airborne radar systems. OPTIMARE's airborne radar solutions are designed to be modular and customizable, allowing for easy integration into various platforms such as aircraft, UAVs, or maritime surveillance systems. This adaptability ensures that OPTIMARE can cater to a wide range of applications and operational scenarios

-

Echodyne Corp. is a technology company focusing on creating advanced radar solutions. Its contributions in the market revolve around providing compact, lightweight, and high-performance radar systems suitable for integration into unmanned aerial vehicles (UAVs), drones, and other airborne platforms. These systems are designed to deliver improved situational awareness, object detection, and tracking in complex and dynamic environments. Echodyne has significantly contributed to the transformation of radar technology, particularly in small and lightweight radar systems suitable for airborne platforms

Key Airborne Radars Companies:

The following are the leading companies in the airborne radars market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- Thales

- Leonardo S.p.A.

- Hensoldt

- Honeywell Aerospace

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- Israel Aerospace Industries

- Indra

- Telephonics Corporation

- OPTIMARE Systems GmbH

- Echodyne Corp.

Recent Developments

-

In January 2024, Lockheed Martin Corporation and Northrop Grumman collaborated to supply the U.S. Navy's E-2D Advanced Hawkeye with the 75th APY-9 radar. The latest iteration of the Advanced Hawkeye is equipped with Lockheed Martin's APY-9 radar system. The E-2, manufactured by Northrop Grumman, demonstrates exceptional proficiency in monitoring air, land, and sea simultaneously

-

In January 2024, The Ministry of National Defence Republic of Lithuania signed a contract with the Dutch Command Materiel and IT (COMMIT) agency to acquire Thales Ground Master 200 Multi-Mission Compact radars. In collaboration with Lithuanian partner ELSIS, Thales will be supported in the project, specifically focusing on integrating the radar system into vehicles. The compact radars boast the capability of simultaneous and precise detection, tracking, and classification of current and emerging dangers, including drones.

-

In June 2023, Hanwha Systems Co. partnered with Leonardo SpA to co-develop an active electronically scanned array (AESA) radar designed explicitly for light fighter jets. This collaboration signifies Hanwha Systems' strategic initiative to jointly create AESA radar systems for fighter aircraft in conjunction with Leonardo. The AESA radar, a pivotal component for next-generation combat aircraft, is critical in detecting and tracking airborne and ground targets

Airborne Radars Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.25 billion

Revenue forecast in 2030

USD 19.43 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, mode, dimension, range, frequency band, installation type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Lockheed Martin Corporation; Thales; Leonardo S.p.A..; Honeywell Aerospace; L3Harris Technologies, Inc.; Elbit Systems Ltd.; Israel Aerospace Industries; Indra; Telephonics Corporation; OPTIMARE Systems GmbH; Echodyne Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Airborne Radars Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global airborne radars market research report based on the component, mode, dimension, range, frequency band, installation type, technology, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Antennas

-

Receivers

-

Processors

-

Transmitters

-

Graphical User Interfaces

-

Stabilization Systems

-

Others

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Air-to-Ground

-

Air-to-Air

-

Air-to-Sea

-

-

Dimension Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

4D

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Long Range

-

Medium Range

-

Short Range

-

Very Short Range

-

-

Frequency Band Outlook (Revenue, USD Million, 2018 - 2030)

-

X-band

-

C-band

-

KU-band

-

S-band

-

HF/VHF/UHF

-

KA-band

-

Multi-band

-

L-band

-

-

Installation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installation

-

Retrofit

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Active Electronically Scanned Array

-

Software-Defined Radar

-

Synthetic Aperture Radar

-

Digital Beamforming

-

Multistatic Radar Systems

-

Low Probability of Intercept

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense and Military

-

Combat Aircraft

-

Special Mission

-

Transport Aircraft

-

Helicopters

-

Unmanned Aerial Vehicles (UAVs)

-

Aerostats

-

-

Commercial and Business

-

Narrow Body Aircraft

-

Wide Body Aircraft

-

Jets

-

Helicopters

-

Urban Air Mobility (UAM)

-

Aerostats

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global airborne radars market size was estimated at USD 10.54 billion in 2023 and is expected to reach USD 11.25 billion in 2024.

b. The global airborne radars market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 19.43 billion by 2030.

b. North America dominated the market with a revenue share of 32.8% in 2023 and is projected to grow over the forecast period. The growing demand for intelligence, surveillance, reconnaissance (ISR), and border surveillance capabilities contributes to the momentum of the airborne radar market in North America.

b. Some key players operating in the airborne radars market include Lockheed Martin Corporation; Thales; Leonardo S.p.A..; Honeywell Aerospace; L3Harris Technologies, Inc.; Elbit Systems Ltd.; Israel Aerospace Industries; Indra; Telephonics Corporation; OPTIMARE Systems GmbH and Echodyne Corp.

b. Factors such as increasing global security threats and the expanding commercial aviation sector and rising air travel demands are driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.