- Home

- »

- Automotive & Transportation

- »

-

Aircraft Seat Actuation Systems Market, Industry Report 2030GVR Report cover

![Aircraft Seat Actuation Systems Market Size, Share & Trends Report]()

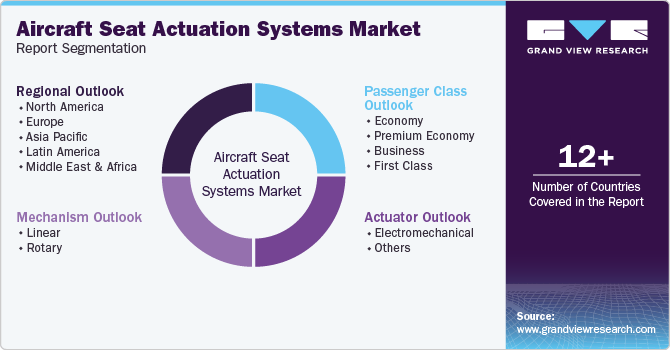

Aircraft Seat Actuation Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Passenger Class (Economy, Premium Economy, Business, First Class), By Mechanism, By Actuator, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-049-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Seat Actuation Systems Market Summary

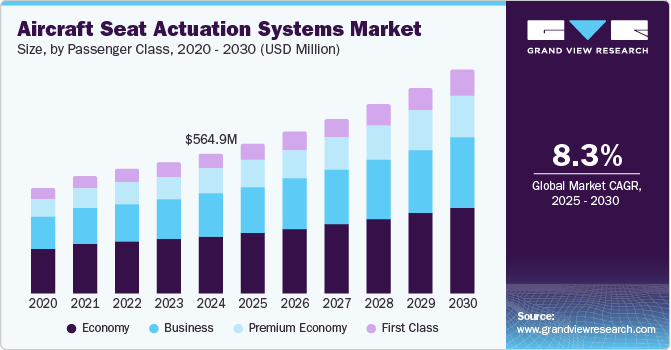

The global aircraft seat actuation systems market size was valued at USD 564.9 million in 2024 and is projected to reach USD 902.9 million by 2030, growing at a CAGR of 8.3% from 2025 to 2030. These systems are crucial for controlling seat movements in both commercial and private aircraft, offering features such as reclining, lumbar support adjustment, and seat track movement.

Key Market Trends & Insights

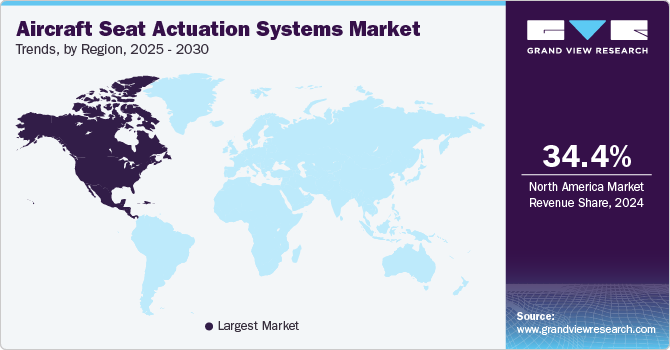

- North America accounted for the largest global revenue share of 34.4% in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- By passenger class, the economy segment accounted for the highest revenue share of 41.1% in 2024.

- By actuator, the electromechanical segment accounted for a dominant revenue share in the global market in 2024.

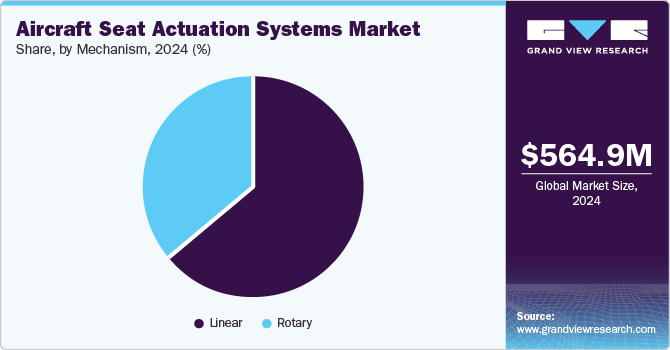

- By mechanism, the linear segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 564.9 Million

- 2030 Projected Market Size: USD 902.9 Million

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The continued growth in air travel globally due to its high safety and reliability, along with rising disposable income levels, has generated a substantial demand for improving flyer comfort. Moreover, as airlines introduce more premium cabins for customers, the need for sophisticated seat actuation systems increases to offer full recline capabilities, sleep modes, and other luxury features.

The adoption and implementation of several technological advancements have created several growth avenues for companies developing actuation systems. The shift toward electric and digital technologies in aircraft seating, including wireless control systems and smart seats, is driving demand for more advanced, lighter, and energy-efficient solutions. Traditional hydraulic and pneumatic systems are increasingly being replaced by electromechanical actuators (EMAs). These systems use electric motors and lead screws to provide precise, smooth, and reliable seat adjustments while eliminating the need for fluid-based systems, which require maintenance and additional weight. Digital actuation technologies, which integrate with other aircraft systems such as in-flight entertainment (IFE) and cabin management, are improving the user experience by enabling more intuitive, customizable, and automated seat controls. Passengers can adjust their seats via touchscreen interfaces or mobile apps, and seat movements can be synchronized with other cabin systems, such as lighting and temperature.

The introduction of wireless seat actuation technology in recent years has allowed for more flexible seat designs by eliminating the need for complex wiring and physical connections. This can lead to lighter, more streamlined seat structures and reduce maintenance needs. Wireless systems use technologies such as Bluetooth or Wi-Fi to enable passengers to control their seats remotely via mobile devices or dedicated touch panels. Airline operators are aiming to leverage technologies and solutions that can ensure a reduction in flight weight, as this leads to improved fuel efficiency. Using lightweight materials, including carbon fiber composites, aluminum alloys, and advanced polymers in actuators and seat mechanisms, helps reduce the system's overall weight. Manufacturers are also looking into energy harvesting, where seat actuation systems are designed to capture and store energy from movements or vibrations during flight. This energy can then be used to power the seat adjustments, reducing the overall energy demand on the aircraft's power systems. Such advances are expected to shape positive developments worldwide in the aircraft seat actuation systems industry.

Passenger Class Insights

The economy segment accounted for the highest revenue share of 41.1% in the global aircraft seat actuation systems industry in 2024. The increasing number of flight operations in developing economies and a growing number of flyers from lower-income categories have increased the demand for economy-class seating. Operators are being encouraged to address passenger comfort expectations through advanced seating mechanisms such as reclining and ergonomic seating with automated adjustments. Features such as leg rests, headrest adjustability, and lumbar support have been integrated into new economy-class seats. The entry of various budget operators has resulted in airlines utilizing electromechanical or pneumatic actuation systems in their seating systems to maintain their competitiveness.

The Premium Economy segment, meanwhile, is expected to advance at the fastest CAGR during the forecast period. There is a growing preference among the middle-income demographic to avail services of the Premium Economy class, which offers more features than the economy segment while still being cost-efficient. For instance, seats in this class offer additional legroom compared to standard economy seats. This extra space is beneficial for long-legged passengers and contributes to a more comfortable flying experience. Premium Economy seats may also feature adjustable footrests, which are a key part of the seat actuation system. These footrests can be raised or lowered to accommodate different seating preferences and enhance overall comfort. They allow passengers to elevate their feet, reducing pressure on the lower body during longer flights.

Actuator Insights

The electromechanical segment accounted for a dominant revenue share in the global market in 2024, owing to the higher efficiency and reliable performance offered by this technology. Electromechanical actuators play a crucial role in modern aircraft seat systems, particularly in adjustable seating, providing smooth, efficient, and precise control of seat functions. These actuators are used to move or adjust various seat parts, such as the backrest, leg rest, recline position, lumbar support, and other adjustable components, enhancing passenger comfort and improving the overall seating experience. Additionally, the system is known for its lightweight features, which is an essential factor for aviation. Lighter actuators help reduce the aircraft's overall weight, contributing to fuel efficiency and operational costs. Moreover, electromechanical actuators are energy-efficient compared to older pneumatic or hydraulic systems.

The others segment, which comprises hydraulic and pneumatic actuators, is anticipated to advance at a moderate CAGR during the forecast period. While electromechanical actuators have become more common in recent years due to their lighter weight and energy efficiency, hydraulic actuators still play a significant role in this business, particularly in specific applications that demand high force and reliability. In premium cabins such as business and first-class, hydraulic actuators are often used to control the reclining mechanism of seats. They provide a high level of force necessary for smoothly moving larger and more complex seat structures, such as lie-flat beds or reclining modules. Some high-end seats in premium cabins are also equipped with massage systems that use hydraulic actuators to perform gentle motions that help with muscle relaxation and circulation.

Mechanism Insights

The linear segment accounted for the largest revenue share in the global aircraft seat actuation systems industry in 2024. A linear actuator creates motion in a straight line and plays a crucial role in enabling a wide range of seat adjustments in modern aircraft systems. These actuators are often part of the electromechanical or hydraulic systems that control seat mechanisms and are highly flexible, offering greater convenience to flyers. The growing popularity of business class and Premium Economy class seats has resulted in a steady segment growth, as linear actuators are widely used to control the recline function of aircraft seats. Linear actuators are often used to adjust the seat pan, which is a part of the seat that controls the thighs. The seat pan can tilt forward or backward, according to passenger preference, to provide optimal support and comfort, which is vital during long-duration flights.

The rotary segment is expected to advance at a significant CAGR from 2025 to 2030 in the global market. The growing demand and popularity of business class and first class seats among consumers aids segment growth, as seats in these segments generally feature a swiveling function that is achieved using rotary actuators. Some seats can swivel to face different directions, allowing for flexible seating arrangements. This is especially useful in suite-style configurations on flights where passengers might want to adjust their seating position for social interaction, work, or relaxation. These actuators further enable passengers to rotate their seats to face the window, the aisle, or another seat in a pod-like setup, enhancing flexibility and privacy. Some premium seats also provide the option to adjust or rotate the armrests, which is another important application area for rotary actuators.

Regional Insights

North America aircraft seat actuation systems market accounted for the largest global revenue share of 34.4% in 2024. The high volume of air travel and an increasing number of flyers annually to and from the U.S. and Canada have created a significant demand for more comfortable seating features and optimal occupant convenience. This has driven the adoption of advanced seat actuation systems, which enhance passenger comfort through features such as adjustable seating positions and recline functions. Moreover, regulatory bodies in the region have imposed stringent safety standards for aircraft seating, compelling airlines to utilize advanced systems that can comply with such safety standards. For instance, in Canada, Transport Canada oversees the safety and airworthiness of aircraft operating within Canadian airspace. This includes regulations related to seating systems, which must meet specific safety standards outlined in the Canadian Aviation Regulations (CARs).

U.S. Aircraft Seat Actuation Systems Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by the increasing demand for international and domestic flights and growing competition among airlines to provide optimal passenger comfort. As per data from the Federal Aviation Administration (FAA), the country witnesses more than 45,000 daily flight operations, carrying more than 2.9 million passengers. Consequently, there is a significant demand for quality seating options with advanced features, leading to cutting-edge actuation systems, particularly in business class and first-class seats. Furthermore, many airlines in the country are investing in fleet upgrades and new aircraft, which often come equipped with modern seating systems that include sophisticated actuation technologies. This fleet renewal drives a healthy demand for such solutions, as airlines aim to offer the latest features in their cabins.

Europe Aircraft Seat Actuation Systems Market Trends

Europe accounted for a substantial revenue share in the global market in 2024, owing to the continued expansion of the air travel industry in regional economies such as Germany, France, and the UK, with both low-cost carriers and full-service airlines seeing an increase in passengers. A noticeable growth in the number of flights, routes, and international travel further contributes to the need for advanced airplane seating technologies. Airlines across the region are increasingly offering premium cabins with customized seating features, especially in first-class and business cabins. The ability to adjust seats to suit individual preferences is a key factor driving the demand for state-of-the-art actuation systems. Airlines are adopting these solutions to create a more comfortable and luxurious experience for high-paying passengers, which helps them differentiate themselves in a competitive market.

Asia Pacific Aircraft Seat Actuation Systems Market Trends

The Asia Pacific region is anticipated to expand at the fastest CAGR from 2025 to 2030. The region is one of the fastest-growing markets globally for air travel, with economies such as China, Japan, Australia, and India handling high passenger volumes daily. With a rapidly expanding middle-class population, increasing disposable income levels, and expanding tourism and business travel, there has been a sharp rise in air passenger numbers. As airline operators aim to accommodate this growing demand, there is a corresponding rise in the need for modern aircraft seating, including advanced seat actuation systems for both new aircraft and retrofitted older fleets. Airlines are adopting the latest seat actuation technologies, which are becoming lighter, quieter, and more energy-efficient. The advancement of electric actuation systems is enabling organizations to improve their operational efficiency, reduce aircraft weight, and enhance passenger comfort.

China accounted for a leading revenue share in the Asia Pacific aircraft seat actuation systems market in 2024, owing to the increasing air traffic enabled by the country’s positioning as a major hub for both domestic and international flights. The Chinese aviation market is witnessing the adoption of electric seat actuation systems, which offer benefits such as energy efficiency, reduced noise, and better reliability. These systems are more suited to modern aircraft's technological direction, contributing to fuel savings and operational efficiency for airlines. Additionally, sustainability has become a major focus area for Chinese airlines, especially as the country looks to lower its carbon emissions. Lightweight seat actuation systems help to achieve fuel savings by reducing the overall aircraft weight, thus contributing to lower fuel consumption and emissions.

Key Aircraft Seat Actuation Systems Company Insights

Some key companies involved in the aircraft seat actuation systems industry include Astronics Corporation, Bühler Motor GmbH, and SAFRAN, among others.

-

Astronics Corporation is an American aerospace electronics company that provides technological solutions primarily for the aerospace, defense, and semiconductor industries. The company caters to both business and commercial aviation divisions, with major customers including Airbus, American Airlines, Boeing, Delta Airlines, and Southwest Airlines. Under the Interior & Seat Solutions segment, Astronics provides seat actuation systems through the Astronics PGA unit. These products are designed and tested to comply with the latest Boeing (D6-36440) and Airbus (2520M1F001200) standards.

-

Bühler Motor GmbH is involved in developing, manufacturing, and marketing advanced electro-motor and mechatronic drive solutions. The company produces a wide range of products, including small brushed DC motors, brushless motors, gears and pumps, and complete actuator systems with integrated electronics. The company provides its solutions to several major markets, including automotive, aviation, healthcare, and industrial. Bühler Motor offers seat actuation systems, control panels, pneumatic systems, and other customized components within the aviation segment. The ‘PAXCOM Seat Actuation System’ is the company’s advanced solution designed for controlling and adjusting aircraft seats.

Key Aircraft Seat Actuation Systems Companies:

The following are the leading companies in the aircraft seat actuation systems market. These companies collectively hold the largest market share and dictate industry trends.

- Astronics Corporation

- Bühler Motor GmbH

- Crane Company

- Moog Inc.

- ITT INC.

- RTX

- Honeywell International Inc.

- NOOK Industries, INC.

- Rollon S.p.A.

- SAFRAN

- Kyntronics

Recent Developments

-

In December 2024, Woodward announced that it had signed an agreement to acquire the North American electromechanical actuation business division of Safran Electronics & Defense. This acquisition would enable Woodward to leverage Safran’s widely used electromechanical technology platform for the next generation of aircraft. The agreement includes complete ownership of the Horizontal Stabilizer Trim Actuation (HSTA) systems designed for aircraft stabilization, which is notably used in the Airbus A350.

-

In November 2024, Rollon announced that it would expand its U.S. manufacturing capacity by opening a new facility in Michigan. The location would oversee the production of several notable product lines, including linear components, actuators, multi-axis systems and gantries, and robotic transfer units. These solutions address the demands of several verticals, including aerospace, manufacturing, logistics, healthcare, and material handling. The company also announced the opening of a new office in New Jersey, which would handle its engineering, customer service, marketing, product management, HR, and purchasing divisions.

Aircraft Seat Actuation Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 606.0 million

Revenue Forecast in 2030

USD 902.9 million

Growth Rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Passenger class, actuator, mechanism, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, South Africa, Saudi Arabia

Key companies profiled

Astronics Corporation; Bühler Motor GmbH; Crane Company; Moog Inc.; ITT INC.; RTX; Honeywell International Inc.; NOOK Industries, INC.; Rollon S.p.A.; SAFRAN; Kyntronics

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Seat Actuation Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aircraft seat actuation systems industry report based on passenger class, actuator, mechanism, and region:

-

Passenger Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Economy

-

Premium Economy

-

Business

-

First Class

-

-

Actuator Outlook (Revenue, USD Million, 2018 - 2030)

-

Electromechanical

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Linear

-

Rotary

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.