- Home

- »

- Electronic Security

- »

-

Airport Security Market Size & Share, Industry Report, 2030GVR Report cover

![Airport Security Market Size, Share & Trends Report]()

Airport Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Location (Landside, Airside, Terminal Side), By Technology (Access Control, Cyber Security, Perimeter Security, Screening, Surveillance), By Region, And Segment Forecasts

- Report ID: 978-1-68038-547-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Airport Security Market Summary

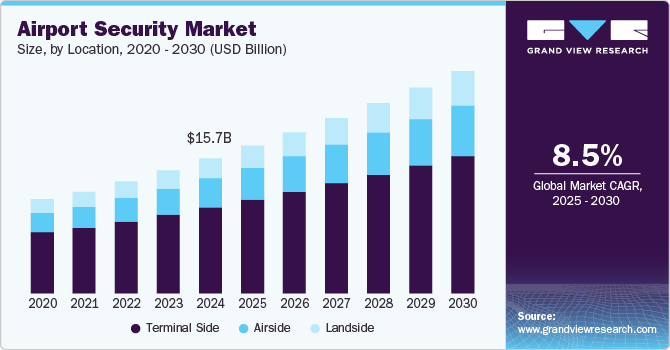

The global airport security market size was estimated at USD 15.75 billion in 2024 and is projected to reach USD 25.94 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. This growth can be attributed to the increasing number of air travelers, necessitating advanced security measures to ensure passenger safety.

Key Market Trends & Insights

- The North America airport security market dominated the global market with a revenue share of 33.2% in 2024.

- The U.S. airport security market dominated the regional market in 2024.

- By location, The terminal side segment dominated the market, with a revenue share of 63.6% in 2024.

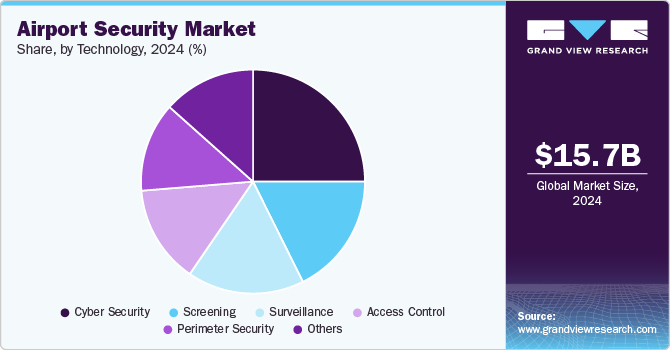

- By technology, the cyber security segment held the highest revenue share of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.75 Billion

- 2030 Projected Market Size: USD 25.94 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2024

Airports are increasingly adopting modern technologies to enhance security while maintaining operational efficiency, which reflects their commitment to safeguarding passengers and operations.

In addition, the evolving threat landscape significantly contributes to the market’s expansion. The growing frequency and sophistication of threats, such as terrorism and smuggling, have led to substantial investments in advanced security solutions. For instance, high-profile incidents have emphasized the importance of robust protocols, fueling demand for biometric technologies and automated screening systems. These innovations improve safety and enhance the passenger experience, enabling a more secure and efficient air travel environment.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into security systems facilitates faster threat detection and predictive analytics, allowing real-time responses to potential risks. Moreover, advanced imaging technologies and automated baggage screening further enhance operational efficiency while ensuring thorough security checks. These technologies empower airports to address emerging threats while effectively improving passenger experiences.

Furthermore, stringent regulatory requirements are crucial in shaping the airport security industry. Aviation security regulations mandate comprehensive measures that align with international standards, compelling airports to continuously upgrade their infrastructure. Frameworks established by organizations such as the International Civil Aviation Organization (ICAO) drive innovation in security technologies, ensuring vigilance against evolving threats and supporting sustained market growth.

Location Insights

The terminal side segment dominated the market, with a revenue share of 63.6% in 2024. This growth is driven by the emphasis on strengthening security measures at airport terminals to ensure passenger safety and operational efficiency. With increasing air travel, airports are investing in advanced technologies, such as biometric systems and automated screening solutions, to enhance security protocols. These innovations improve safety while also streamlining the passenger experience.

The airside segment is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to increasing demand for enhanced security measures in areas beyond the terminal, where aircraft operations occur. With air traffic continuing to rise, airports prioritize improving ground handling and aircraft security safety protocols. In addition, investments in advanced technologies, such as access control solutions and surveillance systems, are expected to contribute significantly toward the growth of the airport security industry in the coming years.

Technology Insights

The cyber security segment held the highest revenue share of the market in 2024. This growth is attributable to the increasing recognition of cyber security as a critical component of airport operations, especially given the rise in cyber threats targeting aviation infrastructure. With airports investing in advanced technologies to protect sensitive data and maintain operational integrity, the demand for robust cybersecurity solutions continues to grow. Moreover, regulatory pressure compels airport authorities to enhance their cyber security frameworks, further driving investment in this segment.

The perimeter security segment is anticipated to witness a significant CAGR during the forecast period. This growth can be attributed to the increasing need for effective measures to safeguard airport boundaries against unauthorized access and potential threats. Airports are focusing on implementing advanced solutions, such as surveillance systems and intrusion detection technologies, to enhance their security protocols. Furthermore, regulatory requirements are encouraging airports to adopt comprehensive security measures. As a result, this segment is expected to play a crucial role in the overall development of the airport security industry.

Regional Insights

The North America airport security market dominated the global market with a revenue share of 33.2% in 2024. This dominance is due to the robust aviation sector with high passenger volumes and extensive flight operations. In addition, significant government funding and investment in security infrastructure have strengthened the region's dominance. The presence of leading technology providers in North America has also facilitated the rapid adoption of innovative security solutions. Moreover, heightened public awareness of security risks has increased the demand for comprehensive security measures at airports.

U.S. Airport Security Market Trends

The U.S. airport security market dominated the regional market in 2024. This growth can be attributed to the extensive network of airports and the high volume of air traffic, which necessitates robust security measures. The U.S. has implemented rigorous security regulations, particularly in response to past threats, driving airports to adopt advanced passenger and baggage screening technologies. In addition, significant federal funding supports ongoing improvements and upgrades to security infrastructure. Furthermore, the local presence of major technology firms accelerates the development and deployment of innovative security solutions tailored to meet the unique challenges faced by U.S. airports.

Europe Airport Security Market Trends

The Europe airport security market held a significant revenue share of the global market in 2024. This can be attributed to the increasing passenger volume and stringent regulatory requirements. The European Union's Aviation Security Regulation mandates advanced security measures, influencing airports to adopt new technologies and enhance existing systems. In addition, investments in innovative solutions, such as biometrics and advanced screening technologies, are expected to strengthen regional security protocols. Consequently, Europe is expected to play a key role in the growth of the airport security industry in the coming years.

Asia Pacific Airport Security Market Trends

The Asia Pacific airport security market is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to the rapid increase in air travel across countries such as China and India, which are expected to account for a significant share of global passenger traffic. In addition, rising investments in modernizing airport infrastructure and implementing advanced security technologies contribute to this trend. The region's heightened focus on addressing security threats and regulatory compliance further supports market expansion.

China airport security market held the largest revenue share in the regional market in 2024.This growth is due to the rapid expansion of the aviation sector, which has experienced a substantial increase in domestic and international air travel. The Chinese government prioritizes airport security, implementing strict regulations and standards to enhance airport safety. Furthermore, significant investments in advanced technologies, such as facial recognition systems and automated screening processes, are being made to improve efficiency and security in the airport security industry.

Key Airport Security Company Insights

Some key companies in the airport security market are SITA, Bosch Sicherheitssysteme GmbH, Thales, Honeywell International Inc., and Leidos. These organizations are focusing on expanding their customer base and gaining a competitive edge in the industry. To achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies. By leveraging these strategies, companies in the airport security market aim to enhance passenger safety, improve operational efficiency, and expand their service offerings to address evolving security challenges.

-

Bosch offers comprehensive security solutions tailored for airports, including video surveillance, access control, and alarm systems. Its technologies are designed to enhance safety while ensuring operational efficiency at airport facilities. The company’s focus on integrating smart technology with traditional security solutions helps airports respond effectively to evolving security challenges.

-

Leidos specializes in providing innovative security solutions tailored to the requirements of transportation systems, particularly airports. Its offerings include advanced analytics and cybersecurity measures to strengthen safety protocols and optimize operational efficiency. Leveraging expertise in data-driven decision-making, Leidos enables airports to proactively identify and address security threats, ensuring a safer and more efficient travel environment.

Key Airport Security Companies:

The following are the leading companies in the airport security market. These companies collectively hold the largest market share and dictate industry trends.

- SITA

- Bosch Sicherheitssysteme GmbH

- Thales

- Honeywell International Inc.

- Leidos

- Siemens

- Amadeus IT Group SA

- IBM

- Elbit Systems Ltd.

- Genetec Inc.

Recent Developments

-

In October 2024, Thales partnered with Adani Airport Holdings Limited to enhance operations and passenger experience at airports in India. The partnership focuses on deploying Thales’ solutions, including the Fly to Gate biometric system and the Airport Technology Control Centre (APOC), to streamline processes, improve security, and support the government’s vision of a digital India.

-

In April 2023, Genetec's unified security platform was deployed at Hercílio Luz International Airport in Brazil to enhance its physical security infrastructure. The platform managed over 500 cameras and 210 access points to critical areas of the airport. It uses a variety of operating systems and sophisticated analytics tools. This initiative boosted operational efficiency and ensured compliance with Brazil's General Data Protection Law (LGPD), enabling better security and data management.

Airport Security Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.25 billion

Revenue forecast in 2030

USD 25.94 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Location, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

SITA; Bosch Sicherheitssysteme GmbH; Thales; Honeywell International Inc.; Leidos; Siemens; Amadeus IT Group SA; IBM; Elbit Systems Ltd.; Genetec Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Airport Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global airport security market report based on location, technology, and region.

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Landside

-

Airside

-

Terminal side

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Access Control

-

Cyber Security

-

Perimeter Security

-

Screening

-

Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.