- Home

- »

- Medical Devices

- »

-

Airway Management Devices Market, Industry Report, 2033GVR Report cover

![Airway Management Devices Market Size, Share & Trends Report]()

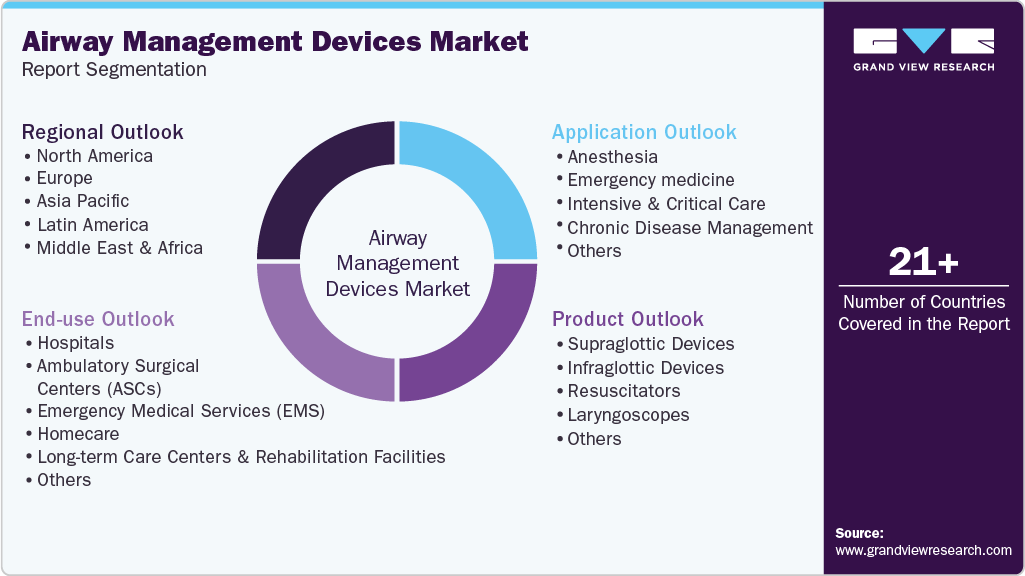

Airway Management Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Supraglottic Devices, Infraglottic Devices), By Application (Anesthesia, Emergency Medicine), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-776-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Airway Management Devices Market Summary

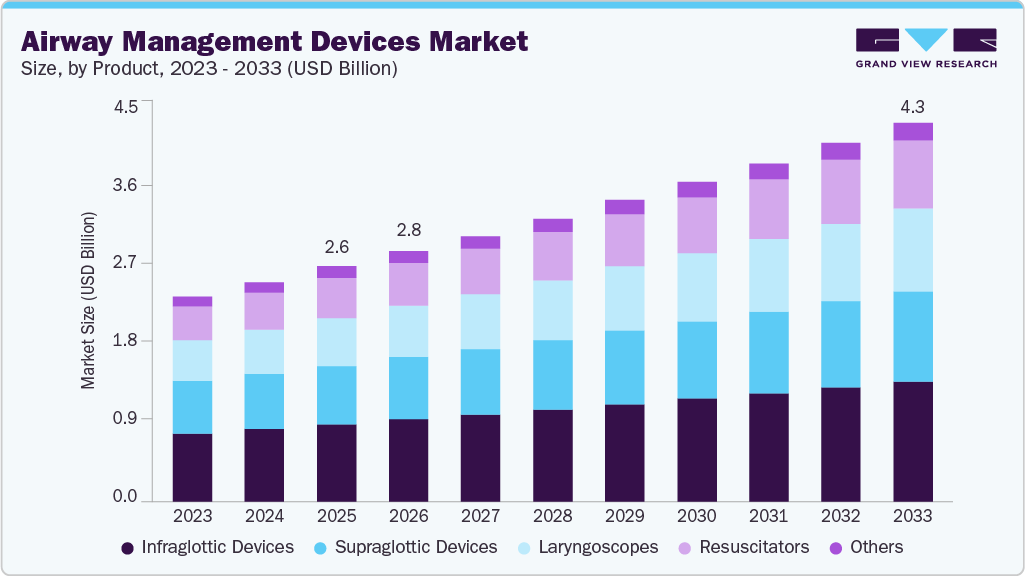

The global airway management devices market size was estimated at USD 2.64 billion in 2025 and is projected to reach USD 4.26 billion by 2033, growing at a CAGR of 6.10% from 2026 to 2033. This growth is attributed to the increasing prevalence of respiratory disorders and chronic diseases such as COPD and asthma.

Key Market Trends & Insights

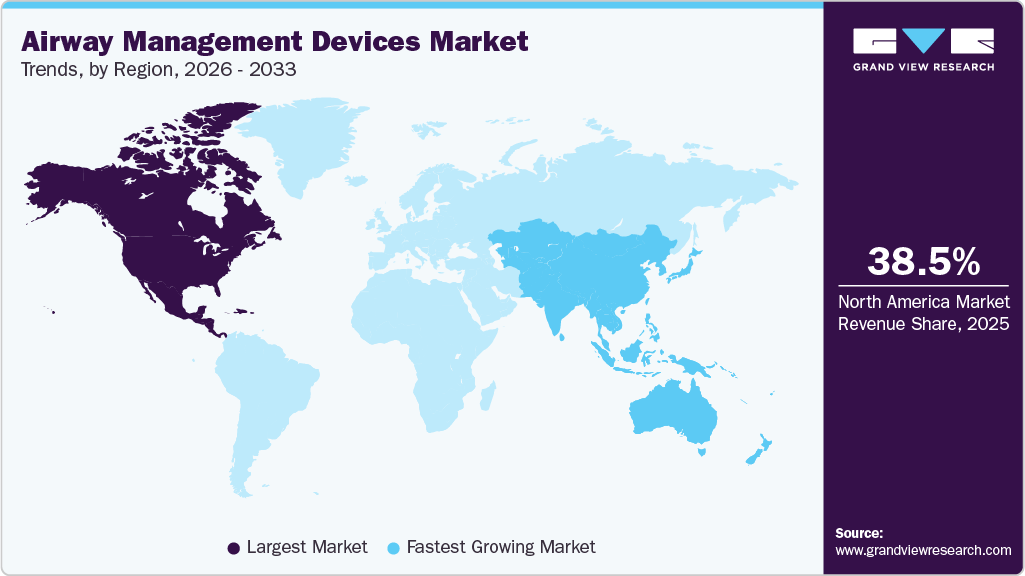

- North America airway management devices industry dominated the global market and accounted for the largest revenue share of 38.54% in 2025.

- The airway management devices industry in the U.S. is expected to grow significantly over the forecast period.

- By application, the anesthesia segment led the market and accounted for the largest revenue share of 37.15% in 2025.

- By product, the infraglottic devices segment dominated the market and accounted for the largest revenue share of 33.0% in 2025.

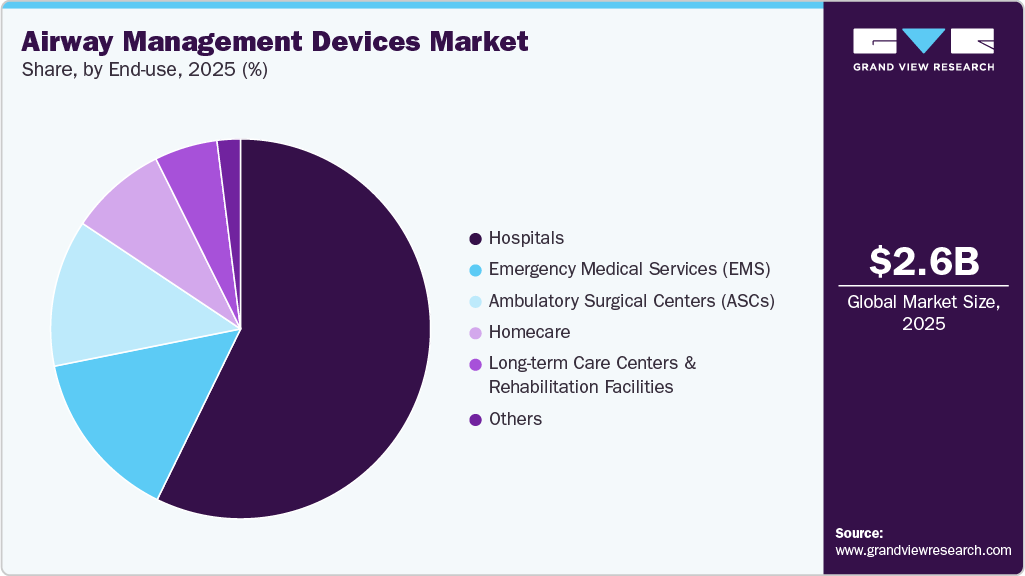

- By end-use, the hospitals segment led the market and accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.64 Billion

- 2033 Projected Market Size: USD 4.26 Billion

- CAGR (2026-2033): 6.10%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The global rise in surgical procedures, both elective and emergency, is a critical driver for the market. Many surgeries, especially those involving general anesthesia, require reliable airway access to ensure patient ventilation and oxygenation, thereby directly influencing the demand for devices such as endotracheal tubes, laryngeal mask airways (LMAs), and supraglottic airway devices (SGADs).Global Surgical Procedure Trends

-

According to a study published in The Lancet, it is estimated that over 313 million surgical procedures are performed each year globally, and this number is steadily increasing due to advancements in surgical care and growing accessibility.

-

In the U.S. alone, the CDC estimates over 51 million inpatient surgical procedures and 53 million outpatient surgeries are performed annually (as per pre-COVID figures).

-

In India, elective surgeries are projected to rise significantly post-pandemic, with the private hospital segment performing over 2 million surgeries annually, a large share of which require general anesthesia and advanced airway support.

-

According to a study published by National Library of Medicine in March 2023, Lancet Oncology Commission’s Global Cancer Surgery report, approximately 80% of newly diagnosed cancer cases will require surgical intervention more than once during the course of treatment. The report estimates that by 2030, nearly 17.3 million cancer patients worldwide will need surgery for purposes including diagnosis, treatment, or palliative care.

In addition, airway management devices are crucial medical instruments designed to ensure and maintain an open airway, facilitating effective ventilation and oxygenation in patients. These devices are vital in various medical scenarios, including emergency care, anesthesia, and critical care, supporting procedures such as intubation and resuscitation. The increasing incidence of respiratory conditions like asthma and COPD has heightened the demand for these devices, which are essential for managing respiratory distress.

Furthermore, the aging population presents a significant market opportunity, as older individuals often require surgical interventions and respiratory support. Technological advancements have led to the developing more innovative, user-friendly airway management solutions, integrating smart technologies and improved materials for enhanced safety and efficiency. The growing prevalence of respiratory diseases globally necessitates effective airway management strategies, further driving market growth.

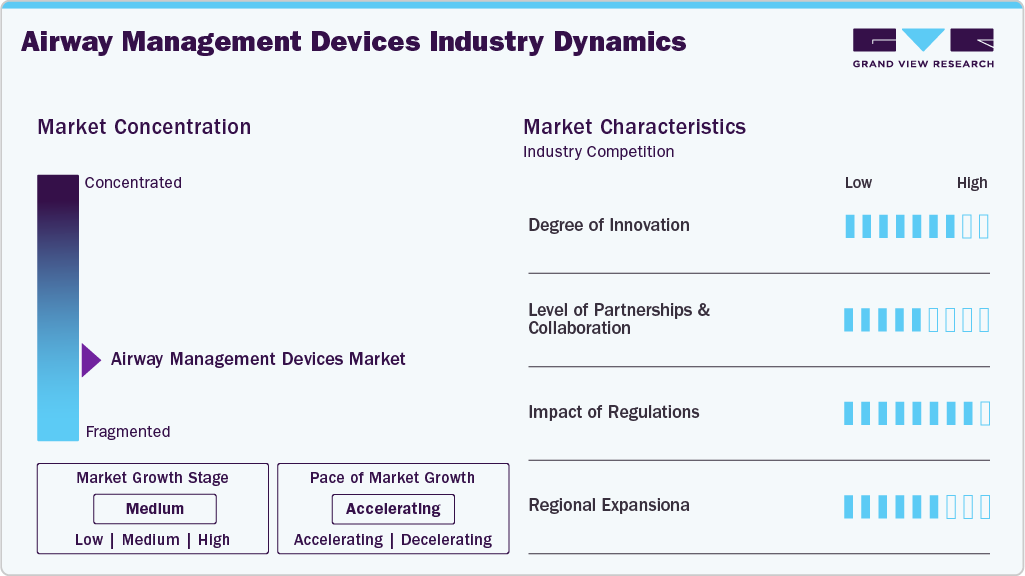

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion.

The market for airway management devices is seeing steady innovation focused on improving safety, visualization, and ease of use. Manufacturers are advancing single-use, infection-control–oriented designs and enhancing visualization through next-generation video laryngoscopes and supraglottic devices. For instance, in May 2025, Ambu A/S launched five pediatric blades for its new Ambu SureSight Connect video laryngoscopy system, further expanding specialized solutions for difficult and pediatric airways.

"With the introduction of the Ambu SureSight Connect, I have all the tools I need to care for the broad range of complex patients I see as a paediatric anaesthesiologist, from our tiniest neonates to our largest teenagers."

-Christopher Ward, M.D.1 Department of Anesthesiology and Critical Care Medicine,

Children’s Hospital of Philadelphia, USA

The market shows a moderate level of partnerships and collaborations, primarily focused on advancing visualization technologies, improving intubation success rates, and expanding access to specialized airway solutions. Manufacturers are collaborating with hospitals, technology developers, and clinical partners to enhance video-enabled devices, optimize ergonomics, and strengthen infection-control–driven single-use portfolios. For instance, in January 2023, Teleflex Incorporated partnered with Shenzhen Insighters Medical Technology Co., Ltd. to become the exclusive U.S. distributor of the Insighters Video Laryngoscope system, an advanced device designed to support endotracheal intubation and upper glottic airway inspection.

Regulations strongly shape the airway management devices industry by enforcing strict safety, performance, and sterility standards from bodies such as the U.S. FDA and EMA. These rules govern device classification, biocompatibility, infection-control requirements, labeling accuracy, and adherence to Good Manufacturing Practices (GMP). While compliance ensures reliable airway access and reduces risks during critical procedures, it also increases production complexity, validation costs, and the need for advanced materials and single-use designs, prompting manufacturers to continually invest in robust quality systems and regulatory alignment.

The airway management devices industry is witnessing moderate expansion as companies work to enhance device safety, improve visualization and intubation success rates, and meet rising clinical demand for reliable, easy-to-use airway solutions across emergency, surgical, and critical care settings.

Product Insights

Based on product, the infraglottic devices segment dominated the market with a revenue share of 33.0% in 2025. The infraglottic devices segment, which includes endotracheal tubes, tracheostomy tubes, and related accessories, is experiencing significant growth due to the rising incidence of respiratory diseases, increasing ICU admissions, and advancements in critical care infrastructure. These devices are essential for securing the lower airway, particularly in patients requiring mechanical ventilation during surgeries, trauma, or respiratory failure.

Laryngoscopes are expected to grow at a CAGR of 7.03% over the forecast period, owing to ongoing technological advancements and the increasing complexity of airway management procedures. Innovations such as video laryngoscopes enhance visualization during intubation, making them essential tools for anesthesiologists and emergency clinicians. In addition, the rising incidence of difficult airways in both elective surgeries and emergency situations drives the demand for these devices.

Application Insights

Anesthesia applications led the market and accounted for the largest revenue share of 37.15% in 2025. This growth is attributed to the rising number of surgical procedures requiring anesthetic intervention. As chronic diseases become more prevalent, there is an increasing need for surgeries that necessitate effective airway management to ensure patient safety and optimal outcomes. In addition, technological advancements have led to the development of innovative devices that enhance the efficiency and efficacy of anesthesia delivery.

Emergency medicines are expected to grow at a CAGR of 7.48% over the forecast period, owing to the increasing incidence of respiratory disorders and acute medical conditions that require immediate intervention. In addition, the prevalence of chronic diseases, such as COPD and asthma, has led to a surge in emergency admissions, necessitating reliable airway management solutions. Furthermore, advancements in device technology have improved their usability and effectiveness in critical situations. Moreover, the growing awareness among healthcare providers about the importance of timely airway management in emergency care further supports market growth, as hospitals and clinics invest in state-of-the-art equipment to address these urgent medical needs effectively.

End-use Insights

The hospitals segment led the market and accounted for the largest revenue share in 2025. This growth is attributed to the rising number of surgical procedures and the increasing prevalence of chronic respiratory diseases. Hospitals serve as primary care centers where airway management devices are essential for ventilation, oxygenation, and anesthetic administration during surgeries. Furthermore, technological advancements have led to developing more efficient and user-friendly devices, encouraging healthcare providers to adopt these solutions. Increased government initiatives to improve patient safety and reduce adverse events also contribute to the growing demand for airway management devices in hospital settings.

The homecare segment is expected to grow at a CAGR of 8.35% over the forecast period. This growth is driven by a rising aging population and a growing emphasis on providing healthcare services in home settings. Patients with chronic respiratory conditions often require continuous monitoring and support, making homecare solutions increasingly vital. The convenience and comfort of receiving care at home, combined with advancements in portable airway management technologies, enhance patient compliance and satisfaction. Furthermore, favorable reimbursement policies for home healthcare services encourage families to invest in these devices, thereby boosting Market growth in this sector.

Regional Insights

North America airway management devices market dominated the global industry in 2025 in terms of revenue share due to its well-established healthcare infrastructure, rising surgical volumes, and high awareness of advanced airway technologies. The increasing prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), obstructive sleep apnea (OSA), and asthma, particularly in the United States, continues to drive demand. For instance, in November 2022, the Centers for Disease Control and Prevention (CDC) reported that over 16 million Americans had been diagnosed with chronic obstructive pulmonary disease (COPD), while approximately 25 million individuals were living with asthma in the United States, reflecting a considerable need for effective airway support solutions.

U.S. Airway Management Devices Market Trends

The airway management devices industry in the U.S. is growing rapidly driven by high surgical volume, particularly in elective procedures and emergency care, which has increased the use of devices such as endotracheal tubes, laryngeal mask airways, and video laryngoscopes. The growing number of ICU admissions and trauma cases, along with an aging population requiring complex airway interventions, further supports market expansion. In addition, favorable regulatory guidelines from bodies such as the CDC, AHA, and ASA that emphasize early and safe airway intervention are encouraging the standardization of advanced airway devices across the U.S. healthcare ecosystem.

Europe Airway Management Devices Market Trends

Europe airway management devices industry holds a significant position in the global market driven by increasing surgical procedure volumes especially among the aging population, which are boosting demand for reliable airway control during anesthesia and critical care. In addition, the region's strong emphasis on infection prevention and patient safety has led to a shift toward single-use and disposable airway devices, such as laryngoscopes and endotracheal tubes. Favorable reimbursement policies, growing adoption of video laryngoscopy in emergency and ICU settings, and the presence of advanced healthcare infrastructure in countries like Germany, France, and the UK further support market expansion.

The airway management devices industry in the UK continues to grow steadily, driven by a strong NHS-led healthcare system, high surgical volumes, and increasing respiratory care needs. An aging population, coupled with a rising prevalence of conditions such as COPD, sleep apnea, and obesity, fuels sustained demand for airway solutions across surgical, emergency, and intensive care settings. Hospitals throughout England, Scotland, Wales, and Northern Ireland have widely adopted reusable and disposable airway tools, while improvements in prehospital and ambulance services have expanded usage beyond clinical environments.

The airway management devices industry in Germany is progressing steadily, driven by a combination of demographic trends, rising surgical volumes, and strong healthcare infrastructure. The country’s aging population and growing incidence of chronic respiratory conditions such as COPD and obstructive sleep apnea are major contributors to demand. In addition, improvements in prehospital care, including emergency medical services, have encouraged the use of airway devices. Germany’s high healthcare spending and hospital density support deep market penetration and consistent procedural growth.

Asia Pacific Airway Management Devices Market Trends

The airway management devices industry in Asia Pacific is expected to grow at a CAGR of 7.75% over the forecast period. This is attributed to rapid economic growth and increasing healthcare spending. In addition, the rising prevalence of respiratory disorders, particularly in countries like China and India, creates a substantial demand for these devices. Government initiatives aimed at improving healthcare access and quality further stimulate market expansion. Furthermore, the emergence of local manufacturers and strategic partnerships among key players enhance product availability and affordability in this diverse region.

Japan's airway management devices industry is driven by the the country’s aging population, high surgical volumes, and a growing emphasis on infectious disease preparedness and clinical resilience. With increasing respiratory complications in elderly patients and rising ICU admissions, the need for advanced airway solutions such as supraglottic devices, endotracheal and tracheostomy tubes, resuscitators, and laryngoscopes has become more critical.

The airway management devices industry in China is expanding steadily, driven by the country’s high burden of respiratory diseases, rising surgical volumes, and long-term healthcare planning. The government’s Healthy China 2030 blueprint emphasizes improving hospital infrastructure, emergency preparedness, and critical care delivery, fostering broader deployment of airway management solutions.

Latin America Airway Management Devices Market Trends

The airway management devices industry in Latin America is experiencing moderate growth, primarily fueled by rising respiratory disease burden and increasing surgical procedures. Brazil and Mexico account for a significant share due to their relatively advanced healthcare infrastructure and growing investments in critical care services.

Middle East & Africa Airway Management Devices Market Trends

The airway management devices industry in the Middle East & Africa is growing steadily, driven by increasing chronic and respiratory disease burdens, rising surgical and trauma procedures, and expanding ICU and emergency care infrastructure in both the public and private sectors. Governments across the Gulf Cooperation Council (GCC) have prioritized infection control and the prevention of ventilator-associated pneumonia, with organizations like the GCC Centre for Infection Control issuing guidelines for MV circuits and artificial airway hygiene.

Key Airway Management Devices Company Insights

Some of the key players operating in the market include Medtronic, Teleflex Incorporated, Ambu A/S, Medline Industries, LP, and BD. These companies adopt various strategies to maintain and increase their market share, including new product development, partnerships, collaboration and agreements, and acquisitions.

Key Airway Management Devices Companies:

The following are the leading companies in the airway management devices market. These companies collectively hold the largest Market share and dictate industry trends.

- Medtronic

- Teleflex Incorporated

- Ambu A/S

- Intersurgical Ltd

- BD

- Medline Industries, LP

- Armstrong Medical Ltd

- ICU Medical, Inc.

- Mercury Medical

- Convatec Group PLC

Recent Developments

-

In January 2025, Ambu A/S launched Ambu SureSight Connect a video laryngoscopy solution. This solution facilitates efficient intubation in both routine and difficult airway procedures.

-

In March 2024, Medline Industries, LP acquired the manufacturing rights and intellectual property for AG Cuffill from Hospitech Respiration Ltd., integrating the compact syringe-style cuff pressure manometer into its airway management portfolio. This acquisition enhances Medline’s respiratory care offerings globally by enabling clinicians across acute and pre-hospital settings to monitor endotracheal cuff pressure accurately and safely, reducing risks of aspiration or ischemic injury

“Medline remains committed to adding clinically differentiated respiratory solutions to make healthcare run better for our global customers. The AG Cuffill is a unique tool to allow clinicians to manage cuff pressure accurately and easily”

-Tim Finnigan, general manager of Medline respiratory division.

-

In September 2023, Verathon unveiled the GlideScope Go 2, an advanced handheld video laryngoscope designed to enhance airway management in urgent and critical care situations. This next-generation device features QuickConnect technology for seamless operation, allowing clinicians to focus more on patient care. The GlideScope Go 2 is now available in the U.S., reinforcing Verathon's commitment to providing innovative airway management devices that support first-pass success in challenging medical environments.

-

In January 2022, ICU Medical Inc. completed its acquisition of Smiths Medical, expanding its portfolio across infusion therapy, vascular access, and critical care products. This acquisition enhances ICU Medical’s capabilities and market presence in advanced medical devices and consumables globally.

“We are pleased that Smiths Medical is now part of ICU Medical, and we welcome our new Smiths colleagues to the ICU team. We look forward to working together to continue providing quality, innovation, and value to our clinical customers worldwide.”

- Vivek Jain, chairman, and chief executive officer at ICU Medical. “

Airway Management Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.82 billion

Revenue forecast in 2033

USD 4.26 billion

Growth rate

CAGR of 6.10% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Market Value in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medtronic; Teleflex Incorporated; Ambu A/S; Intersurgical Ltd; BD; Medline Industries, LP; Armstrong Medical Ltd; ICU Medical, Inc.; Mercury Medical; Convatec Group PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Airway Management Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global airway management devices market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Supraglottic Devices

-

Oropharyngeal devices

-

Nasopharyngeal devices

-

Laryngeal airway masks

-

-

Infraglottic Devices

-

Endotracheal tubes

-

Tracheostomy tubes

-

-

Resuscitators

-

Self-inflating Resuscitators (Bag-Valve Masks)

-

Flow-inflating Resuscitators

-

Others

-

-

Laryngoscopes

-

Direct (Conventional) Laryngoscopes

-

Video Laryngoscopes

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Anesthesia

-

Emergency medicine

-

Intensive & Critical Care

-

Chronic Disease Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Emergency Medical Services (EMS)

-

Homecare

-

Long-term Care Centers & Rehabilitation Facilities

-

Others (Includes academic institutions, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global airway management devices market size was estimated at USD 2.64 billion in 2025 and is expected to reach USD 2.82 billion in 2026.

b. The global airway management devices market is expected to grow at a compound annual growth rate of 6.10% from 2026 to 2033 to reach USD 4.26 billion by 2033.

b. North America dominated the airway management devices market with a share of 38.54% in 2025. This is attributable to the supportive government initiatives, substantial implementation of practice guidelines and the high prevalence of major respiratory diseases.

b. Some key players operating in the airway management devices market include Medtronic, Teleflex Incorporated, Ambu A/S, Intersurgical Ltd, BD, Medline Industries, LP, Armstrong Medical Ltd, ICU Medical, Inc., Mercury Medical, Convatec Group PLC

b. Key factors that are driving the airway management devices market growth include increasing prevalence of respiratory diseases, need of emergency treatment for prolonged illnesses, protracted treatments associated with lung diseases, and advent of advanced techniques.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.