- Home

- »

- Plastics, Polymers & Resins

- »

-

Alcoholic Beverage Packaging Market, Industry Report, 2030GVR Report cover

![Alcoholic Beverage Packaging Market Size, Share & Trends Report]()

Alcoholic Beverage Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Glass, Metal, Others), By Product (Can, Bottle & Jars, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-381-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alcoholic Beverage Packaging Market Summary

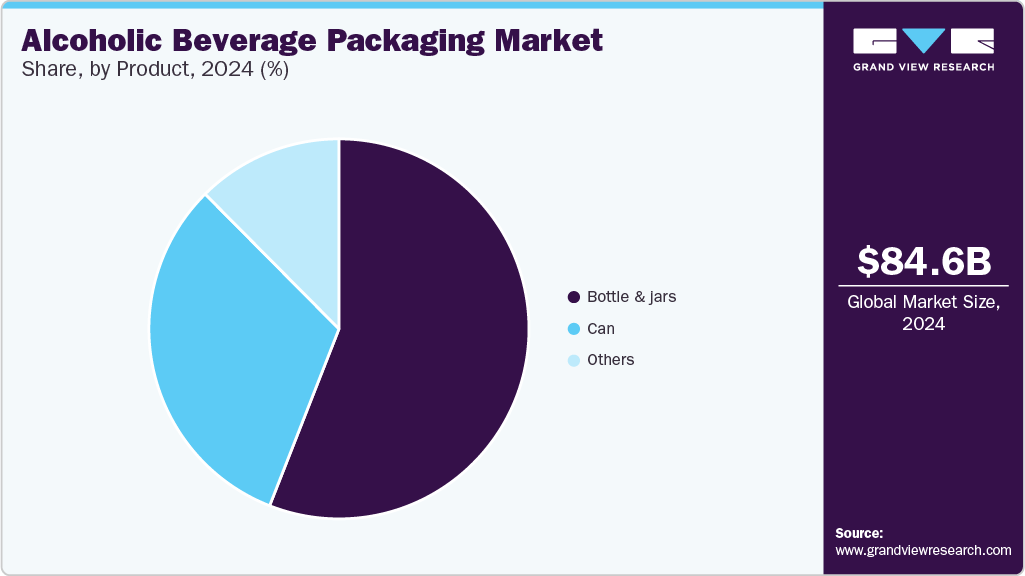

The global alcoholic beverage packaging market size was estimated at USD 84.62 billion in 2024 and is projected to reach USD 118.42 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. The industry is fueled by increasing consumption, innovative designs, sustainable focus, e-commerce growth, regulatory changes, and technological advancements, which are enhancing the demand for premium brands and catering to diverse demographic preferences.

Key Market Trends & Insights

- The Asia Pacific alcoholic beverage packaging market dominated the global alcoholic beverage packaging market with a market share of 33.1% in 2024.

- The North America alcoholic beverage packaging market is expected to register the fastest CAGR of 7.4% during the forecast period.

- Based on material, the Plastic material led the market with a revenue share of 32.1% in 2024.

- Based on product, the bottle & jars dominated the market and held a revenue share of 55.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 84.62 Billion

- 2030 Projected Market Size: USD 118.42 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The market is witnessing a significant surge in demand, driven by a growing trend of increased consumption worldwide. This phenomenon is attributed to a shift in societal dynamics, high disposable income, and the rise of social activities such as parties where the consumption of alcohol is prevalent. Moreover, the growing popularity of craft beers and artisanal spirits has contributed to this trend, as consumers seek out unique and high-quality products.

To stand out in a competitive market, companies are focusing on creative packaging innovations that enhance the consumer experience. This includes the development of aesthetic and eco-friendly packaging solutions that incorporate novelty elements. For instance, the use of lightweight bottles, recyclable materials, and convenient cap designs have been identified as key innovations in the market. These innovations not only improve the consumer experience but also provide a competitive edge for companies.

In response to growing consumer and regulatory pressure in the beverage packaging industry, sustainability has become a critical area of focus for both manufacturers and consumers. Governments are implementing stricter standards on labeling, safety, and environmental factors of packaging materials, while companies are adopting strategies such as reusable materials, recyclable packaging, biodegradable materials, and minimal packaging use to reduce their environmental footprint. As the market continues to evolve, companies must prioritize sustainability to remain competitive and meet the growing demands of environmentally conscious consumers.

Material Insights

Plastic material led the market with a revenue share of 32.1% in 2024. Plastic is cheaper to manufacture and ships as compared to glass or metal and it is easier to handle by the consumers. In addition to taking less time to produce, plastic is also cheaper to produce as compared to glass, which makes it a preferred commodity for manufacturers who want to cut on cost. Compared to glass, plastic is relatively more resilient in the distribution and handling stages and therefore results in fewer damages to the product.

Metal packaging is expected to register the second-fastest CAGR of 6.2% over the forecast period. Aluminum and steel are favored materials for metal containers due to their exceptional strength, providing optimal protection for products against light, oxygen, and physical damage during transportation and handling. Their high strength-to-weight ratio and durability make them an ideal choice for preserving the integrity of packaged goods.

Product Insights

Bottle & jars dominated the market and held a revenue share of 55.9% in 2024. Glass bottles and jars remain the preferred choice for consumers in the alcoholic beverage packaging market, conveying a perception of high quality and exclusivity. Conventional norms, such as wine packaging in glass, also contribute to this perception. The aesthetic appeal of glass is a significant factor in consumer preference, driving demand for premium products.

Cans are expected to register a significant growth of 5.2% over the forecast period. Cans are a preferred packaging option for consumers seeking convenience, as they are easy to carry and less prone to breakage. Their resealable lids allow for slow consumption, reducing spoilage. The tight seal also protects contents from light and oxygen, preserving flavor quality. Cans are ideal for outdoor events and activities, offering a practical and convenient packaging solution.

Regional Insights

Asia Pacific alcoholic beverage packaging market dominated the global alcoholic beverage packaging market with a market share of 33.1% in 2024. Rapid economic growth in countries such as China, India, and Southeast Asia has led to increased disposable incomes among consumers. Urbanization has also enabled access to a wider range of alcoholic products, driving shifts in consumer preferences for packaging and demand. As a result, there is a growing need for innovative packaging solutions that cater to changing consumer habits and preferences.

The alcoholic beverage packaging market in China dominated the Asia Pacific alcoholic beverage packaging market with a market share of 26.1% in 2024. The country’s dominance in the market can be attributed to its large consumer base, government support, low labor costs, established manufacturing capacity, and advanced packaging techniques. These factors have enabled Chinese firms to capture significant market share, solidifying China’s position as a prominent global producer.

North America Alcoholic Beverage Packaging Market Trends

North America alcoholic beverage packaging market is expected to register the fastest CAGR of 7.4% during the forecast period. North America, comprising the U.S. and Canada, is a significant consumer of alcoholic beverages, driven by a strong and thriving economy. High per capita income enables consumers to indulge in premium and ultra-premium products. As a result, consumer awareness has driven the evolution of packaging in the region, with manufacturers adopting eco-friendly and sustainable solutions to meet changing demands.

U.S. Alcoholic Beverage Packaging Market Trends

The alcoholic beverage packaging market in U.S. held significant market share in 2024. The diverse population in the country demands tailored packaging for its various tastes in alcoholic beverages. Despite a complex regulatory framework, the U.S. offers a predictable business environment for alcohol production and sales. As a result, American brands catering to international markets must adapt to meet global packaging standards and requirements.

Europe Alcoholic Beverage Packaging Market Trends

Europe alcoholic beverage packaging market has a substantial market share in 2024. Alcohol beverages play a significant cultural role in Western Europe, particularly in regions such as Bordeaux and Tuscany. These areas not only produce high-quality wines but also embody the region’s rich history and heritage. As a result, consumers in these regions demand premium packaging that honors tradition while showcasing modern flair.

The alcoholic beverage packaging market in Germany is expected to grow substantially over the forecast period. Germany is at the forefront of European innovation, driving advancements in packaging technology. The country’s manufacturers have leveraged cutting-edge processes and materials, such as lightweight glass bottles, eco-friendly packaging, and advanced labeling techniques. This has enabled German companies to establish a unique market position and capitalize on growing demand for sustainable packaging solutions.

Key Alcoholic Beverage Packaging Company Insights

Some key companies in the alcoholic beverage packaging market include Amcor plc; Crown; Amber Packaging; and Berry Global Inc.; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

Sonoco functions in packaging solutions, serving diverse markets including consumer goods, industrial products, protective packaging, and paper and wood products. Committed to sustainability and innovation, Sonoco has established itself in the packaging industry, delivering high-quality solutions worldwide.

-

Mondi offers solutions tailored to meet the specific needs of the beverage industry. The company provides a broad range of products, specifically designed for various types of beverages, including beer, wine, spirits, and ready-to-drink cocktails. This expertise enables Mondi to deliver customized packaging solutions that meet the unique demands of each sector.

Key Alcoholic Beverage Packaging Companies:

The following are the leading companies in the alcoholic beverage packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Crown

- Amber Packaging

- Berry Global Inc.

- Ball Corporation

- Sonoco

- Stora Enso

- Graham Packaging

- Mondi

- Tetra Laval

- WestRock Company

- SIG

Recent Developments

-

In May 2024, Sonoco announced the grand opening of its new Metal Packaging Technical & Engineering Center in Columbus, Ohio, demonstrating its commitment to sustainable metal packaging innovation and customer support.

-

In May 2024, Amcor plc launched its Bottles of the Year program on National Packaging Design Day 2024, celebrating responsible, innovative packaging designs that adhere to the evolving consumer trends in various industries, including beverage, spirits, and food.

-

In April 2024, SIG collaborated with Namaqua Wines, as its carton packaging supplies for its low alcohol wine range. The company invested in a SIG Slimline Aseptic filling machine, enhancing its production capacity and expanding its market presence.

-

In April 2024, Berry Global Inc. acquired F&S Tool Inc. in a strategic move to enhance its full plastic packaging lifecycle solutions, expanding its offerings to include design, production, and recycling capabilities for customers.

Alcoholic Beverage Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 89.34 billion

Revenue forecast in 2030

USD 118.42 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE.

Key companies profiled

Amcor plc; Crown; Amber Packaging; Berry Global Inc.; Ball Corporation; Sonoco; Stora Enso; Graham Packaging; Mondi; Tetra Laval; WestRock Company; SIG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alcoholic Beverage Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alcoholic beverage packaging market report based on material, product, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Glass

-

Metal

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Can

-

Bottle & jars

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global alcoholic beverage packaging market size was estimated at USD 84.62 billion in 2024 and is expected to reach USD 89.34 billion in 2025.

b. The global alcoholic beverage packaging market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 118.42 billion by 2030

b. North America dominated the alcoholic beverage packaging market with a share of 33.1% in 2024. This is attributable to rising demand for premium alcoholic beverages including craft beer. Furthermore, rising popularity of shim drinks is also said to have a positive impact on the market growth over the forecast period.

b. Some key players operating in the alcoholic beverage packaging market include Crown Holdings, Inc.; United Bottles & Packaging; Vetreria Etrusca S.p.A.; Owens-Illinois (O-I), Inc.; Orora Packaging Australia Pty. Ltd.; Encore Glass; Creative Glass; Ball Corp.; Tetra Pak International S.A.; and Brick Packaging, LLC.

b. Key factors that are driving the market growth include increased consumption of premium alcoholic beverages including spirits and wines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.