- Home

- »

- Alcohol & Tobacco

- »

-

Alcoholic Drinks Market Size & Share, Industry Report, 2033GVR Report cover

![Alcoholic Drinks Market Size, Share & Trends Report]()

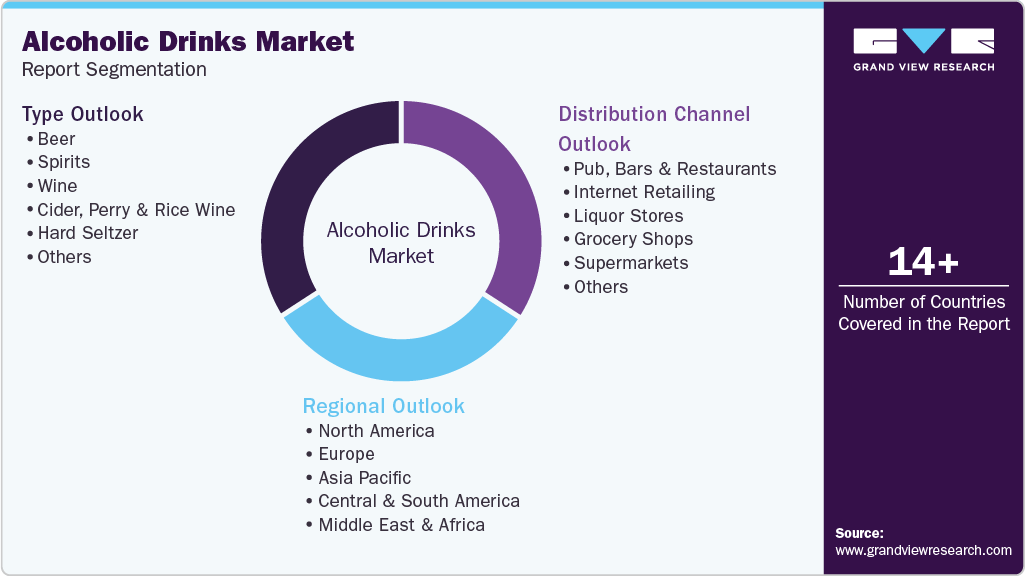

Alcoholic Drinks Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Beer, Spirits, Wine, Cider, Perry & Rice Wine, Hard Seltzer), By Distribution Channel (Pub, Bars & Restaurants, Internet Retailing, Liquor Stores, Grocery Shops, Supermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-925-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alcoholic Drinks Market Summary

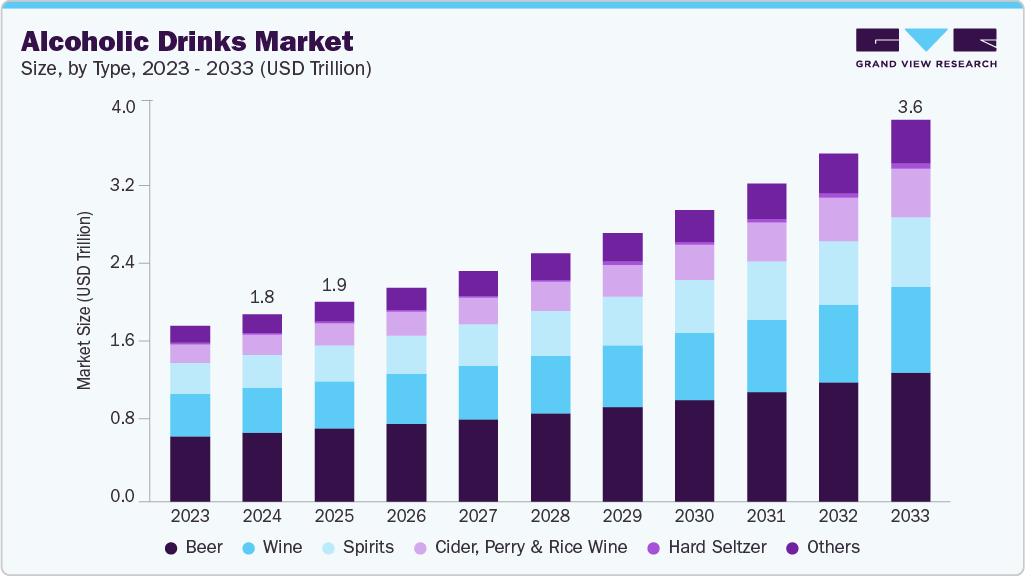

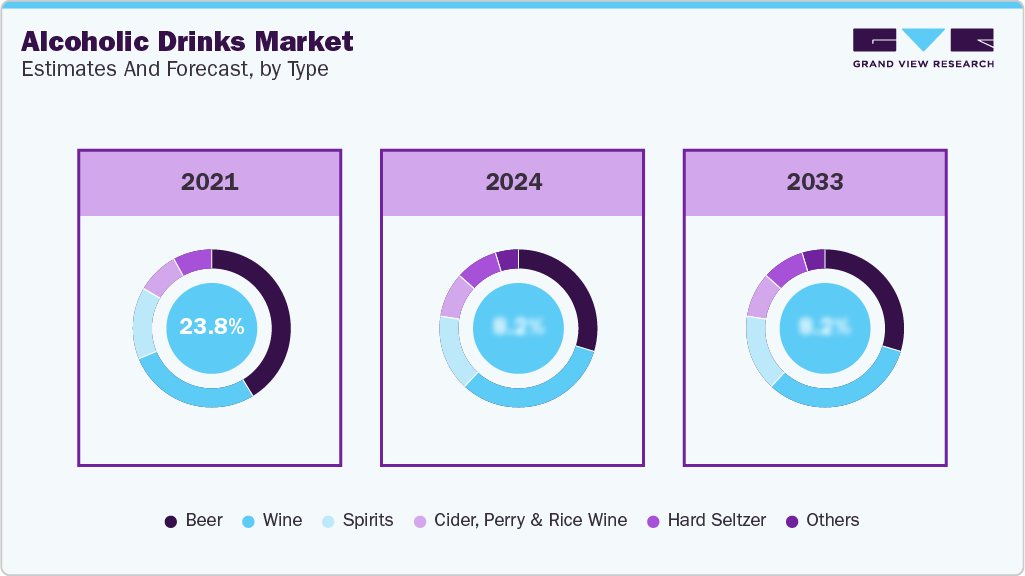

The global alcoholic drinks market size was estimated at USD 1,773.7 billion in 2024 and is projected to reach USD 3,617.9 billion by 2033, growing at a CAGR of 8.4% from 2025 to 2033. The market is experiencing growth as consumers increasingly trade up to premium and craft options.

Key Market Trends & Insights

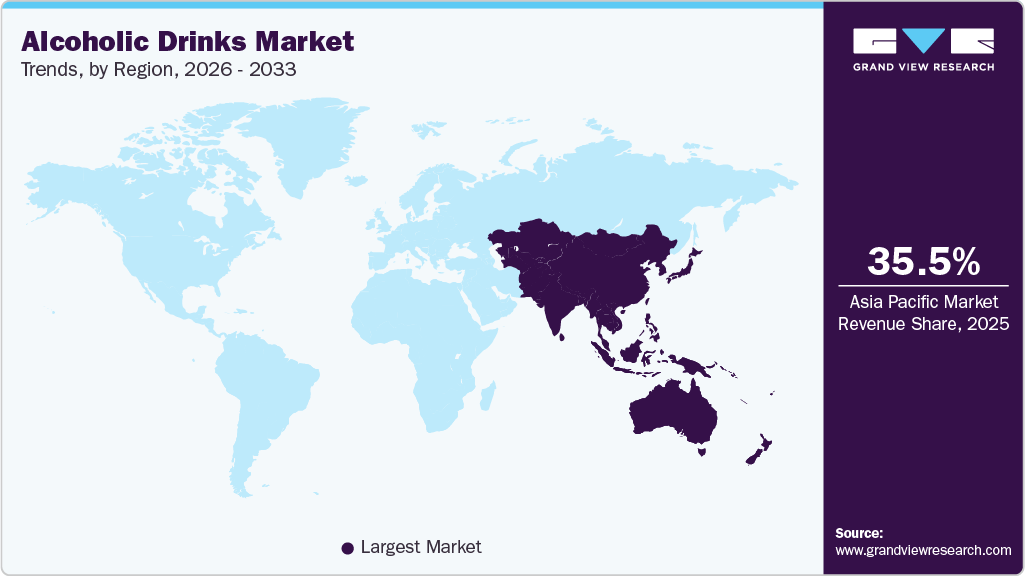

- By region, Asia Pacific led the alcoholic drinks market with a share of 35.1% in 2024.

- By type, beer led the market and accounted for a share of 36.8% in 2024.

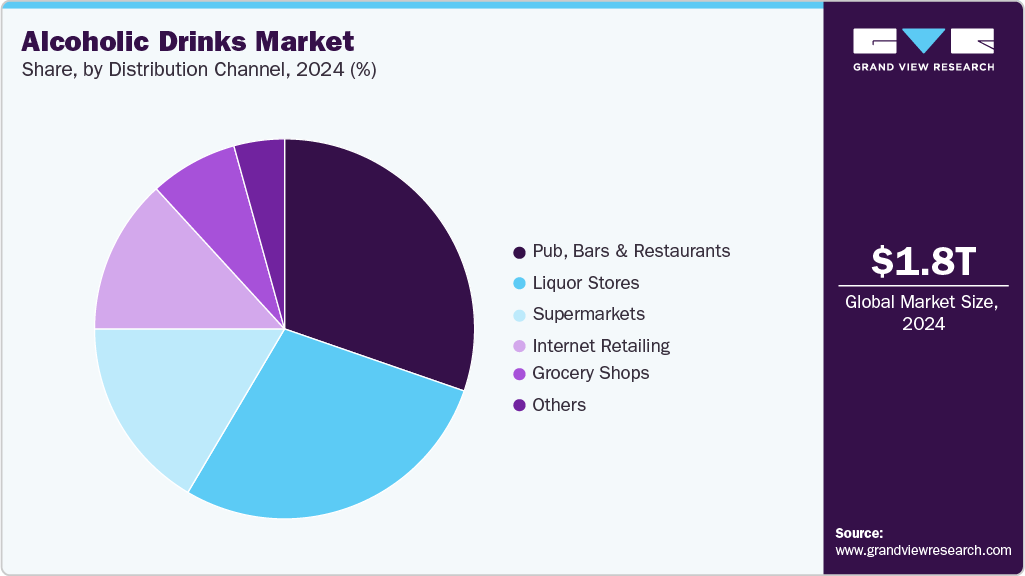

- By distribution channel, the pubs, bars & restaurants segment led the market and accounted for a share of 30.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,773.7 Billion

- 2033 Projected Market Size: USD 3,617.9 Billion

- CAGR (2025-2033): 8.4%

- Asia Pacific: Largest market in 2024

Storytelling around provenance, authenticity, and small-batch production has fueled interest in higher-quality spirits, wines, and beers. This shift has been supported by specialty retailers and on-premise venues, which act as discovery platforms and encourage experimentation with new brands and global flavors such as tequila, mezcal, Japanese whisky, and soju.

As more young people enter the workforce and enjoy rising disposable incomes, they are increasingly willing to spend on leisure and lifestyle products, including alcoholic beverages. This demographic is also more open to premium products, craft brands, and innovative offerings, which supports the premiumization trend across categories such as beer, wine, spirits, and ready-to-drink (RTD) cocktails. Their higher purchasing power and preference for quality experiences make them an attractive consumer base for alcohol companies.

The RTD segment has become a pivotal growth engine in the alcoholic beverage industry, offering consumers convenience, variety, and innovation. Brands are responding by introducing spirit-based RTDs, premium offerings, and higher-alcohol variants to cater to evolving preferences. This innovation is not only expanding product portfolios but also attracting a broader consumer base seeking quality and convenience in their drinking experiences. The proliferation of Ready-to-Drink (RTD) alcoholic beverages and flavored mixers has played a pivotal role in expanding the market by offering convenience, portability, and novel taste experiences. RTDs, such as canned cocktails, hard seltzers, and premixed spirits, allow consumers to enjoy a bar-style drink at home or on the go, aligning with lifestyle trends that favor casual, social, and flexible drinking occasions.

Manufacturers are responding by introducing innovative flavors, seasonal and limited-edition products, and collaborations with lifestyle brands or mixologists. Interactive experiences such as DIY cocktail kits, online mixology tutorials, and social media campaigns are also being employed to engage consumers directly. The convenience channel has benefited from these trends, with alcohol sales increasing by 0.3% in 2024, and convenience stores capturing 10% of U.S. spirits dollar sales. Popular flavor innovations include tropical fruits, botanicals, dessert-inspired combinations, and citrus or berry infusions, which have enhanced appeal for younger consumers seeking new experiences. For instance, in June 2024, Tilaknagar Industries introduced a Green Apple variant to its Mansion House Flandy range, a premium flavoured brandy. This move capitalized on the growing demand for flavoured spirits and the cocktail culture trend, particularly in Telangana, India, where the Prestige & Above segment saw an 18% growth in FY24.

Consumer Insights

Consumers are increasingly shifting their preferences toward more health-conscious and experience-driven alcohol consumption. Younger cohorts such as Gen Z and Millennials are moderating their intake, opting for lighter beverages, low-ABV cocktails, and functional alcohol alternatives. At the same time, premiumization is reshaping the industry: consumers are demonstrating a willingness to pay higher prices for products that deliver superior quality, authenticity, and distinctive stories. Lifestyle experiences such as winery tours, brewery taprooms, and cocktail-focused venues are also becoming central to purchasing behavior, reflecting the rising importance of brand narrative, provenance, and sustainability. Digital channels and direct-to-consumer offerings, including home delivery and subscription clubs, have further broadened access and deepened consumer engagement.

Europe remains the world’s heaviest-drinking region, with adults consuming on average 9–11 liters of pure alcohol per year, though intake has declined by roughly 20–25% since 1980. Men drink nearly four times more than women (about 15 liters vs. 4 liters annually), and heavy episodic drinking is widespread, with nearly 40% of drinkers reporting monthly binge episodes. Beer (40%) and wine (37%) dominate consumption, while spirits account for about 22%. Daily drinking is most common in Southern Europe (Portugal, Italy, Spain), whereas Northern and Eastern countries show much lower daily rates. Overall, around one-quarter of Europeans abstain from alcohol, and while long-term consumption is falling, cultural patterns and beverage preferences vary widely across the region.

However, alcohol consumption patterns are undergoing significant change as consumers become more health-conscious and selective in their drinking habits. While beer, wine, and spirits remain staples, many younger adults are moderating intake or turning to alternatives such as flavored RTDs, non-alcoholic beers, and alcohol-free spirits. Overall spending on drinks increased by 4.4%, with non-alcoholic beverages leading the growth at 6.2%, significantly outpacing the 2.4% rise in alcoholic beverages. This shift is largely driven by consumers identifying new occasions to consume beverages, coupled with a willingness to pay more per unit for premium products that enhance everyday experiences.

Gen Z’s reduced alcohol consumption reflects wider cultural and personal shifts, shaped by health and wellness priorities, evolving social and economic dynamics, and changing lifestyle norms. In the U.S., 21–22% of Gen Z do not consume alcohol at all, and 39% drink only occasionally; 34–46% cite health or lack of interest as reasons for low or no use. In the UK, 44% of young people aged 18–24 regularly consume non-alcoholic drinks, and 39% abstain from alcohol entirely. In India, 54% of Gen Z reported consuming at least four different types of non-alcoholic drinks in the past six months, well above the generational average; 22% tried seven or more types.

Recent product launches are blending bold flavor experimentation with craft and premium appeal. Offerings include barrel-aged aperitifs, alcohol-removed wines, and flavor-forward non-alcoholic beers and cocktails that replicate classic profiles. The focus is on delivering exceptional taste, texture, aroma, and packaging to attract consumers who seek sophistication, even in low-ABV or non-alcoholic beverages.

Type Insights

Beer held the largest share in the alcoholic drinks market, accounting for a share of 36.8% in 2024. The market is experiencing substantial growth, largely fueled by the rising demand for craft, low-alcohol, and flavored beer variants. For instance, India saw a rising trend among Gen Z and millennials favoring non-alcoholic and low-alcohol beers, driven by health consciousness and mindful drinking preferences. Although the total sales of non-alcoholic and low-alcohol beers in India are still relatively small compared to the entire beer market, demand in urban metros grew steadily, encouraging brands such as Budweiser and Heineken to innovate while maintaining authentic taste profiles. This shift reflected a global movement toward moderation and premiumization in the beer market. This trend underscores shifting consumer preferences toward health consciousness, flavor variety, and premium product offerings.

Hard seltzers are anticipated to witness a CAGR of 15.9% from 2025 to 2033. Hard seltzers have rapidly evolved into a prominent segment within the alcoholic beverage industry, driven by consumer preferences for low-calorie, lighter alcoholic drinks with refreshing flavor profiles. For instance, in March 2025, Vizzy Hard Seltzer launched its first-ever Cream Pop Variety Pack across the U.S. The pack featured Orange Cream Pop, Raspberry Cream Pop, and Strawberry Cream Pop flavors, each combining creamy vanilla notes with vibrant fruit flavors. Available countrywide in 12-packs of 12-oz cans, the product contains 5% ABV, 100 calories, and 1 gram of sugar per can. This launch capitalized on consumer interest in playful, nostalgic beverage experiences while maintaining a balanced, light profile.

Distribution Channel Insights

Sales of alcoholic drinks through pubs, bars & restaurants held the largest share, accounting for a share of 30.3% in 2024. Pubs and bars serve as key social hubs focused on alcoholic beverage consumption, entertainment, and social interaction. They offer unique atmospheres and experiences that attract diverse customer segments, with themed venues and live events playing a significant role in drawing consumers. The ongoing shift toward urbanization has significantly increased demand for convenient and accessible dining options. With urban lifestyles characterized by busy schedules and fast-paced routines, consumers are increasingly gravitating toward quick-service formats, digital ordering, and delivery platforms.

Sales of alcoholic drinks through internet retailing are anticipated to witness the fastest CAGR of 10.5% from 2025 to 2033. The market is projected to experience strong growth in the coming years, driven by the convenience of purchasing alcohol from home via e-commerce platforms and mobile applications, which strongly appeals to millennials and Gen Z consumers who prefer digital shopping experiences. This growth is further fueled by the expanding middle class and increasing disposable incomes, particularly in the Asia Pacific region, alongside rapid urbanization. These factors are significantly boosting online alcohol purchases, positioning digital channels as a crucial market segment.

Regional Insights

The North America alcoholic drinks market accounted for a share of 26.0% in 2024. The market is driven by changing consumer preferences, regulatory reforms, and evolving business strategies. The per capita consumption of alcohol in the U.S. and Canada is one of the highest worldwide, with a wide variety of alcohol consumed across different age groups. Customers showcase a strong inclination toward premium, craft, convenient ready-to-drink (RTD) cocktails, flavored beverages, and lower-alcohol choices.

U.S. Alcoholic Drinks Market Trends

In the U.S., strong demand for premium and craft alcoholic beverages is driving companies to diversify product lines and strengthen their distribution channels. New product launches catering to changing consumer preferences also support the market growth. For instance, in September 2025, Kraft Heinz introduced Crystal Light Vodka Refreshers, a low-calorie and zero-sugar RTD cocktail in Wild Strawberry and Lemonade flavors. Each can contain 3.8% ABV and 77 calories, appealing to consumers seeking lighter alcoholic options. The product is available in select Northeast U.S. stores at USD 9.99 per four-pack, with broader distribution and additional flavors planned for 2026.

Europe Alcoholic Drinks Market Trends

The alcoholic drinks market in Europe is expected to grow at a CAGR of 8.6% from 2025 to 2033. The market is experiencing notable growth, driven by a mix of cultural heritage, changing consumer preferences, and strategic industrial developments. Countries such as Germany, Italy, and Spain benefit from long-standing traditions in winemaking and brewing, with Germany’s progressive beer duty system supporting smaller breweries and promoting local diversity. Similarly, France promotes competitiveness among domestic and international producers through favorable tax policies. For instance, on January 1, 2025, excise duty rates were updated, with beer above 2.8% ABV taxed at USD 9.5 (€8.10) per hectoliter per degree and still wine at USD 4.8 (€4.12) per hectoliter, reflecting France’s broader strategy to foster a competitive and dynamic alcoholic drinks market.

Asia Pacific Alcoholic Drinks Market Trends

The Asia Pacific alcoholic drinks market accounted for a share of around 35.1% in 2024. In the Asia Pacific region, the alcoholic drinks market is fueled by rising disposable incomes, a growing middle class, and evolving consumer lifestyles. The region is home to high-population countries, including India, China, and Indonesia, with a significant proportion of young people and urban dwellers among the population. Younger urban consumers increasingly seek premium, craft, and imported brands for their quality and uniqueness. At the same time, the growing tourism and hospitality industry has further fueled the demand, particularly for high-end spirits and cocktails, through hotels, bars, and restaurants.

Central & South America Alcoholic Drinks Market Trends

The Central & South America alcoholic drinks market is expected to grow at a CAGR of 7.7% from 2025 to 2033. The growth is attributed to the rising incomes, urban lifestyles, and young consumers seeking new experiences. Shoppers are gradually shifting from mass-produced beverages to premium, craft, and local heritage brands. Flavored spirits and lower-alcohol alternatives are also gaining popularity due to convenience and changing lifestyles. The region’s high urban population is a key factor supporting this trend, as city dwellers have greater access to diverse beverage options and modern retail channels. In 2024, the average urban population across 12 South American countries was 75.73%, indicating a largely urbanized region. Uruguay has the highest rate at 95.85%, highlighting urbanization as a key driver of the alcoholic drinks market growth.

Middle East & Africa Alcoholic Drinks Market Trends

The Middle East & Africa alcoholic drinks market is expected to grow at a CAGR of 7.3% from 2025 to 2033. One of the major market drivers is the cultural influence of expatriates in urban centers such as the UAE, Saudi Arabia, and South Africa. Expatriates bring diverse drinking preferences and increase demand for premium and innovative alcoholic beverages. This also prompts companies to introduce new brands and products to attract consumers and cater to their diverse taste preferences. For instance, in 2024, South Africa saw premium whiskies launched targeting discerning consumers. In October 2025, Glenfiddich launched a multi-year partnership with the Aston Martin Formula One Team in South Africa, blending heritage and innovation. The collaboration features a limited-edition 16-Year-Old single malt and exclusive experiences such as Club 1959.

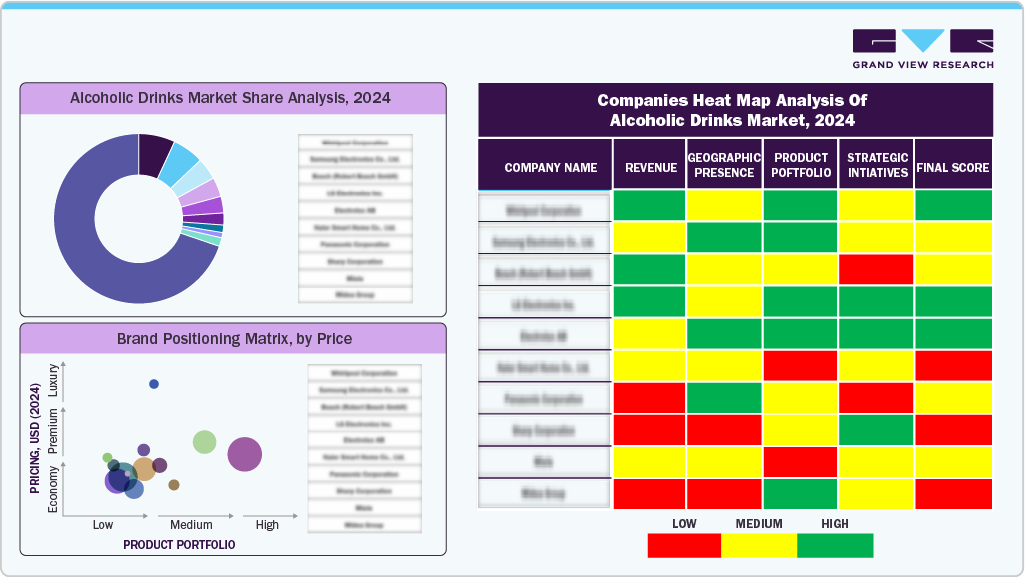

Key Alcoholic Drinks Company Insights

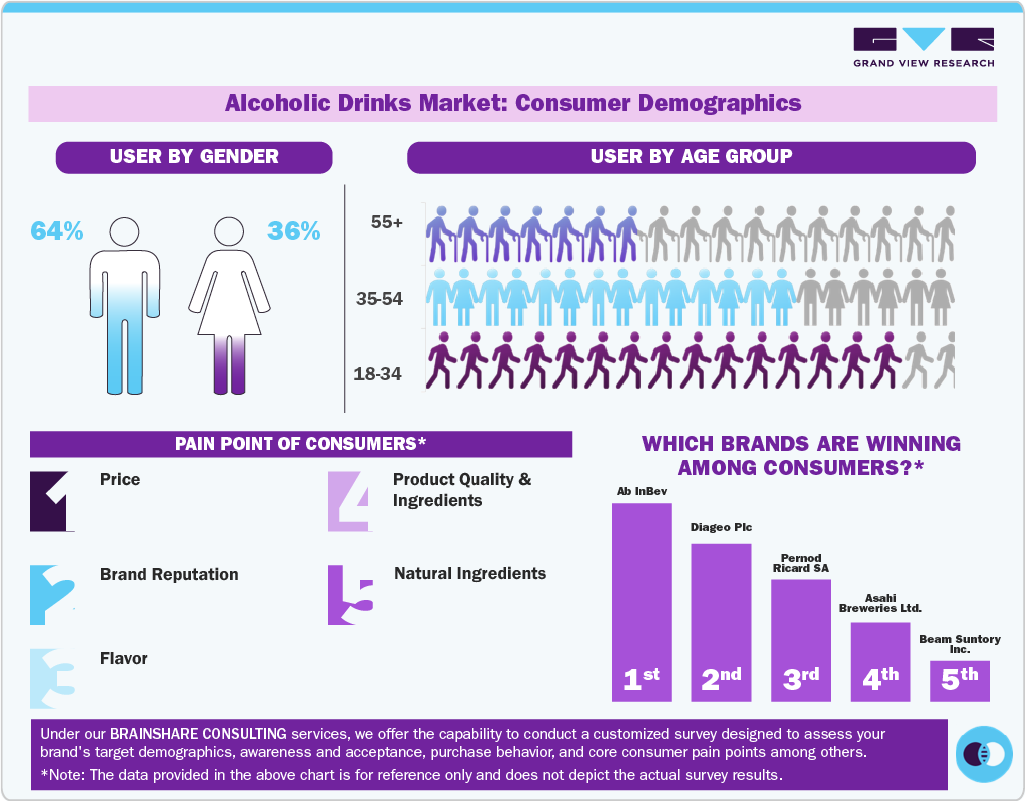

Leading players in the alcoholic drinks market include Anheuser-Busch InBev SA/NV, Bacardi Limited, Suntory Holdings Limited, Constellation Brands Inc., and Diageo Plc. The alcoholic drinks market is highly competitive, with brands working to expand their presence across both online and offline retail channels. Companies are investing in advanced formulation, encapsulation, and delivery technologies to improve ingredient stability, bioavailability, and compatibility with various distribution formats. Increasing consumer awareness of digestive wellness, microbiome balance, immunity, and clean-label/natural products is driving faster adoption. Additionally, the ongoing shift toward plant-based, allergen-free, and sustainably sourced ingredients is reinforcing strong, long-term growth prospects for the alcoholic drinks sector.

Key Alcoholic Drinks Companies:

The following are the leading companies in the alcoholic drinks market. These companies collectively hold the largest market share and dictate industry trends.

- Anheuser-Busch InBev SA/NV

- Bacardi Limited

- Suntory Holdings Limited

- Constellation Brands Inc.

- Diageo Plc

- Molson Coors Beverage Company

- Pernod Ricard SA

- Asahi Group Holdings Ltd.

- Carlsberg A/S

- Brown-Forman Corporation

Recent Developments

-

In April 2025, Bacardi introduced Bacardi Passionfruit, a vibrant rum that combines signature white rum with natural passionfruit flavor. The launch is targeted at markets across the Netherlands, Germany, Sweden, Norway, Poland, and Luxembourg. The gluten-free rum is designed for social and summer occasions and offers a sweet, tangy taste ideal for cocktails. This launch aligns with Bacardi’s strategy to lead the growing flavored rum category by delivering innovative, tropical-inspired products that appeal to evolving consumer preferences.

-

In July 2025, The Washington Spirit partnered with Diageo North America to support community initiatives in Washington, D.C., focusing on alcohol responsibility, education, workforce development, and hospitality training. The collaboration aimed to promote safe consumption among fans and invest in local impact and environmental stewardship through programs both inside and outside the stadium during the 2025 season.

-

In December 2024, Diageo plc India launched India Rare Spirits, an exclusive cask program offering customized, aged malt whiskeys tailored to individual preferences. This initiative combined India’s rich whisky heritage with innovative craftsmanship, providing luxury whisky ownership and marking a significant milestone in the country’s evolving spirits market.

-

In September 2024, Diageo plc launched the X Series by McDowell’s & Co. in India, expanding into white spirits and dark rum. The range included Vodka, Dry Gin, Citron Rum, and Dark Rum, marking the brand’s entry into new categories.

Alcoholic Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,895.3 billion

Revenue Forecast in 2033

USD 3,617.9 billion

Growth rate

CAGR of 8.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Anheuser-Busch InBev SA/NV; Bacardi Limited; Suntory Holdings Limited; Constellation Brands Inc.; Diageo Plc; Molson Coors Beverage Company; Pernod Ricard SA; Asahi Group Holdings Ltd.; Carlsberg A/S; Brown-Forman Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alcoholic Drinks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global alcoholic drinks market report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Beer

-

Spirits

-

Wine

-

Cider, Perry & Rice Wine

-

Hard Seltzer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Pub, Bars & Restaurants

-

Internet Retailing

-

Liquor Stores

-

Grocery Shops

-

Supermarkets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alcoholic drinks market size was estimated at USD 1,773.72 billion in 2024 and is expected to reach USD 1,895.3 billion in 2025.

b. The global alcoholic drinks market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2033 to reach USD 3,617.9 billion by 2033.

b. Beer held the largest share in the alcoholic drinks market, accounting for a share of 36.8% in 2024. The market is experiencing substantial growth, largely fueled by the rising demand for craft, low-alcohol, and flavored beer variants.

b. Some key players operating in the alcoholic drinks market include Anheuser-Busch InBev SA/NV; Bacardi Limited; Beam Suntory Inc; Constellation Brands Inc; Diageo Plc; Molson Coors Brewing Co.; Pernod Ricard SA; United Spirits Ltd; Asahi Breweries Ltd.; and Carlsberg A/S.

b. Key factors that are driving the alcoholic drinks market growth include the growing acceptance of increasing product innovation, the rising demand for artisanal spirits, and the rising popularity of pubs, bars & restaurants in the tourism sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.