- Home

- »

- Consumer F&B

- »

-

Alkalized Cocoa Powder Market Size, Industry Report, 2030GVR Report cover

![Alkalized Cocoa Powder Market Size, Share & Trends Report]()

Alkalized Cocoa Powder Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverages, Cosmetics, Others), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-141-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alkalized Cocoa Powder Market Summary

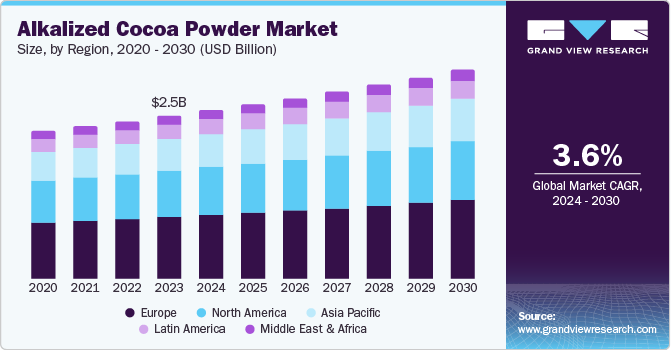

The global alkalized cocoa powder market size was valued at USD 2.51 billion in 2023 and is projected to reach USD 3.22 billion by 2030, growing at a CAGR of 3.6% from 2024 to 2030. The market surge can be credited to the rising consumer demand for chocolate-based products, including confectioneries, baked goods, and beverages.

Key Market Trends & Insights

- The Europe market accounted for the dominant market share of 38.2% in 2023.

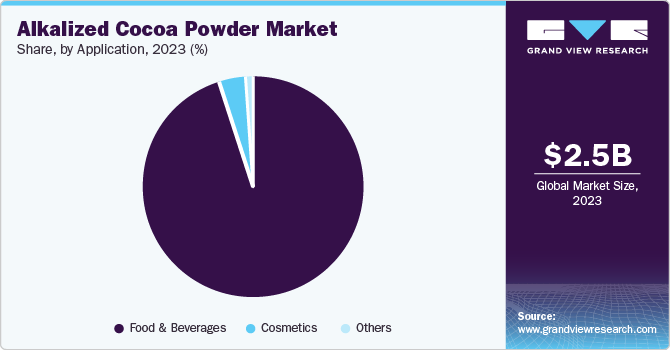

- By application, food & beverages segment dominated the market with a 93.5% share in 2023.

- By application, cosmetics segment expected to grow over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2.51 Billion

- 2030 Projected Market Size: USD 3.22 billion

- CAGR (2024-2030): 3.6%

- Europe: Largest market in 2023

Alkalized cocoa powder, known for its enhanced solubility and consistent flavor profile, is a preferred ingredient in these products. Its ability to dissolve easily in liquids makes it ideal for use in hot chocolate, chocolate milk, and other cocoa-based beverages, providing a smooth and enjoyable drinking experience.

Consumers have become increasingly more discerning about the quality of the ingredients in their food, and premium chocolates often emphasize the use of high-quality cocoa powder. A survey conducted in 2023 found that 73% of Indian consumers are willing to pay more for premium chocolate products that use high-quality ingredients. Alkalized cocoa powder, with its rich flavor and deep color, is favored by manufacturers aiming to create superior chocolate products that appeal to this growing market segment. Additionally, the health benefits associated with cocoa, such as its antioxidant properties, have driven consumer interest and demand for cocoa-based products, further boosting the market.

Furthermore, technological advancements in cocoa processing have stimulated market growth. Innovations in alkalization techniques have improved the efficiency and quality of cocoa powder production, enabling manufacturers to meet the rising demand while maintaining high standards. One example is the use of natural alkalizing agents, such as potassium carbonate derived from renewable sources, instead of synthetic chemicals. These advancements allowed for greater customization of cocoa powder, with manufacturers able to adjust alkalization levels to achieve specific flavor and color profiles, catering to diverse consumer preferences. For instance, companies including Blommer Chocolate Company and Cargill have developed alkalization techniques that allow for precise control over the flavor and color of their cocoa powders.

Moreover, the expanding food and beverage industry with rapid urbanization and increasing disposable incomes has led to a growing shift towards premium and indulgent food products. This trend aligns with the attributes of alkalized cocoa powder, which is known for its ability to impart rich and intense cocoa flavors to a wide range of culinary creations. In addition, the versatility of alkalized cocoa powder finds applications in baking, frozen desserts, and various other food products.

Application Insights

Food & beverages dominated the market with a 93.5% share in 2023 due to the rising consumer demand for chocolate-based products, including confectioneries, baked goods, and beverages. Alkalized cocoa powder offers enhanced solubility and maintains a consistent flavor profile. Its ability to dissolve easily in liquids makes it ideal for use in hot chocolate, chocolate milk, and other cocoa-based beverages, providing a smooth and enjoyable drinking experience. Additionally, the health benefits associated with cocoa, such as its antioxidant properties have driven consumer interest and demand for cocoa-based products, further boosting the market.

Cosmetics are expected to grow over the forecast period owing to the increasing consumer preference for natural and organic ingredients in personal care products. According to a survey by the Organic Trade Association, 82% of U.S. households purchase organic products regularly. Alkalized cocoa powder, derived from cocoa beans, is rich in antioxidants and has moisturizing properties, which makes it an attractive ingredient for skincare and haircare formulations. Its ability to improve skin texture and provide a natural glow is highly valued in the beauty industry. Moreover, innovations in processing techniques have enabled the incorporation of alkalized cocoa powder into a wider range of cosmetic products, including facial masks, scrubs, lotions, and shampoos.

Regional Insights

The North America alkalized cocoa powder market secured a significant share in 2023 owing to the region’s mature and robust bakery and confectionary sector. Manufacturers have used alkalized cocoa powder as a key ingredient in cakes, cookies, pastries, and biscuits. Its ability to provide a deep color and balanced flavor enhances the appeal of these products. Brands such as Ciranda have significantly emphasized the natural and organic aspects of their products in marketing campaigns. This includes highlighting certifications such as USDA Organic or Non-GMO Project Verified to build consumer trust.

U.S. Alkalized Cocoa Powder Market Trends

The alkalized cocoa powder market in the U.S. is expected to be driven by the increasing demand for clean-label products over the forecast period. Consumers have increasingly sought clean-label products owing to the growing preference for natural ingredients with minimal processing. Additionally, the growing emphasis on sustainability in the cocoa supply chain, including ethical sourcing and fair trade certification is expected to stimulate the market.

Europe Alkalized Cocoa Powder Market Trends

The Europe alkalized cocoa powder market accounted for the dominant market share of 38.2% in 2023. The surge can be credited to the region’s strong tradition of chocolate consumption, which includes a wide range of products from confectioneries to beverages. European consumers have increasingly opted for premium chocolates and products with a richer, darker flavor profile. Dark chocolate enhanced with alkalized cocoa powder is perceived as a healthier option due to its higher concentration of antioxidants and lower sugar content compared to milk chocolate. In addition, with the rising interest in plant-based and vegan beverages, alkalized cocoa powder has been increasingly incorporated in non-dairy products. For instance, companies including Barry Callebaut and Moner Cocoa provide alkalized cocoa powders that are essential for creating rich and flavorful vegan chocolate bars.

Asia Pacific Alkalized Cocoa Powder Market Trends

The growth of the Asia Pacific alkalized cocoa powder market is attributable to the growing economies such as China, India, and Southeast Asia. Alkalized cocoa powder is widely used in premium chocolate due to its mild flavor and rich odor. In addition, the shift toward premiumization in the food and beverage sector has led to an increased demand for high-quality ingredients, including alkalized cocoa powder. Consumers have been progressively willing to pay more for premium chocolates, bakery goods, and beverages.

Key Alkalized Cocoa Powder Company Insights

The global alkalized cocoa powder market is intensely competitive. Key market participants include Barry Callebaut, Olam Group, ECOM Agroindustrial Corp. Limited, and others. These companies have increasingly focused on organic initiatives such as product launches, partnerships, mergers & acquisitions, global expansion, and others.

-

Barry Callebaut is a global manufacturer of high-quality chocolate and cocoa products. The company serves a wide range of customers, including multinational and national branded consumer goods manufacturers, and artisanal users including chocolatiers, pastry chefs, bakeries, and caterers.

Key Alkalized Cocoa Powder Companies:

The following are the leading companies in the alkalized cocoa powder market. These companies collectively hold the largest market share and dictate industry trends.

- Barry Callebaut

- Olam Group

- ECOM Agroindustrial Corp. Limited

- Indcre, S.A.

- Bloomer Chocolate Company

- JB Cocoa

- CCBOL Group

- Carlyle Cocoa

- Dutch Cocoa

- Cargill, Incorporated

Recent Development

-

In February 2022, Olam Food Ingredients launched a line of premium cocoa powders, deZaan, in the U.S. The flavor spectrum ranges from delicate and fruity citrus notes to velvety chocolate and caramel undertones, while the color options encompass vivid shades such as crimson red and terracotta, as well as the deep intensity of carbon black.

Alkalized Cocoa Powder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.60 billion

Revenue forecast in 2030

USD 3.22 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Mexico, Canada, UK, France, Germany, Italy, Spain, China, India, Japan, Australia & New Zealand

Key companies profiled

Barry Callebaut; Olam Group; ECOM Agroindustrial Corp. Limited; Indcre, S.A.; Bloomer Chocolate Company; JB Cocoa; CCBOL Group; Carlyle Cocoa; Dutch Cocoa; Cargill, Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alkalized Cocoa Powder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alkalized cocoa powder market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Bakery & Confectionery

-

Beverages

-

Syrup

-

Spreads

-

Dairy Products

-

Others

-

-

Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

MEA

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.