- Home

- »

- Automotive & Transportation

- »

-

All-terrain Vehicle Market Size & Share, Industry Report, 2030GVR Report cover

![All-terrain Vehicle Market Size, Share & Trends Report]()

All-terrain Vehicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Engine Type (Below 400cc, 400 - 800cc, Above 800cc), By Application (Agriculture, Sports, Recreational, Military And Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-076-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

All-terrain Vehicle Market Summary

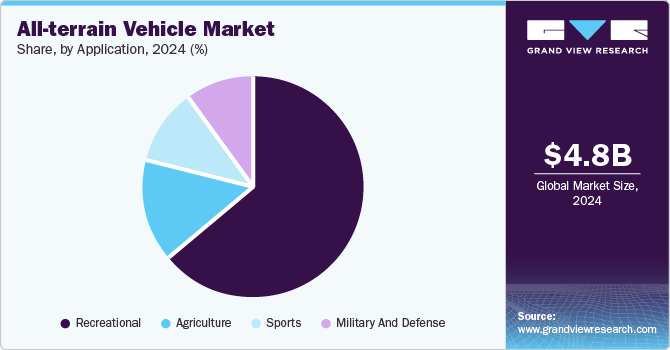

The global all-terrain vehicle market size was estimated at USD 4.77 billion in 2024 and is projected to reach USD 6.01 billion by 2030, growing at a CAGR of 4.0% from 2025 to 2030. This growth is attributed to the increasing popularity of outdoor recreational activities and the rising enthusiasm for off-road sports events.

Key Market Trends & Insights

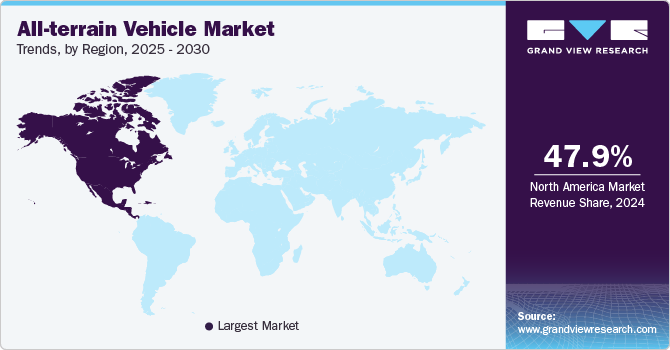

- The North America all-terrain vehicle market held the largest share of 47.92% in 2024.

- The all-terrain vehicle market in the U.S. held a dominant position in 2024.

- Based on engine type, the 400 - 800cc segment accounted for the largest share of 48.13% in 2024.

- Based on application, the recreational segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.77 Billion

- 2030 Projected Market Size: USD 6.01 Billion

- CAGR (2025-2030): 4.0%

- North America: Largest market in 2024

Such activities cater to adventure enthusiasts and drive demand for high-performance all-terrain vehicles (ATVs). Events such as the Mud Nationals, scheduled for 2025 at the Sabine ATV Park in Burkeville, Texas, demonstrate this trend. This five-day event attracts thousands of off-road enthusiasts, providing a platform for ATV manufacturers to showcase their latest innovations and engage with a growing customer base. The event highlights the excitement surrounding off-road sports. It fosters the development of advanced ATV models designed to tackle challenging terrains, thereby propelling the growth of all-terrain vehicle industry. The increasing investment in adventure tourism drives market growth. Many countries actively promote their natural landscapes as adventure tourism destinations, offering guided off-road tours and ATV rentals to attract tourists. This trend is prominent in regions such as North America, Europe, and Asia Pacific, where the combination of scenic terrains and adventurous activities creates lucrative opportunities for providers in the all-terrain vehicle industry.The expanding applications of all-terrain vehicles (ATVs) in agriculture drive market growth. ATVs are transforming the way farming tasks are executed by enabling faster and more efficient operations. Farmers use these vehicles for a range of activities, including transporting tools, equipment, and supplies across vast fields. In addition, ATVs are ideal for hauling harvested crops, carrying fertilizers, and distributing feed to livestock. Their compact size and agility allow them to access areas challenging for larger machinery, ensuring uninterrupted workflow even in rugged or uneven terrains. By streamlining these essential tasks, ATVs save farmers time and labor costs, enhancing overall productivity.

Moreover, the increase in disposable income among the middle class in emerging economies contributes to the affordability and adoption of all-terrain vehicles. The growth in the urban population drives the demand for outdoor and off-road recreational activities, fostering a favorable market environment.

However, environmental concerns, particularly in sensitive ecosystems, restrain market growth. Their off-road capabilities lead to soil erosion, disruption of wildlife habitats, and damage to vegetation. These concerns have led to growing opposition from environmental organizations and stricter government regulations, limiting ATV usage in ecologically fragile areas. Moreover, the carbon emissions associated with fuel-powered ATVs are becoming increasingly scrutinized as the world shifts towards sustainable and eco-friendly technologies.

Engine Type Insights

The 400 - 800cc accounted for the largest share of 48.13% in 2024. The growth can be attributed to the growing popularity of these vehicles for utility activities. For instance, ATVs are built with considerable storage space and are often used for hauling supplies and equipment. Government organizations are adopting these vehicles for search and rescue operations and monitoring wild and forest areas. Prominent players in the market are launching 400cc-800cc ATVs to cater to a broader range of users and discover new application areas.

Above 800cc is expected to grow significantly during the forecast period. An increase in off-trailing events and activities is projected to drive the demand for ATVs with above 800cc engine capacity. Off-trailing events and activities require vehicles with advanced engine movement capacities to deliver improved torque performance, enabling participants to gain a competitive advantage. Introducing improved ATVs would enable competitive desert race events and rough terrain, increasing the demand for ATVs with an engine capacity of 800cc and above.

Application Insights

The recreational segment held the largest market share in 2024. The government and private organizations' initiatives to expand off-road trail networks drive the growth of all-terrain vehicles for recreational activities. Designated ATV parks, off-road tracks, and adventure zones are becoming more common, providing safe and legal spaces for recreational ATV use. This infrastructure development encourages more consumers to participate in off-road activities, thus fueling growth of the all-terrain vehicle industry.

The military and defense segment is expected to register the fastest CAGR during the forecast period. Modern military strategies emphasize speed and mobility, and ATVs play a critical role in achieving these objectives. These vehicles are lightweight and easily transportable via helicopters or other aircraft, enabling rapid deployment in mission-critical situations. Their ability to be deployed quickly in crisis zones or during combat operations makes them indispensable for armed forces aiming to enhance operational efficiency.

Regional Insights

The North America all-terrain vehicle market held the largest share of 47.92% in 2024. The adoption of ATVs witnessed a considerable increase in the U.S. and Canada owing to various factors, such as the higher disposable income of residents, the developed economy, government regulations regarding ATVs, and upcoming electric vehicle projects. The region has numerous off-road terrain trails and parks, such as Northwest Off-Highway Vehicle Park, Rocky Ridge Ranch, and River Valley Motocross, as these off-road terrain trails and parks attract many tourists, thereby driving market growth.

U.S. All-terrain Vehicle Market Trends

The all-terrain vehicle market in the U.S. held a dominant position in 2024 due to the country's popularity of recreation and off-road culture. The abundance of dedicated off-road parks, trails, and recreational areas across the country encourages the use of ATVs for leisure purposes. Organizations and events, such as the National Off-Highway Vehicle Conservation Council (NOHVCC) and annual off-road festivals, promote the off-roading lifestyle, contributing to growth of the all-terrain vehicle industry.

Europe All-terrain Vehicle Market Trends

The all-terrain vehicle market in Europe was identified as a lucrative region in 2024. The expanding tourism industry in the region fuels market growth. ATV tours, especially in remote and scenic areas like Iceland, Scotland, and the Balkans, are gaining traction. These guided experiences, often provided by specialized operators, have introduced ATVs to a wider audience, fostering growth in rental and sales markets.

The UK all-terrain vehicle market is expected to grow rapidly in the coming years due to the growing number of affluent buyers willing to invest in recreational vehicles such as ATVs. Consumers increasingly seek leisure products with more disposable income that offer a unique and adventurous experience, driving demand for high-end, premium ATV models.

The all-terrain vehicle market in Germany held a substantial market share in 2024 owing to increasing demand for ATVs across various industries. These vehicles are used in sectors such as forestry, construction, and waste management due to their ability to handle rough terrain and transport materials efficiently. They are also used for tasks such as maintaining construction sites and navigating hazardous terrain in industrial zones.

Asia Pacific All-Terrain Vehicle Market Trends

The all-terrain vehicle market in Asia Pacific is anticipated to grow significantly during the forecast period. The growth is attributed to increasing disposable income, the popularity of adventure tourism and outdoor activities, infrastructure development to support off-roading, the rising popularity of off-roading as a recreational activity, and the growing awareness and accessibility of ATVs. These factors have collectively contributed to the market expansion in Asia Pacific, providing individuals with exciting outdoor recreational options and driving the demand for ATVs.

Japan all-terrain vehicle market is expected to grow rapidly over the forecast period. The popularity of customization and aftermarket service in the country fuels market growth. Many owners seek to personalize their vehicles with aftermarket modifications, including specialized tires, enhanced suspension systems, performance upgrades, and unique paint jobs.

The all-terrain vehicle market in China held a substantial market share in 2024 owing to economic growth in the region, which led to an increase in disposable income for its citizens, contributing to rising demand for recreational and leisure activities, including ATV usage.

Key All-terrain Vehicle Company Insights

Some of the key companies in the market include Polaris Inc., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Arctic Cat Inc., and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Polaris Inc. is a manufacturer specializing in designing, engineering, and producing power sports vehicles. It offers a diverse product portfolio that includes all-terrain vehicles (ATVs), side-by-side vehicles, snowmobiles, motorcycles, and marine products. The company also provides a wide range of accessories and aftermarket products to enhance the user experience.

-

Arctic Cat Inc. is a manufacturer specializing in designing, engineering, and producing snowmobiles and all-terrain vehicles (ATVs). The company's product lineup includes a variety of recreational vehicles marketed under names such as Arctic Cat, Wildcat, Prowler, and Alterra, along with parts, accessories, and apparel to enhance the riding experience.

Key All-terrain Vehicle Companies:

The following are the leading companies in the all-terrain vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Polaris Inc.

- American Honda Motor Co., Inc.

- Yamaha Motor Co., Ltd.

- BRP

- Kawasaki Heavy Industries, Ltd.

- Arctic Cat Inc.

- CFMOTO

- Suzuki Motor USA, LLC.

- KYMCO

- HISUN

Recent Developments

-

In November 2024, Gravton Motors launched Quanta, an all-terrain electric motorcycle featuring advanced Lithium Manganese Iron Phosphate (LMFP) battery technology. Quanta is designed for both urban and rural commuting, showcasing a range of up to 130 kilometers on a single charge and the capability to reach 80% charge in just 90 minutes using a standard 3-pin socket.

-

In June 2024, Sichuan Jinjia Special Equipment Technology Co., Ltd. launched the "Giant Lizard," an advanced all-terrain vehicle. Engineered for versatility, it excels in navigating difficult terrains and enduring extreme weather conditions, making it ideal for use in a wide range of environments, including deserts, snowy landscapes, mudflats, marshes, and inland waters.

All-terrain Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.94 billion

Revenue forecast in 2030

USD 6.01 billion

Growth rate

CAGR of 4.0% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Engine type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Polaris Inc.; American Honda Motor Co., Inc.; Yamaha Motor Co., Ltd.; BRP; Kawasaki Heavy Industries, Ltd.; Arctic Cat Inc.; CFMOTO; Suzuki Motor USA, LLC.; KYMCO; HISUN

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global All-terrain Vehicle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global all-terrain vehicle market report based on engine type, application, and region:

-

Engine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 400cc

-

400 - 800cc

-

Above 800cc

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Sports

-

Recreational

-

Military and Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global all-terrain vehicle market size was estimated at USD 4.77 billion in 2024 and is expected to reach USD 4.94 billion in 2025.

b. The global all-terrain vehicle market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2030 to reach USD 6.01 billion by 2030.

b. North America dominated the all-terrain vehicle market with a share of 47.9% in 2024. This is attributable to the growing popularity of outdoor entertainment activities such as off-road sports activities.

b. Some key players operating in the all-terrain vehicle market include Polaris Inc.; American Honda Motor Co., Inc.; Bombardier Recreational Products (BRP); Yamaha Motor Corporation; and Arctic Cat Inc.

b. Key factors that are driving the all-terrain vehicle market growth include growing demand for ATVs in agriculture and military & defense, rising number of off-road events and recreational activities in developed countries, increasing disposable income, and higher purchasing power.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.