- Home

- »

- Consumer F&B

- »

-

Almond Butter Market Size, Share & Growth Report, 2030GVR Report cover

![Almond Butter Market Size, Share & Trends Report]()

Almond Butter Market Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-041-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global almond butter market size was estimated at USD 705.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. The rise of health-conscious consumers, particularly in developed economies, has been a major driver for the almond butter demand in recent years. The growing popularity of plant-based diets and the more widespread adoption of healthy eating contribute to the market growth. According to the 2022 Food & Health Survey conducted by the International Food Information Council (IFIC) in the U.S., 30% of respondents said that following a healthy eating pattern benefits them.

In addition, the growing number of people who are lactose intolerant has increased demand for lactose-free products like almond butter, which has fueled the market's expansion. Moreover, the market for almond butter is anticipated to showcase tremendous growth in the coming years due to the rise in the vegan population, particularly in developed nations, and the rapid expansion of online platforms. According to a survey by Finder U.K., in 2023 around 2.6% of the U.K. population are on a vegan diet and 6.5% are vegetarians who opted for natural sources of protein.

The COVID-19 pandemic had a significant impact on the almond butter industry. Transportation restrictions for import and export disrupted the supply chain from one site to another. Transport of raw materials like almond butter and similar goods to enterprises was also prohibited. The manufacturing sector experienced several difficulties as a result of a scarcity of raw materials and a shortage of labor, which ultimately caused the closure of production facilities., thereby delaying the production of almond butter.

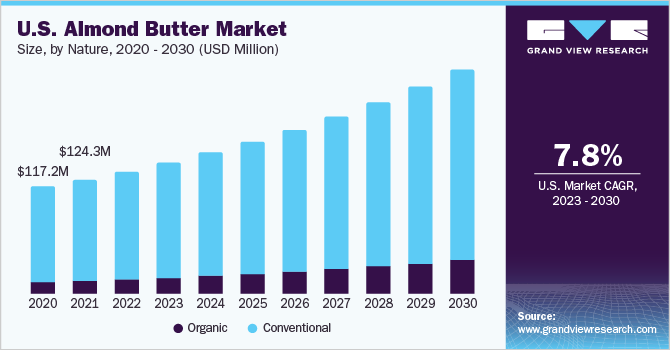

The U.S. almond butter market has been growing in recent years, driven by various factors such as the increasing adoption of organic products and health consciousness among consumers. Moreover, with the increasing concern about heart disease and diabetes in the U.S., the government is also taking initiatives to raise awareness about such diseases and control measures. For instance, in November 2022, the Office of Disease Prevention and Health Promotion raised awareness about diabetes and its impact on millions of Americans. It’s aimed at educating the public about COPD (Chronic Obstructive Pulmonary Disease), its risk factors, and how to prevent and manage the disease.

Nature Insights

Based on nature, the market has been segmented into organic and conventional. The conventional segment held the largest market share of 88.6% in 2022. The organic segment is expected to grow at the fastest CAGR of 10.6% over the forecast period 2022-2030. This can be attributed to the growing popularity of vegan and gluten-free products and the increasing trend of veganism as more and more consumers are shifting from meat and dairy-based products to organic products made without any harmful chemicals and cruelty-free.

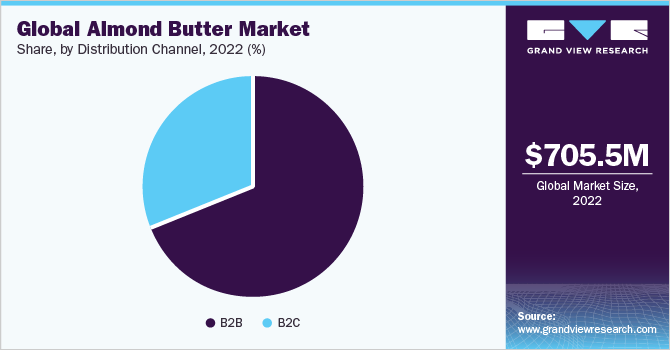

Distribution Channel Insights

Based on the distribution channel, the market is segmented into B2B and B2C. The growing use of almond butter in the food and beverage processing industry, such as in dips, dressings, sauces, soups, and other applications, is driving B2B segment growth. The hypermarket and supermarket segment accounted for the largest market share in the B2C segment in 2022 and is expected to grow at a CAGR of 8.4% CAGR from 2023-2030.

Supermarkets and hypermarkets are implementing a strong and well-coordinated data analytics management plan. This technology is being used to improve consumer engagement, expedite processes, and foster loyalty in the supply chain. Supermarkets and hypermarkets find it simpler to recognize and satisfy the requirements and expectations of their customers, and the increasing sales of the retail chain are anticipated to drive the segment in the coming year. For instance, in December 2022 Planet Organic Limited opened a new organic supermarket with thousands of varieties including almond butter.

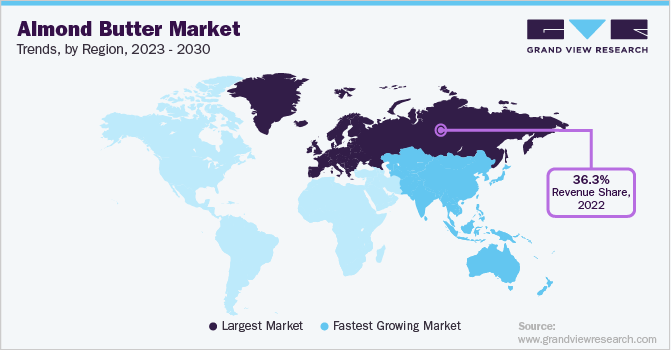

Regional Insights

Europedominated the market with a revenue share of 36.3% in 2022. This is attributed to the increasing demand for organic products and the growth of end-use industries including food & beverage processing and personal care & cosmetics as almond butter is extensively utilized as an ingredient in various food and cosmetic products. According to the U.S. Department of Agriculture (USDA), organic food sales in Germany have increased rapidly in recent years and reached USD 16.85 billion in 2020.

Asia Pacific is expected to grow at the fastest CAGR of 8.5% over the forecast period. This is due to the tremendous growth of the personal care and cosmetics market and the organic food industry in the region. According to the State Administration for Market Regulation of China and the Foresight Industry Research Institute, the size of China's organic food industry increased from USD 4.12 billion to USD 10.0 billion between 2013 and 2019 and is expected to reach USD 14.5 billion in 2023. Moreover, according to the article published by The Business of Fashion in March 2021, L’Oréal stated that 95% of its ingredients are natural and sustainable over the course of the next ten years across all its brands.

Key Companies & Market Share Insights

The almond butter industry features various global, regional, and local players which makes it a competitive market. The world’s leading companies are using partnerships, collaborations, acquisitions, mergers, and agreements as strategies to withstand the intense competition and increase their market share. Almond butter product manufacturers are spending extensively on product enhancement and new product development such as including new flavors. For instance, in August 2022, Justin’s introduced a new honey almond butter flavor, made with real honey and roasted almonds.

In November 2022, Justin's, LLC, and Applegate Farms, LLC announced a joint partnership with Conscious Alliance, a non-profit organization that works to fight hunger in communities across the U.S. The partnership focused on providing healthy, sustainable food to those in need through Conscious Alliance's food rescue and distribution programs. The goal of the campaign has to raise USD 250,000. Some prominent players in the global almond butter market include:

-

Hormel Foods Corporation

-

BARNEY BUTTER

-

Nutty Novelties

-

8th Avenue Food & Provisions

-

Hallstar

-

The Hain Celestial Group, Inc.

-

Cache Creek Foods

-

Nuts 'N More

-

Once Again

-

SOPHIM IBERIA S.L.

Almond Butter Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 756.7 million

Revenue forecast in 2030

USD 1,284.1 million

Growth Rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; France; Germany; China; India; Japan; Brazil; South Africa

Key companies profiled

Hormel Foods Corporation; BARNEY BUTTER; Nutty Novelties; 8th Avenue Food & Provisions; Hallstar; The Hain Celestial Group, Inc.; Cache Creek Foods; Nuts 'N More; Once Again; SOPHIM IBERIA S.L.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Almond Butter Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global almond butter market report based on nature, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

HoReCa

-

Food & Beverage Processing Industry

-

Personal Care & Cosmetic Industry

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

France

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central and South America

-

Brazil

-

South Africa

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global almond butter market size accounted at USD 705.7 million in 2022 and is expected to reach USD 756.7 million in 2023.

b. The global almond butter market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 1,284.1 million by 2030.

b. Europe dominated the almond butter market with a revenue share of 36.3% in 2022. This growth can be attributed to the increasing popularity of plant-based foods and healthy snacking options.

b. Some of the key players operating in the almond butter market include Hormel Foods Corporation, BARNEY BUTTER, Nutty Novelties, 8th Avenue Food & Provisions, Hallstar, The Hain Celestial Group, Inc., Cache Creek Foods, Nuts 'N More, Once Again, SOPHIM IBERIA S.L. among others.

b. The key factors that are driving the global almond butter market include growing health awareness, increasing vegan and vegetarian population, and growing demand for natural and organic products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."