- Home

- »

- Consumer F&B

- »

-

Almond Protein Market Size, Share & Trends Report, 2030GVR Report cover

![Almond Protein Market Size, Share & Trends Report]()

Almond Protein Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Conventional, Organic), By End Use (B2C, B2B), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-083-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Almond Protein Market Size & Trends

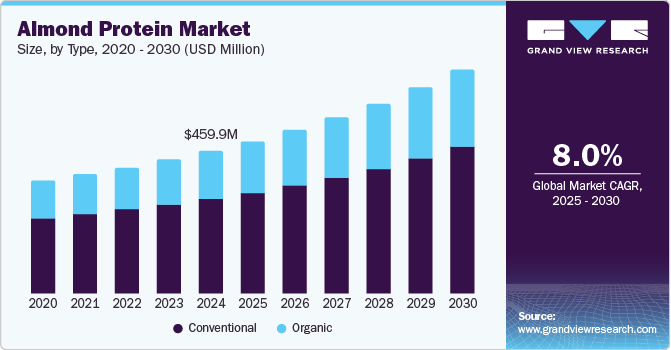

The global almond protein market size was valued at USD 459.9 million in 2024 and is expected to grow at a CAGR of 8.0% from 2025 to 2030. Increasing consumer awareness about the health benefits of plant-based proteins, such as their role in muscle building and overall wellness, is significantly boosting demand. The rising trend of veganism and vegetarianism also propels market growth, as more individuals seek nutritious and sustainable protein alternatives. Additionally, the versatility of almond protein in various applications-including dietary supplements, beverages, and bakery products-makes it a popular choice among manufacturers. The expanding availability of almond protein products in retail and online channels further supports market expansion.

The increasing demand for clean-label and natural products has led manufacturers to focus on almond protein as a preferred ingredient, given its non-GMO and allergen-free properties. The burgeoning functional food and beverage industry also drives the market, as consumers seek foods that offer health benefits beyond basic nutrition. Furthermore, almond protein production's eco-friendly and sustainable nature appeals to environmentally conscious consumers, supporting market growth. The ongoing research and development efforts to enhance almond protein products' taste, texture, and application versatility further boost their market adoption.

Type Insights

Conventional almond protein dominated the market, with the largest revenue share of 66.5% in 2024. Conventional almond protein is widely accessible and relatively more affordable than its organic counterpart, making it a popular choice among manufacturers and consumers. Its established supply chains ensure a steady and reliable availability of the product. Additionally, the versatility of conventional almond protein in various applications, such as in dietary supplements, beverages, and baked goods, enhances its appeal.

The organic almond protein segment is expected to grow at the fastest CAGR of 8.5% over the forecast period. Increasing consumer awareness and preference for organic and clean-label products significantly contribute to this growth. Organic almond protein is perceived as healthier and more environmentally friendly, aligning with the growing demand for sustainable food sources. Additionally, the rise in health-conscious and eco-friendly consumers seeking non-GMO and pesticide-free options supports market expansion. The organic segment's versatility in various applications, from dietary supplements to beverages and bakery products, further fuels its rapid growth.

End Use Insights

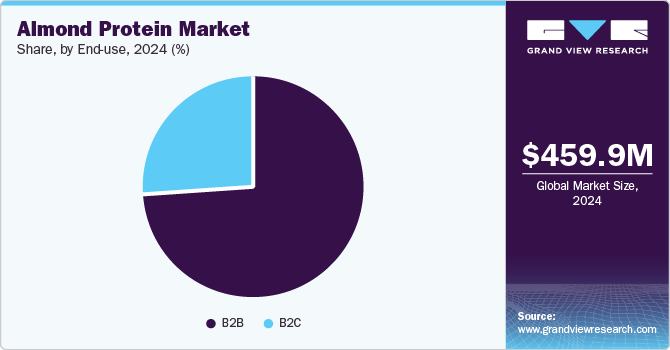

B2B dominated the market with the largest revenue share in 2024. The extensive use of almond protein by food and beverage manufacturers, dietary supplement producers, and other industries drives the bulk of demand. The B2B market benefits from long-term contracts and bulk purchasing, which ensures consistent demand and stable revenue streams. Additionally, the growing trend of incorporating plant-based proteins into various products, from nutrition bars to beverages, further supports the B2B segment's strong market position.

The B2C segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing consumer awareness and demand for plant-based and health-enhancing products. The convenience of purchasing almond protein products through retail stores, online platforms, and health food shops makes them readily accessible to a broad audience. Additionally, the rising popularity of almond protein in various applications, such as smoothies, snacks, and baking, appeals to health-conscious individuals seeking nutritious alternatives. The trend towards personalized health and wellness solutions further supports the robust growth of the B2C segment in the almond protein market.

Regional Insights

North American almond protein dominated the global market with the largest revenue share of 37.5% in 2024, owing to rising consumer awareness about the health benefits of plant-based proteins. The increasing trend towards vegan and vegetarian diets has significantly boosted the demand for almond protein. Additionally, the presence of key market players and advanced product innovation in the region further support market growth. The growing preference for natural and organic products among health-conscious consumers also contributes to the strong performance of the North American almond protein market.

U.S. Almond Protein Market Trends

The U.S. almond protein market is expected to grow significantly over the forecast period. Increasing consumer awareness about the health benefits of plant-based proteins is a major contributor to this surge. The rising trend of vegan and vegetarian diets has also boosted demand for almond protein products. The focus on sustainable and environmentally friendly food sources also supports market expansion. The presence of key market players and continuous product innovation further drive the market.

Europe Almond Protein Market Trends

Europe's almond protein market was identified as a lucrative region in 2024. The increasing consumer awareness about the health benefits of plant-based proteins, such as their role in muscle building and overall wellness, is significantly boosting demand. The rising trend of veganism and vegetarianism also propels market growth, as more individuals seek nutritious and sustainable protein alternatives. Additionally, the region's focus on clean label and natural products aligns well with almond protein's non-GMO and allergen-free properties. The expanding functional food and beverage industry, which includes products like protein bars and shakes, further supports market expansion.

Asia Pacific Almond Protein Market Trends

Asia Pacific almond protein market is expected to grow at the fastest CAGR of 10.2% over the forecast period. The increasing disposable incomes and changing consumption patterns have led to a higher demand for nutritious and high-quality food products. The region's diverse culinary landscape has seen almond protein seamlessly integrating into traditional dishes, expanding its appeal. Government initiatives promoting plant-based diets for sustainability further accelerate market growth. Additionally, the rising health consciousness among consumers, particularly millennials, supports the demand for almond protein products. The expansion of the functional food and beverage industry, including sports nutrition and personal care products, also contributes to the market's rapid growth in the Asia Pacific region.

Key Almond Protein Company Insights

Some key companies in the almond protein market include Celtic Sea Minerals, Marigot Ltd., Maxicrop USA, Inc., BioFlora, Alesco, and others. To stay competitive, companies are introducing new flavors and ingredients. Additionally, several key players engage in various strategic initiatives, such as mergers, acquisitions, and partnerships with leading organizations.

-

Celtic Sea Minerals specializes in marine minerals derived from red seaweed algae, specifically Lithothamnium calcareum. While their primary focus is on animal nutrition, their expertise in marine minerals positions them well within the broader health and nutrition sector, including potential applications in the almond protein market. Their products are known for their high mineral content, which can complement the nutritional profile of almond protein products.

-

Marigot Ltd. offers a range of natural ingredients for the food and beverage industry. Their portfolio includes various plant-based proteins, including almond protein, which is used in products such as protein bars, shakes, and dietary supplements. Marigot Ltd. is known for its commitment to quality and sustainability, making it a reliable supplier for companies looking to incorporate almond protein into their products.

Key Almond Protein Companies:

The following are the leading companies in the almond protein market. These companies collectively hold the largest market share and dictate industry trends.

- Celtic Sea Minerals

- Marigot Ltd.

- Maxicrop USA, Inc.

- BioFlora

- Alesco

- Blue Diamond Ingredients

- Noosh Brands

- Sabinsa Corporation

- InovoBiologic Inc.

- BASF

Recent Developments

-

In October 2024, Blue Diamond introduced the latest seasonal product, Frosted Brownie Almonds, to mark the beginning of the holiday season.

-

In September 2024, Divert, Inc. and Blue Diamond Growers announced a partnership to convert almond processing byproducts into renewable energy. Through Divert's advanced technologies, Blue Diamond will convert low-value byproducts into energy, contributing to California's goal of achieving net-zero carbon emissions by 2045.

Almond Protein Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 491.2 million

Revenue forecast in 2030

USD 721.7 million

Growth Rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Russia, Turkey, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa, Saudi Arabia

Key companies profiled

Celtic Sea Minerals; Marigot Ltd.; Maxicrop USA, Inc.; BioFlora; Alesco; Blue Diamond Ingredients; Noosh Brands; Sabinsa Corporation; InovoBiologic Inc.; BASF

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

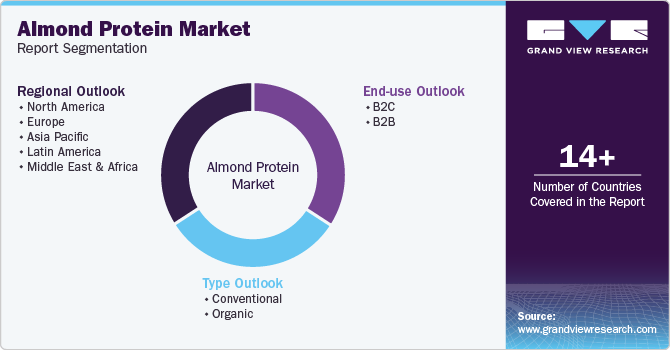

Global Almond Protein Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global almond protein market report based on type, end use, and region:

-

Type Outlook (Revenue USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

B2C

-

B2B

-

Food & Beverages

-

Supplements

-

Cosmetics & Personal Care

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.