- Home

- »

- Homecare & Decor

- »

-

Alternative Accommodation Market Size, Share Report, 2030GVR Report cover

![Alternative Accommodation Market Size, Share & Trends Report]()

Alternative Accommodation Market (2022 - 2030) Size, Share & Trends Analysis Report By Accommodation Type (Home, Apartments/Condominium), By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-959-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Alternative Accommodation Market Summary

The global alternative accommodation market size was estimated at USD 127,278.2 million in 2021 and is projected to reach USD 504,949.3 million by 2030, growing at a CAGR of 16.5% from 2022 to 2030. The global market is mainly driven by the constantly evolving international tourism sector, consumer inclination toward cheap and comfortable vacation stays such as apartments, homestays, and cottages, and rising spending on leisure and business travel.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2021.

- Country-wise, Mexico is expected to register the highest CAGR from 2022 to 2030.

- In terms of segment, home accounted for a revenue of USD 44,996.6 million in 2021.

- Apartments/Condominium is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 127,278.2 Million

- 2030 Projected Market Size: USD 504,949.3 Million

- CAGR (2022-2030): 16.5%

- North America: Largest market in 2021

Given the rise of online travel booking agencies and the growth of the hotel industry across the globe, alternative accommodations are likely to bring continued disruption to the hotel industry. Additionally, key players operating in the industry are constantly focusing on several business tactics to attract customers and offer better services. This has offered key players an opportunity to expand their global outreach, further bolstering the growth of the global industry.The industry witnessed a negative downturn due to the COVID-19 pandemic and key players witnessed a negative financial downturn and low occupancy rates. The widespread containment and mitigation measures to stop the virus's spread have harmed travel and tourism. However, with the improved mitigation and contingency plans, governments across the globe have been able to counter the adverse effects caused by the outbreak. With governments across the globe lifting their pandemic travel ban and opening doors for international travelers, the holiday season was filled with travelers across the globe reconnecting with loved ones and looking for adventurous activities. Prevalent during the height of the pandemic, alternative accommodations are expected to continue to encroach on traditional hotels and gain a dominant position. Over the forecast period, the industry is expected to witness strong growth owing to numerous domestic leisure travelers, government initiatives to promote the regional travel and tourism industry, and the increased focus of key players on extensive business strategies.

Alternative lodgings may generate new revenue for hotel chains, enabling them to draw in millennials looking for original, one-of-a-kind, and highly personalized vacation experiences. Additionally, it offers them a financially appealing investment model owing to reduced overhead expenses and better profitability than a hotel, which will also aid in the overall development and growth of the economy. Key companies with excellent investment and execution plans, supported by access to a variety of vacation rental spaces, are projected to offer new business possibilities, support the expansion of the local economy, and provide employment, particularly in underserved leisure areas. Additionally, the industry is expected to undergo huge technological advancements, and over the forecast period, technology will be imperative to carve out a competitive edge while offering an efficient and best guest experience.

The global market has been witnessing steady growth in European countries and the U.S. capturing significant shares driven by the rising travel and tourism sector. The global tourism industry is expanding exponentially as a result of the quick advancement of communication and transportation technology, expansion of the right to vacation, and improvements in the distribution of income across the globe. The consumer demands are different and diversifying sub-markets including alternative accommodation that address the varied understandings of accommodation and vacation are emerging in the growing tourism market. While economic mass tourism, package tours, and demand for efficient and budget-friendly accommodation that meet these trends are on the rise, individual preferences for alternative accommodation that fall out of these including condominiums, serviced apartments, and villas are expected to gain prominent traction.

Realizing that alternative accommodation is not a passing trend but is here to stay, hotel companies are entering the global market and diversifying their portfolio. Following COVID-19, companies are witnessing an evolution in consumer preference as many travelers have the flexibility to work or live from anywhere irrespective of the places and they are choosing short-term rentals to accommodate for larger group travel and longer stays. This consumer shift is expected to contribute to market growth and present a plethora of opportunities for market players to list more properties on their websites and attract new customers. Additionally, rising investments in travel and tourism and digital infrastructure are expected to emerge as one of the prominent factors contributing to the growth. However, rising geopolitical tensions between the countries, increased waste, pollution, and emissions, coupled with constantly evolving consumer expectations regarding the accommodation, are expected to be some of the major challenges faced by key market players.

Accommodation Type Insights

The home segment captured the largest revenue share of over 30.0% in 2021. The growth of the segment is attributed to the increasing popularity of homestays among domestic and international travelers due to the ease of comfort, safety, and privacy it offers. Additionally, due to the low cost and pet-friendly environment, travelers across the globe are inclined toward home-based vacation rentals. Consumers are more likely to choose a home vacation rental since it is less expensive than hotels and offers similar amenities. This is expected to make constructive addition to the growth of the global market.

The apartments/condominium segment is projected to register the highest CAGR of 17.7% from 2022 to 2030. Millennials and business travelers across the globe are opting to stay in apartments or condominiums buildings due to the luxury amenities it offers such as clubhouses, sports clubs, and swimming pools. Additionally, according to Real Estate Trade Association, staycation activities have increased drastically in the condominium segment mainly driven by their affordable price point. Thus, rising disposable income, travel and tourism spending across the globe, and ease of comfort offered by apartments/condominium rental are expected to drive the segment over the forecast period.

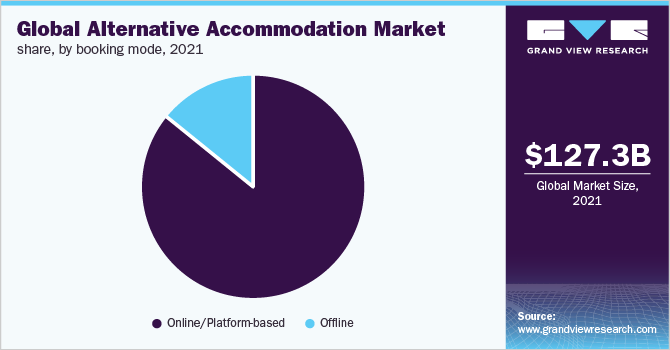

Booking Mode Insights

In terms of revenue, the online booking mode captured the largest share of over 85.0% in 2021. The online travel sector has seen various changes in recent years as a result of technological improvements. The fast expansion of mobile application usage and the increasing use of the internet have shaped the hotel booking process through online channels, making it quicker and simpler. Booking Holdings, Expedia, Airbnb, and other online travel agencies are significant participants in the industry and they offer services including discounts, information exchange, and transactions that are advantageous to both service providers and hotel guests. Additionally, in recent times, consumers have started opting for online booking platforms due to their features such as easy payments, easy bookings, safer payment modes, and easy and free cancelation. This has further elevated the demand for online booking channels.

The offline booking mode segment is driven by Gen X and baby boomers as they form the major consumer base. Consumers across the globe are still opting for offline booking mode due to the option of checking and reviewing the place before booking it. Additionally, travelers expect flexibility and a high-quality customer experience while booking through offline channels. This has contributed to the growth. However, customers are predicted to alter their preferences toward online booking as internet and smartphone usage among consumers increases. The rise of online travel booking channels is expected to disrupt the industry in the coming years.

Regional Insights

North America dominated the global market with a revenue share of over 35.0% in 2021 owing to the growing trend of glamping across the region and rising expenditure on booking accommodation in homes and condominiums. Additionally, increased tourism activities in North America owing to the high popularity of destinations, followed by the development of technologically advanced infrastructure, have exponentially contributed to the growth. The U.S., Canada, and Mexico held a significant share in 2021 and are expected to maintain growth. The regional market presents numerous opportunities for key players, thus key players are likely to invest in micro hotels and condominiums/apartments in the urban cities.

Asia Pacific is expected to register the highest CAGR of 17.6% from 2022 to 2030. The growth is primarily attributed to rising consumer expenditure on staycations and traveling. The growing dependency of several economies across the region on the hotel and accommodation industry and rising government investments in the development of sophisticated infrastructure to attract new tourists are expected to make constructive addition to the market growth. In addition, governments in countries like India, Indonesia, China, Vietnam, Australia, and Thailand are putting constant efforts into growing the tourist industry to promote the region's overall growth through tourism and produce income and jobs. The demand is also being fueled by tourists becoming more aware of the availability of holiday rentals. Asia Pacific is thus expected to witness strong growth in the years to come.

Key Companies & Market Share Insights

The global market is characterized by the presence of small and large-scale companies thriving in the competition and diversifying their service offerings to maintain their dominance.

-

In April 2021, Trivago, one of the prominent players, launched trivago Weekend to enable consumers from the U.S. and the U.K. to discover weekend getaways near their homes. Trivago Weekend will help travelers to find explicit deals on accommodation and introduce them to staycations near to their homes

-

In November 2021, Airbnb partnered with The International Olympic Committee (IOC) to support the Olympic Movement through to 2028. With this partnership, Airbnb aims to provide accommodations to help reduce costs for Olympic stakeholders and organizers and help local hosts and communities to generate direct revenue

-

In April 2022, Airbnb partnered with Visit North Carolina to promote travel to 16 rural counties with an extensive focus on unique stays, charming experiences, and local attractions. This strategic initiative is aimed to support the regional post-pandemic recovery for restaurants, workers, and many unique local shops that rely on the local tourism industry

Some prominent players in the global alternative accommodation market include:

-

holidu.co.uk

-

Trivago

-

Airbnb, Inc.

-

Booking.com

-

VRBO (Expedia Group)

-

MakeMyTrip Limited

-

Wyndham Destinations Inc.

-

HomeToGo

-

Peakah

-

Trip.com Group Limited

-

TripAdvisor, Inc.

Alternative Accommodation Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 147.31 billion

Revenue forecast in 2030

USD 504.95 billion

Growth rate

CAGR of 16.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation type, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

holidu.co.uk; Trivago; Airbnb, Inc.; Booking.com; VRBO (Expedia Group); MakeMyTrip Limited; Wyndham Destinations Inc.; HomeToGo; Peakah; Trip.com Group Limited; TripAdvisor, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alternative Accommodation Market Segmentation

This report forecasts growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global alternative accommodation market report on the basis of accommodation type, booking mode, and region:

-

Accommodation Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Home

-

Apartments/Condominium

-

Alternative Accommodation & Camping

-

Hostel

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online/Platform-based

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alternative accommodation market size was estimated at USD 127.28 billion in 2021 and is expected to reach USD 147.31 billion in 2022.

b. The global alternative accommodation market is expected to grow at a compound annual growth rate of 16.5% from 2022 to 2030 to reach USD 504.95 billion by 2030.

b. North America dominated the alternative accommodation market with a share of 36.06% in 2021. This is attributable to the rising trend of glamping across the region and rising expenditure for booking accommodation in homes and condominiums.

b. Some key players operating in the alternative accommodation market include holidu.co.uk; Trivago; Airbnb, Inc.; Booking.com; VRBO (Expedia Group); MakeMyTrip Limited; Wyndham Destinations Inc.; HomeToGo; Peakah; Trip.com Group Limited; and TripAdvisor, Inc.

b. The growth of the global alternative accommodation market is mainly driven by the constantly evolving international tourism sector, consumer inclination towards cheap and comfortable vacation stays such as apartments, homestays, cottages among others, and rising spending on leisure and business travel.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.