- Home

- »

- Next Generation Technologies

- »

-

Global Alternative Financing Market Size & Share Report, 2030GVR Report cover

![Alternative Financing Market Size, Share & Trends Report]()

Alternative Financing Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Peer-to-Peer Lending, Invoice Trade), By End-user (Individual, Businesses), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-933-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alternative Financing Market Summary

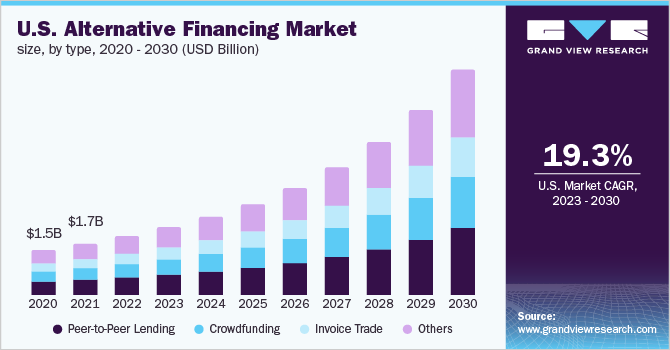

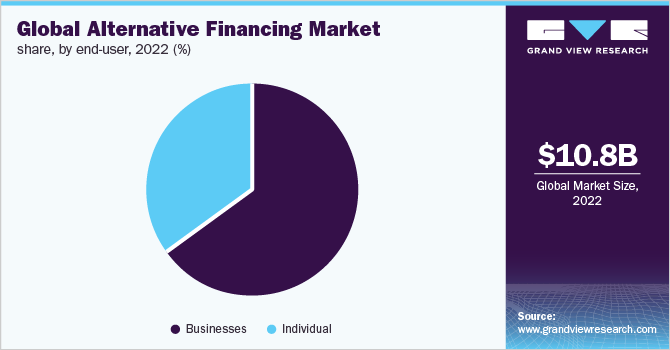

The global alternative financing market size was valued at USD 10.82 billion in 2022 and is expected to reach USD 45.72 billion by 2030, growing at a compound annual growth rate (CAGR) of 20.2% from 2023 to 2030. The industry has been driven by the need for small businesses and individuals to access capital.

Key Market Trends & Insights

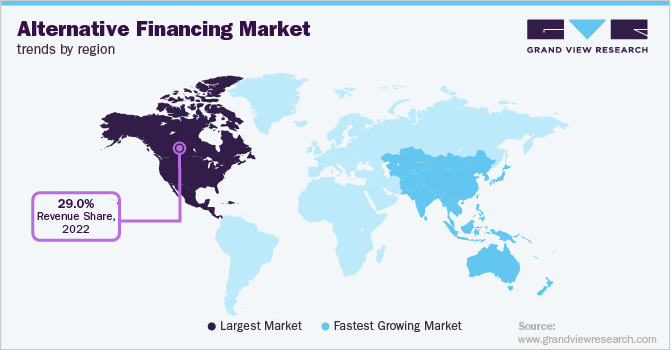

- North America dominated the global industry in 2022 and accounted for the maximum share of more than 29.0% of the overall revenue.

- By type, the peer-to-peer lending segment dominated the industry in 2022 and accounted for the largest share of more than 28.00% of the overall revenue.

- By end-user, the businesses segment dominated the industry in 2022 and accounted for the largest share of more than 65.0% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 10.82 Billion

- 2030 Projected Market Size: USD 45.72 Billion

- CAGR (2023-2030): 20.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Traditional banking institutions have stringent requirements, making it difficult for many to secure loans. Alternative finance products make capital more accessible, particularly for those who may not meet the strict requirements of traditional banks. This has led to a significant increase in the use of alternative finance products as a means of obtaining capital. Moreover, technological advancements, particularly in fintech and online lending platforms, have played a major role in the growth of the industry.

These innovations have made it possible to automate the lending process, reducing the time and cost associated with traditional banking methods. Online lending platforms have also made it easier for small businesses and individuals to access capital by connecting them with a wide range of lenders. In addition, there has been a shift in attitudes toward borrowing and alternative financing in recent years. The stigma associated with alternative financing has diminished as more people recognize it as a viable option for obtaining capital. Economic downturns have also been a driving force in the growth of the industry. During tough economic times, traditional banking institutions often become more cautious in their lending practices, making it harder for small businesses and individuals to secure loans.

Alternative financing provides a solution by offering access to capital during these difficult times, helping businesses and individuals weather economic storms. Furthermore, alternative financing is often seen as more flexible and less costly than traditional bank loans, which has contributed to the change in attitudes. Governments around the world have also played a role in driving the growth of the industry by providing support and regulations. This has encouraged more people and businesses to use alternative financing as a means of obtaining capital. Government support has also helped increase consumer confidence in alternative financing, as regulations provide protection for borrowers and lenders alike. The increased government support has helped to further solidify alternative financing as a viable and trusted option for obtaining capital.

One of the major restraints of the industry is the lack of awareness and understanding of the options available. Many people and businesses still need to familiarize themselves with alternative finance products and their benefits. This lack of awareness can lead to a lack of trust and a reluctance to use alternative financing options. To overcome this restraint, education and awareness campaigns are needed to inform people and businesses about the options available in the alternative financing sector. Providing clear and concise information on the benefits, risks, and processes of alternative financing can increase trust and encourage wider adoption.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a significant impact on the global industry. The sudden and widespread economic disruption caused by the pandemic led to an increased demand for alternative financing options as small businesses and individuals struggled to access capital through traditional banking institutions. In addition, the pandemic accelerated the shift towards digital and online lending platforms, as social distancing measures made it difficult for people to access traditional banks in person. The widespread adoption of technology and digital platforms during the pandemic further propelled the growth of the industry.

Type Insights

The peer-to-peer lending segment dominated the industry in 2022 and accounted for the largest share of more than 28.00% of the overall revenue. Peer-to-peer lending provides a more efficient and accessible way for individuals and businesses to access credit. The online nature of peer-to-peer lending platforms means that borrowers can apply for loans from anywhere, at any time. This can be especially beneficial for individuals and businesses in areas where access to credit is limited or nonexistent, as well as for those who need help to secure loans from traditional financial institutions.

The crowdfunding segment is anticipated to register a significant growth rate over the forecast period. Crowdfunding allows individuals and businesses to raise funds from a large number of people, typically through online platforms. This means that even those who would not typically be able to secure funding through traditional sources, such as banks or venture capital firms, can still access capital to bring their ideas to life. Another advantage of crowdfunding is that it provides a level of transparency and accountability that is often not found in other forms of alternative financing.

End-user Insights

The businesses segment dominated the industry in 2022 and accounted for the largest share of more than 65.0% of the overall revenue. The primary advantage for businesses using alternative financing is the ability to access capital quickly and efficiently. Traditional forms of financing, such as bank loans or venture capital, can take time and effort to secure, often requiring extensive paperwork and a lengthy approval process. Alternative financing options, such as crowdfunding, peer-to-peer lending, or invoice financing, can provide businesses with access to capital in a matter of days or even hours, allowing them to take advantage of new opportunities and stay ahead of the competition.

The individual segment is anticipated to register significant growth over the forecast period. One of the primary factors contributing to the segment’s growth is the ability to invest in a broader range of financial products. Traditional investment options, such as stocks, bonds, or mutual funds, can be limited in their scope and may not align with an individual’s values or interests. Alternative financing options, such as crowdfunding or social impact investing, allow individuals to invest in a wide range of projects and ideas, including those that align with their values and goals.

Regional Insights

North America dominated the global industry in 2022 and accounted for the maximum share of more than 29.0% of the overall revenue. North America has a large and mature financial services market, well-developed infrastructure, and a large pool of potential investors and borrowers. This provides a favorable environment for alternative financing providers to operate in, allowing them to reach a large customer base and secure the capital they need to grow and succeed. Another reason North America dominates the industry is its high level of innovation and technology adoption.

Moreover, it is home to many of the world’s leading technology companies, and its consumers quickly embrace new and innovative financial products and services. Asia Pacific is expected to emerge as the fastest-growing region over the forecast period. The region’s growth can be attributed to the supportive regulatory environment for alternative financing in many countries. Governments in the region are keen to promote financial innovation and have put in place regulations that support the growth and development of alternative financing providers while still protecting consumers and investors. This has encouraged more entrants into the market, further fueling its growth.

Key Companies & Market Share Insights

Many alternative financing companies have entered into partnerships and collaborations with other financial institutions, fintech companies, and technology providers to expand their reach and offer a broader range of products and services. For instance, in May 2022, OnDeck disclosed a growing list of strategic alliances, including SoFi Technologies, Inc. and LendingTree, intending to assist small businesses across the country. These collaborations combine best-in-class fintech offerings and digital lending products with OnDeck’s Artificial Intelligence (AI) and Machine Learning (ML) expertise, providing small businesses with more options for obtaining easy access to working capital to support their growth.

Alternative financing companies have been diversifying their product offerings to meet the changing needs of borrowers and lenders. Digital transformation has been a significant focus for many alternative financing companies as they strive to offer a seamless and convenient experience for borrowers and lenders. In addition, prominent players in the industry have been expanding into new markets to tap into new growth opportunities. These strategic initiatives demonstrate the ongoing innovation and evolution in the industry. Some of the prominent players operating in the global alternative financing market include:

-

LendingCrowd

-

Upstart Network, Inc.

-

Funding Circle

-

OnDeck

-

GoFundMe

-

Wefunder, Inc.

-

LendingTree, LLC

-

Prosper Funding LLC

-

Fundly

-

Kickstarter, PBC

Alternative Financing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.61 billion

Revenue forecast in 2030

USD 45.72 billion

Growth rate

CAGR of 20.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Italy; Spain; India; China; Japan; South Korea; Brazil; Mexico

Key companies profiled

LendingCrowd; Upstart Network, Inc.; Funding Circle; OnDeck; GoFundMe; Wefunder, Inc.; LendingTree, LLC; Prosper Funding LLC; Fundly; Kickstarter, PBC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alternative Financing Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global alternative financing market report based on type, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Peer-to-Peer Lending

-

Crowdfunding

-

Invoice Trade

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Individual

-

Businesses

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global alternative financing market size was estimated at USD 10.82 billion in 2022 and is expected to reach USD 12.61 billion in 2023.

b. The global alternative financing market is expected to grow at a compound annual growth rate of 20.2% from 2023 to 2030 to reach USD 45.72 billion by 2030.

b. North America dominated the alternative financing market with a share of 29.45% in 2022. North America has a large and mature financial services market, well-developed infrastructure, and a large pool of potential investors and borrowers. This provides a favorable environment for alternative financing providers to operate in, allowing them to reach a large customer base and secure the capital they need to grow and succeed.

b. Some key players operating in the alternative financing market include LendingCrowd; Upstart Network, Inc.; Funding Circle; OnDeck; GoFundMe; Wefunder, Inc.; LendingTree, LLC; Prosper Funding LLC; Fundly; Kickstarter, PBC.

b. Key factors driving the growth of alternative financing include the need for individuals and small businesses to access capital and the proliferation of online lending platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.