- Home

- »

- Next Generation Technologies

- »

-

Aluminum Curtain Wall Market Size Report, 2030GVR Report cover

![Aluminum Curtain Wall Market Size, Share & Trends Report]()

Aluminum Curtain Wall Market Size, Share & Trends Analysis Report By Application (Commercial, Residential), By Type (Stick-built, Semi-unitized, Unitized), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-218-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

The global aluminum curtain wall market size was valued at USD 35.53 Billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2030. The growing emphasis on energy efficiency and sustainable building practices drives market growth. Aluminum curtain walls offer superior insulation properties, reducing the need for artificial heating and cooling, which helps buildings meet stringent energy efficiency standards. As green building certifications such as LEED and BREEAM gain prominence, aluminum curtain walls are becoming more common, particularly in commercial and high-rise residential structures.

Another factor contributing to the demand is the rapid urbanization and development of infrastructure in emerging economies. Countries in Asia-Pacific, the Middle East, and Africa are witnessing a construction boom, with numerous skyscrapers and large commercial projects underway. Aluminum curtain walls are favored in these projects due to their lightweight nature and durability. The material allows for more creative and modern architectural designs, which are highly sought after in urban landscapes.

Furthermore, technological advancements in manufacturing and installing aluminum curtain walls have made them more accessible and cost-effective. Innovations in aluminum processing and developing high-performance glazing systems have improved these curtain walls' structural capabilities and energy efficiency. This has led to the broader adoption of aluminum curtain walls in new constructions and renovation projects across various regions.

Lastly, the increasing awareness of aluminum's long-term benefits, such as its recyclability and low maintenance requirements, encourages builders and developers to choose aluminum curtain walls over traditional materials. As sustainability becomes a core focus in the construction industry, the demand for aluminum curtain walls is expected to continue growing globally.

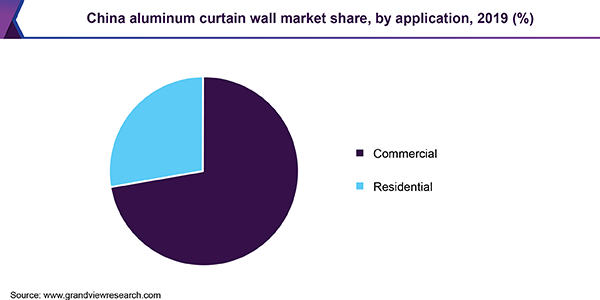

Application Insights

The commercial segment held the largest market revenue share of 72.4% in 2023. The growing emphasis on energy-efficient and aesthetically appealing building designs in the commercial sector drives the segment growth. Aluminum curtain walls are favored for their lightweight, durable, and low-maintenance properties, making them ideal for large-scale commercial projects like office buildings, shopping malls, and hotels. Additionally, the increasing trend toward high-rise commercial buildings, particularly in urban areas, drives the demand for aluminum curtain walls as they offer enhanced structural support and flexibility in design.

The residential segment is projected to grow significantly over the forecast period. Homeowners and developers are increasingly seeking modern architectural designs emphasizing sleek and contemporary exteriors, which aluminum curtain walls provide. These walls also improve energy efficiency by enhancing insulation and reducing thermal bridging, which is crucial in meeting stringent energy regulations. Additionally, aluminum's corrosion resistance and low maintenance requirements make it a cost-effective and long-lasting option for residential buildings. As urbanization continues and more high-rise residential projects emerge, the adoption of aluminum curtain walls in this segment is expected to grow.

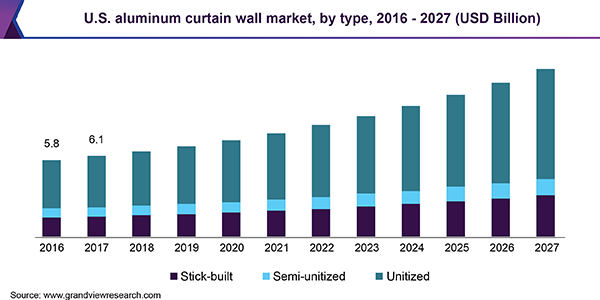

Type Insights

The unitized segment held the largest market revenue share in 2023. Unitized curtain walls are pre-fabricated and assembled in controlled factory environments, ensuring high precision and quality. This method significantly reduces installation time on-site, as large sections can be quickly erected, minimizing labor costs and reducing project timelines. Additionally, unitized systems offer superior thermal insulation and weatherproofing, which are increasingly important in modern, energy-efficient building designs. As urbanization and the construction of high-rise buildings continue to grow globally, unitized aluminum curtain walls' efficiency and performance benefits are driving their rising demand in the market.

The stick-built segment is projected to grow significantly over the forecast period. Stick-built curtain walls allow for on-site assembly, which is advantageous for irregular shapes or custom specifications, unlike unitized systems. This method also provides cost-effectiveness for small to medium-sized projects, reducing the need for extensive prefabrication. The stick-built system offers better control over the installation process, enabling adjustments during construction to accommodate unforeseen challenges. As a result, it is favored for projects that require a high degree of customization and precision, driving its growing demand in the market.

Regional Insights

The North American market is projected to witness significant growth in the coming year. As urbanization accelerates and cities expand, there is a rising need for modern, energy-efficient buildings, driving the adoption of aluminum curtain walls. These walls are favored for their durability, low maintenance, and ability to support large glass panels that contribute to natural lighting and energy efficiency. Additionally, the push for green building certifications like LEED (Leadership in Energy and Environmental Design) in the U.S. and Canada has further propelled the use of aluminum curtain walls, which contribute to sustainable construction practices.

U.S. Aluminum Curtain Wall Market Insights

The U.S. market held the largest market revenue share regionally in 2023. The rapid growth of urban areas in the U.S. has resulted in a higher demand for aluminum curtain walls due to the need for more commercial and residential structures. The material's ability to support large glass panels while offering flexibility in design also makes it a preferred choice among architects and builders, contributing to its increasing demand.

Europe Aluminum Curtain Wall Market Insights

Europe aluminum curtain wall market is projected to grow significantly over the forecast period. European regulations, particularly the Energy Performance of Buildings Directive (EPBD), are driving the adoption of materials that contribute to better insulation and reduced energy consumption in buildings. Additionally, the growing trend towards modern architectural designs emphasizing large glass facades is fueling demand, as aluminum curtain walls offer the flexibility required for such constructions. The increasing investments in commercial real estate and infrastructure projects across key European cities also contribute to this demand.

The UK market is anticipated to witness a significant growth over the coming years. The UK construction industry has seen a surge in developing high-rise commercial and residential buildings, particularly in urban areas like London and Manchester. Additionally, the push for energy-efficient buildings in the UK, driven by stringent government regulations and the growing emphasis on sustainability, has led to a preference for aluminum curtain walls. These systems offer superior thermal insulation and can be integrated with energy-saving technologies, making them a preferred choice for environmentally conscious construction projects.

Asia Pacific Aluminum Curtain Wall Market Insights

Asia Pacific market held the largest market revenue share of 48.2% in 2023. Rapid urbanization and the ongoing construction boom in countries such as China and India drive market growth. These regions are experiencing significant growth in high-rise buildings, commercial complexes, and infrastructure projects, all requiring durable and aesthetically pleasing building facades. Additionally, government initiatives promoting sustainable construction practices further boost the adoption of aluminum curtain walls as they contribute to building energy conservation.

India market is projected to grow rapidly in the coming years. The rapid urbanization and growth in the construction of commercial and residential buildings drive the demand for aluminum curtain walls. The Indian government's focus on infrastructure development, including the Smart Cities Mission and affordable housing projects, has accelerated the adoption of modern building technologies such as aluminum curtain walls, which offer energy efficiency and durability.

Latin America Aluminum Curtain Wall Market Insights

The Latin American market is projected to grow significantly over the forecast. As cities across Latin America experience growth, there is a rising need for modern buildings that offer energy efficiency and durability, which aluminum curtain walls provide. Additionally, governments and private developers in countries such as Brazil, Mexico, and Argentina are increasingly adopting sustainable construction practices, where aluminum curtain walls play a key role due to their recyclability and low environmental impact. This trend is further supported by the growing emphasis on green building certifications in the region, which encourages using materials such as aluminum that contribute to energy-efficient building designs.

Key Companies and Market Share Insights

Some key companies in the aluminum curtain wall market include Alumil; Aluplex; ALUTECH; EFCO, LLC; Enclos Corp.; GUTMANN Group; HansenGroup; and others.

-

ALUTECH’s ALT F50 Curtain Wall System is a versatile solution for translucent constructions. It features a 50 mm visible width post-transom facade, allowing maximum translucency and visual lightness. The system accommodates fillings from 4 to 50 mm thick, imitating structural glazing while maintaining flexibility. ALT F50 offers color customization, thermal insulation, and anodized profiles. ALUTECH also provides other architectural solutions like interior partitions, skylights, and ventilated facades.

-

Alumil International offers a broad range of aluminum curtain wall systems designed to serve as building envelopes. These systems ensure maximum daylight intake while creating a comfortable environment for occupants. Notable offerings include the M50 SMARTIA, which combines high energy efficiency with infinite design possibilities, and the M7 SMARTIA, an affordable and energy-efficient option that meets stability and safety standards.

Key Aluminum Curtain Wall Companies:

The following are the leading companies in the aluminum curtain wall market. These companies collectively hold the largest market share and dictate industry trends.

- Alumil

- Aluplex

- ALUTECH

- EFCO, LLC

- Enclos Corp.

- GUTMANN Group

- HansenGroup

- heroal

- HUECK System GmbH & Co. KG

- Josef Gartner GmbH

- Kalwall

- Kawneer Company, Inc.

- National Enclosure Company

- Ponzio

- Purso

- RAICO Bautechnik GmbH

- Reynaers

- SAPA

- Schüco India

- Skansa

Recent Developments

- In August 2024, Alumil announced the launch of LOOP 80, a pioneering initiative focused on aluminum recycling. This initiative represents a significant step towards sustainable production. The initiative aims to create an aluminum alloy containing at least 80% recycled content, a milestone in the company's efforts to reduce its environmental footprint. This approach aligns with Alumil's broader commitment to sustainability and circular economy principles.

Aluminum Curtain Wall Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.85 Billion

Revenue forecast in 2030

USD 63.70 Billion

Growth Rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Type, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Russia, Turkey, Poland, U.K., Germany, France, Spain, China, India, Japan, Taiwan, Thailand, Malaysia, Singapore, Indonesia, Australia, Brazil, Mexico, Saudi Arabia, UAE

Key companies profiled

Alumil; Aluplex; ALUTECH; EFCO, LLC; Enclos Corp.;GUTMANN Group; HansenGroup; heroal; HUECK System GmbH & Co. KG; Josef Gartner GmbH; Kalwall; Kawneer Company, Inc.; National Enclosure Company; Ponzio; Purso; RAICO Bautechnik GmbH; Reynaers; SAPA; Schüco India; Skansa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Curtain Wall Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the aluminum curtain wall market report based on application, type, and region.

-

Aluminum Curtain Wall Market Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Aluminum Curtain Wall Market Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stick-built

-

Semi-unitized

-

Unitized

-

-

Aluminum Curtain Wall Market Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Russia

-

Turkey

-

Poland

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

Thailand

-

Malaysia

-

Singapore

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aluminum curtain wall market size was estimated at USD 31.9 billion in 2019 and is expected to reach USD 34.6 billion in 2020.

b. The global aluminum curtain wall market is expected to grow at a compound annual growth rate of 9.6% from 2020 to 2027 to reach USD 65.7 billion by 2027.

b. Asia Pacific dominated the aluminum curtain wall market with a share of 44.8% in 2019. This is attributable to healthy spread of construction activities along with initiatives taken by the governments for infrastructure development.

b. Some key players operating in the aluminum curtain wall market include Alumil Aluminium Industry S.A.; EFCO Corporation; GUTMANN AG; HansenGroup Ltd.; and Kawneer Company, Inc.

b. Key factors that are driving the market growth include growing need to secure outside walls of business structures coupled with growing demand for lightweight curtain walls in construction projects.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."