- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Forging Market Size, Share & Growth Report 2030GVR Report cover

![Aluminum Forging Market Size, Share & Trends Report]()

Aluminum Forging Market Size, Share & Trends Analysis Report By Product (Open Die, Closed Die), By Application (Automotive, Aerospace), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-041-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

“2030 aluminum forging market value to reach USD 33.61 billion.”

Aluminum Forging Market Size & Trends

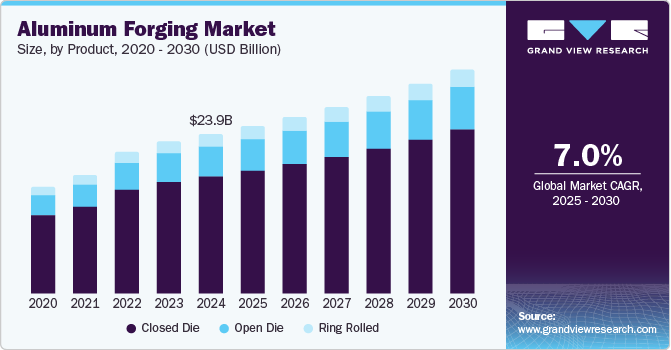

The global aluminum forging market size was estimated at USD 23.93 billion in 2024 and is projected to grow at a CAGR of 7.0% from 2025 to 2030.The rising demand for lightweight materials in the automotive industry is driving growth. Automobile manufacturers have been trying to reduce the weight of vehicles for many years to increase fuel efficiency and improve vehicle performance, as well as to reduce carbon emissions. According to the U.S. Department of Energy, a decrease in the weight of vehicles by 10% can increase fuel efficiency by 6% to 8%. Thus, global automotive manufacturers are shifting towards the production of lightweight cars.

Increasing demand for new defense aircraft is expected to further augment market growth. Airbus experienced a remarkable 200% increase in profits, primarily driven by a surge in passenger aircraft sales and heightened demand for military aircraft. In response to this growth, the company announced in May 2022 plans to boost A320 production by 50%, aiming to manufacture a minimum of 75 aircraft per month by 2025. This strategic move highlights Airbus's commitment to scaling operations in line with market demand.

Drivers, Opportunities & Restraints

The demand for aluminum forged components from the global aerospace & defense industry has surged rapidly. According to the International Air Transport Association (IATA), there will be 8.2 billion passengers flying throughout the world by 2037. The aluminum forged components used in this industry are offered by a few well-established global companies that make significant financial investments to provide their clients with the most cutting-edge products. Manufacturers of engines, landing gears, etc. used in aircraft are opting for lightweight materials such as forged aluminum for developing their products to lower the weight of aircraft.

The volatility in global aluminum prices has persisted beyond 2023 due to ongoing market shifts. Key factors now influencing these fluctuations include China's production strategies, as the country prioritizes environmental goals by capping aluminum output. China’s transition to hydropower-based smelting in provinces like Yunnan has also introduced operational constraints, limiting future capacity growth. Meanwhile, the ongoing Russia-Ukraine conflict continues to disrupt supply chains, contributing to uncertainties in raw material availability and energy costs.

Industry 4.0 offers the aluminum forging market opportunities through automation, IoT, and AI-driven solutions, optimizing production, reducing waste, and enhancing product quality. These technologies enable efficient operations, predictive maintenance, and better customization, meeting growing demand from sectors like automotive, aerospace, and renewable energy.

Price Trend Analysis

Since 2023, aluminum forging prices have been volatile, driven by growing demand from EVs, aerospace, and renewable energy sectors, along with high energy costs and supply disruptions. The surge in lightweight automotive components and aerospace recovery has increased reliance on forged aluminum.

However, geopolitical factors, such as energy crises and trade shifts, add further pricing pressure. To mitigate volatility, manufacturers are adopting recycling technologies and advanced aluminum alloys to lower costs and align with sustainability goals. Environmental regulations, especially in Europe and North America, are also reshaping production methods, emphasizing eco-friendly practices to ensure long-term market stability

Product Insights

“Closed die forging held the revenue share of over 72% in 2024.”

The process is carried out between flat dies or very simple shapes, struck, bars, and hollows. Forge components from this process find applications in industries such as aerospace, defense, energy, and automotive.

Closed die process produces more complex shapes with higher tolerances than the open die because of the presence of two or more dies enclosed during the process. Closed-die forging is typically more economical than open die in case of large-scale production. The components manufactured from this process are primarily used in the aerospace and automotive industries.

The ring-rolled segment is anticipated to register a CAGR of 6.3%, in terms of revenue, over the forecast period. Rings are lightweight, able to resist corrosion, and extremely durable. Owing to the aforementioned reasons, the process is an ideal choice for applications that require high stress such as parts used in the defense and aerospace industry.

Application Insights

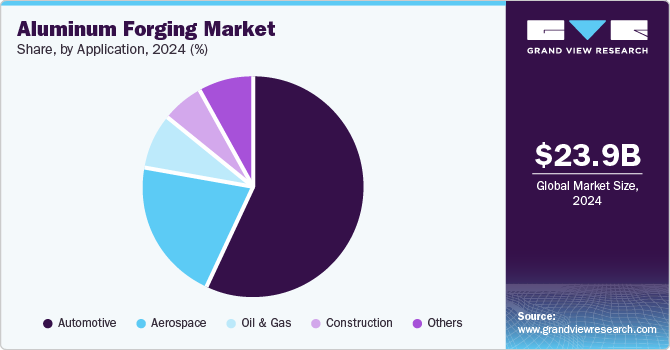

“Automotive segment held the revenue share of over 56% in 2024.”

Aluminum forged components are used in automobiles in applications that require high mechanical performance such as chassis suspension system control arms, steering knuckles, wheels, and air-conditioning scroll plates of vehicles.

The global automotive industry is increasing its consumption of forged components to lower the weight of vehicles. This has led to new orders from automobile manufacturers to companies offering forged components. For instance, in 2022, Bharat Forge secured a new order of aluminum forging worth USD 121.6 million from the automotive and industrial sectors. According to the company, its utility vehicle segment grew by approximately 43% in 2022 due to these new orders.

The aerospace segment is expected to register a CAGR of 7.0%, in terms of revenue, during the forecast period. The weight of aircraft is significantly reduced when aluminum alloys are used in its production, as they weigh almost one-third lighter than steel. This enables aircraft to carry the increased weight of cargo and passengers or reduces their fuel consumption.

Aluminum forged components are used in the development of structures wherein the performance and safety parameters are of the highest priority. One of the most important advantages of aluminum is its high strength-to-weight ratio.

Regional Insights

“China held over 60% revenue share of the overall Asia Pacific aluminum forging market.”

Asia Pacific Aluminum Forging Market Trends

Asia Pacific aluminum forging market held over 47% revenue share of the global aluminum forging market. Asia Pacific aluminum forging market is experiencing strong growth, driven by rising demand from automotive, aerospace, and industrial sectors. Countries such as China, India, and Japan are increasing production of lightweight components to meet stricter emission standards and support electric vehicle adoption. In addition, the aerospace sector's recovery has bolstered demand for high-strength, durable aluminum parts. However, the market faces challenges from fluctuating raw material prices and energy costs. Advancements in forging technologies and a focus on sustainable practices, including recycling, are shaping the region’s growth trajectory going forward.

China aluminum forging market benefitted from the East-European conflict as European traders switched to China for aluminum imports. The war heavily impacted the European aluminum forging industry and other countries as well that import aluminum from Russia and Ukraine. This led to a shortage of aluminum supplies in Europe as the majority of supplies came from Russia.

North America Aluminum Forging Market Trends

The North America aluminum forging market is anticipated to increase significantly during the forecast period owing to the increase in orders to the U.S. for new defense aircraft from other countries is expected to propel market growth in the coming years. For instance, in 2022, Jordan ordered 70 new F-16 fighter jets. Similarly, Bahrain is set to receive 70 F-16 fighter jets by 2024.

The U.S. and Europe play a key role in the global aerospace & defense industry owing to the presence of leading companies such as the Boeing Company, Airbus SE, Bombardier Inc., Dassault Aviation SA, and Lockheed Martin Corporation in these geographies.

U.S. Aluminum Forging Market Trends

The U.S. aluminum forging market is a prominent producer and consumer of aluminum forged products in North America. As air transportation has become a popular mode of transportation in the world, it has resulted in an increased number of U.S. air passengers. This, in turn, has fueled the demand for aircraft, thereby leading to the growth of the aviation industry. The U.S. aerospace industry, which is a vital end user of aluminum forged components is driving the growth of the market.

Europe Aluminum Forging Market Trends

In 2024, Germany accounted for a revenue share of 34.0% of the European market and is one of the leading producers of aluminum forged components in Europe. The increasing demand for lightweight components from the automotive industry is driving product demand in the country.

For instance, in December 2022, Germany-based Mercedes received low-carbon aluminum from Norsk Hydro that complies with European standards related to emissions. The aluminum forged components have been ordered by the former to be used in a range of its car models in 2023 to achieve net zero carbon emissions by 2030.

Central & South America Aluminum Forging Market

The aluminum forging market in Central & South America is growing, supported by increasing automotive production and infrastructure projects, particularly in Brazil and Argentina. Demand for lightweight, durable components is rising, though price fluctuations and limited local production remain challenges. Sustainability efforts, including recycling, are gaining importance to meet global eco-friendly standards and reduce costs.

Middle East & Africa Aluminum Forging Market

The aluminum forging market in the Middle East & Africa is experiencing steady growth, fueled by increased investments in infrastructure and renewable energy. Demand for lightweight materials in construction and transportation is driving the adoption of aluminum forging, known for its strength and corrosion resistance. However, challenges such as fluctuating aluminum prices and geopolitical uncertainties continue to impact the market dynamics.

Key Aluminum Forging Company Insights

Some of the key players operating in the market include Farinia Group, and ATI

-

Farinia Group specializes in manufacturing precision aluminum forgings, serving various sectors including automotive and aerospace. With a strong focus on innovation and technical expertise, the company aims to meet the evolving demands of its clients.

-

ATI is a leading producer of specialty materials, including aluminum forgings. The company is known for its advanced manufacturing capabilities and commitment to quality, providing tailored solutions for industries such as aerospace and defense.

Key Aluminum Forging Companies:

The following are the leading companies in the aluminum forging market. These companies collectively hold the largest market share and dictate industry trends.

- Alcoa

- Aluminum Precision Products

- American Handforge

- Arconic

- ATI

- Bons & Evers

- Farinia Group

- FORGINAL industrie

- Norsk Hydro

- STAMPERIE SpA

View a comprehensive list of companies in the Aluminum Forging Market

Recent Developments

-

In September 2024, Ramkrishna Forgings announced plans to establish a new aluminum forging facility in Jamshedpur, India. This strategic move aims to enhance the company's capabilities in producing lightweight and high-strength aluminum components, catering to the growing demand from the automotive and aerospace sectors.

-

In January 2023, Pacific Precision Forging in China expanded its investment in aluminum forging technology with a fully automatic eccentric forging press that is closed die. This is expected to enhance the overall product quality and provide lightweight solutions to automotive sector.

Aluminum Forging Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.10 billion

Revenue forecast in 2030

USD 33.61 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada, Mexico; Germany; UK; France; Spain; Netherlands; Italy; China; India; Japan; South Korea; Brazil; GCC

Key companies profiled

Alcoa; Aluminum Precision Products; American Handforge; Arconic; ATI; Bons & Evers; Farinia Group; Norsk Hydro ASA; FORGINAL industrie; STAMPERIE SpA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

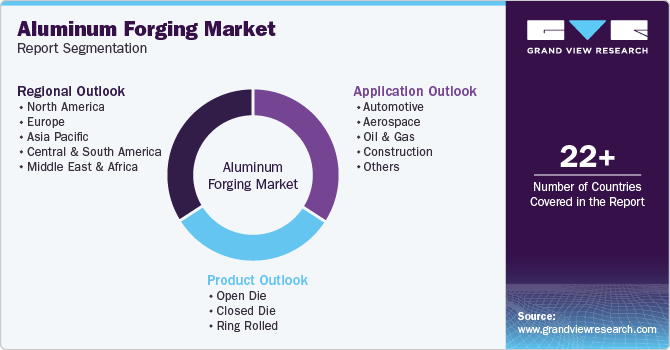

Global Aluminum Forging Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aluminum forging market report on the basis of product, application and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Open Die

-

Closed Die

-

Ring Rolled

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Oil & Gas

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global aluminum forging market size was estimated at USD 23.93 billion in 2024 and is expected to reach USD 25.10 billion in 2025.

b. The global aluminum forging market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 33.61 billion by 2030.

b. Based on application segment, automotive held the largest revenue share of more than 56.0% in 2024 owing to rapid demand for electric vehicles.

b. Some of the key vendors of the global aluminum forging market are Alcoa, Aluminum Precision Products, American Handforge, Arconic, ATI, Bons & Evers, Farinia Group, Norsk Hydro ASA, FORGINAL industrie, among others.

b. The key factor that is driving the growth of the global aluminum forging market is the rising penetration of aluminum-forged components in the automotive and aerospace industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."