- Home

- »

- Pharmaceuticals

- »

-

Alzheimer's Therapeutics Market Size & Share Report, 2030GVR Report cover

![Alzheimer’s Therapeutics Market Size, Share & Trends Report]()

Alzheimer’s Therapeutics Market (2023 - 2030) Size, Share & Trends Analysis By Product (Cholinesterase Inhibitors, NMDA Receptor Antagonist, Combination Drug, Pipeline Drugs), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-123-8

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alzheimer's Therapeutics Market Summary

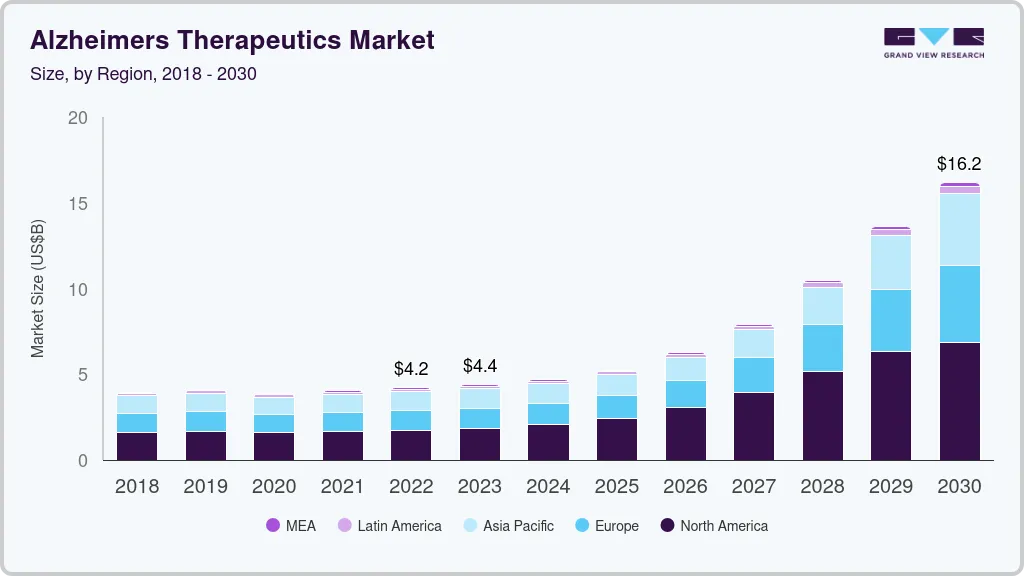

The global alzheimer’s therapeutics market size was estimated at USD 4.05 billion in 2022 and is anticipated to reach USD 15.19 billion by 2030, growing at a CAGR of 19.99% from 2023 to 2030. The rising prevalence of Alzheimer’s Disease (AD) and approval of disease-modifying therapies are expected to fuel market growth.

Key Market Trends & Insights

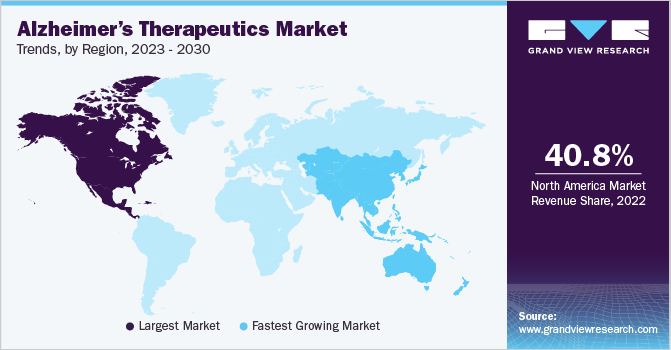

- North America dominated the market with a share of over 40.79% in 2022 and is anticipated to grow at a significant rate over the forecast period.

- The Asia Pacific region is expected to emerge as the fastest-growing region over the forecast period.

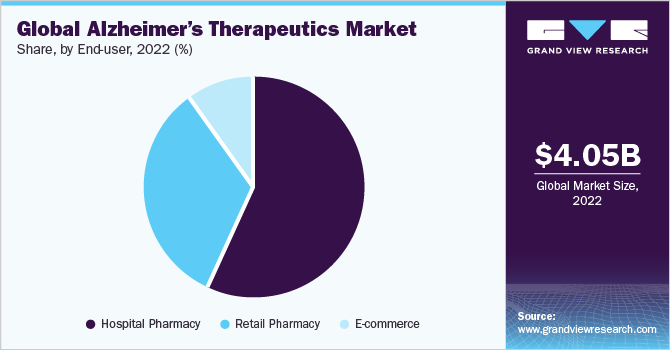

- Based on end-user, the hospital pharmacy segment dominated the market in 2022 with a revenue share of over 57.07% owing to the high hospitalization rate.

- By product, the cholinesterase inhibitors segment held the largest revenue share of over 51.24% in 2022, as it is the standard of care for Alzheimer’s treatment

Market Size & Forecast

- 2022 Market Size: USD 4.05 Billion

- 2030 Projected Market Size: USD 15.19 Billion

- CAGR (2025-2030): 19.99%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

According to the NCBI, in 2021, about 6.2 million people aged 65 and above living in America were suffering from Alzheimer’s disease, which is estimated to increase to around 13.8 million by 2060. Women are more prone to be diagnosed with Alzheimer’s disease than men due to the longer life expectancy of women. Moreover, Alzheimer’s disease is becoming the most common cause of death in neurodegenerative diseases and a common cause of physical disability that require immediate treatment.The impact of the COVID-19 pandemic on the market was negative due to strict measures undertaken by the government such as lockdown to control infection spread. During the pandemic, the prescription rate for drugs used to treat Alzheimer’s was lowered due to a decline in patient visits to clinics and hospitals for treatment and fear of COVID infection, thereby restraining market growth.

The introduction of new highly sensitive cloud-based cognitive assessment systems will assist pharmaceutical companies in identifying the effects of drugs on patients. This will enable pharmaceutical companies to effectively evaluate the cognitive efficacy and safety of pipeline drugs. For instance, Cambridge Cognition’s Cantab Connect product has been specifically developed to measure the effectiveness of drugs for mild, moderate, and prodromal AD. The adoption of such technology is expected to enhance the chances of product approvals, consequently driving the Alzheimer's disease treatment market.

The uncertainty, failure, and discontinuation of the clinical trials of Alzheimer’s drugs lead to the availability of limited treatment alternatives. This increases the costs related to research and development. Hence, it is expected to restrain market growth. For instance, Amgen Inc. and Novartis AG discontinued their Phase 2 clinical trial for CNP520 (umibecestat), a BACE1 inhibitor for Alzheimer’s disease, in July 2019, due to the lack of desired results.

Product Insights

The cholinesterase inhibitors segment held the largest revenue share of over 51.24% in 2022, as it is the standard of care for Alzheimer’s treatment. In March 2022, the U.S. FDA approved the cholinesterase inhibitor Adlarity (donepezil hydrochloride) developed by Corium Inc., for the treatment of patients with severe dementia of Alzheimer’s disease (AD). It is a transdermal patch administered once a week and delivers a stable dose of donepezil and was the fourth cholinesterase drug approved and launched in the U.S. Based on product, the market is divided into cholinesterase inhibitors, NMDA receptor antagonists, combination drugs, and pipeline drugs.

The pipeline drugs segment is expected to witness the fastest growth over the forecast period owing to the impending launch of multiple disease-modifying therapies. Companies such as F. Hoffmann La Roche Ltd.; Biogen/Eisai Inc.; and Eli Lilly and Company have drug candidates under development that will modify the treatment landscape of AD. According to Alzheimer’s Association, there were 143 drug candidates in 172 clinical trials for AD. Of these, 31 drug candidates in phase 3 clinical trial, 82 drug candidates in phase 2, and 30 drug candidates in phase 1. Successful completion of trials and subsequent approval of these products are anticipated to boost the market growth.

End-user Insights

The hospital pharmacy segment dominated the market in 2022 with a revenue share of over 57.07% owing to the increasing hospitalization due to a rise in the geriatric population and Alzheimer’s patients. According to Alzheimer’s Association report 2022, there are 518 hospitalizations per 1,000 Medicare beneficiaries in the geriatric population having Alzheimer’s or other dementias as compared to only 234 hospitalizations per 1,000 Medicare beneficiaries without these conditions. However, the total number of hospitalizations of AD patients is expected to remain low compared to the prevalence of Alzheimer’s disease.

The e-commerce segment is expected to expand at a lucrative CAGR over the forecast period. An increase in the usage of the internet and smartphone, ease of ordering medications through an e-commerce platform, and increasing e-commerce services globally are expected to fuel the segment growth in the coming years.

Regional Insights

North America dominated the market with a share of over 40.79% in 2022 and is anticipated to grow at a significant rate over the forecast period. The growing research for the treatment of Alzheimer’s is propelling the market growth. In June 2021, Eisai Co., Ltd. and Biogen’s product lecanemab (BAN2401), an anti-amyloid beta protofibril antibody for treating Alzheimer’s disease, was granted the Breakthrough Therapy designation by the U.S. FDA. Moreover, the increasing government initiatives and funding are expected to boost the growth of the market.

The Asia Pacific region is expected to emerge as the fastest-growing region over the forecast period owing to increasing awareness among people and the increasing research activities to develop novel drugs to treat AD. In 2022, there are around 487,500 Australians living with dementia and this number is expected to increase to 1.1 million by 2058. Dementia is the second leading cause of death in Australia.

Key Companies & Market Share Insights

New product launches and R&D investments are some of the key strategies adopted by the key players to acquire a greater market share. For instance, in January 2023, the FDA approved Eisai Co., Ltd.’s Leqembi (lecanemab-irmb) for the treatment of Alzheimer’s disease. It reduces amyloid-β plaques and moderately slows mild cognitive decline in patients with early AD. Successful launch of such drugs over the coming years is expected to fuel the market growth. Some prominent players in the global Alzheimer’s therapeutics market include:

-

Eisai Co., Ltd.

-

Novartis AG

-

AbbVie Inc. (Allergan Plc.)

-

Adamas Pharmaceuticals, Inc.

-

H. Lundbeck A/S

-

Biogen

-

AC Immune

-

F. Hoffmann La Roche Ltd.

-

Daiichi Sankyo Company, Limited

-

Johnson & Johnson Services, Inc.

-

TauRx Pharmaceuticals Ltd.

Alzheimer’s Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.24 billion

Revenue forecast in 2030

USD 15.19 billion

Growth rate

CAGR of 19.99% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Eisai Co., Ltd.; Novartis AG; AbbVie Inc. (Allergan Plc.); Adamas Pharmaceuticals, Inc.; H. Lundbeck A/S; Biogen; AC Immune; F. Hoffmann La Roche Ltd.; Daiichi Sankyo Company, Limited; Johnson & Johnson Services, Inc.; TauRx Pharmaceuticals Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alzheimer’s Therapeutics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global Alzheimer’s therapeutics market report on the basis of product, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cholinesterase inhibitors

-

Donepezil

-

Galantamine

-

Rivastigmine

-

NMDA Receptor Antagonist

-

Combination Drug

-

Pipeline Drugs

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Alzheimer's therapeutics market size was estimated at USD 4.05 billion in 2022 and is expected to reach USD 4.24 billion in 2023.

b. The global Alzheimer's therapeutics market is expected to grow at a compound annual growth rate of 19.99% from 2023 to 2030 to reach USD 15.19 billion by 2030.

b. North America dominated the Alzheimer's therapeutics market with a share of 40.79% in 2022. This is attributable to the favorable regulatory policies, high target patient population and better treatment rates for AD.

b. Some key players operating in the Alzheimer's therapeutics market include Novartis AG, Allergan (AbbVie), Johnson & Johnson Services, Inc., Biogen, Eisai Co., Ltd., Johnson & Johnson Services, Novartis AG, AC Immune, H. Lundbeck A/S, and DAIICHI SANKYO COMPANY, LIMITED

b. Key factors that are driving the Alzheimer's therapeutics market growth include the increasing prevalence of the disease, the rising geriatric population, and the approval & launch of disease-modifying therapies such as anti-amyloid monoclonal antibodies for the treatment of AD.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.