- Home

- »

- Medical Devices

- »

-

Ambulatory Surgery Centers Market Size, Share Report 2030GVR Report cover

![Ambulatory Surgery Centers Market Size, Share, & Trends Report]()

Ambulatory Surgery Centers Market Size, Share, & Trends Analysis Report By Application, By Ownership, By Center Type (Single-Specialty, Multi-Specialty), By Services (Treatment, Diagnosis), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-893-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global ambulatory surgery centers market size was estimated at USD 134.95 billion in 2023 and is expected to expand at a CAGR of 6.25% during the forecast period. The market is expected to grow substantially, driven by an increase in the number of ambulatory surgery centers (ASCs) and the rise in a shift of surgical procedures from hospitals to ambulatory centers, which requires cost-effective and efficient treatment. Furthermore, advancements in diagnostic techniques and surgeries, such as minimally invasive surgeries, endoscopy, and laparoscopy, are expected to drive market growth.

Furthermore, the rising cost of hospital stays has led to demand for ambulatory services and is expected to fuel market expansion. According to a report from the Ambulatory Surgery Center Association, the availability and utilization of ambulatory surgery centers have led to a reduction of annual healthcare costs in the United States by USD 38 billion. This demonstrates the positive impact of ASCs on healthcare affordability and accessibility.

Moreover, healthcare expenditure in ambulatory surgery centers is significantly lower than in hospitals. An extensive report by OR Manager, based on CMS statistics from January 2020, stated that 57 billion surgical procedures are performed in the U.S. every year. Less than 20% of these procedures are estimated to be done in inpatient hospital facilities, which indicates a shift in demand toward ambulatory surgery centers. The lower healthcare expenditure associated with ASCs has contributed to their increasing popularity. It has led to a significant transformation in the healthcare landscape, with more patients opting for outpatient procedures in these specialized facilities.

Major players in the healthcare industry are undertaking strategic initiatives to increase their market share through the acquisition of medical practices and outpatient facilities. These initiatives are aimed at expanding their reach and enhancing their service offerings. For instance, in October 2023, SurgNet Health Partners, Inc. announced the acquisition of Lippy Surgery Center, a provider of medical and surgical otolaryngology services, and Executive Ambulatory Surgery Center, a provider of surgical services.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of partnerships & collaborations activities, impact of regulations, and geographic expansion. For instance, the ASC market is fragmented, with many service providers entering the market. The degree of innovation is moderate, and the level of partnerships & collaborations activities is also high. The impact of regulations on the market is moderate, and the geographic expansion of the market is high.

The market is experiencing significant innovation as numerous service providers introduce new facilities to meet the rise in needs for ASCs. For instance, in April 2024, Compass Surgical Partners, Bon Secours Mercy Health, and local physicians collaborated to open a new facility known as Millennium Surgery Center in Greenville. This facility provides a range of services, including same-day orthopedic surgeries, pain management procedures, and otolaryngology interventions. These procedures will function using advanced equipment such as Stryker’s Mako Robotic-Arm Assisted System, which is specifically designed to enhance surgical predictability for total hip and total knee replacements.

The level of partnerships & collaborations in the market is high due to several local and mature providers engaging in partnerships and collaboration activities to expand their market presence. For instance, in December 2023, MDsave Incorporated announced a partnership with Fountain Point Surgery Center. The aim of this partnership is to enhance patients' and employers' access to outpatient surgery options with no surprise bills.

The new guidelines and reimbursement policies set by government healthcare programs and private insurance companies play a crucial role in the financial viability and expansion of ASCs.

The level of regional expansion in the market is moderate due to the growing number of surgeries, which are experiencing significant growth in the market. For instance, in January 2024, Baptist Health, a health system provider, partnered with Compass Surgical Partners, a full-service ASC management and development partner, to launch a group of ASCs branded as Horizon Surgery Center. The initial center will be in Jacksonville, Florida, on the premises of Baptist Medical Center Beaches. Furthermore, multiple centers will be opened in Northeast Florida with modern outpatient procedures.

Application Insights

Based on the application, the orthopedics segment dominated the market with a revenue share of 26.97% in 2023. Patients' demand for ASCs due to the lower risk of infection compared to hospitals and strict infection control protocols is attributed to the growing demand for orthopedic surgeries in ASCs. Moreover, ASCs offer convenient and efficient settings for orthopedic surgeries, along with reduced wait times.

For instance, a June 2021 Canadian Health Information Institute report showed that 55,300 hip replacements and 55,285 knee replacements were performed in Canada during 2020-2021. Additionally, knee and hip replacement surgeries have increased by an average of about 5% in recent years in this country. Hence the demand for ambulatory surgery centers is expected to increase due to the high number of orthopedic surgeries, thus fueling segment growth.

The otolaryngology segment is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is owing to patients' increase in adoption of ASC services for their Ear, Nose, and Throat (ENT) surgery. In the U.S., approximately 9% of all otolaryngology procedures are conducted in Ambulatory Surgery Centers (ASC). Thus, the growing prevalence of hearing loss disorders due to factors like noise pollution has increased the demand for otolaryngology surgeries in ASC.

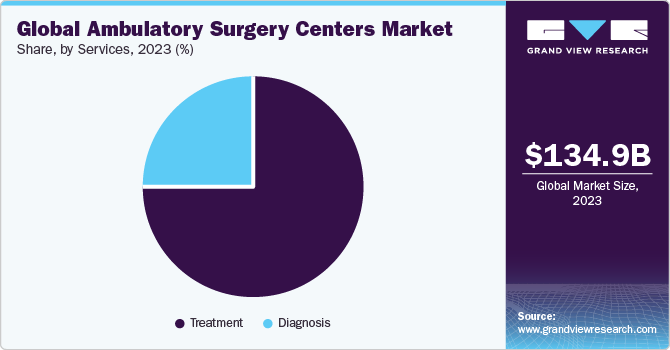

Services Insights

Based on services, the treatment segment dominated the market with a revenue share of 75.19% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is driven by several key factors including advancement in medical technology, including minimally invasive surgical techniques and improved anesthesia methods, and the cost-effectiveness of ASCs. Moreover, regulatory and policy support, such as favorable reimbursement models from Medicare and private insurers further incentivize the utilization of ASCs.

The diagnosis segment is anticipated to grow at a significant CAGR during the forecast period. This growth is driven by technological advancements and the integration of next-generation systems in ASCs, enhancing their diagnostic capabilities. Additionally, increasing awareness about the importance of early diagnosis to address the rising incidence of chronic diseases, combined with the cost-effective and high-quality healthcare provided by ASCs, is expected to boost patient visits.

Center Type Insights

Based on center type, the single-specialty segment dominated the market with a revenue share of 61.22% in 2023. The centers offer cost-effective alternatives to hospital-based surgeries coupled with potential savings in out-of-pocket expenses for patients, and the presence of a large number of specialized single-specialty ambulatory surgery centers catering to medical specialties such as orthopedics, ophthalmology, otolaryngology, attributed to market growth. For instance, as of June 2023, according to ASC Data, the number of single-specialty ambulatory surgical centers in the U.S. stood at 3,082.

Hernia repair, knee replacements, colonoscopy, and other less-intrusive treatments are among the surgeries carried out in single-specialty ambulatory surgical centers. These establishments must follow strict guidelines and criteria for patient safety and care quality. Furthermore, the reimbursement rate for procedures at these facilities is high. Hence, the market for single-specialty ambulatory surgical centers is growing rapidly.

The multi-specialty segment is expected to grow at the fastest CAGR during the forecast period, due to its broad and patient-focused strategy for surgical treatment, bringing a variety of services under a single roof and helping medical procedures run more smoothly. Increased surgical procedures in fields such as gastroenterology, pain management, and ophthalmology are anticipated to drive revenue in the multi-specialty segment.

Ownership Insights

Based on ownership, the physician-owned segment dominated the market in 2023 with a revenue share of 62.12%. This is owing to advantages such as the chance to communicate directly with medical professionals who are familiar with each patient's situation and the capability to completely focus on a small number of treatments in a single environment. The increase in revenue in this segment is anticipated to be fueled by reduced surgical operation expenses compared to other facilities, favorable reimbursements, and other associated variables.

The hospital-owned segment is poised to expand at the fastest pace through the forecast period, due to a rising shift of patients from inpatient healthcare facilities to hospital-owned ambulatory surgery facilities. Key players are launching various programs through partnerships to aid market growth. For instance, in November 2021, an innovative total joint program was introduced by the Effingham Ambulatory Surgery Center, an affiliate of USPI (United Surgical Partners International), and joint venture partner Sarah Bush Lincoln Health System (SBLHS) located in downstate Illinois. The patient receives individualized support through this initiative from the moment the surgery is scheduled until they have recovered from the operation. Such initiatives help raise the standard of care provided.

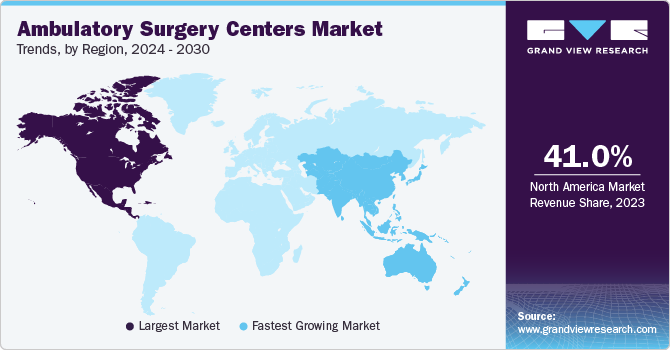

Regional Insights

North America region held the largest revenue share of over 41% in 2023. This can be attributed to the rapid adoption of technologically developed products in the region. Increasing government support for primary care and expansion of outpatient care are the major factors for the expansion of the ambulatory surgical center market in the North America region.

U.S. Ambulatory Surgery Centers Market Trends

The U.S. ambulatory surgery centers market held the largest share in 2023 due to the growing preference for minimally invasive surgical procedures among patients. Additionally, there has been a shift in surgical volume from hospital outpatient departments toward ASCs. This shift is driven by factors such as the convenience and accessibility offered by ASCs, shorter wait times, and the ability to provide specialized care in a focused setting.

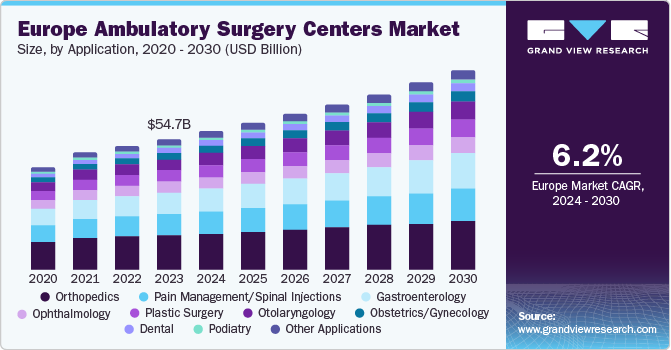

Europe Ambulatory Surgery Centers Market Trends

The ambulatory surgery centers market in Europe is anticipated to grow significantly due to favorable government policies aimed at improving the healthcare system, along with rapid economic development in many European countries.

UK ambulatory surgery centers market is expected to grow significantly over the forecast period. This can be attributed to staffing shortages and high wait periods in hospitals. More than 50% of elective surgical procedures are performed in ASCs also known as same-day surgery centers in the UK.

The ambulatory surgery centers market in Germany held the largest share in 2023, owing to the growing focus of the government on outpatient services over inpatient care. High operational costs, regional overcapacity, hospital privatization, and focus on specialty-based medical care have led to a major restructuring in the German health system. Thus, ASC providers are expected to witness rapid demand growth in Germany.

Asia Pacific Ambulatory Surgery Centers Market Trends

Asia Pacific ambulatory surgery centers market is expected to witness the fastest growth over the forecast period. The expansion of outpatient facilities is driven by growing healthcare costs, an increase in health awareness among the people, and rising hospitalization rates, which have led to increased demand for ambulatory surgical services in the region.

The ambulatory surgery centers market in Japan held the largest share in 2023, owing to the technological advancements in surgical instruments and equipment due to increased demand for minimally invasive surgical procedures for specific medical conditions. Minimally invasive surgeries offer benefits such as shorter recovery times, reduced pain, and smaller incisions. This demand has led to an increase in the number of procedures performed at ASCs.

India ambulatory surgery centers market is driven by factors such as increasing treatment costs, growing consumer awareness, and the aging population. Moreover, the growing government initiatives aimed at expanding healthcare infrastructure for ASCs have further bolstered the growth of ASCs in the country and are expected to contribute to the growth of industry in India.

Latin America Ambulatory Surgery Centers Market Trends

The ambulatory surgery centers market in Latin America is anticipated to grow significantly due to a rise in the number of surgeries being performed, and technological advancement in surgical instruments, equipment, and medical technology.

Brazil ambulatory surgery centers market is anticipated to grow significantly due to the cost-effectiveness of treatment offered by ASCs, increasing government support for primary care, and the expansion of outpatient facilities to a favorable environment for the development and demand of ASCs.

Middle East & Africa Ambulatory Surgery Centers Market Trends

The ambulatory surgery centers market in the Middle East and Africa is anticipated to grow significantly due to the increase in healthcare expenditures, improvement in reimbursement policies for services provided by ASCs, and increased number of surgical procedures performed safely in ASCs.

South Africa ambulatory surgery centers market is anticipated to grow significantly due to the growing need to alleviate the burden on public hospitals, the country's rising middle class and expanding health insurance coverage, and the increase in government reform and private sector investments in healthcare infrastructure. Development of ambulatory surgery centers in the country is an attractive option for both patients and healthcare providers.

Key Ambulatory Surgery Centers Company Insights

The market is highly fragmented, with the presence of many country-level service providers. Increasing healthcare cost and rise in shift towards outpatient care is driving the market growth. To stay ahead of the competition, companies are adopting various strategies such as acquisitions, collaborations, partnerships, and launching new services. Some of the few small players include Bayside Ambulatory Surgery Center, Camp Lowell Surgery Center,River Valley Ambulatory Surgical Center, Odyssey ASC Endoscopy Center, and others.

Key Ambulatory Surgery Centers Companies:

The following are the leading companies in the ambulatory surgery centers market. These companies collectively hold the largest market share and dictate industry trends.

- CHSPSC, LLC.

- Edward-Elmhurst Health

- Eifelhöhen-Klinik AG

- Envision Healthcare Corporation

- Healthway Medical Group

- Nexus Day Surgery Centre

- Pediatrix Medical Group

- Prospect Medical Holdings, Inc.

- SurgCenter

- Surgery Partners

- TH Medical

- UNITEDHEALTH GROUP

Recent Developments

-

In May 2024, Panoramic Health, an integrated kidney care provider group, expanded its presence by opening a new five-operating-room ASC in partnership with Florida Kidney Physicians in Tampa, Florida. This expansion of the center will improve the delivery of outpatient care and enhance the overall provider and patient experience.

-

In February 2023, Spire Orthopedic Partners partnered with Dutchess County Orthopedic Associates, making Spire one of the largest orthopedic platforms in the United States. This will enable the company to serve existing patients better and meet the increasing demand.

-

In July 2022, the Southeastern Spine Institute Ambulatory Surgery Center, an affiliate of United Surgical Partners International, introduced a robotic surgery program. The center is equipped with advanced robotic systems to improve the accuracy and effectiveness of total knee replacement surgery.

-

In January 2022, ValueHealth LLC revealed that Penn State Health, its joint venture partner, had acquired shares in the Surgery Center of Lancaster. This acquisition aims to enhance the growth of the center's service offerings and improve access to value-based surgical care in the region.

Ambulatory Surgery Centers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 142.86 billion

Revenue forecast in 2030

USD 205.52 billion

Growth rate

CAGR of 6.25% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, ownership, center type, services, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; and Kuwait

Key companies profiled

CHSPSC, LLC.; Edward-Elmhurst Health; Eifelhöhen-Klinik AG; Envision Healthcare Corporation; Healthway Medical Group; Nexus Day Surgery Centre; Pediatrix Medical Group; Prospect Medical Holdings, Inc.; SurgCenter; Surgery Partners; TH Medical; UNITEDHEALTH GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ambulatory Surgery Centers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ambulatory surgery centers market report based on application, ownership, type, services, and regions.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Pain Management/Spinal Injections

-

Gastroenterology

-

Ophthalmology

-

Plastic Surgery

-

Otolaryngology

-

Obstetrics/Gynecology

-

Dental

-

Podiatry

-

Other Applications

-

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Physician Owned

-

Hospital Owned

-

Corporate Owned

-

-

Center Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Specialty

-

Multi-Specialty

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Treatment

-

Diagnosis

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the ASCs market with a share of around 41.20% in 2023. This is attributable to increasing government funding to advance primary care services and rising coverage for outpatient services.

b. Some key players operating in the ASCs market include CHSPSC, LLC.; Envision Healthcare Corporation; TH Medical; Pediatrix Medical Group.; UNITEDHEALTH GROUP.; Surgery Partners; Healthway Medical Group; SurgCenter; Prospect Medical Holdings, Inc.; Group Eifelhöhen-Klinik AG; Edward-Elmhurst Health; Nexus Day Surgery Centre

b. Key factors that are driving the ASCs market growth include increasing demand for minimally invasive surgeries, technological developments in surgical devices and equipment, and surgeons’ control over the choice of such equipment.

b. The global ambulatory surgery centers market size was estimated at USD 134.95 billion in 2023 and is expected to reach USD 142.86 billion in 2024.

b. The global ambulatory surgery centers market is expected to grow at a compound annual growth rate of 6.25% from 2024 to 2030 to reach USD 205.52 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."