- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Americas High-Purity Limestone Market Trends, Industry Report, 2025GVR Report cover

![Americas High-Purity Limestone Market Size, Share & Trends Report]()

Americas High-Purity Limestone Market Size, Share & Trends Analysis Report By Application (Construction, Metallurgical, Chemical), By Type (Calcined, Crushed, Ground), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-687-5

- Number of Report Pages: 74

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Advanced Materials

Report Overview

The Americas high-purity limestone market size was valued at USD 766.2 Million in 2017. It is projected to witness a CAGR of 6.9% from 2018 to 2025. Rising demand from end-use industries, such as construction and metallurgy, is anticipated to drive the market.

Crushed limestone is majorly used as an ingredient in the manufacturing of Portland cement clinker. High-purity limestone with sand, water, and other aggregates is finely ground, blended into proportions, and then heated to a temperature of 2,640 degrees Fahrenheit for producing cement clinkers. These clinkers are further ground into cement.

Rising number of roadway projects, new manufacturing plants, and development of large corporate offices will stir up the demand for cement. In addition, increased government investments in development of projects encompassing public transit as well as green & social infrastructure are estimated to further fuel the demand for cement. This, in turn, is expected to stimulate the growth of the market.

High-purity limestone is largely utilized in metallurgical operations. For instance, it is used as a fluxing material in the steel manufacturing sector for removing impurities such as phosphorus, silica, and sulfur. Moreover, the product is extensively utilized during iron extraction for removal of impurities.

Steel is considered as the backbone of the U.S. manufacturing industry and is a key material for downstream producers in the automotive, rail, container, energy, appliance, and machinery & equipment industries. The health & public safety infrastructure sector uses steel in the development of dams & reservoirs, public water supply systems, waste & sewage treatment facilities, and residential construction.

According to a 2017 report published by the International Organization of Motor Vehicle Manufacturers, nearly 17 million vehicles were produced in North America in the same year. Growing focus on manufacturing of lightweight vehicles to meet fuel economy is likely to boost the consumption of advanced high-strength steel. This trend, in turn, is poised to fuel the demand for high-purity limestone in the region.

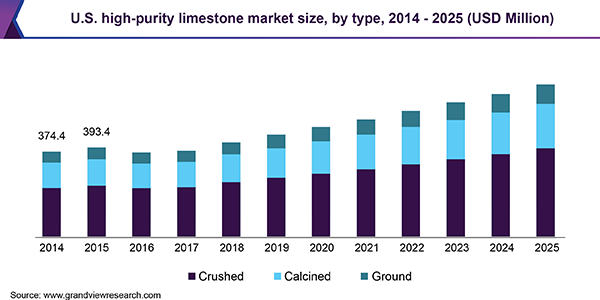

Type Insights

Based on type, the market has been segmented into calcined, crushed, and ground high-purity limestone. Lime (calcium oxide) is produced after heating (calcination) of limestone (calcium carbonate) to a temperature of approximately 900 degrees Celsius. Calcined limestone is used for producing drinking water by effectively and efficiently treating hard water. It can also be used for treatment of sludge and wastewater by eliminating impurities and neutralizing its acidity.

The ground segment is estimated to post a CAGR of 6.6%, in terms of revenue, over the forecast period. The product is used as an extender or filler pigment in decorative coatings and stains. Its main function, when used in coatings, is to drop the cost by either maximizing or extending efficiency of costlier color pigments and decreasing amounts required to attain desired color. Moreover, it fills the volume of the paint and, therefore, reduces the utilization of solvents and/or resins.

The crushed segment represented a volume share of approximately 60.0% in 2017. The product is in pulverized form and primarily used for construction. It is available in different shapes as well as sizes, as per its intended application. It can be used to produce concrete, which is a combination of water, sand, cement, and crushed aggregate. Crushed limestone also acts as a base to make roads. The product is frequently used for bedding underground pipes owing to its ability to not contract and expand, thereby preserving the integrity of pipeline.

In building & construction application, high-purity limestone is used for removing impurities in metal refining processes such as smelting. In agricultural application, it can be used to regulate pH levels of the soil and thereby improvise soil conditions for better crop availability.

Application Insights

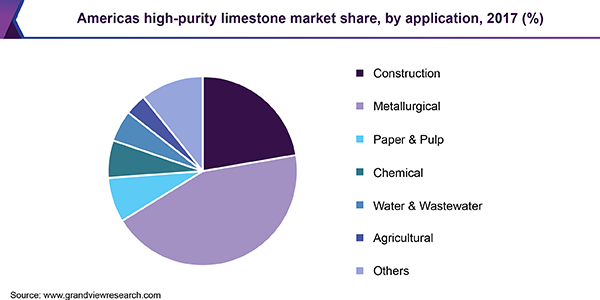

The metallurgical segment commanded the leading revenue as well volume share in the Americas high-purity limestone market in 2017. In the metallurgical industry, limestone-related products are used to remove impurities when metals are refined from their ores. Wide spectrum use of metals such as steel & aluminum in industries such as construction, automotive, energy, transport, and packaging is expected to drive the market in the region over the forecast period.

Paper industry utilizes limestone in the form of a causticizing agent as well as for bleaching. The product, when used as a filler in paper manufacturing, enhances whiteness of the paper and consistency as well as opacity of the paper. In pulp mills, it is used in sulfite pulping process as well as Kraft-pulping process.

The use of limestone-related products in water & wastewater application includes desalination plants, where it is used for adjusting the pH of industrial water. Water & wastewater application is likely to exhibit a CAGR of 7.2% in terms of revenue during the forecast period.

Regional Insights

North America accounted for a volume share of over 68.0% in 2017. In the same year, the U.S. was the key revenue contributor in the region and accounted for a volume share of more than 70.0% in North America. Rising investments in the country to maintain, upgrade, and/or construct new infrastructure are poised to foster the growth of the cement sector. This, in turn, will work in favor of the market in the U.S.

As per the Federal Aviation Administration (FAA), the U.S. aviation network includes 3,334 airports as a part of the National Plan of Integrated Airport Systems (NPIAS) of 2016 with existing 3,331 and 14 are proposed. The same source depicted that there were a total of 786 Million enplanements in 2015 and the number is projected to further increase to 1.24 billion by 2036.

Increased demand in the U.S. for air travel is anticipated to encourage expansion of airports, which in turn, can bolster the demand for cement. The automotive industry is one of the key users of steel. Mexico's vehicle production was about 3.5 million units in 2016, which reached 4.0 Million units in 2017, marking an increase of about 13.0%. This trend is estimated to continue over the forecast period and benefit the country’s steel industry.

The government of Mexico in 2013, under its National Infrastructure Program, announced plans to invest about USD 586 billion in infrastructure projects from 2014 to 2018. The project focuses on the renovation and construction of airports, ports, railways, and roads. Increased initiatives undertaken by the government of the country for infrastructure development are expected to propel the limestone industry.

Key Companies & Market Share Insights

Cement manufacturers require a variety of raw materials and fuels including high-purity limestone, clay, and coal. Cement companies that have their quarries or mines are likely to witness a stable supply of limestone-related products, which is the primary raw material used for cement manufacturing. Suppliers are engaged in business with major customers in the construction and retail industries that require end-use products such as cement and concrete.

Process integration is relevant among players present in the market. Players, such as Graymont Limited; Carmeuse; Lhoist; Sumitomo Osaka Cement Co., Ltd.; the United States Lime & Minerals, Inc.; Nittetsu Mining Co., Ltd.; and Minerals Technologies Inc., are engaged in mining, crushing, and production of downstream products related to the limestone sector.

Domestic producers also market downstream products such as hydrated lime and quicklime. Some distributors in the market are Indiana Limestone Company; American Limestone Company; and United States Lime & Minerals, Inc. Downstream products are further utilized by end-use industries such as construction, metallurgy, chemical, and agriculture.

Americas High-Purity Limestone Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 896 million

Revenue forecast in 2025

USD 1300 million

Growth Rate

CAGR of 6.9% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD million and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, region

Regional scope

North America, Central & South America

Country scope

U.S., Canada, Mexico, and Brazil

Key companies profiled

Graymont Limited; Carmeuse; Lhoist; Sumitomo Osaka Cement Co., Ltd.; United States Lime & Minerals, Inc.; Nittetsu Mining Co., Ltd.; and Minerals Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at regional & country levels and provides an analysis of industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the Americas high-purity limestone market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

Calcined

-

Crushed

-

Ground

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

Construction

-

Metallurgical

-

Paper & Pulp

-

Chemical

-

Water & Wastewater

-

Agricultural

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The Americas high-purity limestone market size was estimated at USD 896 million in 2019 and is expected to reach USD 976 million in 2020.

b. The Americas high-purity limestone market is expected to grow at a compound annual growth rate of 6.9% from 2019 to 2025 to reach USD 1.3 billion by 2025.

b. Metallurgical applications dominated the Americas high-purity limestone market with a share of 44.5% in 2019. This is attributable to limestone-related products being used to remove impurities when metals are refined from their ores. Wide spectrum use of metals such as steel & aluminum in industries such as construction, automotive, energy, transport, and packaging is expected to drive the market in the region over the forecast period.

b. Some key players operating in the Americas high-purity limestone market include Graymont Limited; Carmeuse; Lhoist; Sumitomo Osaka Cement Co., Ltd.; United States Lime & Minerals, Inc.; Nittetsu Mining Co., Ltd.; and Minerals Technologies Inc.

b. Key factors that are driving the market growth include rising demand from end-use industries, such as construction and metallurgy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."