- Home

- »

- Pharmaceuticals

- »

-

Aminoglycosides Market Size & Share, Industry Report, 2030GVR Report cover

![Aminoglycosides Market Size, Share & Trends Report]()

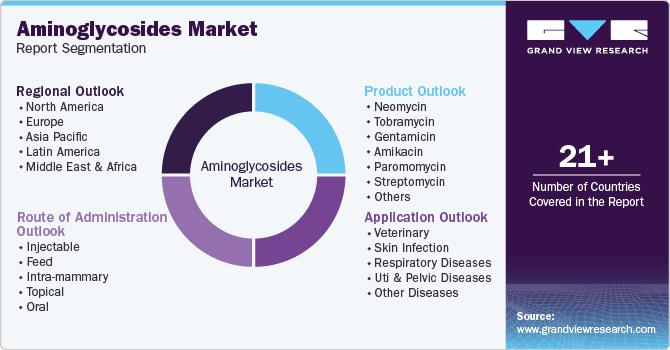

Aminoglycosides Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Neomycin, Tobramycin, Gentamicin), By Route Of Administration (Injectables, Feed, Intra-mammary), By Application (Veterinary, Skin Infection), By Region, And Segment Forecasts

- Report ID: 978-1-68038-630-1

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aminoglycosides Market Size & Trends

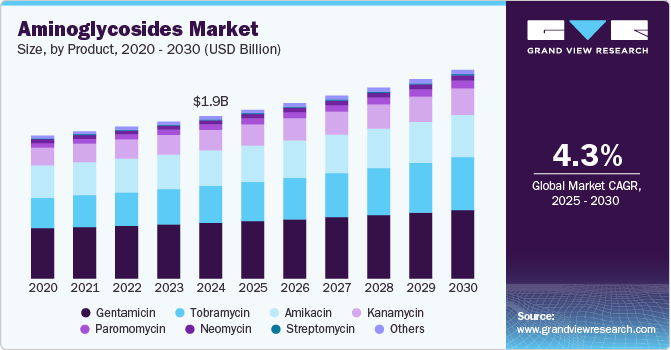

The global aminoglycosides market size was estimated at USD 1.91 billion by 2024 and is projected to grow at a CAGR of 4.34% from 2025 to 2030, owing to the rising incidence of bacterial infections caused by gram-positive and gram-negative bacteria. According to a report published in April 2024, infections accounted for approximately 28% of the global disease burden, in 2019, of these, bacterial infections were responsible for 14%, underscoring their significant impact on global health. Severe bacterial infections are associated with high rates of illness and death; thus, selecting appropriate therapy can significantly influence clinical outcomes.

According to CDC data from February 2025, antimicrobial resistance (AMR) poses a critical global public health threat. In the United States, over 2.8 million infections resistant to antimicrobial agents occur annually, leading to more than 35,000 deaths. Worldwide, AMR directly caused at least 1.27 million deaths and was associated with nearly 5 million deaths in 2019. The increasing prevalence of bacterial infections, antimicrobial resistance, and dynamic usage of aminoglycoside drugs for treating various diseases are the key factors contributing to the market growth of aminoglycosides. This treatment related application of drugs from this class is an important factor expected to drive growth.

Furthermore, the rising incidence of tuberculosis is expected to fuel demand for aminoglycosides, especially in low-income countries where the incidence is alarmingly high, and there is a need for TB drug regimens. According to a CDC report of March 2025, 10,347 tuberculosis (TB) cases were provisionally reported, yielding a rate of 3.0 cases per 100,000 population in 2024. This represents an 8% increase in case counts and a 6% rise in rates from 2023.The World Health Organization (WHO), along with the European Respiratory Society (ERS), have introduced digital health initiatives aimed at eradicating tuberculosis (TB). These initiatives are expected to enhance TB prevention and care through the integration of digital technologies.

On March 2024, the Center for Global Digital Health Innovation at Johns Hopkins University published a research roundup titled "Digital Tools for Tuberculosis Management." According to WHO, there was an increase in growth in the drug development pipeline of TB drugs from 28 in 2023, and in August 2024, 29 drugs were undergoing clinical trials. This accelerated growth reflects TB drug development, driven by increased investments from various funders and collaborative efforts from multiple platforms. It also indicated that more effective and diverse therapeutic options may soon enhance TB care and management.

Pipeline Analysis

According to a June 2023 article, Apramycin (EBL-1003), an aminoglycoside antibiotic developed by Juvabis AG, marks a significant milestone in the evolution of the market for aminoglycosides. Traditionally used exclusively in veterinary medicine within the European Union, Apramycin has now entered the clinical spotlight for human use following the successful completion of a Phase I clinical trial in October 2020. This development holds considerable long-term implications for the market. As resistance to conventional antibiotics rises, Apramycin’s demonstrated efficacy against multidrug-resistant Gram-negative pathogens positions it as a promising candidate for next-generation therapies. Its unique structure and low cross-resistance with other aminoglycosides enhance its appeal for combating difficult-to-treat infections. Over time, Apramycin could help rejuvenate the aminoglycoside class by expanding its clinical utility beyond legacy drugs like gentamicin or amikacin, especially in hospital settings. The approval and commercialization of Apramycin for human medicine would not only diversify the aminoglycoside portfolio but also potentially drive investment and R&D interest in this antibiotic class.

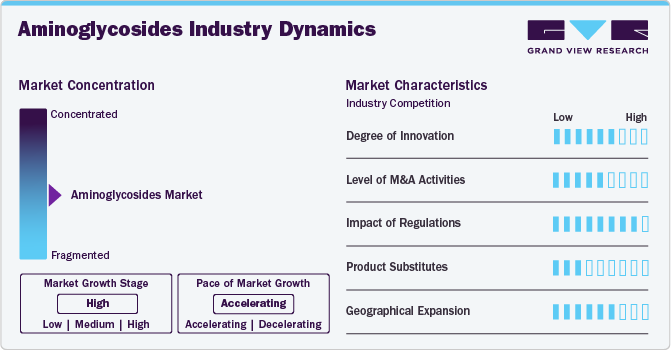

Market Concentration & Characteristics

The degree of innovation is high in the market characterized by a growing level of research and development. For example, according to an article from 2022, researchers have explored the use of gold nanoparticles conjugated with aminoglycosides like ribostamycin. This combination enhances antibacterial activity, offering a promising approach to combat resistant bacterial strains. In addition, an investigation of aminoglycosides is being conducted to reduce toxicity, increase drug availability, and lower doses. Incorporating aminoglycoside antibiotics into various nanoparticle carriers is an emerging strategy to enhance their antibacterial efficacy and reduce systemic toxicity.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For example, In November 2023, Pfizer acquired Nektar Therapeutics for USD 7.5 billion, strengthening its position in the antibiotics market, particularly within the aminoglycosides segment. Also in 2020,Arixa Pharmaceuticals, a company focused on developing next-generation oral antibiotics for drug-resistant Gram-negative infections, announced that Pfizer's Hospital Business has agreed to acquire it. This acquisition aligns with Pfizer's strategy to enhance its commercialization capabilities and broaden the availability of migraine treatments.

Regulations in the market set standards for safety, efficacy, and accessibility. They govern approval processes, manufacturing standards, labeling, and surveillance. Compliance is vital for companies to introduce and sustain their drugs. Regulations protect patients by minimizing risks and ensuring accurate information. Despite posing challenges, regulations maintain trust and enhance patient outcomes.For example, in 2024, Cipla received approval from India's Central Drugs Standard Control Organization (CDSCO) to market plazomicin, a novel intravenous aminoglycoside antibiotic, for treating complicated urinary tract infections (cUTI), including pyelonephritis.

Regional expansion for aminoglycosides involves expanding market reach to new geographical areas beyond current operations. For example, Baxter International Inc. expanded its U.S. pharmaceuticals portfolio by introducing new injectable products, including Vancomycin Injection, USP in 5% Dextrose. Vancomycin is indicated for treating severe infections caused by susceptible strains of methicillin-resistant staphylococci. This expansion strategy aims to tap into previously untapped markets and increase accessibility to antimicrobial treatments.

Product Insights

Based on product, the market has been categorized into Neomycin, streptomycin, gentamicin, kanamycin, tobramycin, amikacin, and others that are included in the product categorization of aminoglycosides. Gentamicin led the market and accounted for 34.24% of the global revenue in 2024. Advancements in gentamicin have undergone significant evolution, introducing novel options characterized by enhanced efficacy, delivery methods, and tolerability. For instance, the Food and Drug Administration (FDA) approved Cerament G, a resorbable, gentamicin-eluting ceramic bone void filler, for use in skeletally mature patients in May 2022. It serves as an adjunct to systemic antibiotic therapy and surgical debridement in the treatment of osteomyelitis. In March 2024, the FDA further expanded Cerament G's indications to include its use in open fractures, enhancing its role in preventing infection in traumatic bone injuries. Furthermore, topical application of gentamicin has emerged as a promising treatment for genodermatosis resulting from nonsense mutations. This approach not only minimizes toxicity but also offers convenience and affordability.

Tobramycin is expected to exhibit significant growth in the market over the forecast period. It is a potent aminoglycoside antibiotic that plays a critical role in the global aminoglycosides industry due to its broad-spectrum efficacy against Gram-negative bacteria, particularly Pseudomonas aeruginosa. It is widely used in the treatment of serious infections, including respiratory tract infections, septicemia, and hospital-acquired infections. The increasing prevalence of chronic conditions such as cystic fibrosis, where Tobramycin is a first-line inhaled therapy, continues to drive its demand. Moreover, its effectiveness in combating multidrug-resistant organisms has positioned it as a vital therapeutic option in both human and veterinary medicine. Pharmaceutical companies are focusing on innovative drug delivery systems, such as liposomal and nebulized formulations, to enhance bioavailability and reduce toxicity, further expanding Tobramycin’s clinical applications.

Route of Administration Insights

Based on route of administration, the market is categorized into injectable, feed, intra-mammary, topical, oral, and injectable, led the market with a market share of 26.73% in 2024. Injectable drugs often provide rapid and effective relief from infections, making them a preferred choice for individuals experiencing severe or acute infections. In February 2024,Cipla furthered its commitment to combating antimicrobial resistance (AMR) by securing approval from India's Central Drugs Standard Control Organization (CDSCO) to introduce ZEMDRI (plazomicin) injection in the Indian market. Plazomicin is a novel intravenous (IV) aminoglycoside antibiotic indicated for treating complicated urinary tract infections (cUTI), including pyelonephritis. On September 2023, Insmed Incorporated announced positive topline results from its Phase 3 study of ARIKAYCE (amikacin liposome inhalation suspension) for patients with newly diagnosed or recurrent non-tuberculous mycobacterial (NTM) lung infections.

The oral segment is expected to exhibit significant growth in the market over the forecast period. This growth is driven by advancements in drug formulations and a growing demand for convenient administration routes. While aminoglycosides are traditionally administered via injection due to their poor gastrointestinal absorption, recent pharmaceutical innovations have enabled the development of oral formulations with improved bioavailability and reduced toxicity. This has expanded their applicability, particularly in outpatient settings and in regions with limited access to injectable therapies. The oral segment also gains traction from the increasing focus on antimicrobial stewardship programs, which emphasize appropriate and targeted antibiotic use.

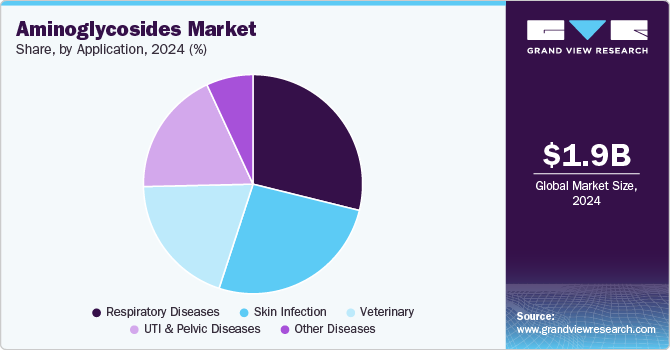

Application Insights

Aminoglycosides are antibiotics utilized across various medical fields, including dermatology, respiratory medicine, urology, gynecology, neonatology, and veterinary medicine. Based on application, respiratory diseases led the market and accounted for 3.69% of the global revenue in 2024 and is anticipated to grow significantly over the forecast period. In September 2023, USFDA approvedBimeda Inc., the company’s SpectoGard, as the first genericavailable to vet and cattle producers across the United States, offering an effective treatment option for bovine respiratory disease (BRD). Bimeda has committed to providing quality animal health products, and the reintroduction of SpectoGard aims to support the effective management of BRD in cattle. In July 2023, Harrow Health, a U.S. eyecare pharmaceutical company, expanded its portfolio by acquiring certain U.S. and Canadian commercial rights from Santen Pharmaceutical Co., Ltd. This acquisition includes TOBRADEX ST (tobramycin and dexamethasone ophthalmic suspension).

Skin infections are anticipated to grow at the fastest CAGR over the forecast period. Skin infections represent a significant driver for the market, owing to their high prevalence and the effectiveness of aminoglycosides in treating gram-negative bacterial infections. These antibiotics are commonly used in topical formulations for conditions like impetigo, infected wounds, burns, and dermatitis. The growing burden of skin disorders, especially in tropical and developing regions, along with increased incidences of antibiotic-resistant infections, is accelerating demand for effective treatment options. In addition, rising healthcare awareness, improved access to dermatological care, and expanding use of over-the-counter topical antibiotic products are contributing to market growth in this segment, bolstering the demand for aminoglycosides.

Regional Insights

The North America aminoglycosides industry held 37.60% of the global revenue share in 2024. This large share is attributed to bacterial infections, which are dominant in North America, and a well-established healthcare infrastructure affecting millions of people. The rising incidence of these cases in the region contributes to the growth of the market.

U.S. Aminoglycosides Market Trends

The aminoglycosides industry in the U.S. is expected to grow over the forecast period due to improved awareness about infections and their impact on quality of life, prompting more individuals to seek medical treatment. For instance, in June 2022, Harrow Health, Inc., an ophthalmic-focused healthcare company, expanded its portfolio by acquiring the U.S. commercialization rights to several FDA-approved ophthalmic products from Novartis. Among these are IOPIDINE 1% and MAXITROL, both now available for distribution in the United States. The company has secured significant funding, including a USD 5.6 million grant from the U.S. Department of Defense, to support the pre-clinical development of this innovative treatment.

Europe Aminoglycosides Market Trends

Europe aminoglycosides industry was identified as a lucrative region globally. The growth of the market in the region can be attributed to a significant population affected by migraines, contributing to a substantial market size for these drugs. According to an article published in May 2023, ELX-02, a synthetic aminoglycoside, had been studied for its ability to mitigate cystic fibrosis. Clinical trials evaluating ELX-02 had been conducted at leading investigator sites in Europe, Israel, and the United States.

The aminoglycosides industry in the UK is expected to grow over the forecast period due to the presence of a well-developed healthcare infrastructure with access to a wide range of medical services and prescription medications. This facilitates the distribution and availability of aminoglycosides supporting market expansion.

According to the February 2024 report, Biocomposites, a UK-based medical device company specializing in infection management products for bone and soft tissue, has initiated two Phase II clinical trials in the United States for its product, STIMULAN VG. STIMULAN VG is a calcium matrix antibiotic carrier combined with vancomycin and gentamicin, designed to deliver antibiotics directly to infection sites.

Germany’s aminoglycoside industry is driven by strong in-hospital protocols for sepsis management and perioperative prophylaxis, where Gentamicin and Tobramycin are widely utilized. The country is also advancing research into aerosolized aminoglycosides, targeting localized pulmonary infections, especially in ICU settings. In the veterinary sector, Kanamycin is commonly integrated into combination therapy protocols for livestock bacterial infections, reflecting Germany’s strict but progressive approach to animal health. Pharmacovigilance programs are encouraging newer, safer formulations.

France aminoglycoside industry has seen a shift in aminoglycosides usage towards multidrug-resistant bacterial outbreaks, particularly in geriatric care facilities. Streptomycin, although older, is still used under controlled protocols for tuberculosis, where it is a part of second-line therapy. There is also renewed interest in topical delivery systems, especially gentamicin-impregnated wound dressings for chronic ulcers. Paromomycin is seeing growth in niche infectious disease centers, particularly for leishmaniasis, as France maintains close medical support ties with endemic regions. Academic-industry partnerships are exploring liposomal delivery for reduced toxicity.

Asia Pacific Aminoglycosides Market Trends

Asia-Pacific aminoglycosides industry is experiencing rapid market expansion driven by high infectious disease burdens, rising livestock production, and increasing healthcare access. Countries such as India, China, and Japan are key growth engines. Gentamicin and Streptomycin are widely used in hospital injectables, while Neomycin remains prominent in topical formulations for skin infections. Veterinary feed applications using Kanamycin and Neomycin are widespread in poultry and swine farming. Advances in oral and injectable drug delivery technologies are aiding penetration in rural and emerging areas.

Japan aminoglycosides industry is defined by a high standard of care and technological integration. Tobramycin inhalation therapy is being adopted more widely in pediatric and geriatric respiratory care. With an aging population, there is an increasing focus on gentamicin-based prophylaxis in orthopedic and prosthetic surgeries. Neomycin continues to be popular in otological and ophthalmic formulations, often combined with steroids. Veterinary trends show controlled use of kanamycin in aquaculture, aligned with Japan’s sustainable seafood policies. The oral segment, though small, is supported by precision GI-targeted applications.

The China aminoglycoside industry is rapidly evolving, with a strong push toward self-sufficiency in API production. Gentamicin and Amikacin are used extensively in rural health centers for severe infections, while Paromomycin is gaining approval in public health programs for parasitic disease control. The government’s emphasis on veterinary antibiotic regulation is encouraging feed reformulations with safer aminoglycoside dosing, especially for poultry farming. Investment in generic injectable formulations is high, aimed at both domestic and export markets.

Latin America Aminoglycosides Market Trends

Latin America aminoglycosides industry is growing due to increasing investments in infectious disease control and veterinary health. Brazil, Mexico, and Argentina are central to this growth. Gentamicin and Neomycin are commonly used in topical and injectable forms, while Paromomycin is used in treating intestinal parasitic infections. The veterinary segment, especially in feed-based applications, is expanding due to the region’s strong agribusiness sector. Hospital pharmacies lead in acute infection management, while retail distribution is gradually expanding.

Brazil aminoglycoside industry is expanding through public hospital investments and improvements in diagnostic microbiology, leading to more targeted use of Amikacin and Tobramycin for Gram-negative infections. Intra-mammary gentamicin is being used in dairy veterinary medicine, where mastitis control is a top priority. There is a rising demand for oral Paromomycin in the Amazon basin, targeting parasitic diseases such as amebiasis and leishmaniasis. Brazil’s pharmaceutical companies are increasingly investing in low-cost topical generics for over-the-counter markets.

Middle East & Africa Aminoglycosides Market Trends

The Middle East & Africa aminoglycoside industry is witnessing steady growth in aminoglycosides, driven by increasing awareness of bacterial resistance and expanded access to antibiotics. Saudi Arabia, South Africa, and UAE are showing a growing demand for Amikacin and Gentamicin in hospital settings for treating UTIs and respiratory infections. Veterinary applications, especially via feed and intra-mammary routes, are vital in regional livestock care. Topical Neomycin is gaining traction in over-the-counter skin infection treatments, with retail pharmacy access on the rise.

Saudi Arabia aminoglycoside industry is enhancing its aminoglycoside usage through digitized hospital systems that allow precise antimicrobial tracking and dosing. Amikacin is increasingly used in ICU protocols for ventilator-associated pneumonia. There is growing deployment of Neomycin-containing ear and eye preparations, particularly in telemedicine-driven primary care settings. The veterinary market is being reshaped by halal-compliant production standards and antibiotic stewardship programs, favoring controlled injectable and intra-mammary routes. Regulatory fast-tracking under Vision 2030 is also allowing quicker market access for advanced formulations.

Key Aminoglycosides Company Insights

Some of the leading players operating in the market include AbbVie Inc., Cipla, and Pfizer. Key players are using existing customer bases in the region to prioritize maintenance of high-quality standards and increasing market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced therapeutic classes and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Vega Pharma, Insmed Incorporated, Medson Pharmaceuticals, and Zoetis Inc. are some of the emerging market participants. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Aminoglycosides Companies:

The following are the leading companies in the aminoglycosides market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Merck & Co., Inc.

- AbbVie Inc.

- Teva Pharmaceutical Industries

- Cipla Limited

- Sun Pharmaceutical Industries

- Lupin Limited

- Aurobindo Pharma

- Fresenius Kabi

- Viatris Inc.

Recent Developments

-

According to the report of February 2024, Biocomposites, a UK-based medical device company specializing in infection management products for bone and soft tissue, has initiated two Phase II clinical trials in the United States for its product STIMULAN VG.

-

In February 2024, Cipla furthered its commitment to combating antimicrobial resistance (AMR) by securing approval from India's Central Drugs Standard Control Organization (CDSCO) to introduce ZEMDRI (plazomicin) injection in the Indian market. Plazomicin is a novel intravenous (IV) aminoglycoside antibiotic indicated for treating complicated urinary tract infections

-

In July 2023, Harrow Health, a U.S. eyecare pharmaceutical company, expanded its portfolio by acquiring certain U.S. and Canadian commercial rights from Santen Pharmaceutical Co., Ltd. This acquisition includes TOBRADEX ST (tobramycin and dexamethasone ophthalmic suspension).

Aminoglycosides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.98 billion

Revenue forecast in 2030

USD 2.45 billion

Growth rate

CAGR of 4.34% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, route of administration, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Pfizer Inc.; Merck & Co., Inc.; AbbVie Inc.; Teva Pharmaceutical Industries; Cipla Limited; Sun Pharmaceutical Industries; Lupin Limited; Aurobindo Pharma; Fresenius Kabi; Viatris Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aminoglycosides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2030. For this study, Grand View Research has segmented the global aminoglycosides market report based on product, route of administration, application, and region.

-

Product Outlook (Revenue, USD Million, 2025 - 2030)

-

Neomycin

-

Tobramycin

-

Gentamicin

-

Amikacin

-

Paromomycin

-

Streptomycin

-

Kanamycin

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2025 - 2030)

-

Injectable

-

Feed

-

Intra-mammary

-

Topical

-

Oral

-

-

Application Outlook (Revenue, USD Million, 2025 - 2030)

-

Veterinary

-

Skin Infection

-

Respiratory diseases

-

UTI & Pelvic Diseases

-

Other diseases

-

-

Regional Outlook (Revenue, USD Million, 2025 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aminoglycosides market size was estimated at USD 1.91 billion in 2024 and is expected to reach USD 1.98 billion in 2025.

b. The global aminoglycosides market is expected to grow at a compound annual growth rate of 4.34% from 2025 to 2030 to reach USD 2.45 billion by 2030.

b. Based on product, the Gentamicin segment accounted for the largest revenue share of 34.23% in 2024. This is due to advancements in gentamicin have undergone significant evolution, introducing novel options characterized by enhanced efficacy, delivery methods, and tolerability

b. Key players operating in the market are Pfizer Inc., Merck & Co., Inc., AbbVie Inc., Teva Pharmaceutical Industries, Cipla Limited, Sun Pharmaceutical Industries, Lupin Limited, Aurobindo Pharma, Fresenius Kabi, Viatris Inc.

b. The aminoglycosides market is driven by factors such as the increasing prevalence of bacterial infections, advancements in drug development, growing awareness and diagnosis

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.