- Home

- »

- Advanced Interior Materials

- »

-

Ammunition Market Size And Share, Industry Report, 2033GVR Report cover

![Ammunition Market Size, Share & Trends Report]()

Ammunition Market (2026 - 2033) Size, Share & Trends Analysis Report By Caliber (Small Caliber, Medium Caliber, Large Caliber), By Product (Rimfire, Centerfire), By Application (Civil & Commercial, Defense), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-183-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ammunition Market Summary

The global ammunition market size was estimated at USD 80.86 billion in 2025 and is expected to reach USD 28.37 billion by 2033, registering a CAGR of -14.0% from 2026 to 2033, by rising geopolitical tensions and ongoing international conflicts, which compel nations to bolster their defense capabilities. Increased military modernization programs across various regions are pushing demand for advanced and precise ammunition types, fueling sustained market growth.

Key Market Trends & Insights

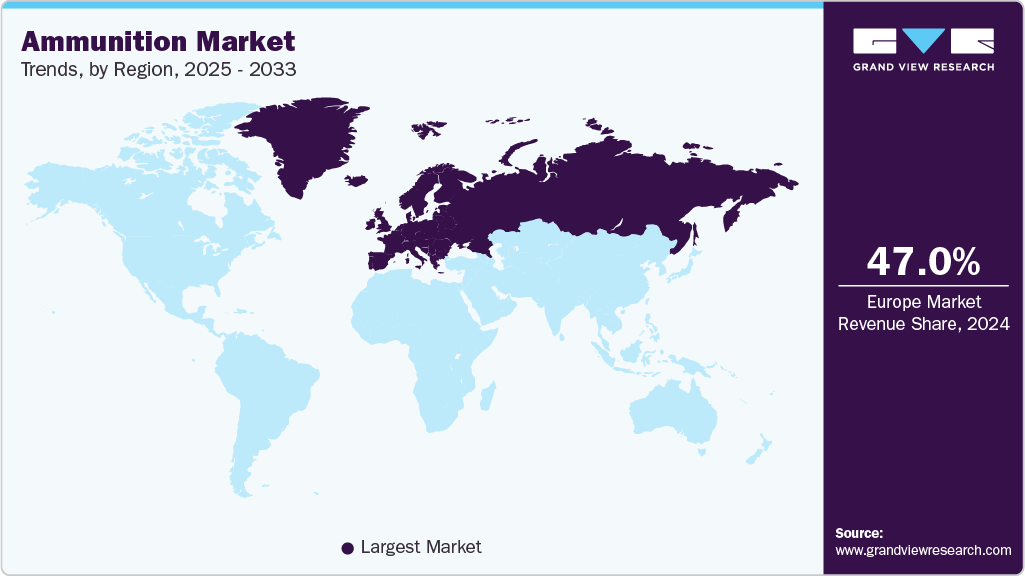

- Europe dominated the ammunition market with the largest revenue share of 48.3% in 2025.

- By caliber, medium caliber segment is expected to grow at CAGR of -3.4% over the forecast period.

- By product, centerfire segment is expected to grow at CAGR of -5.7% over the forecast period.

- By application, defense segment is expected to exhibit a CAGR of -12.7% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 80.86 Billion

- 2033 Projected Market Size: USD 28.37 Billion

- CAGR (2026-2033): -14.0%

- Europe: Largest market in 2025

- MEA: Fastest growing market

Moreover, the escalation of terrorist activities worldwide prompts defense forces to procure more effective ammunition, reinforcing the market's upward trajectory.The growing popularity of recreational shooting sports and increased civilian firearm ownership in several regions have also contributed to market expansion. Small-caliber ammunition used in rifles and pistols for sport shooting is gaining traction as more civilians participate in shooting activities. In addition, the commercial segment related to hunting and shooting sports supplements defense-driven demand, broadening the market base.

Another significant driver is the steady increase in global defense budgets, particularly in major markets such as North America, where military expenditure remains robust. Governments worldwide are investing heavily not only in traditional ammunition but also in research and development of innovative ballistic technologies, including lightweight polymer-based cases and smart munition systems. These technological advancements improve ammunition performance and versatility, attracting higher procurement volumes.

Market Concentration & Characteristics

The global ammunition market exhibits a moderate degree of concentration, with a handful of major players such as Northrop Grumman, BAE Systems, and Rheinmetall commanding significant market shares alongside regional specialists. Innovation is a key characteristic, focusing on enhancing accuracy, lethality, and environmental sustainability through advancements in smart munitions, precision-guided projectiles, and eco-friendly propellants. The industry witnesses moderate merger and acquisition activities aimed at vertical integration and expanding capabilities, exemplified by recent acquisitions among leading firms. Regulatory frameworks impact the market considerably, involving stringent licensing, export controls, and growing emphasis on responsible and green ammunition production, shaping product development and compliance requirements.

End-user concentration remains heavily weighted towards military applications, which account for the majority of demand, supported by multi-year government procurement contracts ensuring steady revenue streams. Law enforcement agencies and civilian sport-shooting sectors provide additional but smaller market segments, creating diverse demand channels that help mitigate risks associated with dependency on a single end-user group. Service substitutes, including non-lethal weaponry and advanced defense systems, primarily impact niche areas without significantly displacing conventional ammunition.

Caliber Insights

The large caliber segment led the market and accounted for the largest revenue share of 51.5% in 2025, driven by increasing military modernization programs and the growing need for high-impact artillery and tank munitions. Governments across the world are allocating significant budgets toward enhancing artillery capabilities, demanding advanced large caliber rounds with extended range and precision guidance. Technological advancements in propellants and smart munitions further boost this segment's growth, making it vital for contemporary defense strategies.

Medium caliber segment is expected to grow at CAGR of -3.4% over the forecast period, driven by by versatile applications in infantry weapons and armored vehicles. Its growth is supported by rising investments in modernizing infantry arms and the integration of programmable ammunition to enhance operational flexibility. Militaries are focusing on calibers that balance lethality with portability, making medium calibers essential in both conventional and asymmetric warfare scenarios.

Application Insights

The defense segment dominated the market and accounted for the largest revenue share of 66.8% in 2025, driven by heightened geopolitical tensions and increased defense spending worldwide. Procurement activities focus on enhancing national security by upgrading weapon arsenals with precision-guided and environmentally sustainable munitions. Strategic defense collaborations and R&D investments in innovative ammunition technologies sustain growth within this segment.

Civil & commercial segment is expected to grow at CAGR of -17.2% over the forecast period, driven by increasing recreational shooting sports, law enforcement demand, and hunting activities. Growth is particularly strong in regions with rising firearm ownership and supportive regulatory environments. Product innovations in reliability, safety, and cost-efficiency cater to civilian consumers, boosting ammunition sales apart from military needs.

Product Insights

The centerfire segment led the market and accounted for the largest revenue share of 68.5% in 2025, driven by their extensive use in rifles, pistols, and shotguns for both defense and civilian applications, favored for its higher stopping power and reliability. Rising demand for precision shooting and tactical applications supports growth, alongside technological developments in polymer and lead-free centerfire cartridges aiming to meet stricter environmental regulations.

Rimfire caliber segment is expected to grow at CAGR of -6.6% over the forecast period, driven by their popularity in training, sport shooting, and small-game hunting due to their affordability and lower recoil. The segment benefits from increasing civilian participation in shooting sports and the availability of rimfire ammunition in various standardized sizes. Moreover, ongoing innovations in rimfire cartridge design aim to enhance consistency and accuracy, expanding the segment's market appeal.

Regional Insights

Asia Pacific Ammunition Market Trends

The Asia Pacific ammunition market is driven by increasing defense budgets and territorial tensions among regional powers such as China, India, and South Korea. Governments are focusing on indigenous manufacturing and technology transfers to reduce dependency on imports. Rapid military modernization programs and growing participation in global peacekeeping missions stimulate procurement of small, medium, and large-caliber ammunition. The region also witnesses growing interest in non-lethal ammunition for riot control and homeland security. Moreover, advancements in propellant technologies and ballistic efficiency are reshaping Asia Pacific’s defense landscape.

The China ammunition market is driven by continuous expansion of defense capabilities and domestic production advancements. The Chinese government’s focus on self-reliance in defense manufacturing supports local ammunition producers through strategic investments and innovation. Rising military exercises and border security challenges drive steady procurement of advanced ammunition systems. In addition, China’s investment in precision-guided munitions and hybrid propellants reflects its efforts to enhance combat effectiveness. Growing exports to allied nations in Asia and Africa also contribute to the expansion of the country’s ammunition market.

North America Ammunition Market Trends

The North America ammunition market is driven by increasing defense modernization programs and growing civilian demand for firearms. The U.S. and Canada continue to invest heavily in advanced ammunition technologies to enhance military readiness and border security. In addition, a rise in sports shooting and hunting activities, along with a robust gun ownership culture, supports steady demand. The market also benefits from domestic ammunition manufacturing capabilities and strong distribution networks. Increasing geopolitical tensions and government funding for defense contracts further strengthen the region’s ammunition market outlook.

U.S. Ammunition Market Trends

The U.S. ammunition market is primarily driven by consistent military procurement and strong demand from law enforcement agencies. The U.S. Army’s focus on next-generation small-caliber ammunition and advanced materials enhances operational efficiency and precision. In addition, the expanding civilian firearm industry, supported by self-defense and recreational shooting trends, continues to fuel consumption. Regulatory flexibility and the presence of key manufacturers such as Winchester, Remington, and Federal Premium contribute to steady market expansion. The country’s emphasis on research and development in smart and lightweight ammunition reinforces its global leadership.

Europe Ammunition Market Trends

The Europe ammunition market is driven by increasing defense collaborations, modernization programs, and the ongoing need for NATO-standard ammunition. The Russia-Ukraine conflict has particularly intensified ammunition demand across European nations, prompting governments to boost domestic production capacity. European defense manufacturers are investing in sustainable and lead-free ammunition technologies to align with environmental regulations. The market also benefits from joint procurement initiatives that strengthen regional defense integration. In addition, the rise in border security measures and counter-terrorism operations continues to stimulate market demand.

The Germany ammunition market is driven by heightened defense spending and the country’s commitment to NATO operational readiness. The modernization of the Bundeswehr and enhanced participation in international defense programs contribute to growing ammunition procurement. German manufacturers are emphasizing innovation in eco-friendly, non-toxic ammunition to meet strict EU environmental standards. The market also benefits from increased investments in training ammunition for military and law enforcement agencies. Furthermore, Germany’s strong export capabilities and precision engineering expertise support its competitive position in Europe’s defense industry.

Latin America Ammunition Market Trends

The Latin America ammunition market is driven by the growing need for border security, counter-narcotics operations, and defense modernization initiatives. Countries such as Brazil and Mexico are strengthening their law enforcement and military capabilities, leading to higher ammunition demand. Rising crime rates and expansion of private security services further boost small-caliber ammunition consumption. In addition, regional governments are investing in domestic manufacturing facilities to reduce reliance on imports. Technological collaborations with international defense companies are fostering the development of cost-efficient and advanced ammunition solutions.

Middle East & Africa Ammunition Market Trends

The Middle East & Africa ammunition market is driven by geopolitical instability, military modernization, and the persistent threat of insurgency across several nations. Countries such as Saudi Arabia, the UAE, and Israel are investing heavily in next-generation ammunition systems to enhance defense capabilities. In Africa, growing demand from peacekeeping forces and internal security agencies fuels market growth. The region is also witnessing a gradual shift toward localized production supported by government partnerships with global defense firms. Continuous defense spending and modernization initiatives sustain long-term market expansion in the region.

Key Ammunition Company Insights

Some of the key players operating in market include Ammo Inc., Arsenal JSCo.

-

Ammo Inc. specializes in integrating advanced materials and environmentally friendly solutions into ammunition products, catering to both defense forces and the civilian shooting sports market. Their product focus includes lead-free projectiles designed for high performance while minimizing environmental impact.

-

Arsenal JSCo. offers a broad portfolio of large and small caliber ammunition, supported by strong supply chain capabilities. The company emphasizes digital monitoring technologies that enhance production efficiency and traceability across its manufacturing processes.

BAE Systems PLC, CBC Global Ammunition are some of the emerging market participants in ammunition market.

-

BAE Systems PLC leverages decades of defense industry expertise to provide advanced artillery and guided ammunition solutions globally. Their product offerings focus on next-generation military munitions alongside comprehensive lifecycle management services.

-

CBC Global Ammunition operates a global network with multi-brand expertise in small and medium caliber ammunition. Their offerings include integrated logistics solutions and ongoing investments in R&D to bolster operational flexibility and product innovation.

Key Ammunition Companies:

The following are the leading companies in the ammunition market. These companies collectively hold the largest market share and dictate industry trends.

- Ammo Inc.

- Arsenal JSCo.

- BAE Systems PLC

- CBC Global Ammunition

- Denel SOC Ltd.

- Hanwha Corporation

- Hornady Manufacturing, Inc.

- Leonardo S.p.A.

- Nammo AS

Recent Development

-

In February 2023, Remington Arms Company LLC launched their new product line. The company announced updates in their existing product line of handgun, shotshell, rimfire and rifle.

Global Ammunition Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 83.94 billion

Revenue forecast in 2033

USD 28.37 billion

Growth rate

CAGR of -14.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Caliber, application, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Turkey; Spain; Russia; Czech Republic; Poland; China; India; Japan; South Korea; Australia; Singapore; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Ammo Inc.; Arsenal JSCo.; BAE Systems PLC; CBC Global Ammunition; Denel SOC Ltd.; Hanwha Corporation; Hornady Manufacturing, Inc.; Leonardo S.p.A.; Nammo AS

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ammunition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2023. For this study, Grand View Research has segmented the global ammunition market report based on caliber, application, product, and region:

-

Caliber Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small Caliber

-

5.56 mm

-

7.62 mm

-

7.62 x 51 mm

-

7.62 x 39 mm

-

Others

-

-

9 mm

-

9 x 18 mm

-

9 x 19 mm

-

Others

-

-

-

Medium Caliber

-

23 mm

-

30 mm

-

Others

-

-

Large Caliber

-

Tank Ammunition

-

Artillery Ammunition

-

-

Rockets, Missiles and Other

-

VSHORAD

-

122 mm

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Civil & Commercial

-

Sports

-

Hunting

-

Self Defense

-

-

Defense

-

Military

-

Law Enforcement

-

-

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Rimfire

-

Centerfire

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Spain

-

Turkey

-

Czech Republic

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ammunition market size was estimated at USD 80.86 billion in 2025 and is expected to reach USD 83.94 billion in 2026.

b. The ammunition market is expected to grow at a compound annual growth rate of -14.0% from 2026 to 2033 to reach USD 28.37 billion by 2033.

b. The defense segment dominated the market and accounted for the largest revenue share of 68.2% in 2025, driven by heightened geopolitical tensions and increased defense spending worldwide

b. Key players in global ammunition market include Ammo Inc., Arsenal JSCo., BAE Systems PLC, CBC Global Ammunition, Denel SOC Ltd., Hanwha Corporation, Hornady Manufacturing, Inc., Leonardo S.p.A., and Nammo AS.

b. The key factors that are driving the ammunition market include rising global military expenditure. Rising terrorist activities and political violence across the globe are anticipated to ascend the demand for ammunition over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.