- Home

- »

- Pharmaceuticals

- »

-

Anal Fistula Treatment Market Size & Share Report, 2030GVR Report cover

![Anal Fistula Treatment Market Size, Share & Trends Report]()

Anal Fistula Treatment Market Size, Share & Trends Analysis Report By Treatment Type (Surgical, Non-Surgical), By Application, By End User, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-175-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Anal Fistula Treatment Market Size & Trends

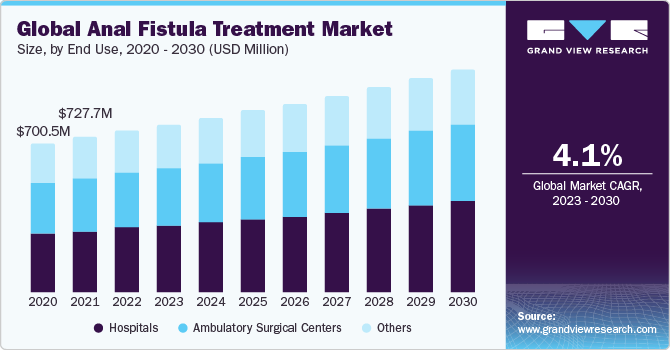

The global anal fistula treatment market was valued at USD 756.23 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% over the forecast period. The market growth is attributed to the increasing geriatric population, rising incidences of constipation, and growing adoption of unhealthy diets. According to a study published in the Lancet in June 2021, around 1 million hospital visits are due to constipation yearly.

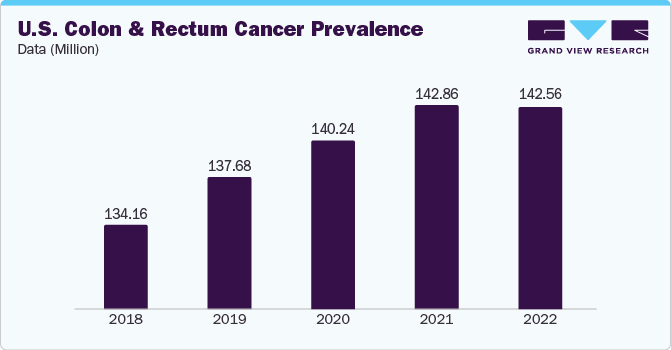

The market growth is driven by increasing inflammatory bowel conditions like Crohn's disease and ulcerative colitis, the launch of new products, and a growing demand for non-surgical approaches such as fibrin glue injection and adipose-derived stem cell therapy. For instance, a study conducted in 2022 by researchers at the University of Nottingham, supported by funding from Crohn's & Colitis UK and Coeliac UK, revealed that the prevalence of Crohn's and Colitis in the UK is significantly higher and it also indicated that 1 out of every 123 individuals in the UK is affected by either Crohn's disease or ulcerative colitis, equating to nearly half a million people in the UK living with inflammatory bowel disease (IBD). While inflammatory bowel disease may not be extremely common, it still exerts a substantial impact on a significant portion of the UK population.

The COVID-19 pandemic significantly impacted the market. According to a 2021 article titled "Insights into Managing Anorectal Conditions During the COVID-19 Era," the treatment of anal fistula was delayed during the pandemic, leading to discomfort for patients. In such situations, alternative options like outpatient examination with proctoscopy and seton placement were considered. Moreover, a 2021 article titled "Rising Cases of Anal Fissures in the COVID Era; Necessity of Treatment!" highlighted that other than antibiotics, some patients showcased existing fissure symptoms in the long term by overdosing on zinc tablets, vitamins, and herbal tonics during the COVID-19 period.

Treatment Type Insights

Based on the treatment type, the market is segmented into surgical and non-surgical. The surgical segment held the largest share in 2022 owing to the increasing occurrence of infections associated with fistulas and a growing demand for safe and efficient treatment methods. For instance, according to an article published in 2021 titled ‘Anal Fistula: Contemporary Insights into a Complex Issue’, surgical procedures such as fistulotomy have demonstrated a success rate exceeding 90%. Moreover, the combination of medical therapy with surgical interventions is expected to reduce the disease's severity significantly and even hold the potential for complete eradication. Thus, surgery is the recommended approach for patients with anal fistulas to address the issue, and the adoption of the surgical segment is projected to increase over the forecast period.

Application Insights

Based on application, the market is segmented into intersphincteric fistula, transsphincteric fistula, suprasphincteric fistula, and others. Intersphincteric fistula accounted for the largest market share in 2022, as intersphincteric fistulas are the most common type of anal fistula, accounting for about 60% of all cases. The rising incidence of anal fistulas, coupled with the development of new and innovative intersphincteric fistula treatments, is also fueling the growth of the segment. For example, the introduction of minimally invasive procedures, such as video-assisted anal fistula treatment (VAAFT), has led to a shift from traditional open surgery to less invasive and more effective treatments.

End Use Insights

Based on end use, the market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest share in 2022. The growth is attributed to the wide range of treatment options hospitals offer, including surgery, minimally invasive procedures, and medication. Additionally, hospitals have the necessary infrastructure and expertise to provide comprehensive care for patients with anal fistulas. Moreover, the rising number of people with chronic diseases, such as diabetes and obesity, is also contributing to the growth of the hospital segment. People with chronic diseases are more likely to develop complications from anal fistulas, such as abscesses and infections.

Regional Insights

North America dominated the market in 2022 owing to the substantial patient population suffering from inflammatory bowel diseases, the early adoption of cutting-edge technologies, and significant healthcare investments from public and private sectors within the region. The Mayo Clinic's 2022 report revealed that Mayo Clinic surgeons in the U.S. have extensive expertise in treating anal fistulas, with more than 1,000 patients receiving treatment annually. Moreover, ongoing advancements in the field of anal fistula treatment in North America are anticipated to fuel market growth during the forecast period.

Competitive Insights

Key players operating in the market are Pfizer Inc., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline Plc., Medtronic, Biolitec AG, Cook Group, Eisai Co Ltd., Abbott Laboratories, and Bayer AG. The market participants are constantly working towards new product development, clinical trials, M&A activities, and other strategic alliances to gain new market avenues.

The following are some instances of strategic initiatives:

-

In March 2022, Ossium Health, Inc. obtained approval from the U.S. Food and Drug Administration (FDA) for its Investigational New Drug (IND) application concerning OSSM-001, which is a mesenchymal stem cell (MSC) product intended for addressing refractory perianal fistulas in individuals diagnosed with Crohn's disease.

-

In February 2022, Takeda disclosed the initial six-month interim analysis findings from the INSPIRE study, revealing that clinical remission was observed in 65% of patients in both cohorts assessed at the 6-month mark. INSPIRE is a European, post-approval, observational, multicenter, open-enrollment study designed to assess the real-world effectiveness and safety of Alofisel in individuals with Crohn's disease (CD) and complex perianal fistulas.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."