- Home

- »

- Medical Devices

- »

-

Anesthesia CO2 Absorbent Market Size & Share Report 2030GVR Report cover

![Anesthesia CO2 Absorbent Market Size, Share & Trends Report]()

Anesthesia CO2 Absorbent Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Type (Premium, Traditional), By Form (Powder, Granular), By End Use (Hospitals, Clinics, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-754-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anesthesia CO2 Absorbent Market Trends

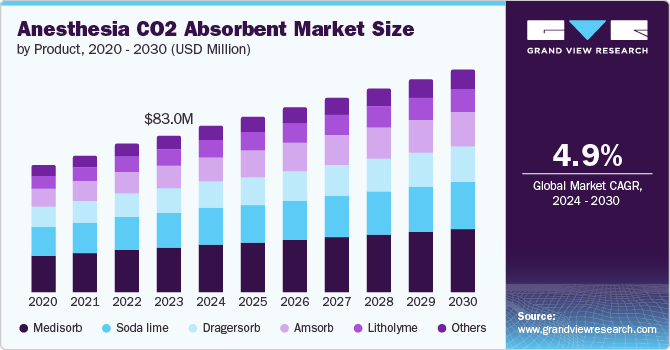

The global anesthesia CO2 absorbent market size was valued at USD 83.03 million in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The market is expected to grow significantly due to the rising incidences of chronic illnesses and fatal accidents, augmenting the geriatric population and increasing the volume of surgeries. Increasing incidences of chronic conditions are expected to increase the demand for surgeries. With the rising volume of surgeries, required anesthesia is anticipated to rise, thereby propelling the market growth. Furthermore, guidelines and safety parameters decided by institutes such as the Anesthesia Patient Safety Foundation, the CEA, and the CDC are other vital impact-rendering drivers.

A huge geriatric population base is prone to suffer from diseases such as cardiac disorders, neurological conditions, respiratory diseases, and diabetes, ultimately demanding surgical intervention. This acts as a major driver for growth. Diabetes is becoming an increasingly prevalent health issue worldwide, impacting individuals, families, and entire countries. According to the IDF Diabetes Atlas (2021), approximately 10.5% of the adult population (20-79 years) currently has diabetes, with nearly half of them unaware of their condition. The projections for the future are concerning, as the number of adults living with diabetes is expected to rise significantly by 2045. It is estimated that 1 in 8 adults, totaling around 783 million people, will be affected by diabetes, representing a staggering increase of 46%. These figures highlight the urgent need for awareness, prevention, and effective management of diabetes to address its growing global burden.

Supportive government initiatives for healthcare are expected to impact the growth of anesthesia disposables positively and, thereby, the overall growth of the market. According to the 2020 WHO Report, a comprehensive analysis of global health spending trends from 2000 to 2018 offers valuable insights into health expenditure trajectory during the transition from the Millennium Development Goals (MDGs) to the Sustainable Development Goals (SDGs) era before the 2020 crisis. The report explains global spending on health experienced a consistent upward trend during this period, reaching an impressive USD 8.3 trillion, equivalent to 10% of the world's GDP. However, the data also revealed persistent challenges in low and lower-middle-income countries, where out-of-pocket spending remained high, accounting for over 40% of total health expenditure in 2018.

Product Insights

The medisorb segment dominated the market and accounted for a revenue share of 28.8% in 2023 as medisorb CO2 absorbents are essential for the safe administration of anesthesia. As the demand for anesthesia grows, the demand for medisorb CO2 absorbents is also expected to grow.

The amsorb is expected to grow at the fastest CAGR of 6.0% from 2024 to 2030. Amsorb CO2 absorbents have several advantages over other CO2 absorbents, including a lower risk of toxicity and a longer lifespan. This improved safety profile is making absorbing CO2 absorbents more attractive to hospitals and other healthcare providers. For instance, in 2022, Amsorb plus CO2 absorbent was launched, which had a HEPA filter. The HEPA filter helps to remove particulate matter from the exhaled gas, which can help to improve patient comfort and reduce the risk of infection.

Type Insights

The premium segment dominated the market and accounted for a revenue share of 62.0% in 2023 due to features such as enhanced CO2 absorption capacity or efficiency, reduced environmental impact through its chemical composition, lower risk of generating certain byproducts during CO2 absorption, and extended lifespan compared to traditional absorbents. Hospitals prioritizing the advancement in patient safety choose premium options of anesthesia CO2 absorbent.

The traditional segment is expected to grow at the fastest CAGR of 5.0% from 2024 to 2030. This growth is attributed to the cost-effectiveness of traditional absorbents such as Medisorb, which is generally adopted for its affordability and effectiveness. Traditional absorbents have a long history of safe and effective use in anesthesia. This established reliability can be a major factor for some hospitals or clinics to choose traditional anesthesia CO2 absorbents.

End Use Insights

The hospital segment dominated the market with a revenue share of 56.2%in 2023. Hospitals are the primary places for surgeries and medical procedures that require anesthesia, leading to a higher demand for anesthesia equipment and CO2 absorbents. In addition, hospitals have larger budgets and resources compared to clinics, allowing them to invest in advanced anesthesia systems that require CO2 absorbents.

The clinic segment is projected to experience the fastest CAGR of 6.2% during the forecast period. This growth is anticipated to the rising number of specialty clinics performing outpatient surgeries and procedures that require anesthesia services. Moreover, advancements in medical technology have led to the development of compact and portable anesthesia systems suitable for clinic settings.

Form Insights

The powder segment dominated the market and accounted for a revenue share of 53.2% in 2023. Powder absorbents have been traditionally used in anesthesia machines and have been well-recognized by healthcare professionals for a long time.

The granular is expected to grow at the fastest CAGR of 5.1% from 2024 to 2030. Granular absorbents are known for their superior performance in terms of carbon dioxide absorption capacity and resistance to channeling, which leads to more consistent and reliable results during anesthesia procedures. Growing awareness among healthcare professionals about the benefits of granular anesthesia CO2 absorbents, such as reduced maintenance requirements and longer-lasting performance, is driving their adoption across various medical settings.

Regional Insights & Trends

North America anesthesia CO2 absorbent market dominated the global market with a revenue share of 35.4% in 2023. It is attributable to advanced technologies, stringent regulations by government authorities, high awareness about patient safety practices, and a well-established healthcare infrastructure

U.S. Anesthesia CO2 Absorbent Market Trends

The U.S. anesthesia CO2 absorbent market dominated the North America market in 2023. Increasing surgical volume and supportive initiatives by government and healthcare agencies to expand medical tourism and prevent U.S. citizens from traveling to other countries are expected to drive growth. According to the Society of Thoracic Surgeons (STS), an estimated 1.3 million cardiovascular surgeries were performed in North America in 2022. Of these, 730,000 were coronary artery bypass grafting (CABG) procedures, 330,000 were valve procedures, and 240,000 were heart transplantations. The number of cardiovascular surgeries performed in North America has been increasing steadily over the past few decades due to a number of factors, including the aging population, the rising prevalence of risk factors for cardiovascular disease, and advances in surgical techniques. The risk of death from cardiovascular surgery varies depending on the type of procedure performed.

Europe Anesthesia CO2 Absorbent Market Trends

Europe anesthesia CO2 absorbent market was identified as a lucrative region in 2023 due to the increasing prevalence of chronic diseases that require surgical interventions, advancements in healthcare infrastructure, the rising geriatric population, and the growing demand for minimally invasive surgical procedures.

The UK anesthesia CO2 absorbent market is expected to grow significantly in the coming years due to a rise in healthcare awareness, increasing surgical procedures due to the increasing geriatric population, and technological advancement in the healthcare sector.

The Germany anesthesia CO2 absorbent market held a substantial share in 2023 owing to a well-established healthcare system, aging population and increasing surgical procedures in the country.

Asia Pacific Anesthesia CO2 Absorbent Market Trends

Asia Pacific anesthesia CO2 absorbent market is anticipated to witness the fastest CAGR in the coming years. This growth is owing to the significantly increasing investments in healthcare facilities. The need for anesthesia CO2 absorbent is being driven by increasing prevalence of chronic diseases and developing facilities in the Asia Pacific developing countries.

The anesthesia CO2 absorbent market in India is expected to grow rapidly from 2024 to 2030 due to its large population, increasing awareness about health, and improving healthcare infrastructure. It is estimated that 30 million surgical procedures are carried out in India annually. In addition, healthcare tourists coming to India for surgeries are contributing to the market growth.

The China anesthesia CO2 absorbent market is expected to grow rapidly in the coming years due to the rise in healthcare awareness and the increasing geriatric population.

Latin America Anesthesia CO2 Absorbent Market Trends

Latin America is expected to witness a lucrative CAGR during the forecast. The number of surgeries being performed in Latin America is increasing due to several factors, including the aging population, the rising prevalence of chronic diseases, and the increasing availability of healthcare services.

According to Economic Commission for Latin America (ECLA), population aging is a significant demographic trend impacting Latin America and the Caribbean. As of 2022, the region is home to 88.6 million people aged 60 years and above, making up 13.4% of the total population. This proportion is projected to rise to 16.5% by 2030. The aging process is rapidly advancing, and by 2050, older persons are expected to make up 25.1% of the total population, with approximately 193 million people falling into this age group. This represents a substantial increase of 2.1 times more older persons compared to the figures observed in 2022. The region faces the challenge of adapting to this demographic shift and addressing the needs and well-being of its aging population in the years to come.

Key Anesthesia CO2 Absorbent Company Insights

reater opportunities in developed and developing countries encourage companies to undertake various strategic initiatives, such as mergers, acquisitions & collaborations, to develop novel, innovative solutions and expand operations to increase their global presence. For instance, in 2021, Drägerwerk AG & Co. KGaA launched their anesthesia CO2 absorbent, the Drägersorb 800 HEPA, in response to the growing demand for safer and more effective CO2 absorbents in the anesthesia market. Drägersorb 800 HEPA is a calcium hydroxide-based absorbent that is non-toxic and non-irritating to the lungs. It is also effective at absorbing CO2, even at low gas flows. Drägersorb 800 HEPA has a HEPA filter that helps to remove particulate matter from the exhaled gas, which can help to improve patient comfort and reduce the risk of infection. Drägersorb 800 HEPA is CE-marked and FDA-approved and used in hospitals and other healthcare settings worldwide.

Key Anesthesia CO2 Absorbent Companies:

The following are the leading companies in the anesthesia CO2 absorbent market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Baxter

- GE HealthCare

- Cardinal Health

- Ecolab

- Medline Industries, LP.

- Koninklijke Philips N.V.

- KCWW

- Teleflex Incorporated

- Thermo Fisher Scientific Inc.

- SunMED Medical

- Armstrong Medical Ltd.

Recent Developments

- In May 2023, SunMED Medical acquired Vyaire Medical’s respiratory and anesthesia consumables business. This merger is expected to create a leading manufacturer of operative care and airway management, offering high quality anesthesia and consumable respiratory medical products, thereby supporting best patients’ outcomes.

Anesthesia CO2 Absorbent Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 87.9 million

Revenue forecast in 2030

USD 117.3 million

Growth Rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, form, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Kuwait, and South Africa

Key companies profiled

3M; Baxter; GE HealthCare; Cardinal Health; Ecolab; Medline Industries, LP.; Koninklijke Philips N.V.; KCWW; Teleflex Incorporated; Thermo Fisher Scientific Inc.; SunMED Medical and Armstrong Medical Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anesthesia CO2 Absorbent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anesthesia CO2 absorbent report based on product, type, form, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Soda lime

-

Medisorb

-

Dragersorb

-

Amsorb

-

Litholyme

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Premium

-

Traditional

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Granular

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.