- Home

- »

- Healthcare IT

- »

-

Anesthesia Information Management Systems Market Report, 2030GVR Report cover

![Anesthesia Information Management Systems Market Size, Share & Trends Report]()

Anesthesia Information Management Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Solutions, By End-use (Hospitals, Ambulatory Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-964-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AIMS Market Size & Trends

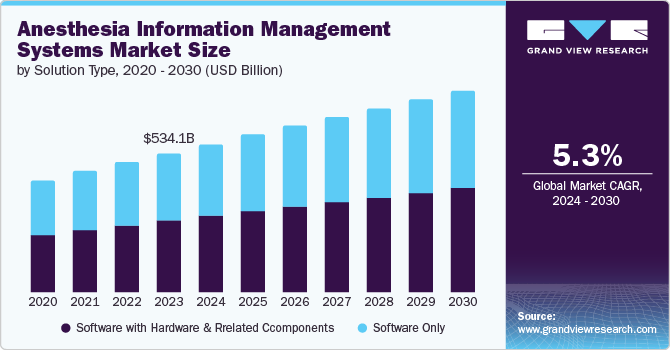

The global anesthesia information management systems market size was valued at USD 534.07 billion in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The market is anticipated to witness growth as a result of rising hospital admission rates, an increase in surgical operations around the globe, and the quick uptake of healthcare information technology (HCIT) solutions. It is anticipated that the market for anesthesia information management systems (AIMS) would rise due to the rising importance of anesthetic dose and thorough data management. According to the Anesthesia Patient Safety Foundation, 84% of academic anesthesiology departments in the U.S. planned to use anesthesia information management systems in 2020, up from an estimated 75% in 2014. According to a study by the National Library of Medicine, every year in the U.S., about 64 million surgical procedures are carried out by surgeons, which can vary from tooth removal to open heart surgery, driving the demand for the anesthesia market.

Information technology is quickly changing clinical practices across the world. Healthcare providers interact with and rely on electronic medical information daily. Additionally, it is anticipated that partnerships between major competitors for cloud-based anesthesia information management systems would aid in the market's expansion.

Hospitals are facing pressure to work in an economically viable setup and to become more effective. In addition, operating rooms are the primary reason for almost 40% of the total hospital revenue and 70% of hospital administration. Owing to this, the market players are involved in product launches to improve operating room efficiency. For instance, Pics provides the perioperative suite which includes the anesthesia manager and operating room manager to offer clinical information solutions to automate the perioperative process.

The increasing need for patient-specific clinical information and anesthesia records in hospitals and ambulatory surgical centers is expected to drive the growth of the market. For instance, with the paper record, anesthesia providers might spend more than 20 minutes or more working through historical information and struggling to read poor handwriting to determine if bad outcomes occurred, in the past.

Medical information systems for operating rooms are the wave of the future. For instance, Plexus TG's anesthesia touch automates the collection of real-time anesthesia data throughout the perioperative period, enabling anesthesia professionals to provide safe, effective care to patients and ultimately widening the market opportunities for other competitors to come up with better solutions. As a result, various strategic initiatives and the launch of innovative solutions are expected to be carried out during the forecast period.

The cost remains the major obstacle to the implementation of these solutions at any healthcare facility. For instance, in 2016, the total setup cost for the AIMS Software with hardware and supporting components (IT support, Training Costs (Per Provider)) per operation room was 104,122 USD. As a result, in the near term, the cost of installing the entire setup works as a barrier. However, growing competition and increasing acceptance of this system are anticipated to overcome this barrier during the forecast period.

Solution Insights

The software with hardware and related components [IT support, training costs (per provider)] segment accounted for the largest market share of 51.2% in 2023. Due to many hospitals and related end-users adopting advanced healthcare infrastructure, software with hardware and related components is also experiencing a relatively higher market volume. Installing such software along with the complete setup would give the user a cost-effective option of saving the high-spending on-capital equipment and related maintenance

An AIMS also increases patient safety by automatically transferring data from physiological monitoring and anesthesia equipment to an electronic anesthetic chart and by making evidence-based suggestions to reduce risks during surgery. These are a few of the perks that are anticipated to catch the attention of medical professionals and hospitals as these cutting-edge technologies would ultimately lead to reduced dose mistakes, thus contributing to market expansion during the forecast period.

The companies are establishing their market presence by implementing tactics such as partnerships with regional players to expand their reach and offer better solutions at a more affordable cost, which will eventually result in a rise in overall market growth throughout the forecast period. For instance, in February 2022, Provation appointed Gulf Medical Company, Ltd., as an exclusive collaborator in Saudi Arabia to sell and distribute its clinical productivity solution.

The software only segment is expected to register a significant CAGR of 5.3% during the forecast period. The software collects and organizes extensive patient information such as medications, medical history, procedures, vital signs, and results. The stored information is vital for making clinical decisions, improving quality, and conducting research.

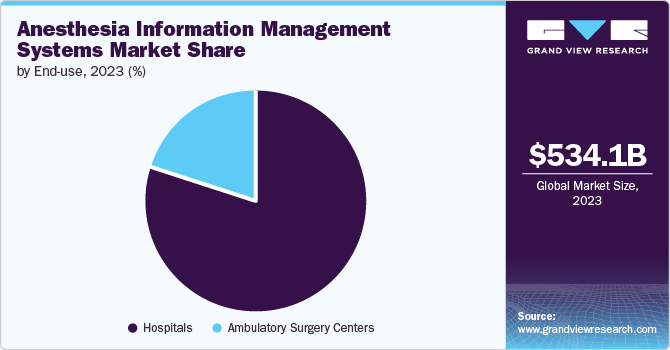

End-use Insights

The hospitals segment dominated the market and accounted for largest share in 2023. The next-generation technology AIMS software, and its associated setup helps physicians make better decisions and manage hospital OR rooms and ASC settings altogether, which leads to faster adoption.

As most hospitals handle significant fatal or chronic disease-related treatments, the need for advanced OR settings-which, in some cases, also necessitates specialized AIMS installations-leads to the hospital sector holding the biggest market share in 2021, at over 80%, and is anticipated to hold that position throughout the forecast period.

The hospitals are an essential component of healthcare and serve as the main source of sales for the whole sector, which supports technology and development not just in nations like the U.S. but also generally in areas like Europe. Due to this, a few companies spend on techniques like sales & advertising, and marketing to sell their products at the majority of hospitals. In February 2022, Plexus Technology Group, LLC proclaimed that its Anesthesia Touch has grabbed a critical breakthrough by being deployed into over 1,000 hospital systems countrywide.

The ambulatory surgery centers (ASC) segment is expected to register the fastest CAGR during the forecast period. The growth in costs, which also adds to the fact that a specific set of people can afford the essential treatment, including surgical procedures, is a major problem confronting the healthcare sector. Additionally, ASCs provide the patient defensive measures and are preferable settings for elective surgery. As a result, healthcare providers have been obliged to switch to more advanced settings, one of which includes AIMS as a component to find new ways to make such healthcare more affordable without compromising quality. The improvements in minimally invasive medical techniques and surgical tools have led to a wider range of surgeries in ASCs. A shift from inpatient to outpatient care is driving growth of ASCs in the market. The increasing number of elderly population requiring surgeries is driving the demand for ASCs. According to Age UK, in 2023, England had a population of 11 million individuals who were over the age of 65. It is expected to grow by 10% in the next five years and by 32% by 2043.

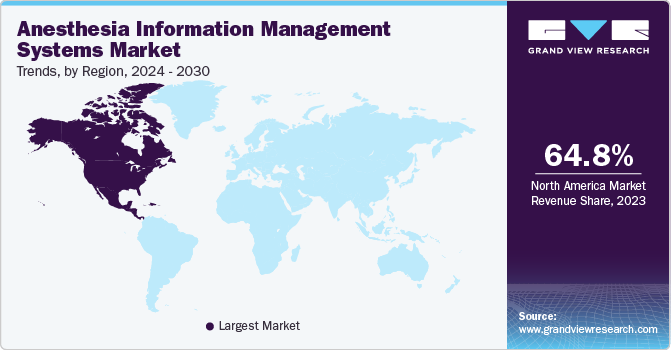

Regional Insights

The North America anesthesia information management systems market held majority of the revenue share with 64.8% in 2023. The awareness of AIMS effectiveness, increased emphasis on anesthetic dosage, and complete data management, along with growing demand for knowledge-based, medical equipment are driving the market demand.

U.S. Anesthesia Information Management Systems Market Trends

The U.S. anesthesia information management systems (AIMS) market dominated the North America market in 2023 due to the increasing requirement for better patient treatment databases. As the population getting affected by chronic diseases is increasing, it is leading to a rising demand for AIMS. The increasing number of chronic diseases among individuals is fueling the need for AIMS. According to a study by the U.S. Department of Health and Human Services, approximately 129 million individuals in the U.S. are affected by at least one major chronic illness such as cancer, obesity, heart disease, hypertension, and other diseases.

Europe Anesthesia Information Management Systems Market Trends

The Europe anesthesia information management systems (AIMS) market identified as a lucrative region in 2023 due to the rising geriatric population and the increasing need for healthcare facilities. This change in demographics leads to a rise in chronic illnesses and surgical procedures, which in turn boosts the need for effective anesthesia control.

Asia Pacific Anesthesia Information Management Systems Market Trends

Asia Pacific anesthesia information management systems (AIMS) market anticipated to witness significant growth in the coming years. The market is fueled by a growing pool of patient populations with chronic conditions that necessitate surgical treatments. The region is set for major growth as healthcare digitization accelerates. The huge investments in developing healthcare IT infrastructure is increasing, leading to the AIMS market growth.

Key Anesthesia Information Management Systems Company Insights

Some key companies in anesthesia information management systems (AIMS) market include Coronis Health, Drägerwerk AG & Co. KGaA, GE Healthcare, Koninklijke Philips N.V., Talis Clinical, LLC, and others. The players use different strategies, such as raising their investment to add more stacks around their earnings. The purchase will help the company enhance its standing as a leader in advanced scheduling technology within the industry.

-

Provation software solutions aim to simplify clinical processes and enhance documentation and patient care in different medical environments such as surgical suites, endoscopy units, and hospitals. It offers Provation iPro for anesthesia information management, quality concierge for anesthesia quality reporting, and other products in the AIMS market.

Key Anesthesia Information Management Systems Companies:

The following are the leading companies in the anesthesia information management systems (AIMS) market. These companies collectively hold the largest market share and dictate industry trends.

- Drägerwerk AG & Co. KGaA

- GE Healthcare

- Koninklijke Philips N.V.

- Surgical Information Systems

- Talis Clinical, LLC

- Coronis Health

- Provation Software, Inc.

- Oracle (Cerner)

- Veradigm LLC (formerly Allscripts)

- Fukuda Denshi UK

- iMDsoft

Recent Developments

-

In March 2023, MEDHOST launched MEDHOST Anesthesia Experience. It is an anesthesia management solution supporting essential anesthesia care aspects across perioperative workflow.

Anesthesia Information Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 568.78 billion

Revenue forecast in 2030

USD 774.66 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, France, Italy, Spain, Switzerland, Sweden, Belgium, China, Japan, India, South Korea, Australia, Brazil, Argentina, Chile, Saudi Arabia, UAE, and South Africa

Key companies profiled

Drägerwerk AG & Co. KGaA; GE Healthcare; Koninklijke Philips N.V.; Surgical Information Systems; Talis Clinical, LLC; Coronis Health; Provation Software, Inc.; Oracle (Cerner); Veradigm LLC (formerly Allscripts); Fukuda Denshi UK; iMDsoft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

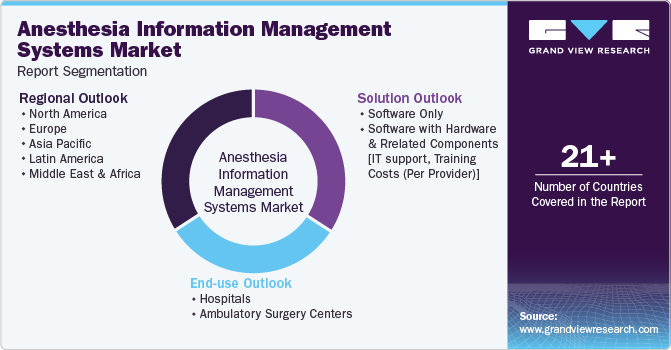

Global Anesthesia Information Management Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anesthesia information management systems market report based on solution, end-use, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software Only

-

Software with Hardware and Related Components [IT support, Training Costs (Per Provider)]

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Switzerland

-

Belgium

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.