- Home

- »

- Medical Devices

- »

-

Aneurysm Clips Market Size & Trends Analysis Report, 2030GVR Report cover

![Aneurysm Clips Market Size, Share & Trends Report]()

Aneurysm Clips Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Titanium Aneurysm Clip, Polymer, Others), By Indication, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-030-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

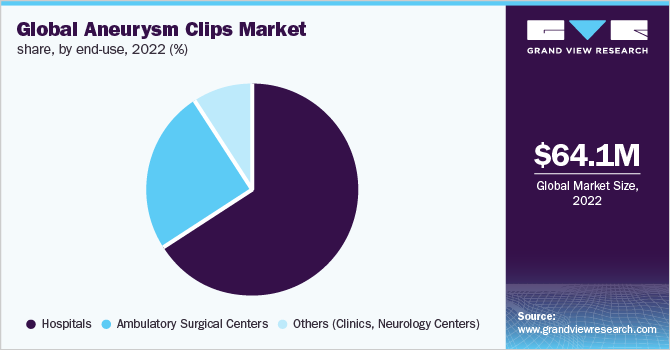

The global aneurysm clips market accounted for USD 64.09 million in 2022 and is expected to expand at a CAGR of over 7.36% during the forecast period. The rising incidence of laparoscopic surgical procedures and the use of highly appropriate materials including stainless steel alloys, such as pure titanium, titanium alloy, Elgiloy, and Phynox in aneurysm clips are the factors that are anticipated to have an impact on the growth of the aneurysm clips market. In addition, the market is expected to be driven by the growing adoption of unhealthy lifestyles, a rising geriatric population, rising incidence of intracranial aneurysm ruptures, and the accessibility of biocompatible aneurysm clips in various sizes and shapes.

The global market for aneurysm clips is experiencing rapid technological advancements in terms of portability and miniaturization such as clip appliers and tipsters which can be used endoscopically or laparoscopically without making significant incisions on a patient’s body surface area. For instance, in May 2019, Stryker received FDA PMA for Neuroform Atlas Stent System for treating intracranial aneurysms, which is a second aneurysm adjunctive stent used to treat wide-neck brain aneurysms in combination with embolic detachable coils.

The COVID-19 pandemic had a detrimental influence on the global healthcare industry. Neurocare and neurosurgeons have been significantly impacted by the pandemic. During this period, brain-related procedures were often postponed or even canceled to prevent the transmission of the disease. In the worst pandemic-affected countries, such as India, the U.S., Brazil, Russia, France, Italy, the UK, and Spain neurosurgical procedures declined to 55%. These are some of the severely impacted countries in terms of positive cases and reported deaths. Due to the restrictions, there was a limitation on the total number of general surgical operations that could be carried out globally. The closure of several departments at various hospitals around the world due to a shortage of available staff has also had an influence on the number of procedures.

A rise in the prevalence of disorders related to neurology such as cerebral or brain aneurysms, epilepsy, and strokes among many others in several countries is anticipated to fuel the aneurysm clips market growth. According to an NHS England article, published in January 2021, around 1 in 15,000 individuals in England have a ruptured brain aneurysm annually. Furthermore, about 3% of adults in the U.K. have a cerebral aneurysm. Increasing prevalence of hypertension, alcohol consumption, and smoking results in brain aneurysms. Hence, this result in boost of aneurysm clips market across healthcare providers.

According to the data published by Cleveland Clinic in April 2020, about 6% of the citizen of the U.S. have unruptured brain aneurysms and around 30,000 U.S. citizens suffer from brain rupture aneurysms annually. As per an article released by NEWS Medical Lifescience, in May 2020, brain aneurysms are more common in females, that is, about 60% of the overall female population. Moreover, it especially occurs in females of the postmenopausal age group, making it more risker. This above factor is anticipated to increase the growth of aneurysm clips market.

Additionally, high cholesterol, diabetes, cigarette smoking, and high blood pressure increase the risk of atherosclerosis causing brain aneurysm rupture. According to an article released by IDF Diabetes Atlas Tenth edition 2021, in September 2021, approximately 537 million, between the age group of 20 to 79 years have diabetes. Furthermore, it is anticipated to rise by 643 million and 738 million by 2030 and 2045 respectively. Thus, rise in unhealthy lifestyle among youth worldwide is expected to fuel the aneurysm clips market in the coming future.

Material Insights

The titanium aneurysm clips segment dominated the market with a market share of 81.94% in 2022 and is anticipated to grow at the highest CAGR of 7.40% in the forecast period. The features of titanium aneurysm clips such as inertness, durability, high tensile strength, non-reactivity, and lightness. The compatibility with imaging modalities namely MRI, CT, and X-rays along with its ability to secure effectively the closure of delicate vessels during procedures makes it a preferred option as surgical equipment, thereby driving the segment growth. Furthermore, compared to other materials, titanium aneurysm clips have minimal interference with MRI and CT (tomography) scans.

According to Brain Aneurysm Foundation, titanium clips are used generally as they are MRI compatible, and thus, do not set off alarms under metal detectors. In the field of medical equipment, titanium and its alloys are widely used due to their high biocompatibility. As per an article published by Medical Device News Magazine, in November 2022, more than 70% of surgical implant equipment and 95% of orthopedic implants are made from metal due to their strength and durability. Titanium and its alloys are chosen materials in spinal implants, hip and joint implants, and various other implants owing to its promising differentiating features.

Indication Insights

The stroke segment dominated the market with a share of 57.09% in 2022, owing to the variables such as rising stroke prevalence, hypertension, and various other neurological disorders. As per CDC, one in every 6 individuals worldwide will have a stroke at some point of time in their lifespan, more than 795,000 individuals in the U.S. experience stroke. Strokes are the second major cause of death worldwide and are responsible for around 140,000 fatalities annually in the US. The rise in the prevalence of stroke across the world caused due to unhealthy lifestyle, hypertension, and old-age would rise in the growth of aneurysm clips market.

The cerebral aneurysm segment is anticipated to grow at the highest CAGR during the forecast period, primarily due to the rising incidence of intracranial aneurysms. According to an article published by Frontiers Media S.A. in March 2022, globally it is anticipated that approximately 6 people in every 100,000 experience aneurysmal subarachnoid hemorrhage. Moreover, rising demand for minimal invasion surgeries, the adoption of advanced technological equipment, and in February 2020, Cerus Endovascular Ltd. received European CE Mark approval for its flagship product, the Contour Neurovascular System, for the procedure of intracranial aneurysms.

End-use Insights

The hospital segment dominates the market for aneurysm clips and accounted for a revenue share of 65.79% in 2022. This is attributed to the rising number of surgical procedures, such as abdominal and neurosurgery laparoscopy, and the growing frequency of trauma.In developed countries, insurance companies pay for medical expenditures that include ligature costs. The rise in surgical procedures carried out in hospitals employing clipping equipment, as a result, had a favorable effect on the segment's growth.

Ambulatory surgical centers (ASCs), are expected to have the highest CAGR during the forecast period. This can be owned due to, lower out-of-pocket expenses, reduced facility costs, and better patient accessibility. The majority of Middle Eastern and Asian countries still do not have the economy or infrastructure to establish ambulatory centers, however, they are working towards the same to minimize the burden related to surgical operations in hospitals.

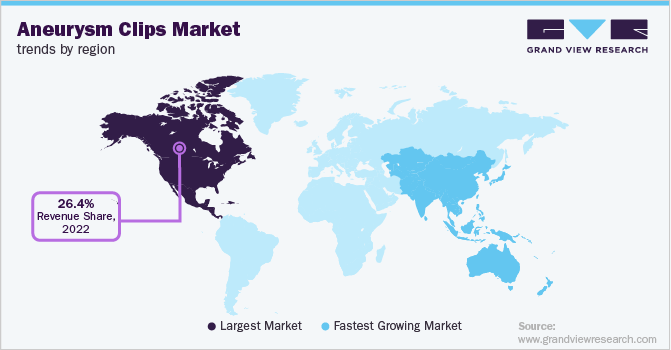

Regional Insights

In 2022, North America dominated the market with a revenue share of 26.44% in terms of revenue. The rising prevalence of neurological disorders and increasing demand for minimally invasive surgical procedures are driving the aneurysm clips market growth in this region. For instance, according to the CDC, in the US, yearly more than 795,000 people suffer from stroke, with 87% identified as ischemic stroke.

Furthermore, an increasing number of initiatives are being undertaken by various organizations is expected to fuel aneurysm clips market growth in the U.S. For instance, the Bee Foundation (TBF), a nonprofit organization, is focused on spreading awareness and reducing the number of deaths due to cerebral aneurysms through innovative research.

The medical market in Asia Pacific is anticipated to witness the fastest growth rate over the forecast period owing to the factors, such as the rising target disease burden, growing geriatric population, rising unhealthy lifestyle among youngsters, and increasing incidence of acute ischemic stroke. According to an article by ResearchGate, published in April 2020, the prevalence of obesity in individuals 18 years and above in ASEAN countries is Cambodia at 50.20%, Indonesia at 28%, Laos at 20.9%, Malaysia 15.4%, Singapore at 44.1%, Myanmar at 8.4%, Vietnam at 2.53%, Thailand at 12.7%, and Brunei Darussalam at 29.5% Furthermore, in all ASEAN countries the obesity rate is more prevalent in females.

In addition, emerging economies such as China, South Korea, and India are expected to witness considerable growth over the forecast period. Furthermore, the establishment of organizations such as the Asia-Pacific Centre for Neuromodulation (APCN), which is founded for conducting research and promoting awareness about the associated benefits of deep brain stimulation surgeries, is anticipated to boost the aneurysm clips market growth.

Key Companies & Market Share Insights

Companies are focusing on the development of novel medical devices, expansions, and technological innovations. Moreover, mergers and acquisitions for new product development and strengthening of supply chain networks constitute some of the strategic initiatives implemented by major players. For instance, in December 2022, Integra LifeSciences, a medical technology company announced the acquisition of Surgical Innovation Associates (SIA), to grow its aneurysm clips market globally. Some of the key players operating in the global aneurysm clips market include:

-

Aesculap, Inc. - a B. Braun company

-

Datenschutz/Rebstock Instruments GmbH

-

Mizuho Medical Co., Ltd.

-

adeor medical AG

-

evonos GmbH & Co. KG

-

Integra LifeSciences

Aneurysm Clips Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 68.7 million

Revenue forecast in 2030

USD 112.92 million

Growth rate

CAGR of 7.36% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Aesculap, Inc. – a B. Braun company, Datenschutz/Rebstock Instruments GmbH; Mizuho Medical Co., Ltd. ; adeor medical AG; evonos GmbH & Co. KG; Integra LifeSciences

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aneurysm Clips Market Segmentation

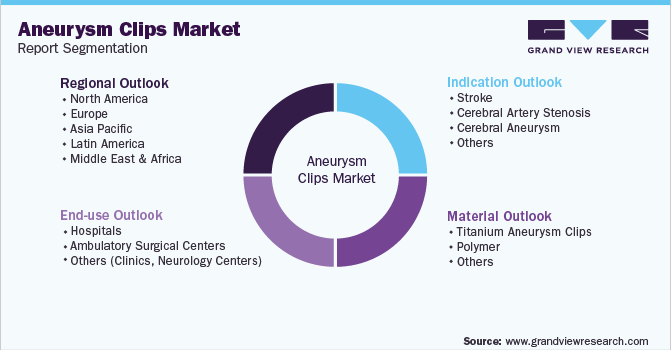

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aneurysm clips market based on material, indication, end-use, and region:

-

Material Outlook (USD Million, 2018 - 2030)

-

Titanium Aneurysm Clips

-

Polymer

-

Others

-

-

Indication Outlook (USD Million, 2018 - 2030)

-

Stroke

-

Cerebral Artery Stenosis

-

Cerebral Aneurysm

-

Others

-

-

End-use Outlook (USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others (Clinics, Neurology Centers)

-

-

Regional Outlook (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aneurysm clips market size was estimated at USD 64.09 million in 2022 and is expected to reach USD 68.70 million in 2023.

b. The global aneurysm clips market is expected to grow at a compound annual growth rate of 7.36% from 2023 to 2030 to reach USD 112.92 million by 2030.

b. North America dominated the aneurysm clips market with a share of 26.44% in 2022. This is attributable to the rising adoption of cosmetic lift-ups and increasing demand for aesthetic surgeries along with high disposable income and increasing healthcare spending by patients.

b. Some of the key players operating in the aneurysm clips market include Aesculap, Inc. – a B. Braun company, Datenschutz/Rebstock Instruments GmbH, Mizuho Medical Co., Ltd., adeor medical AG, evonos GmbH & Co. KG, Integra LifeSciences

b. Key factors that are driving the aneurysm clips market growth include the rising incidence of laparoscopic surgical procedures, growing adoption of unhealthy lifestyles, a rising geriatric population, rising incidence of intracranial aneurysm ruptures, the accessibility of biocompatible aneurysm clips in various sizes and shapes, and the use of highly appropriate materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.