- Home

- »

- Medical Devices

- »

-

Angioplasty Balloons Market Size And Share Report, 2030GVR Report cover

![Angioplasty Balloons Market Size, Share & Trends Report]()

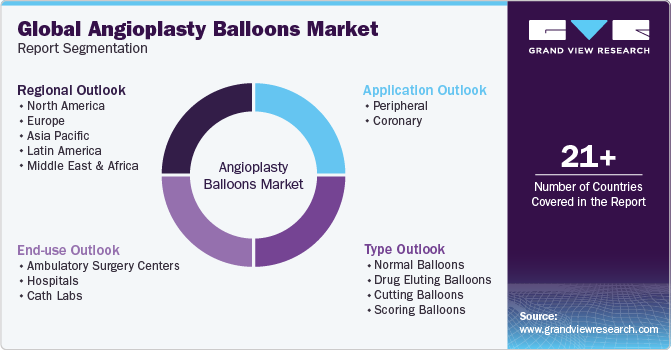

Angioplasty Balloons Market Size, Share & Trends Analysis Report By Type (Normal, DEB, Cutting, Scoring), By Application (Peripheral, Coronary), By End-use (Hospitals, ASCs, Cath Labs), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-356-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Angioplasty Balloons Market Size & Trends

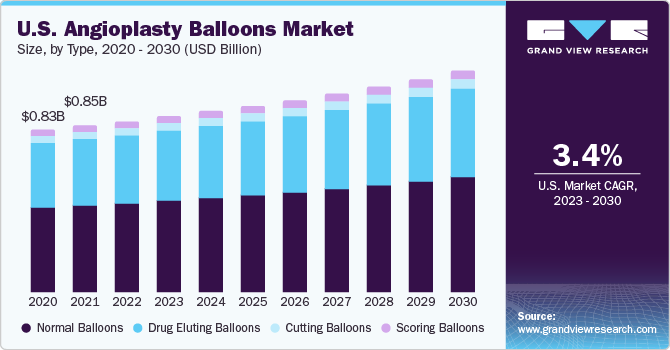

The global angioplasty balloons market size was valued at USD 2.39 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. This growth is attributed to technological advancements and rising angioplasty procedures being performed due to the minimally invasive nature of the surgery. Peripheral and coronary artery diseases are common signs of atherosclerosis and may lead to stroke, myocardial infarction, and/or cardiovascular death.

The increasing incidence of these diseases is likely to boost the market growth in the coming years. For instance, according to the World Health Organization (WHO), approximately 17.9 million deaths occurred due to cardiovascular diseases (CVDs) in 2019, equating to 32% of all global deaths. An increasing target population base across the globe is also expected to drive the market. Furthermore, developments in imaging technologies and the advent of advanced products are expected to boost the market growth during the forecast period.

The quick adoption of advanced technologies, especially in the developed regions, in angioplasty segment, such as drug-eluting and cutting balloons, is a major factor anticipated to propel the market growth over the forecast period. Moreover, the success rate of angioplasty balloons is higher than traditional angioplasty techniques, which is also likely to spur market growth.

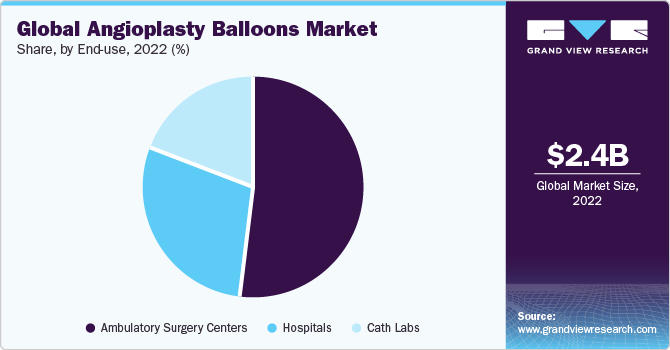

End-use Insights

The ASCs segment accounted for the largest share of 51.8% in 2022 and is also projected to advance at the highest CAGR of 4.1% through 2030, due to the huge demand for treatments in these settings. This can be attributed to the availability of advanced services and minimum hospital stay requirements. In addition, treatments performed in ASCs are cost-effective, which helps cut down on overall medical expenses. This is also contributing to the segment growth.

On the basis of end-use, the global angioplasty balloons market has been segmented into Ambulatory Surgical Centers (ASCs), hospitals, and catheterization laboratories (Cath labs). Private and public hospitals, along with cath labs, are significantly contributing to the industry’s growth. Hospitals accounted for the second-highest share of around 29.0% of the global market revenue in 2022. The segment is projected to expand further in the future as these healthcare settings provide patient care during and after the treatment.

Regional Insights

In 2022, North America accounted for the maximum revenue share of 39.6%. The local presence of key industry players, changes in U.S. FDA policies, and a growing number of percutaneous coronary interventions are the primary drivers of the region. Asia Pacific is expected to be the most lucrative regional market with a CAGR of 4.7%, on account of the growing healthcare expenditure and positive government support in the region.

In addition, increased investments by major market players in the region are estimated to augment market expansion during the forecast years. For instance, in October 2016, Cardinal Health signed an agreement with Kaneka. Through this agreement, the company acquired distribution rights to Kaneka's PTCA balloon catheters in the Middle East and Africa (MEA), Europe, Latin America (LATAM), and Asia Pacific regions.

Type Insights

The normal balloons segment led the market in 2022 with a share of 54.2% due to the low cost of these devices, supportive government regulations and submission processes for approval, and favorable reimbursement policies. Drug-Eluting Balloons (DEBs) are anticipated to show a significant demand growth. Favorable reimbursement policies led to increased sales of DEBs in 2022 and this trend is estimated to be maintained during the forecast years.

The scoring balloons segment is estimated to expand at the fastest CAGR of 5.6% over the forecast period, which can be attributed to the increasing prevalence of peripheral artery disease (PAD) and coronary artery disease (CAD), which require effective and minimally invasive treatment options. Better plaque modification, lower risk of vessel dissection and recoil, and improved stent delivery and expansion are also the key drivers.

In January 2022, Cardiovascular Systems, Inc. and OrbusNeich Medical Company Ltd. announced that the U.S. Food and Drug Administration (FDA) had provided approval to the Scoreflex NC, a focused force Percutaneous Transluminal Coronary Angioplasty (PTCA) scoring balloon consisting of a dual-wire system, which facilitates controlled plaque modification at low pressure.

The segment growth is attributed to the introduction of new products in the market, the advantages of DEBs over standard balloons, and low cost as compared to stents. Adoption of specialty products, such as scoring and cutting balloons, and R&D investments by major firms are likely to drive the demand further. Specialty balloons, such as AngioSculpt and Flextome, received marketing authorization from U.S., Europe, Japan, and other major regions. Hence, the availability of products in key markets is projected to boost their share in the coming years.

Application Insights

In 2022, the coronary segment led the market with a share of 54.1% due to the high incidence of coronary artery diseases, which are the most common type of all heart diseases. As stated by the CDC, over 370,000 deaths occur due to these diseases. On the basis of application, the market has been segmented into coronary and peripheral vascular diseases.

The peripheral vascular diseases segment is anticipated to be the fastest-growing with a CAGR of 4.5% over the forecast period, due to the rising number of approvals for novel products in recent years. Moreover, rising awareness about diseases related to peripheral arteries and the availability of advanced products are likely to drive the segment further. In February 2023, SIS Medical AG launched the OPN NC PTCA dilatation catheter in the U.S. The devices, which uses the TWIN-Wall technology, has been approved by the FDA and provides high-pressure resistance of up to 35atm.

Key Companies & Market Share Insights

Partnerships, collaborations, and product & technological developments are the major business strategies undertaken by companies. For instance, in December 2017, C.R. Bard, Inc. was acquired by BD (Becton, Dickinson, and Company), expanding BD’s product offerings globally. In November 2022, Johnson & Johnson announced a definitive agreement for the acquisition of Abiomed, a leader in heart support and recovery technologies, with an upfront payment of USD 380 per share, which equates to USD 16.6 billion. With this acquisition, Johnson & Johnson aims to develop breakthrough treatments for cardiovascular diseases and reach more patients globally.

Key Angioplasty Balloons Companies:

- Medtronic

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- Abbott

- C. R. Bard, Inc.

- Spectranetics

- Terumo Medical Corporation

- Cardinal Health

- BIOTRONIK

- Cook

- ENDOCOR GmbH

- B. Braun Melsungen AG

Angioplasty Balloons Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.47 billion

Revenue forecast in 2030

USD 3.24 billion

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Boston Scientific Corporation; Johnson & Johnson Services, Inc.; Abbott; C. R. Bard, Inc.; Spectranetics; Terumo Medical Corporation; Cardinal Health; BIOTRONIK; Cook; ENDOCOR GmbH; B. Braun Melsungen AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Angioplasty Balloons Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global angioplasty balloons market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Normal Balloons

-

Drug Eluting Balloons

-

Cutting Balloons

-

Scoring Balloons

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral

-

Coronary

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

ASCs

-

Hospitals

-

Cath Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global angioplasty balloons market size was estimated at USD 2.4 billion in 2022 and is expected to reach USD 2.5 billion in 2023.

b. The global angioplasty balloons market is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 3.2 billion by 2030.

b. The normal balloons segment led the market in 2022 with a 54.2% share due to the low cost of these devices, supportive government regulations and submission processes for approval, and favorable reimbursement policies. Drug-Eluting Balloons (DEBs) are anticipated to be the fastest-growing type segment.

b. Some of the key companies in the global market are Boston Scientific Corporation; Medtronic PLC; Spectranetics Corp.; Becton, Dickinson and Company (C. R. Bard, Inc.); Abbott Laboratories; Cook Medical, Inc.; Cardinal Health (Cordis); ENDOCOR GmbH; and Johnson & Johnson.

b. Key factors that are driving the market growth include technological advancements and rising angioplasty procedures being performed due to the minimally invasive nature of the surgery

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."