- Home

- »

- Animal Health

- »

-

Animal Biotechnology Market Size, Industry Report, 2030GVR Report cover

![Animal Biotechnology Market Size, Share & Trends Report]()

Animal Biotechnology Market Size, Share & Trends Analysis Report By Product (Diagnostics Tests, Biologics, Drugs, Reproductive & Genetic, Nutrition), By Application, By Animal Type (Livestock, Companion), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-958-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Animal Biotechnology Market Size & Trends

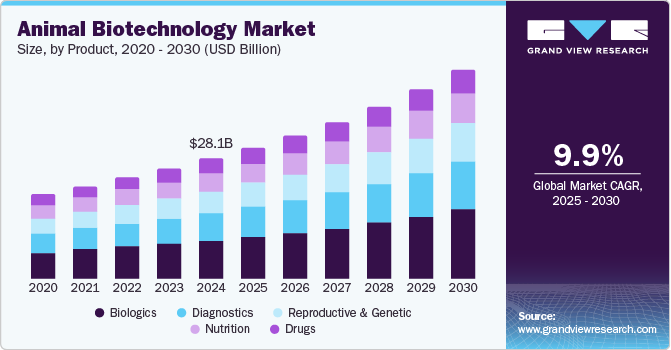

The global animal biotechnology market size was estimated at USD 28.11 billion in 2024 and is expected to grow at a CAGR of 9.89% over the forecast period to reach a market valuation of USD 49.03 billion by 2030. Key growth drivers include rising R&D initiatives, rising prevalence of different diseases in animals, increasing regulatory control, support initiatives by industry participants.

The rising incidence of diseases such as cancer in animals is fueling market growth. As per estimates by the Animal Care Foundation, nearly 6 million new cancer cases are diagnosed in dogs and cats every year. Moreover, the American Veterinary Medical Association projects that 1 in 4 dogs develop cancer at some point, and almost 50% of dogs over age 10 are at risk of developing cancer. Furthermore, in livestock animals, there has been a high increase in a variety of diseases as well as outbreaks of potentially fatal diseases.

For instance, according to a 2024 article published in Nature Journal, some parts of the African continent suffer from very high cases of Foot-and-Mouth Disease (FMD) among the cattle population. In some parts of the region, such as Ethiopia, its seroprevalence is estimated to be as high as 63%. Additionally, another part of the world, i.e., the U.S., since March 2024, has been experiencing a high number of H5N1 or Bird Flu-infected cattle; over 320 dairy herds across 14 states, according to the latest statistics from USDA & CDC. This increasing prevalence of different types of diseases highlights the need for efficient diagnostic and treatment products, driving the market.

The animal biotechnology market is experiencing significant strides in researching, testing & developing novel veterinary products using biotechnology to manage the growing onslaught of diseases in animals effectively. For instance, in August 2024, the U.S. Secretary of Agriculture, Tom Vilsack, authorized a field trial of a vaccine targeting the H5N1 avian influenza virus in cattle. This first-of-a-kind field trial aims to gauge the vaccine's effectiveness in protecting livestock from potential outbreaks. It will involve collaboration with various stakeholders to ensure comprehensive evaluation and safety.

Furthermore, in July 2024, Innocan Pharma Corporation from Israel submitted an Investigational New Animal Drug (INAD) application for its LPT-CBD product to the FDA's Center for Veterinary Medicine. LPT-CBD is a cannabidiol-based product for the management of pain in animals. The initial studies have shown positive results concerning the drug's efficacy and tolerability in dogs and other animals.

These initiatives reflect a growing emphasis on disease prevention and animal health management, which is critical in addressing livestock health challenges and enhancing productivity. The development of innovative products, such as cannabidiol-based treatments for pain management, displays the market's shift towards novel therapeutic solutions. In addition, collaboration among stakeholders fosters an environment conducive to research and development, further propelling advancements in biotechnology that meet the rising demands for food security and animal welfare.

Another crucial factor driving the market is the increasing regulatory dynamism owing to evolving regulatory guidelines. For example, in January 2024, the USFDA's Center for Veterinary Medicine released draft guidelines for establishing Good Manufacturing Practice (GMP) standards for active pharmaceutical ingredients (APIs) in veterinary products. Through these guidelines, the regulatory body aims to ensure that APIs meet specified quality standards to enhance the safety and efficacy of end products. These guidelines are aligned with the ones set by the International Council for Harmonisation (ICH) for human pharmaceuticals. This draft addresses various aspects of manufacturing, including quality management, documentation, and laboratory controls. Such initiatives reflect a commitment to improving veterinary drug quality through standardized practices, driving the market.

Product Insights

The biologics segment held the largest revenue share of over 31.56% in 2024 and is also expected to grow with the highest growth rate of more than 10% over 2025-2030. The growth of the segment is primarily attributed to the increasing burden of animal infections. These infections are naturally transmitted from animals to humans owing to contaminated food and water consumption or direct communication with infected humans or animals. Vaccination effectively lowers disease burden in animals and plays an essential role in preventive healthcare and disease control.

For instance, researchers at Yale University announced in March 2024 that they have developed a canine vaccine for treating cancer in dogs. The vaccine has shown promising results in clinical trials involving more than 300 dogs. It has successfully enhanced immune response against tumors, increasing the 12-month survival rate from 35% to 60% for certain cancers.

Furthermore, in November 2024, Washington State University commenced a program in the African continent to improve the penetration of animal vaccines. The institution has congregated about USD 35 million in funds and is funded by the US Agency for International Development. They will open a Feed the Future Veterinary Vaccine Delivery Innovation Lab to develop novel vaccines for African countries such as Kenya and Tanzania.

Application Insights

The application of animal preventive care is estimated to account for the largest market share in 2024 due to the growing adoption of companion animals. The advent of pet parents as part of the pet humanization trend is a critical revenue-generating trend for overall market growth. Besides, an international survey by HABRI and Zoetis indicates a direct relationship between the human-animal bond and consistent veterinary care. The study included participants in the U.S., France, the UK, Spain, Germany, Japan, Brazil, and China. It showed an evident global phenomenon of the improved bond between humans and pets, with 95% of respondents stating that they consider their pets a part of the family. Thus, such human-animal bond advances to better preventive care.

The product research & development application is anticipated to witness exponential growth throughout the forecast period. In recent years, there have been immense efforts across the globe to research innovative products to diagnose and treat animal health complications more effectively. Governments, animal welfare organizations, animal health companies, and others have been continuously involved in exploring novel ways to research and develop veterinary products such as biologics, medicines, diagnostic test kits, genetics, reproductive, and other verticals. For instance, in April 2024, The UC Davis Veterinary Genetics Laboratory (VGL) expanded into a new laboratory location for its research and educational programs in veterinary DNA testing and genetics. This laboratory is expected to be fully operational by 2025 and will be a crucial contributor to the veterinary research & development field.

Animal Type Insights

The livestock segment held the largest share of the market in 2024. Livestock is becoming increasingly vital in the growth of agriculture in developing nations. The contributions made by livestock to both agriculture and gross domestic product have risen in various countries. The demand for livestock products is a function of income in different parts of the world. Growing urban populations and changes in diet and lifestyle promote livestock production growth. Thus, contributes to the segment growth. Furthermore, government initiatives undertaken for livestock vaccinations encourage market growth.

The companion segment is expected to grow most over the forecast period. This can be attributed to rapidly expanding research and development efforts for companion animals such as dogs, cats, and horses. These innovative R&D products are of various types such as veterinary genetic tests & test kits, diagnostic test kits, biologics such as vaccines, monoclonal antibodies (mAbs), stem-cell therapies, and also in sectors such as animal nutrition in the form of modified diets to cater to specific health complications. In addition, these efforts are not only restricted to particular health complications, but they also range from essential nutrition to advanced complications such as cancer, orthopedic issues, and cardiovascular issues, among others.

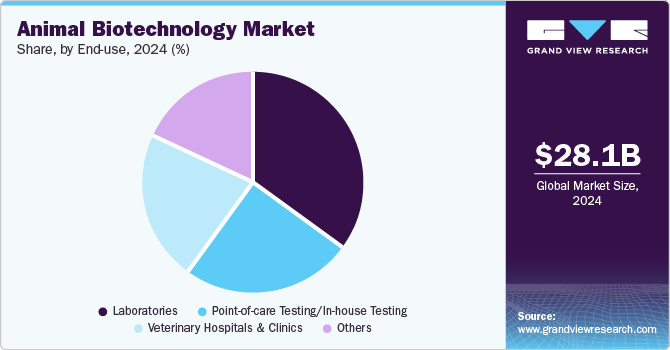

End-use Insights

The laboratories segment, which consists of both veterinary reference labs and research labs, held the largest share of over 35.24% in 2024. This can be attributed to the involvement of these diagnostic laboratories in conducting advanced research and developmental activities to enhance the diagnosis and treatment of animal ailments. Furthermore, many diagnostic kit launches for various animal diseases have been launched in the industry in recent years. These activities boost the ability to diagnose animal disease efficiently, further boosting the segment towards lucrative growth over the forecast period.

The veterinary hospitals & clinics segment is expected to grow fastest over the forecast period in this biotechnology market. The availability of a wide range of treatment and diagnostic options in veterinary hospitals and clinics is a high-impact driver for this segment. An increase in the incidence of zoonotic diseases caused by globalization and climate change is expected to drive the demand for diagnostic procedures, which is expected to drive the segment in the coming years.

Regional Insights

North America animal biotechnology market accounted for the largest revenue share of over 34% in 2024, owing to high animal awareness levels and improved healthcare infrastructure. The presence of healthcare programs and a rise in the number of initiatives to promote animal health are factors anticipated to increase the industry potential in this region.Moreover, high R&D spending in the area is expected to boost the animal biotechnology market in North America. In August 2024, Elanco Animal Health invested about USD 130 million to expand its Kansas, U.S. facility by 25,000 sq. ft and subsequently enhance its veterinary biologics manufacturing capabilities.

U.S. Animal Biotechnology Market Trends

The animal biotechnology market in the U.S. is set to exhibit lucrative rise due to efforts taken by regulatory agencies to structure veterinary research and development activities in the countries. For instance, in May 2024, the USFDA updated its regulations for heritable intentional genomic alterations (IGAs) in animals. These enhancements provide a risk-based approach to streamline the approval process for IGAs to give greater flexibility in their development and commercialization.

Europe Animal Biotechnology Market Trends

The Europe animal biotechnology market is set to witness lucrative rise due to increasing attempts by industry leaders to enhance therapeutic innovation in the veterinary sector through various activities such as partnerships & collaborations, acquisitions of competitors, etc. For instance, in January 2024, Ceva, an industry leader, acquired Scout Bio, a company focused on researching and developing biotechnology-driven pet therapies. The former has taken this step to enhance its biotechnology capabilities by integrating the former’s innovative therapies, including monoclonal antibodies and gene therapies for pets. This strategic move is designed to accelerate biotherapeutic innovations and address chronic diseases in animals.

The animal biotechnology market in UK is set to witness lucrative growth due to a similar trend to other market leaders acquiring biotechnology-driven veterinary companies to merge their industry reach and expertise with the latter's science. For instance, Dechra announced the acquisition of Invetx Inc. in July 2024. This was done to enhance Dechra's portfolio of monoclonal antibody therapeutics for companion animals and leverage Invetx's innovative drug development technologies to improve treatment options and compliance for veterinarians and pet owners.

Asia Pacific Animal Biotechnology Market Trends

The Asia Pacific animal biotechnology market is estimated to witness the fastest increase over the forecast period. Rise in middle-class households, increased disposable income, acceptance of pet animals, new product launches, and high demand for animal proteins are some of the key factors expected to boost the growth of the animal biotechnology market in the region. In July 2024, a leading Chinese veterinary company, Ringbio, launched a novel ELISA test kit to detect antibodies across multiple animal species. The main focus of this kit is to diagnose various strains of Brucella infection, a significant zoonotic disease affecting livestock and humans.

The animal biotechnology market in India is estimated to exhibit the fastest increase of 12.26% globally over the forecast period. This can be attributed to the increasing degree of innovation displayed by research institutions and forging international collaborations to enhance veterinary research. For instance, in September 2024, The National Institute of Animal Biotechnology (NIAB), Hyderabad, India, and The Pirbright Institute (UK) announced a long-standing partnership to enhance veterinary research and development in the country by creating an animal disease & zoonosis laboratory. This collaboration is a part of the multiple mutual partnerships between the countries in various sectors under the 2030 India-UK Roadmap.

Latin America Animal Biotechnology Market Trends

The Latin America animal biotechnology market is estimated to witness lucrative rise over the forecast period. This can be attributed to countries in the region forming international partnerships to enhance research & development and boost startup culture across multiple sectors, including veterinary. For instance, in July 2023, the governments of India & Argentina announced a bilateral exchange of research scientists and startups to boost R&D in multiple domains under the biotechnology and agriculture sectors.

The animal biotechnology market in Brazil is subject to lucrative increase owing to expansion efforts by industry-leading companies in the country to expand their business and enhance access to veterinary products. For instance, in July 2024, Biogenesis Bagó, the largest producer of veterinary vaccines in Latin America, announced an investment of USD 30 million to open a new veterinary vaccine production facility in Brazil. This facility will supposedly provide more than 300 employees in the Campo Largo region of Brazil and can produce more than 10 million vaccine doses annually.

MEA Animal Biotechnology Market Trends

The animal biotechnology market in MEA is estimated to witness lucrative growth over the forecast period. This can be attributed to the region's rapidly increasing degree of innovation. Startups from countries such as Israel are engaged in various R&D activities to tackle imminent threats such as rising animal and zoonotic diseases. For example, scientists at a startup from Israel, Remilk, in 2019, utilized biotechnological prowess to artificially engineer a yeast that can beta-lactoglobulin, which is the base protein in milk, eliminating the use of cows as the source of milk and milk products. Currently, the company is producing trial batches and testing methods to transform this protein into milk products such as cheese, ice cream, etc., with the help of plant oils and sugars.

This animal biotechnology market in South Africa is subject to lucrative growth owing to local organizations indulging in advanced veterinary technology research such as genetics. For instance, Afrigen Biologics partnered with Belgian biotech company BioSourcing to research and develop mAbs by utilizing the milk of transgenic goats. This innovative method will make biotherapeutics affordable in the country, diverting from import reliance to local production. Such initiatives mark a significant step towards improving veterinary healthcare in South Africa and potentially across the continent.

Key Animal Biotechnology Company Insights

Major players operating in the market are involved in various strategies such as distribution agreements, mergers & acquisitions, and expansions. Most crucially, they exhibit a very high degree of innovation in product research & development to improve their market penetration.

Key Animal Biotechnology Companies:

The following are the leading companies in the animal biotechnology market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Boehringer Ingelheim

- Merck & Co. Inc.

- Virbac

- Elanco

- Idexx Laboratories

- Dechra Pharmaceuticals

- Heska Corporation

- Indian Immunologicals Ltd

- Hester Biosciences Pvt. Ltd

- Biogénesis Bagó

View a comprehensive list of companies in the Animal Biotechnology Market

Recent Developments

-

In September 2024, Bioassay GmbH received a GMP Manufacturing License for its bioanalytical testing solutions manufacturing plant in Germany, producing veterinary products.

-

In September 2024, global animal health products leader Zoetis expanded its existing veterinary medicine and vaccine manufacturing facility in Hyderabad, India, to manufacture advanced veterinary technological tools efficiently.

-

In August 2024, Fischer Medical Ventures (India) partnered with Bio Angle Vacs Sdn Bhd (Malaysia) for the development & commercialization of innovative vaccines to address mortality rates of livestock and aquaculture in India.

-

In August 2024, Anvive Lifescience Inc. signed a USD 33 million contract with the National Institute of Allergy and Infectious Diseases (part of the National Institute of Health - NIH) for the development of a vaccine for combating Valley Fever (caused by Coccidiodes fungi) in dogs.

-

In August 2024, Akston Biosciences and Purdue University announced a strategic collaboration for drug co-development in canine oncological complications.

-

In February 2024, USFDA's Center for Veterinary Medicine (CVM) introduced the Animal and Veterinary Innovation Agenda to foster the development of novel veterinary products by addressing drug shortages, supporting emerging technologies such as gene editing, and modernizing regulatory pathways to expedite the approval of innovative therapies.

-

In January 2024, Genics, an Australian veterinary biotech company, launched Shrimp MultiPath2.0, a test kit that can detect 18 types of diseases in shrimps in a single test.

-

In January 2024, a startup from Poland, known as Bioceltix, acquired funding of EUR 2.5 million (USD 2.7 million) from European Funds for their R&D into biologics for treating canine diseases.

Animal Biotechnology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.59 billion

Revenue forecast in 2030

USD 49.03 billion

Growth rate

CAGR of 9.89% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, animal, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MiddleEast and Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Japan; India; China; Australia; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Zoetis; Boehringer Ingelheim, Merck & Co. Inc.; Virbac; Elanco; Idexx Laboratories; Dechra Pharmaceuticals; Heska Corporation; Indian Immunologicals Ltd; Hester Biosciences Pvt. Ltd; Biogénesis Bagó

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Biotechnology Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global animal biotechnology market report on the basis of product, application, animal type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Biologics

-

Drugs

-

Reproductive And Genetic

-

Nutrition

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis of Animal Diseases

-

Treatment of Animal Diseases

-

Preventive Care of Animals

-

Product Research & Development

-

Other Applications

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Livestock

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratories

-

Point-of-care testing/In-house testing

-

Veterinary Hospitals & Clinics

-

Other end use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global Animal Biotechnology market is expected to grow at a compound annual growth rate of 9.89% from 2025 to 2030 to reach USD 49.03 billion by 2030

b. The Biologics segment held the largest revenue share of over 31.56% in 2024 and is also expected to grow with the highest growth rate of more than 10% over 2025-2030. The growth of the segment is primarily attributed to the increasing burden of animal infections.

b. Some of the key players in the Animal Biotechnology market are Merck Animal Health; Ceva; Zoetis; Boehringer Ingelheim GmbH; Elanco; Indian Immunologicals Ltd.; Biogénesis Bagó; Phibro Animal Health; among others

b. Key factors that are driving the Animal Biotechnology market growth include the rising prevalence of animal diseases, a surge in the demand for animal protein, and advancements in animal health biotechnology services.

b. The global Animal Biotechnology market size was estimated at USD 28.11 billion in 2024 and is expected to reach USD 30.59 billion in 2025

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."