- Home

- »

- Animal Health

- »

-

Animal Drug Compounding Market Size & Share Report, 2030GVR Report cover

![Animal Drug Compounding Market Size, Share & Trends Report]()

Animal Drug Compounding Market Size, Share & Trends Analysis Report By Animal Type (Companion Animals, Livestock Animals), By Product, By Route of Administration, By Dosage Form, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-040-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global animal drug compounding market size is worth USD 1.3 billion in 2022 and is expected to project a CAGR of 8.19% over the forecast period. The market will grow as more pet parents become conscious of the advantages of compounded medications which is anticipated to encourage more individuals to adopt them. Furthermore, the market has witnessed opportunities as a result of the increasing demand for customized and specialized drugs for pet animals, along with the growing animal population, and longer life expectancies. Furthermore, the increase in compounding animal drug prescriptions is expected to drive market growth. According to the FDA, veterinarians in the U. S. issue 6.3 million prescriptions for animal drugs that are compounded each year.

Compounding is the practice of mixing, integrating, or modifying components to prepare a medication that meets the medical needs of an animal or a smaller group of animals. These drugs are anticipated to be essential in veterinary care, especially for diseases for which FDA-approved drugs are unavailable. Compounding drugs for animals is typically done by licensed pharmacists or vets. The wide range of species that veterinarians treat makes compounding an important part of veterinary practice.

Furthermore, a large number of vets prescribe compounded medications due to their benefits, including improved patient compliance and affordability. According to the AVMA findings, compounding drugs for animals has sharply increased over the last five years due to an increase in FDA-drug shortages and the resale of medications at prices many times the initial cost. Additionally, the use of compounded preparations is permitted when manufactured medications are ineffective, such as when a medication is unavailable in the dosage required for animals, for example, a parakeet or a cat that won't take a pill in form of medication, herein a customized dosage form works better to meet the animal need.

The COVID-19 pandemic had a negative impact on the market for animal drug compounding in 2020, just like on several other global industries. The most significant effects of COVID-19 on the veterinary healthcare system are listed as supply chain disruptions, a drop in sales, a slowdown in demand, and operational challenges brought on by shifting regulations and policies. Manufacturing firms, pharmacies, and veterinary service providers were severely impacted as many areas entered nationwide lockdowns and imposed restrictions on the movement of people and goods. For instance, according to the American veterinary medical association, in April 2020, approximately 60% of veterinary practices were canceled or delayed due to the outbreak of coronavirus and in July 2020, the number of veterinary practices declined to about 30%. Thus, the impact of COVID-19 is expected to hamper market growth.

Moreover, pet ownership has increased by double digits in several nations, and there has been a surge in the desire for animals globally. In addition, Low levels of activity were seen in the first half of the year, and after limitations were lifted, there was a catch-up in the second half. The demand for compounding pharmacies is expected to fuel by the increasing rate of drug failure and the global drug shortage after the pandemic.

Animal Type Insights

The companion animal segment dominated the global animal drug compounding market by animal type in 2022 with the largest share. Similarly, the companion animals segment is also expected to grow at the fastest rate of more than 8% in the coming years. The growing companion animal population, rising pet care expenditure, growing awareness among pet parents and veterinarians about animal drug compounding, and several benefits associated with it for pet animals, all contribute to this segment's growth.

Additionally need for customized veterinary medication to increase patient compliance is also expected to boost market growth during the forecast period. For example, a member of the AVMA compounding task force claims that medicating cats can be difficult for many owners and, occasionally for vets as well. Thus, the demand for compounding in feline medicine is fueled by the need to have medications accessible in a way that maintains the human-animal bond while increasing and ensuring patient compliance in administering it. This could necessitate compounding the medicine into a small, palatable chew, a transdermal gel, or a palatable liquid form.

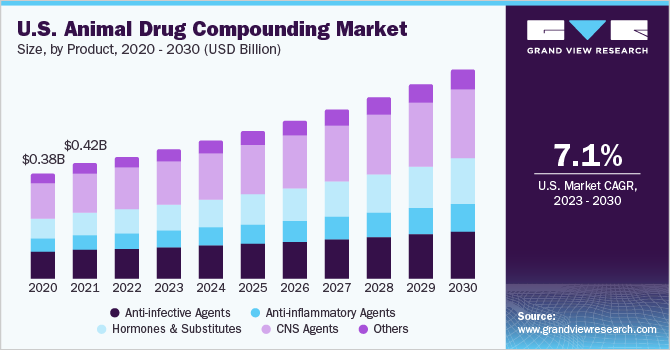

Product Insights

The CNS Agents segments dominated the global animal drug compounding market with a revenue share of more than 33% in 2022 as CNS agents are the most frequently prescribed medication for treating neurological conditions such as a change in behavior, blindness, seizures, etc. in pets. There are several categories of drugs that are used as CNS agents or psychotropic agents in veterinary medicine. Some include anticonvulsants, tranquilizers, analgesics, sedatives, antidepressants, antipsychotics, mood-stabilizing drugs, and anxiolytics among others. Companies such as Wedgewood pharmacy have enormous CNS agents compounded for specific medical needs.

Hormones & Substitutes is the fastest-growing segment with a rate of over 9% since compounded bioidentical hormones and substitutes are both better and more potent in veterinary hormonal replacement therapy. Compounded hormones are gaining traction globally among veterinary practitioners for various therapeutic use, regulating reproduction or enhancing production, and largely used for improving physiological functions. Some commonly used veterinary hormones include endogenous steroids, testosterone, synthetic steroids, synthetic non-steroidal estrogens, progesterone, and several other hormones.

Route of administration Insights

The oral segment dominated the global industry by route of administration in 2022 with a share of more than 53%. Oral formulations are the preferred, easy, and more acceptable route of drug administration. It is preferred widely due to its advantages such as non-invasiveness, patient compliance, and simplicity of medication distribution. The oral route of administration is used in both livestock and companion animals frequently, owing to their systemic effects after rapid drug absorption in the GI tract. However, oral drugs require careful formulations as they can lead to irregular absorption, slow onset of action, and other possible side effects.

Topical is the fastest-growing segment with a rate of about 9% as its gaining popularity in recent years due to its advantages in pets that cannot or refuse to take pills. This route serves as local treatment of skin, transdermal delivery of therapeutic drugs, parasite controls, and other conditions. The topical drugs include ointments, gels, creams, pastes, dusting powders, and other semisolid-based veterinary drugs. The parasite control drugs for livestock and companion animals are mostly administered in the topical route owing to their ease of usage and wide patient compliance.

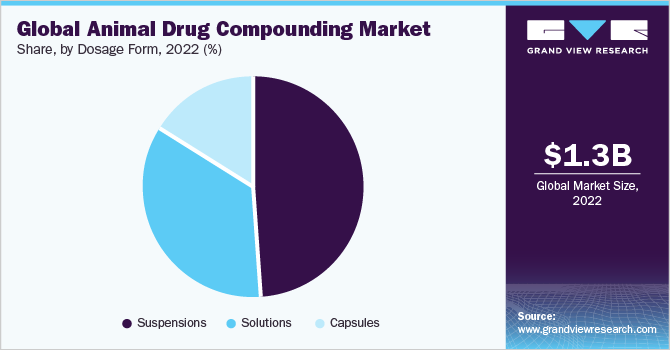

Dosage Form Insights

The suspension segments dominated the market by dosage form in 2022 with a share of about 49%. Several veterinarians formulate drug suspensions to enhance the drug’s efficacy, and shelf life as well as to increase patient compliance. When it's necessary for the material to be present in a finely divided form in the GI system or to administer insoluble or poorly soluble drugs, suspensions are known to be a useful method. Additionally, most medications taste less detectable in suspension over the solution and enable suspensions to a commonly recommended dosage form in the compounding of animal medications.

Solutions are the fastest-growing segment with a rate of over 8% during the forecast period. Compared to other dosage types, solutions have several benefits. Solutions are usually more GI mucosa-friendly than solid dosage forms as they are more quickly absorbed. In addition, unlike suspensions, phase separation during storing is not an issue with solutions. Thus, solutions are expected to gain popularity during the forecast period.

Regional Insights

North American region registered the highest market revenue share of about 40% in 2022 owing to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing product launches in the region. For instance, In November 2020, Chewy, Inc., the industry pioneer in pet e-commerce, extended its Pharmacy (Rx) division to provide compounded animal drugs that are tailored to the individual requirements of pets.

Asia Pacific is anticipated at the fastest CAGR of around 10% during the forecast period. The growth is majorly due to an increase in pet humanization, growing animal healthcare expenditure, and the availability of low-cost animal compounding medications. Similarly, growing investment by global players to expand their presence in this region, as well as an increase in demand for compounded veterinary medications, particularly for pets and non-food-producing animals in the region is expected to fuel the market growth.

Key Companies & Market Share Insights

Extensive mergers and acquisitions, expansion of product portfolio, geographic expansions, and joint research and development initiatives are among the strategies implemented by these key players. To gain a larger market share, existing players are concentrating on expanding their distribution network by acquiring smaller companies, and attempting to enter into collaborative agreements with local players, to introduce new products. For instance, in august 2022, to better serve veterinary clinics throughout Germany, Heiland GmbH, a top online ordering tool, has been acquired by Vimian Group. The acquisition represents a significant turning point in Vimian Group's strategy to digitalize its extensive service portfolio for veterinary hospitals. Some of the key players in the global animal drug compounding market include:

-

WEDGEWOOD PHARMACY

-

Vimian

-

Pharmaca.

-

Akina Animal Health

-

Triangle Compounding.

-

Davis Islands Pharmacy and Compounding Lab

-

Custom Med Compounding Pharmacy

-

Central Compounding Center South.

-

Wellness Pharmacy of Cary.

-

Miller's Pharmacy

Animal Drug Compounding Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.4 billion

Revenue forecast in 2030

USD 2.5 billion

Growth Rate

CAGR of 8.19% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, route of administration, dosage form, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

WEDGEWOOD PHARMACY; Vimian; Pharmaca; Akina Animal Health; Triangle Compounding; Davis Islands Pharmacy and Compounding Lab; Custom Med Compounding Pharmacy; Central Compounding Center South; Wellness Pharmacy of Cary; Miller's Pharmacy

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Drug Compounding Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal drug compounding market report based on animal type, product, route of administration, dosage form, and region:

-

Animal Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Others

-

-

Livestock Animals

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Anti-infective Agents

-

Anti-inflammatory Agents

-

Hormones & Substitutes

-

CNS Agents

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million; 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million; 2018 - 2030)

-

Suspensions

-

Solutions

-

Capsules

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global animal drug compounding market size was estimated at USD 1.32 billion in 2022 and is expected to reach USD 1.41 billion in 2023.

b. The global animal drug compounding market is expected to grow at a compound annual growth rate (CAGR) of 8.19% from 2023 to 2030 to reach USD 2.45 billion by 2030.

b. North American region registered the highest market revenue share of about 40% in 2022 owing to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing product launches in the region.

b. Some key players operating in the global animal drug compounding market include WEDGEWOOD PHARMACY, Vimian, Pharmaca, Akina Animal Health, Triangle Compounding, Davis Islands Pharmacy and Compounding Lab, Custom Med Compounding Pharmacy, Central Compounding Center South, Wellness Pharmacy of Cary, Miller's Pharmacy.

b. The key factors driving the market growth include a rise in pet adoption, huge animal healthcare spending, increased pet owner awareness regarding specialty pharmaceuticals, the high cost of branded veterinary products, pet humanization trends, and increased demand for custom-made, compounded animal medications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."