- Home

- »

- Pharmaceuticals

- »

-

Antacids Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Antacids Market Size, Share & Trends Report]()

Antacids Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Tablet, Liquid), By End-use (Retail Pharmacy, Hospital Pharmacy), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-693-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antacids Market Summary

The global antacids market size was estimated at USD 7.73 billion in 2024 and is projected to reach USD 9.99 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. Changing dietary habits is among the major factors expected to fuel the growth of the market during the forecast period.

Key Market Trends & Insights

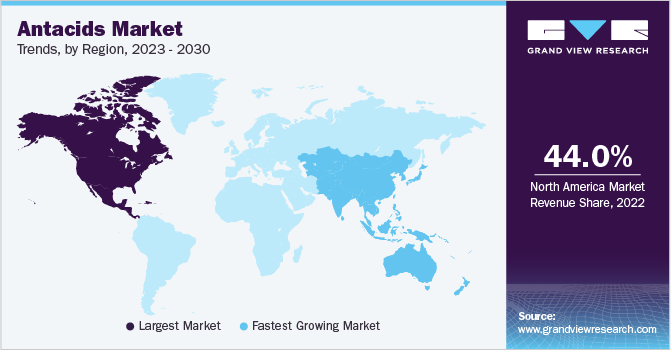

- North America is the largest market for antacids, with a revenue share of 44.0% in 2022.

- Asia Pacific is projected to register the fastest CAGR of 5.4% over the forecast period.

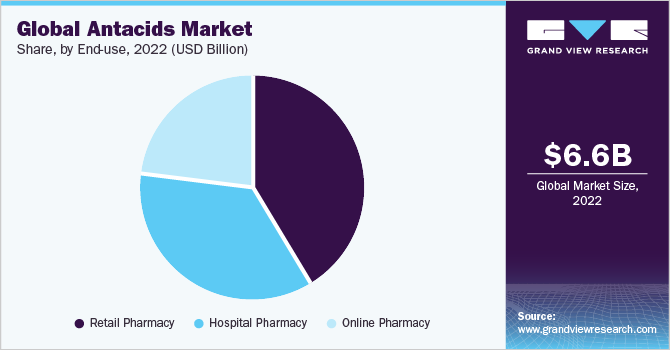

- Based on end-use, the retail pharmacy segment held the largest revenue share of 41.5% in 2022.

- Based on type, the tablets segment dominated the market in 2022.

Market Size & Forecast

- 2024 Market Size: USD 7.73 Billion

- 2030 Projected Market Size: USD 9.99 Billion

- CAGR (2025-2030): 4.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The increasing prevalence of gastroesophageal reflux disease (GERD), peptic ulcers, and various other digestive disorders, which result in acidity, digestion problems, and heartburn are also expected to drive the market. According to a study published by the National Institutes of Health (NIH) in 2022, 783.95 million people were diagnosed with GERD globally in 2019. The total number of years of life lived with disability (YLD) increased by 77.19%, whereas the total number of prevalent cases increased by 77.53%, and the total number of incident cases increased by 74.79% from 1990 to 2019.

Furthermore, increasing awareness about GERD is anticipated to boost the market growth. According to an article published in the International Foundation for Gastrointestinal Disorders, the 23rd Annual GERD Awareness Week was in November 2022, which provided information and support regarding this condition. Also, the International Foundation for Functional Gastrointestinal Disorders (IFFGD) encourages patients suffering from GERD-related symptoms, to consult their physicians.

Other factors include rising awareness and availability of over-the-counter (OTC) antacids that offer quick and effective relief from these symptoms and the growing geriatric population that is more prone to digestive issues and requires frequent use of antacids. Changing dietary habits and lifestyle factors such as stress, smoking, alcohol consumption, and obesity that contribute to the development of acid-related disorders can also affect the growth of the market.

In the geriatric population, acid complications create a unique challenge for both general practitioners and gastroenterologists. Moreover, such patients often suffer from various symptomatic disorders such as Barrett's esophagus, and esophageal cancer. For the treatment of such disorders, a combination of treatments is used and the use of antacids in such cases has increased significantly, which is expected to drive the market growth over the forecast period.

Furthermore, e-commerce is driving the demand for antacids through which online retail channels are growing rapidly owing to the convenience offered by them. Thus, the growing popularity of e-commerce and the increasing number of online healthcare providers are having a positive impact on the overall growth of the market.

One of the primary hindrances for the antacid market is the side effects associated with antacid consumption. The milk-alkali syndrome and dose-dependent rebound hyperacidity are two common antacid side effects. In addition, antacids containing aluminum hydroxide can have negative side effects such as osteomalacia, hypophosphatemia, constipation, and aluminum poisoning. The growing concerns about these side effects are anticipated to restrain the growth of this market.

Antacids were previously available only in tablets, liquids, and powders; however, researchers have now developed a mouth-melting antacid consisting of micro granules that dissolve easily in the mouth. These granules integrate the effects of the herbal ingredients contained with the latest melting technology. Mouth-melting antacids are a new trend in the market for antacids, which is expected to provide a lucrative opportunity for market growth during the forecast period. For instance, Pepmelt, an instant mouth-melting powder manufactured by Sun Pharmaceuticals Ltd., gives quick relief to the consumer.

Type Insights

Based on type, the market is segmented into tablets, liquids, and others. The tablets segment dominated the market in 2022. The presence of chewable tablets in different flavors helps in improving patient adherence to the medication, also, tablets can provide the exact amount of dosage to the patients compared to other dosage forms and they are easy to store. These factors can be attributed to the segment growth over the forecast period. Some well-known brands of chewable tablets include TUMS manufactured by the Haleon Group of Companies, Alka-Seltzer manufactured by Bayer AG, and Rolaids manufactured by Sanofi Consumer Healthcare.

The development and approval of several new tablets reduce gastric acid, which can further boost the market growth. For instance, in August 2022, the new tablet formulation approved by AstraZeneca reduced acid reflux in patients with blood cancer. The need for intervention in patients suffering from cancer is further expected to boost the market growth as the number of patients diagnosed with cancer increases annually.

The liquid segment is expected to grow at a significant CAGR over the forecast period. The presence of key players, such as Pfizer Inc., GlaxoSmithKline plc. and Dabur offering liquid antacids is estimated to boost the segment growth. Also, the liquid dosage form is one of the most favored choices for children and the elderly population due to its palatable taste. This factor is also anticipated to foster market growth.

End-use Insights

Based on end-use, the market is trifurcated into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment held the largest revenue share of 41.5% in 2022. This can be attributed to the ease of access, convenience, and the proximity of pharmacy stores. Apollo Pharmacy is India’s largest chain of pharmacies, with over 4,200 stores across the country in 2022.

Online pharmacy is anticipated to grow at the fastest CAGR of 4.8% over the forecast period owing to perks such as quick home delivery, diversity in options for goods, better pricing, and discounts. Some of the top online pharmacy companies in the U.S. include Sesame, Amazon Pharmacy, CVS, Pill Pack, Blink Health, and GeniusRx.

Regional Insights

Based on region, North America is the largest market for antacids, with a revenue share of 44.0% in 2022. This can be attributed to a well-developed and established healthcare system and infrastructure, high disposable income, and an increasing geriatric population. An increase in the number of digestive disorders is also anticipated to be a factor. For instance, according to the Centres for Disease Control and Prevention (CDC), in 2018 14.8 million adults were identified with stomach ulcers which is 5.9% of the total population of the U.S. In addition, in 2020, approximately 8.0 million people visited the emergency departments who were diagnosed primarily with digestive system diseases.

Asia Pacific is projected to register the fastest CAGR of 5.4% over the forecast period, which can be attributed to high unmet clinical needs, availability of effective treatment methods, rising disposable income, and consumer awareness about the availability of these products. Besides, the presence of key players, such as GlaxoSmithKline plc.; Pfizer Inc.; Abbott is anticipated to expand its market over the forecast period. Improving healthcare infrastructure and growing investments by market players are expected to increase its growth.

Key Companies & Market Share Insights

The market can be characterized by the presence of several multinational players and small-scale companies, competing to gain higher market share. New product launches, geographical expansion, and joint ventures are some of the key strategies undertaken by key players in the market.

In February 2022, GlaxoSmithKline plc (GSK) announced a demerger and listing of Haleon, a consumer health company, which is expected to handle multiple brands including antacids TUMS and ENO. This strategic demerger is expected to help GSK create a focused global consumer healthcare business by introducing Haleon. Haleon comprises four key strategic elements: portfolio growth penetration drive, capitalization of growth opportunities, strong implementation, financial discipline, and responsible business operation.

In addition, in June 2022, an Austin-based startup, Wonderbelly, was launched with over-the-counter (OTC) chewable antacids tablets named Wonderbelly, consisting of flavors such as strawberry milkshake, watermelon mint, and fruity cereal. The tablets are non-genetically modified (GMO), vegan, and free of talc, synthetic sweeteners, dyes, common allergens, dairy, parabens, gluten, artificial flavors, and preservatives. Some prominent players in the global antacids market include:

-

GlaxoSmithKline plc

-

Bayer AG

-

Boehringer Ingelheim International GmbH

-

Dr. Reddy’s Laboratories Ltd.

-

Sanofi

-

Reckitt Benckiser Group plc

-

Sun Pharmaceuticals Ltd.

-

Takeda Pharmaceutical Company Limited

-

Pfizer Inc.

-

Procter & Gamble

Antacids Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.07 billion

Revenue forecast in 2030

USD 9.99 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

GlaxoSmithKline plc; Bayer AG; Boehringer Ingelheim International GmbH; Dr. Reddy’s Laboratories Ltd.; Sanofi; Reckitt Benckiser Group plc; Sun Pharmaceuticals Ltd.; Takeda Pharmaceutical Company Limited; Pfizer Inc.; Procter & Gamble

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antacids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antacidsmarket report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablet

-

Liquid

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antacids market size was estimated at USD 6.6 billion in 2022 and is expected to reach USD 6.81 billion in 2023.

b. The global antacids market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 8.79 billion by 2030.

b. Asia Pacific dominated the global antacids market with a share of 22.2% in 2022. This is attributable to high unmet clinical needs, availability of effective treatment methods, rising disposable income, and consumer awareness about the availability of these products.

b. Some key players operating in the global antacids market include GlaxoSmithKline plc; Bayer AG; Boehringer Ingelheim International GmbH; Dr. Reddy’s Laboratories Ltd.; Sanofi; Reckitt Benckiser Group plc; Sun Pharmaceuticals Ltd.; Takeda Pharmaceutical Company Limited; Pfizer Inc.; and Procter & Gamble.

b. Key factors that are driving the market growth include increasing prevelance of gastroesophageal reflux diseases (GERD), growing geriatric population and increasing prevalence of heartburn

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.