- Home

- »

- Medical Devices

- »

-

Anti-Infective Agents Market Size, Industry Report, 2030GVR Report cover

![Anti-Infective Agents Market Size, Share & Trends Report]()

Anti-Infective Agents Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Antibacterial, Antiviral, Antifungal & Antiparasitic), By Route Of Administration (Oral, Parenteral), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-973-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-Infective Agents Market Size & Trends

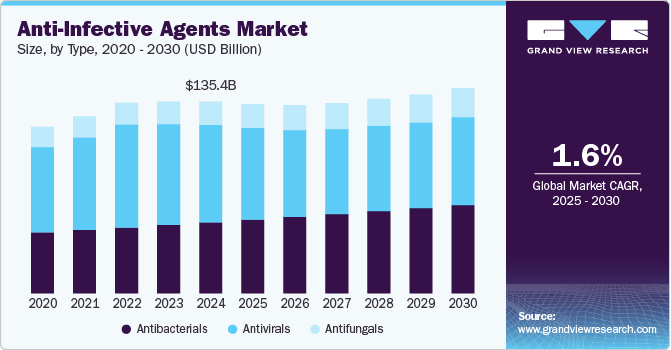

The global anti-infective agents market size was estimated at USD 135.43 billion in 2024 and is projected to grow at a CAGR of 1.61% from 2025 to 2030. The market growth can be attributed to the rising prevalence of infectious diseases, increased healthcare investments, and advancements in R&D. Factors like the emergence of drug-resistant infections, government support, and expanding pharmaceutical industries are driving the demand for innovative treatments. Moreover, the growing focus on global health initiatives further fuels market expansion.

The growing incidence of infectious diseases worldwide has led to a robust demand for effective anti-infective agents. Diseases caused by bacteria, viruses, and fungi continue to rise, fueled by factors such as global travel, urbanization, and climate change, which increase the spread of pathogens across regions. This global health challenge necessitates a proactive approach to developing anti-infective agents to combat new and re-emerging diseases. Notable examples include recent outbreaks of Ebola and Zika, reinforcing the need for quick-response treatments. The COVID-19 pandemic highlighted this urgency, underscoring the critical role of targeted antiviral therapies to contain and treat high-impact infections swiftly.

Moreover, the demand for antiviral drugs surged in response to the pandemic as the healthcare sector aimed to curb the spread and impact of the novel coronavirus. Pharmaceutical companies and research institutions mobilized rapidly, leading to significant investments in the research, development, and repurposing of existing drugs to meet the global demand. This period saw accelerated timelines for drug approvals, with regulatory agencies streamlining processes to bring treatments to market faster than before. The urgency around COVID-19 also spurred innovations in the anti-infective space, driving the development of new therapeutic approaches, including mRNA-based therapies, which could serve as blueprints for tackling future infectious diseases. This rapid mobilization increased production and sales in the anti-infective agents market, underscoring their pivotal role in global public health.

Governments and global health organizations also play a key role in driving R&D for anti-infective drugs by offering pharmaceutical companies funding, grants, and incentives. Such support allows companies to mitigate the high costs and risks associated with R&D in this space, which has traditionally been challenging due to the complexity and time required to develop new anti-infective agents. For example, several initiatives were launched during the COVID-19 pandemic to fast-track the development of antiviral treatments and vaccines, demonstrating the positive impact of targeted R&D investment.

Public awareness campaigns have gained momentum, especially in light of recent outbreaks like COVID-19, Ebola, and Zika. These efforts highlight the need for preventive measures, including regular handwashing, vaccination programs, and proper use of medications. By increasing public understanding of these practices, health organizations are reducing the risk of spreading infections and ensuring that communities are better prepared to respond to outbreaks.

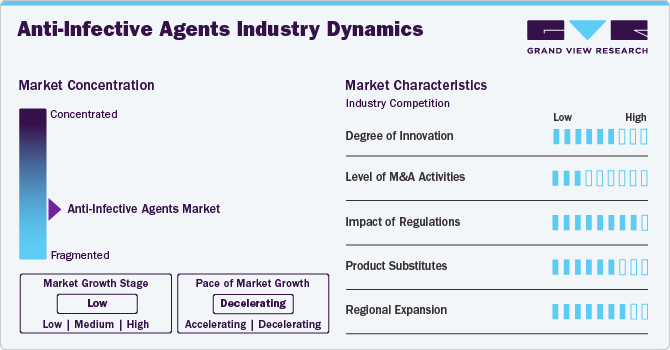

Market Concentration & Characteristics

The market growth stage is low. The market is witnessing moderate innovation, focusing on developing targeted therapies and improving drug delivery systems, particularly in combating antimicrobial resistance. Novel drug classes like bacteriophage therapies and CRISPR-based anti-infectives are gaining traction but remain in the early stages of development.

The anti-infective market has seen an uptick in mergers and acquisitions, driven by larger pharmaceutical companies acquiring biotechs with promising pipelines. These activities are particularly concentrated in segments like antibiotics and antiviral drugs to expand portfolios and address resistance challenges.

Regulatory frameworks, such as FDA's GAIN Act and similar initiatives in Europe, are incentivizing R&D in antibiotics. However, stringent approval processes and post-market surveillance requirements for anti-infectives impact the speed of new product launches.

The emergence of biologics and non-pharmaceutical alternatives, such as probiotics, vaccines, and preventive measures, poses a potential threat to traditional anti-infective agents. However, these substitutes are often complementary rather than direct replacements.

Growth opportunities in emerging markets, especially in Asia-Pacific and Africa, are driving regional expansion. These regions are experiencing increased healthcare spending, improved infrastructure, and higher disease burden, making them lucrative markets for anti-infective agents.

Type Insights

Antiviral segment dominated the market with a 50.9% share in 2024. Antiviral drugs are crucial components of the anti-infective agents market, primarily used in the treatment and prevention of viral infections such as influenza, HIV, hepatitis, and more recently, COVID-19. The global increase in viral infections, particularly the emergence of new strains and pandemics, has driven significant growth in this segment. As a result, antiviral medications are seeing increased demand and innovation across various therapeutic areas.

The antifungal segment is expected to grow at the fastest CAGR during the forecast period.The antifungal market is witnessing substantial growth, driven by increasing prevalence of fungal infections and innovations in treatment options. In recent years, several new drug approvals have provided critical advancements, with drugs such as Fosmanogepix by Amplyx Pharmaceuticals and Vivjoa (oteseconazole) by Mycovia Pharmaceuticals offering promising results for treating fungal infections. These innovations, alongside increased funding for research and development, are expected to drive market growth. Public awareness campaigns, such as the CDC’s Fungal Disease Awareness Week, are also contributing to increased diagnosis rates, which are likely to spur the adoption of antifungal treatment.

Route of Administration Insights

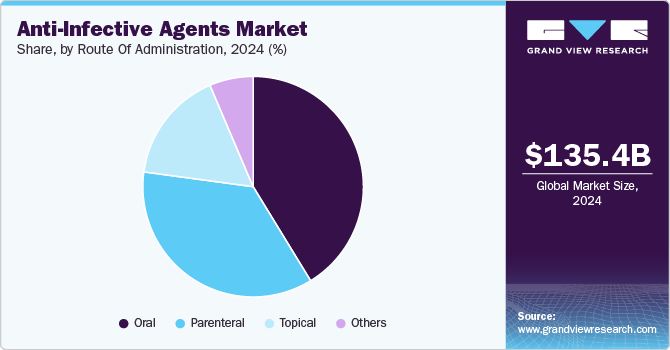

Oral segment dominated the space in 2024, driven by new product developments and a robust pipeline. Oral antifungal medications are essential for treating systemic infections, such as throat and mouth yeast infections (e.g., thrush). These medications, including fluconazole (Diflucan) and terbinafine (Lamisil), are favored for their effectiveness in severe cases, as they target fungal cells throughout the body. However, they carry a higher risk of drug interactions compared to topical treatments. For instance, oral medications such as fluconazole can be effective with a single dose, while ibrexafungerp (Brexafemme) requires a twice-daily one-day regimen to address specific fungal strains.

The parenteral segment is likely to grow at the fastest CAGR from 2025 to 2030. Intravenous anti-infectives are crucial for managing severe infections that require immediate systemic intervention, such as sepsis, meningitis, and severe bacterial and fungal infections. This route ensures 100% bioavailability, delivering the active ingredient directly into the bloodstream, critical for rapid therapeutic effects. Consequently, IV anti-infectives are extensively used in hospital settings, particularly in emergency departments and intensive care units, where quick and potent infection control can be life-saving. The growing incidence of hospital-acquired infections and the rise in invasive procedures and chronic conditions requiring hospitalizations support this market's growth.

Distribution Channel Insights

Hospital pharmacies segment dominated the market with a revenue share of 48.5% in 2024, driven by the rising number of hospitalizations globally. Hospitals offer comprehensive patient care, prompt reimbursement, and favorable insurance policies, making them a preferred choice for patients. Hospital pharmacies are typically found in large medical institutions with advanced healthcare facilities, often including specialized departments such as infectious disease or intensive care units, where patients with severe infections receive treatment.

The other segment is expected to exhibit a fastest CAGR during the forecast period. The Others segment in the distribution channel for antiparasitic drugs, particularly online pharmacies, is growing rapidly. The convenience of purchasing medications online, especially for over-the-counter antifungal treatments, drives demand in regions seeking quick access to drugs. E-commerce platforms offer a variety of antifungal products, including generics, which may not be readily available in traditional retail pharmacies. This enhances consumer choice, offering cost-effective alternatives. The ability to order medications at any time and have them delivered directly to consumers' homes is particularly beneficial for those facing mobility issues, time constraints, or living in remote areas.

Regional Insights

North America dominated the anti-infective agents market in 2024 and held the largest revenue share of 38.1%. Key drivers of regional market growth are advanced healthcare infrastructure and growing awareness among healthcare professionals and clinicians. In addition, strong government efforts to raise public health awareness, promote infection prevention, support vaccination programs, and encourage responsible antibiotic use, along with favorable reimbursement policies and high purchasing power for costly medications, are expected to further drive the market.

U.S. Anti-Infective Agents Market Trends

The anti-infective agents market in the U.S. is expected to grow over the forecast period attributed to launch of projects and initiatives focused on improving the health of women is further anticipated to drive market. For instance, in April 2024, Cleveland Clinic announced the launch of new women’s health comprehensive health and resource center, with an aim to improve and address the unique health needs of women during their midlife period.

Europe Anti-Infective Agents Market Trends

Europe anti-infective agents market was identified as a lucrative region in this industry. The market is experiencing robust growth, driven by the rising prevalence of infectious diseases and increasing concerns about antimicrobial resistance. Government support plays a critical role in this expansion, with various initiatives to enhance the development and approval processes for new antibiotics. In April 2024, Pfizer Inc. announced that the European Commission (EC) had granted marketing authorization for EMBLAVEO to treat adult patients with complicated intra-abdominal infections, hospital-acquired pneumonia, including ventilator-associated pneumonia, and complicated urinary tract infections. Regulatory agencies are streamlining the approval pathway for innovative anti-infective agents to ensure timely access to effective treatments.

The Anti-Infective Agents market in UK is growing primarily due government's proactive action plan on antimicrobial resistance (AMR). In May 2024, UK health officials announced a new five-year national action plan on antimicrobial resistance (AMR) covering the period from 2024 to 2029. This action plan replaces the previous five-year strategy (2019 to 2024), during which the UK achieved significant reductions in the use of antimicrobials in both humans and food-producing animals. The earlier plan also led to the development of enhanced surveillance systems and the pilot implementation of a subscription-style antibiotic payment scheme within the National Health Service. This plan includes initiatives to enhance public awareness, improve surveillance of resistance patterns, and encourage better prescribing practices among healthcare professionals.

The Anti-Infective Agents market in Germany is growing steadily, supported by robust government funding and strategic collaborations to combat infectious diseases. The German government has allocated significant resources to advance research in antimicrobial resistance (AMR) and accelerate the development of new anti-infective therapies. In October 2022, the German Federal Ministry of Education and Research announced an additional USD 54.53 million in funding to support the essential work of the Global Antibiotic Research & Development Partnership (GARDP) for the next five years (2023-2027). This funding from Germany will enable GARDP to develop new treatments for drug-resistant infections and ensure they are accessible to everyone in need. Through initiatives such as the German Antibiotic Resistance Strategy (DART), the government promotes responsible antibiotic use, enhanced surveillance, and funding for innovation in anti-infectives.

The Anti-Infective Agents market in France is expanding, driven by collaborations between research institutions and companies to address infectious diseases and combat antimicrobial resistance. For instance, in March 2023, Nosopharm, a biotech firm focused on discovering antibiotics from unconventional sources, was selected for the French Tech Health20 program. This recognition supports the company’s innovative approach to tackling antimicrobial resistance, bolstering research and development efforts in the anti-infective space.

Asia Pacific Anti-Infective Agents Market Trends

The Asia-Pacific anti-infective agents market is experiencing robust growth driven by increasing infectious disease prevalence and significant investments in research and development by key market players. Companies are focusing on innovation to develop novel antibiotics and antiviral agents, addressing the urgent need for effective treatments against resistant pathogens. In July 2024, Eisai Co., Ltd. announced a license agreement with Sato Pharmaceutical Co., Ltd. for the development and commercialization rights of the antifungal agent fosravuconazole in the Asia/Oceania region. As part of this agreement, Eisai grants Sato Pharma exclusive rights to the intellectual property of fosravuconazole in the specified countries and regions.

The Anti-Infective Agents market in Japan is experiencing significant growth, driven by government funding and initiatives aimed at combating antimicrobial resistance (AMR) and supporting pharmaceutical innovation. In October 2023, the Government of Japan announced an increase in funding for the Global Antibiotic Research & Development Partnership (GARDP) to bolster its crucial efforts in developing new treatments for drug-resistant infections and ensuring these treatments are accessible to those in need.

Latin America Anti-Infective Agents Market Trends

The anti-infective agents market in Latin America is experiencing significant growth due to various factors, including the rising incidence of infectious diseases, increased healthcare investments, and ongoing research and development efforts. According to the World Bank, Haiti reported the highest incidence of tuberculosis (TB) in the region in 2021, with 159 new cases per 100,000 people. Peru followed closely with 130 new cases per 100,000 people. Notably, Brazil, Peru, and Mexico collectively account for over half of all TB cases in the Americas. This alarming trend highlights the urgent need for effective anti-infective treatments. In 2020, the highest incidence rates were recorded in Haiti, Peru, and Bolivia, with rates of 168, 116, and 105 cases per 100,000 population, respectively. These statistics underscore the critical demand for innovative solutions to combat infectious diseases and improve public health across the region.

The Anti-Infective Agents market in Brazil is experiencing significant growth, bolstered by the introduction of new drugs and substantial government support for research initiatives. In July 2024, GSK plc, in collaboration with Medicines for Malaria Venture (MMV), launched tafenoquine, the first single-dose medication designed to prevent the relapse of Plasmodium vivax malaria. Co-administered with chloroquine for radical cure, this breakthrough is a crucial step in Brazil’s efforts to eliminate malaria.

MEA Anti-Infective Agents Market Trends

The anti-infective agents market in the Middle East and Africa (MEA) is witnessing substantial growth, driven by an increasing prevalence of infectious diseases and heightened awareness of their impact on public health. Conditions such as tuberculosis, malaria, HIV/AIDS, and various bacterial infections are widespread in parts of the region, underscoring the urgent need for effective treatment solutions. The Middle East and North Africa (MENA) region is one of only two areas globally where HIV cases are increasing.

The Anti-Infective Agents market in Saudi Arabia is experiencing notable growth, driven by extensive government-led health initiatives and the expansion of the pharmaceutical sector. The Ministry of Health has implemented several key programs aimed at reducing infectious diseases, with a particular focus on tuberculosis (TB). Through its National Program to Combat Tuberculosis, the Ministry successfully lowered TB incidence by 21% in 2022 compared to 2015, underscoring the positive impact of these public health interventions.

Key Anti-Infective Agents Company Insights

Some of the key players operating in the market are undertaking various strategic initiatives to gain market share, such as mergers & acquisitions, technological collaborations, partnerships, and innovative product developments & launches. Some of the key major players are Pfizer Inc.; AbbVie.; Gilead Sciences, Inc.; Bristol-Myers Squibb Company; Merck & Co., Inc.; Sandoz International GmbH; and B. Braun SE. Some of the market players are adopting strategies such as acquisitions to strengthen their presence in other regional markets.

Key Anti-infective Agents Companies:

The following are the leading companies in the anti-infective agents market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Merck & Co., Inc.

- Gilead Sciences, Inc.

- AbbVie

- Bristol-Myers Squibb

- AstraZeneca

- Sandoz International GmbH

- Bayer AG

- Xellia Pharmaceuticals

- Mankind Pharma

- B. Braun SE

- Boehringer Ingelheim

Recent Developments

-

In August 2024, Shionogi & Co. announced that its New Drug Application (NDA) for cefiderocol, a novel siderophore cephalosporin antibiotic, has been accepted for review in China by the Center for Drug Evaluation. Cefiderocol targets gram-negative bacteria, including multidrug-resistant strains, and has demonstrated superior efficacy in a Phase III trial compared to imipenem/cilastatin. It is already approved in over 10 countries, including Japan, Europe, and the U.S., and is recognized on the WHO's Essential Medicines List. Shionogi aims to enhance global access to this treatment amid rising antimicrobial resistance (AMR) concerns.

-

IIn March 2024, Sandoz opened a new antibiotic production facility in Kundl, Austria, with a USD 53.81 million (EUR 50) investment. This expansion increases capacity by 20%, enabling the production of 240 million packages annually. The facility will produce an additional one billion penicillin tablets, doubling the output of key pediatric formulations. This move strengthens Sandoz's commitment to improving global access to antibiotics and addressing shortages, reinforcing its position as a key European supplier of penicillin. The facility is part of a broader EUR 200 million investment in the site. This expansion strengthens the global supply chain for penicillin, ensuring a steady and scalable supply to meet rising demand. By enhancing production and addressing market needs, the initiative helps improve access to affordable penicillin, fostering growth in the global market.

-

In January 2024, Basilea Pharmaceutica announced its acquisition of a preclinical antibiotics program from Spexis AG. The program targets multidrug-resistant Gram-negative bacteria using novel antibiotics that disrupt lipopolysaccharide transport, a key mechanism for bacterial survival. This novel approach has shown promising bactericidal activity in both in vitro and in vivo studies against resistant strains such as E. coli and K. pneumoniae. The strategic initiative contributes to penicillin market growth by fostering innovation in antibiotic treatments targeting drug-resistant bacteria, enhancing the industry's response to urgent bacterial threats. This approach strengthens the antibiotic portfolio, creating synergies that indirectly support penicillin demand and expand treatment options in infection management.

Anti-Infective Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 133.82 billion

Revenue forecast in 2030

USD 144.96 billion

Growth rate

CAGR of 1.61% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion/Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Pfizer Inc.; Abbott.; Gilead Sciences, Inc.; Bristol-Myers Squibb Company; Sandoz; B. Braun; Xellia Pharmaceuticals; Mankind Pharma; Bayer AG; AstraZeneca; Boehringer Ingelheim International GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-Infective Agents Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Anti-Infective Agents Market report on the basis of type, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibacterials

-

Cephalosporins

-

Penicillin

-

Fluoroquinolones

-

Macrolides

-

Carbapenem

-

Others

-

-

Antivirals

-

Antifungals

-

Azoles

-

Echinocandins

-

Polyenes

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Topical

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global anti-infective agents market size was estimated at USD 135.43 billion in 2024 and is expected to reach USD 133.82 billion in 2024.

b. The global anti-infective agents market is expected to grow at a compound annual growth rate of 1.61% from 2025 to 2030 to reach USD 144.96 billion by 2030.

b. Antiviral dominated the anti-infective agents market with a share of 50.88% in 2024. This is attributable to the introduction of novel drugs and the large patient population suffering from viral infections that require long treatment procedures.

b. Some key players operating in the global anti-infective agents market include GlaxoSmithKline plc.; Pfizer Inc.; Bayer AG; Sanofi; Merck & Co., Inc.; Bristol-Myers Squibb Company; Abbott; Novartis AG; Johnson & Johnson Services Inc.; Gilead Sciences, Inc.; and Astellas Pharma Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.