- Home

- »

- Pharmaceuticals

- »

-

Anti-malarial Drugs Market Size, Share, Growth Report, 2030GVR Report cover

![Anti-malarial Drugs Market Size, Share & Trends Report]()

Anti-malarial Drugs Market Size, Share & Trends Analysis Report By Drug Class, By Malaria Type, By Mechanism Of Action, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-179-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Anti-malarial Drugs Market Size & Trends

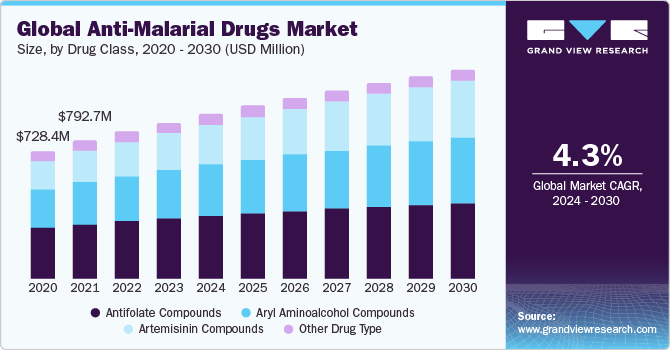

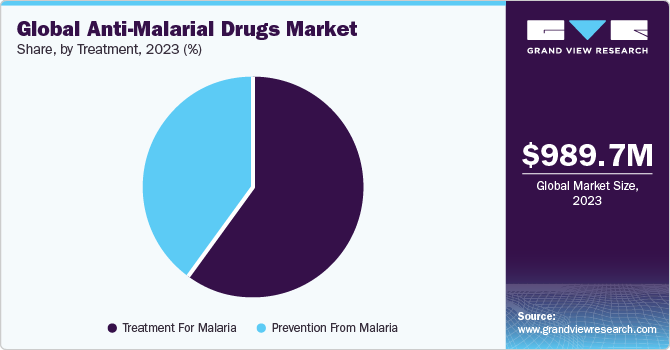

The global anti-malarial drugs market size was valued at USD 989.7 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.26% from 2024 to 2030. The anti-malarial drugs market is driven by the persistently high global burden of malaria, with millions of estimated cases and deaths reported annually. Continuous efforts to develop innovative treatments, such as new drug combinations and formulations, contribute to market growth. Regulatory approvals for novel anti-malarial drugs and expanded indications, coupled with initiatives for malaria control and elimination, further drive the market.

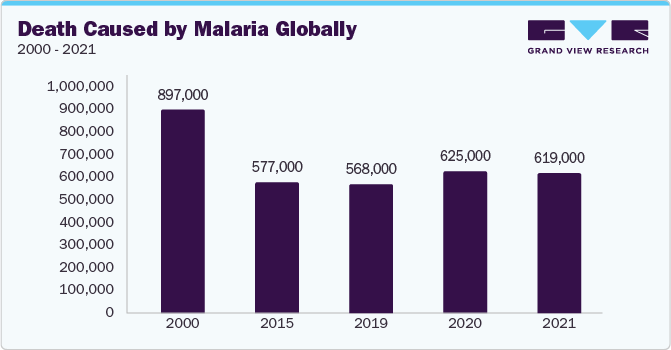

The persistent prevalence of malaria globally serves as a significant driving force for the anti-malarial drugs market. As highlighted in the World Malaria Report of 2022, the global landscape witnessed around 247 million estimated cases of malaria in 2021, with an uncertainty range of 224–276 million. Additionally, the report indicated approximately 619,000 estimated malaria-related deaths, emphasizing the urgent and ongoing demand for effective anti-malarial drugs to address this substantial health challenge on a global scale.

Furthermore, the high prevalence of malaria in the WHO African Region is a critical driver for the anti-malarial drugs market. The Region bears a significant burden, comprising 95% of global malaria cases and 96% of malaria-related deaths in 2021. The vulnerability of children under 5, representing about 80% of all malaria deaths in the Region, underscores the urgent need for effective anti-malarial drugs to combat this major public health challenge in the African context.

Drug Class Insights

On the basis of drug class insight, the anti-malarial drugs market is segmented into aryl aminoalcohol compounds, antifolate compounds, artemisinin compounds, and other drug types. The antifolate compounds segment held the largest share in 2023 due to its effectiveness in targeting the malaria parasite. Antifolate drugs, such as sulfadoxine-pyrimethamine, work by inhibiting the synthesis of folate, a crucial component for the growth and reproduction of the malaria parasite. This targeted approach disrupts the parasite's life cycle, making it a key and widely used class of drugs in malaria treatment and prevention. Additionally, the segment's dominance may be influenced by factors such as efficacy, safety, and cost-effectiveness, making Antifolate compounds a preferred choice in the fight against malaria.

Malaria Type Insights

On the basis of malaria type, the market is segmented into plasmodium falciparum, plasmodium vivax, plasmodium malaria, and plasmodium ovale. The plasmodium falciparum segment gained a maximum market share in 2023. Malaria has a severe and often fatal impact, especially in regions with high malaria transmission, such as sub-Saharan Africa. There is a focus on developing effective treatments to reduce the overall burden of this particular parasite due to plasmodium falciparum clinical importance and contribution to a significant percentage of malaria-related deaths,

Mechanism Of Action Insights

On the basis of mechanism of action insight, the market is segmented into treatment for malaria and prevention from malaria. The treatment for malaria gained a maximum market share in 2023 and is driven by the urgent need for effective interventions against malaria. This segment plays a crucial role in addressing both uncomplicated and severe cases, aiming to alleviate symptoms, clear parasites, and prevent relapses. Given the global prevalence of malaria and its impact on public health, there is a continuous demand for anti-malarial drugs to provide prompt and effective treatment, contributing to the reduction of malaria-related morbidity and mortality.

Regional Insights

North America dominated the market in 2023. However, Asia Pacific is expected to grow at the fastest CAGR for the forecast period. In May 2020, the U.S. Food and Drug Administration (FDA) approved artesunate injection as an anti-malarial drug in North America. This approval provides healthcare professionals with a vital tool for treating severe malaria cases in both adult and pediatric patients.

The availability of intravenous (IV) artesunate offers an effective and potentially life-saving intervention for severe malaria, contributing to improved patient outcomes. The FDA's endorsement emphasizes the importance of having diverse and advanced treatment options, addressing the specific needs of the North American population in the fight against malaria.

Competitive Insights

Key players operating in the market are Cadila Healthcare, Cipla Limited, GlaxoSmithKline Plc., Novartis AG, Alvizia Healthcare, Bayer AG, Lincoln Pharmaceuticals, Strides Pharma Science Limited, Glenmark Pharmaceuticals, and Alliance Pharma PLC. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In November 2022, Novartis and Medicines for Malaria Venture decided to progress to a Phase 3 clinical trial for the innovative lumefantrine/ganaplacide-SDF combination, targeting both adults and children affected by malaria.

-

In January 2021, MMV and GSK announced that the Australian Therapeutic Goods Administration (TGA) approved the submission of a Category 1 application seeking to expand the indication of Kozenis single dose (tafenoquine) to include pediatric populations. This extension aims to address the radical cure, preventing relapse, of Plasmodium vivax (P. vivax) malaria.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."