- Home

- »

- Next Generation Technologies

- »

-

Anti-money Laundering Market Size & Share Report, 2030GVR Report cover

![Anti-money Laundering Market Size, Share & Trends Report]()

Anti-money Laundering Market Size, Share & Trends Analysis Report By Component, By Product Type, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-449-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Anti-money Laundering Market Size & Trends

The global anti-money laundering market size was valued at USD 1.32 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.9% from 2023 to 2030. The growth of the Anti-money Laundering (AML) market is driven by the increasing adoption of digital payments. As more transactions are conducted online, there is a growing need to monitor and detect fraudulent transactions. AML solutions can help financial institutions identify and investigate transactions that are suspicious or outside of the normal behavior of the account holder. This can help reduce the risk of fraud and financial crime.

The increasing globalization of financial transactions is also driving the anti-money laundering market. As more companies operate across borders, tracking and monitoring financial transactions becomes more difficult. Moreover, the increasing use of digital currencies has created new challenges for AML compliance. Digital currencies are decentralized and difficult to trace, which makes it easier for cybercriminals to launder money using these currencies. AML solutions are being developed to help financial institutions monitor digital currency transactions and detect suspicious activity.

The increasing regulatory pressure is another driver of the anti-money laundering market. Governments worldwide are implementing stricter AML regulations, and financial institutions are under increasing pressure to comply with these regulations. AML solutions can help financial institutions meet their compliance obligations and avoid penalties for non-compliance. Moreover, the growing awareness of the impact of financial crime on society is also driving the AML market. Financial crime can have significant social and economic consequences, including funding terrorism, drug trafficking, and other illegal activities. AML solutions can help prevent financial crime and contribute to a safer and more stable society.

Using Artificial Intelligence (AI) and machine learning in AML solutions has revolutionized how financial institutions detect and prevent financial crime. These technologies can analyze vast amounts of data at a speed that is not achievable with traditional methods. Machine learning algorithms can learn from past data to identify patterns and predict suspicious activity. They can also adapt to new and evolving threats, making them a valuable tool for detecting emerging financial crime trends. The use of AI and machine learning is not limited to transaction monitoring. These technologies can also help financial institutions with enhanced customer due diligence processes; thereby propelling the market growth.

One major restraint of the anti-money laundering market is the cost of implementing and maintaining AML solutions. Many financial institutions, particularly smaller ones, may find it difficult to justify the cost of implementing anti-money laundering solutions, especially if they have not experienced any significant money laundering incidents. To overcome this restraint, financial institutions can consider implementing a risk-based approach to AML compliance, where they assess the risk of money laundering in their organization and allocate their resources accordingly. This approach can help institutions focus their anti-money laundering efforts on higher-risk areas, thereby minimizing the cost of compliance.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the anti-money laundering market. Financial institutions have had to adapt quickly to new challenges posed by the pandemic, including the potential for increased financial crime. As a result, there has been a greater emphasis on the importance of AML solutions and the need for more effective and efficient monitoring and detection of suspicious activity. The pandemic has also led to increased collaboration and information-sharing among financial institutions and regulatory authorities, which can help to improve the effectiveness of anti-money laundering efforts.

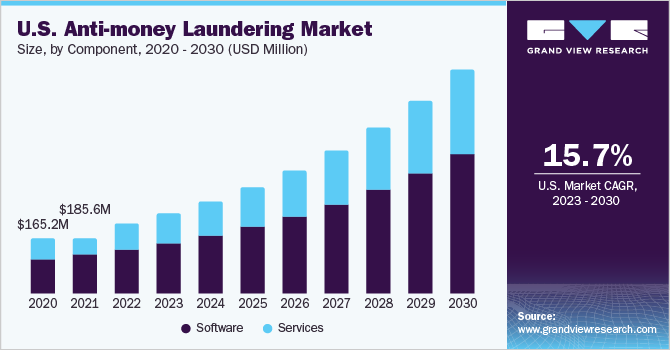

Component Insights

The software segment dominated the market in 2022 and accounted for a revenue share of more than 63.0%. AML software can help financial institutions detect, investigate, and report suspicious transactions by using advanced algorithms and machine learning techniques to analyze large volumes of data. The integration of anti-money laundering software with financial systems and tools, such as payment systems and risk management solutions, further boosted the demand for the software segment. These solutions can also help institutions comply with regulatory requirements and reduce the risk of financial penalties and reputational damage. In addition, the rising use of artificial intelligence and big data analytics in AML software is expected to drive the segment's growth over the projected years.

The services segment is anticipated to register significant growth over the forecast period. One of the primary drivers of the services segment is the increasing complexity of regulatory requirements and the need for specialized expertise to implement AML solutions effectively. Outsourcing anti-money laundering services to third-party providers can help financial institutions reduce costs and improve efficiency by leveraging the provider's expertise and technology infrastructure. The emergence of new technologies and changing regulatory requirements have also led to a growing demand for consulting and training services to help financial institutions stay current with the latest developments in the AML landscape. As a result, the services segment is expected to grow at an emerging rate over the projected period.

Product Type Insights

The transaction monitoring segment dominated the market in 2022 and accounted for a revenue share of more than 35.0%. Transaction monitoring is a crucial component of AML compliance programs, allowing financial institutions to monitor and analyze all transactions in real time. Transaction monitoring software can flag suspicious transactions based on predetermined risk indicators, such as unusual transaction amounts or patterns. This product type is essential for detecting and preventing money laundering, terrorist financing, and other financial crimes that can pose a risk to the financial system, further driving their adoption in the anti-money laundering market.

The customer identity management segment is anticipated to register significant growth over the projected period. Customer identity management solutions can help institutions to streamline and automate the KYC process, reduce manual errors, and enhance the overall customer experience. Moreover, these solutions can also enable financial institutions to conduct ongoing customer monitoring and screening against global watchlists to identify high-risk customers and potential money laundering activities. Financial institutions seek to improve their compliance processes and mitigate the risks associated with money laundering; propelling segment growth.

Deployment Insights

The on-premise segment dominated the AML market in 2022 and accounted for a revenue share of over 54.0%. On-premise solutions are deployed locally on a company's own servers, which provide greater control and customization options. This has made on-premise solutions popular among larger financial institutions with significant resources to manage and maintain their IT infrastructure. In addition, on-premise deployment has been favored in regions where internet connectivity and cloud infrastructure may not be as robust.

The cloud segment is anticipated to register significant growth. Cloud-based AML solutions offer cost-effectiveness, as they eliminate the need for on-premise hardware and IT infrastructure, reducing the overall cost of ownership. Moreover, cloud-based solutions offer scalability and flexibility, enabling financial institutions to quickly and easily add or remove users and features as needed. This is particularly important for smaller institutions that may not have the resources to maintain their own on-premise AML systems. In addition, cloud-based solutions offer improved accessibility, as authorized users can access the system from anywhere with an internet connection, increasing efficiency and reducing delays.

Enterprise Size Insights

The large enterprises segment dominated the anti-money laundering market in 2022 and accounted for a global revenue share of over 68.0%. Large enterprises deal with large volumes of financial transactions, making it challenging to detect suspicious activity manually. AML solutions can help these enterprises monitor their transactions in real-time and detect potential money laundering activities. In addition, large enterprises have the resources to invest in advanced AML technologies and compliance programs, making them more likely to adopt AML solutions. The high regulatory burden and potential legal consequences for non-compliance also make AML solutions critical for large enterprises to mitigate their risks and protect their reputation.

The small and medium enterprises segment is anticipated to register significant growth. The growth can be attributed to the increasing regulatory scrutiny on small and medium enterprises to comply with anti-money laundering regulations, as well as the rising need for affordable and scalable AML solutions for smaller businesses. Small and medium enterprises are also increasingly adopting cloud-based AML solutions, as they offer lower upfront costs and require less IT infrastructure than on-premise solutions. In addition, the growing adoption of digital channels for financial transactions by small and medium enterprises is also driving the demand for AML solutions that can monitor and detect suspicious activity in these channels.

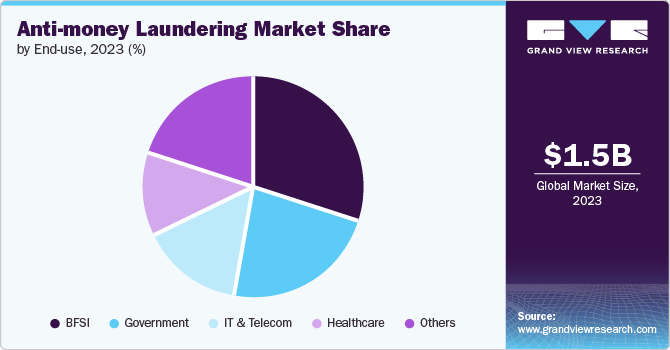

End-use Insights

The BFSI segment dominated the market in 2022 and accounted for a global revenue share of above 30.0%. The use of anti-money laundering solutions in the BFSI sector is driven by the increasing adoption of digital banking services, making it easier for cybercriminals to launder money and transfer funds across borders. The BFSI sector is also characterized by high volumes of transactions and complex operations, making it difficult for institutions to monitor transactions manually. Therefore, AML solutions are becoming increasingly crucial for the BFSI sector to manage risks and ensure compliance with AML regulations.

Governments are implementing stringent regulations to prevent financial crimes and protect their economies. As part of this effort, they are deploying AML solutions to monitor financial transactions, identify suspicious activity, and investigate potential cases of financial crimes. In addition, governments are increasingly collaborating with financial institutions and other organizations to share information and coordinate efforts in the fight against financial crimes.

Regional Insights

North America dominated the anti-money laundering market in 2022 and accounted for a revenue share of more than 29.0%. The North America region has dominated the anti-money laundering market due to the presence of a large number of financial institutions and strict regulations to combat money laundering and terrorist financing in the region. The U.S. government has been actively enforcing AML regulations and imposing hefty penalties on financial institutions that fail to comply with these regulations, which includes The Bank Secrecy Act and The Patriot Act. This has resulted in increased spending on AML solutions by financial institutions in the region.

The Europe regional market is anticipated to emerge as the fastest-growing market from 2023 to 2030. Europe is emerging as a rapidly growing region in the anti-money laundering market due to financial institutions' increasing adoption of AML solutions, particularly in the UK, Germany, and France. The institutions aim to strengthen the fight against money laundering and terrorist financing in the region, increasing demand for AML solutions among financial institutions. In addition, the region is witnessing a surge in digitalization, which has led to a rise in online transactions and financial crimes. This has further fueled the demand for AML solutions in the region.

Key Companies & Market Share Insights

The key players in the anti-money laundering market continuously focus on developing and launching innovative solutions to cater to the growing demand for AML solutions. They are investing heavily in research and development activities to improve their product offerings and stay ahead of their competitors. These companies are also expanding their global presence through strategic partnerships, collaborations, and acquisitions. Moreover, key market players are also focused on expanding their product portfolios to address the growing demand for AML solutions across various end-use industries.

In addition, market players are also investing in advanced technologies such as artificial intelligence and machine learning to improve the efficiency and effectiveness of their AML solutions. For instance, in March 2023, CSI, a regtech and fintech solutions provider, has teamed up with Hawk AI, a global provider of fraud prevention and anti-money laundering technology for payment companies and banks, to offer WatchDOG AML and WatchDOG Fraud. These products use artificial intelligence and machine learning to provide automated oversight, which can detect and report suspicious or fraudulent activities in real-time through a multilayered approach. Some of the prominent players in the anti-money laundering market include:

-

NICE Actimize

-

Tata Consultancy Services Limited

-

Cognizant Technology Solutions Corporation

-

ACI Worldwide, Inc.

-

SAS Institute, Inc.

-

Fiserv, Inc.

-

Oracle Corporation

-

BAE Systems

-

Accenture

-

Open Text Corporation

-

Experain Information Solutions, Inc.

Anti-money Laundering Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.51 billion

Revenue forecast in 2030

USD 4.24 billion

Growth rate

CAGR of 15.9% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, product type, deployment, enterprises size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; and South Africa

Key companies profiled

NICE Actimize; Tata Consultancy Services Limited; Cognizant Technology Solutions Corporation; ACI Worldwide, Inc.; SAS Institute, Inc.; Fiserv, Inc.; Oracle Corporation; BAE Systems; Accenture; Open Text Corporation; Experian Information Solutions, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-money Laundering Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global anti-money laundering market report based on component, product type, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Compliance Management

-

Currency Transaction Reporting

-

Customer Identity Management

-

Transaction Monitoring

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-money laundering market size was estimated at USD 1.32 billion in 2022 and is expected to reach USD 1.51 billion in 2023.

b. The global anti-money laundering market is expected to grow at a compound annual growth rate of 15.9% from 2023 to 2030 to reach USD 4.24 billion by 2030.

b. North America dominated the anti-money laundering market with a share of 29.24% in 2022. This is attributable to increased illegal activities that facilitate the use of cash for drugs, human smuggling/trafficking, and corruption in the U.S.

b. Some key players operating in the anti-money laundering market include NICE Actimize; Tata Consultancy Services Limited; Cognizant Technology Solutions Corporation; ACI Worldwide, Inc.; SAS Institute, Inc.; Fiserv, Inc.; Oracle Corporation; BAE Systems; Accenture; Open Text Corporation; and Experian Information Solutions, Inc.

b. Key factors that are driving the anti-money laundering market growth include a growing volume of non-cash transactions, stringent government compliance, and growth of advanced analytics to identify threat patterns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."