- Home

- »

- Pharmaceuticals

- »

-

Antibody Fragments Market Size Worth $11.36 Billion By 2030GVR Report cover

![Antibody Fragments Market Size, Share & Trends Report]()

Antibody Fragments Market Size, Share & Trends Analysis Report By Specificity (Monoclonal Antibodies, Polyclonal Antibodies), By Type, By Therapy, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-973-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

The global antibody fragments market size was valued at USD 7.14 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030. Fragment antibodies are a promising tool in diagnostic and imaging as they are capable of identifying cellular proteins with high specificity and affinity. They can be easily linked to radioisotopes, fluorescent enzymes, or molecules that could tag specific biomarkers to the patients. Moreover, they have produced easier steps compared to complex antibodies, making them possibly faster to produce high yields.

The COVID-19 pandemic positively impacted market growth. For instance, in September 2020, a study published by researchers from Karolinska Institutet in Sweden suggested that antibody fragments type could neutralize SARS-CoV-2. They have also suggested that antibody fragments could be cheaply produced, making them a promising candidate to prevent COVID-19 infection. Similarly, in February 2022, a research article stated that human inhalable antibody fragments have potential application to neutralize SARS-CoV-2 variants for COVID-19 therapy.

Furthermore, the utilization of antibody-based therapeutics has shown to be a promising tool for clinical purposes in patients with cancer. For instance, multiple instances have shown the effectiveness of antibody-drug conjugates in the treatment of lymphomas and solid tumors. However, one of the key factors limiting the effectiveness of antibody-targeted cancer therapies could be the partial penetration of the antibody-drug conjugate in the tumor. The introduction of advanced recombinant DNA technology has revolutionized pharmaceuticals for diagnosis and therapeutics. The minimal antigen-binding fragments, including single variable domain (sVD), fragment antigen binding (Fab), and Fragment variable (Fv), have emerged as a probable alternative to monoclonal antibodies in several applications. These factors would further drive the market in the coming years.

Specificity Insights

The monoclonal antibodies segment captured the largest revenue share of over 95.0% in 2021. Monoclonal antibodies (mAbs) are considered a significant class of therapeutic agents recommended in the therapy of several forms of malignancies. However, the applications of conventional mAbs may also encounter various limitations in anticancer immunotherapies such as adverse effects and insufficient efficacy. The application of antibody fragments for cancer therapy has gained wider recognition than any other therapeutic application.

However, its application to develop pharmacological tools for the treatment of autoimmune diseases and infectious diseases has been increasing expeditiously. For instance, in March 2019, researchers from the University of Utah Health started their research on disabling the specific immune cell sets that cause stress in inflammatory diseases, while maintaining the integrity of healthy immune cells to allow them to carry out their tasks.

Polyclonal antibodies (pAbs) have high specificity and flexibility and are much better than monoclonal antibodies for clinical applications. pAbs are secreted by different B-cell clones, therefore its heterogenous nature allows them to bind with several epitopes of an antigen. As the antibodies are mostly used as reagents, most of the manufacturers produce pAbs. However, since pAbs antibody reagents are inconsistent in nature, researchers have had difficulty using them since it interferes with their research studies. These are some of the factors that might limit the use of polyclonal antibodies, hence hindering the expansion of the market as a whole.

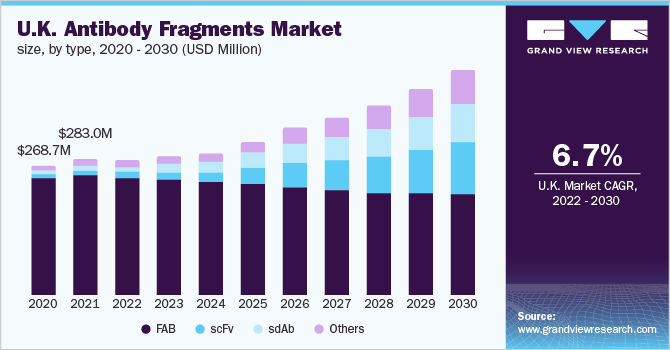

Type Insights

The FAB segment captured the largest revenue share of over 85.0% in 2021 as it is the first generation of antibody fragments. The increasing prevalence of cancer, infectious diseases, and autoimmune diseases has created a high demand for F(ab) fragments, thus fueling segment growth. Also, the approval and launch of novel therapies to facilitate the treatment of life-threatening diseases are expected to support segment growth. However, the market share is anticipated to decline over time with the introduction of the second and third-generation molecules of antibody fragments since the quality of molecules is increasing.

Single chain variable fragments (scFvs) are anticipated to register the fastest growth rate over the forecast period. They provide several advantages such as heterologous production, multivalency, low molecular weight, and multimeric form over the mAb. It is used for various medical applications, including bioimaging and targeted therapy. The scFv phage display antibody technology has become one of the most popular methods for developing recombinant antibodies. These factors are contributing to segment growth.

Therapy Insights

The monoclonal antibodies segment led the market and held a revenue share of over 95.0% in 2021. The Ranibizumab (Lucentis) segment captured the largest revenue share in 2021. Ranibizumab is a monoclonal antibody fragment that is produced in E.coli cells by recombinant DNA technology. In the pharmaceutical sector, it is present in the form of injection wherein it is used for the treatment of visual impairment due to diabetic macular edema, neovascular (wet) age-related macular degeneration (AMD), proliferative diabetic retinopathy (PDR), and others. Several academies and companies are working to understand the challenges and seek opportunities that could influence Ranibizumab R&D.

Beovu (brolucizumab-dbll) is anticipated to witness the fastest growth over the forecast period. It is a monoclonal single-chain Fv antibody fragment used for ophthalmic intravitreal injection. Moreover, in June 2022, the FDA approved Beovu (brolucizumab-dbl) to be used for the treatment of patients suffering from diabetic macular edema (DME). Advancements in this segment are anticipated to drive the market in the coming years.

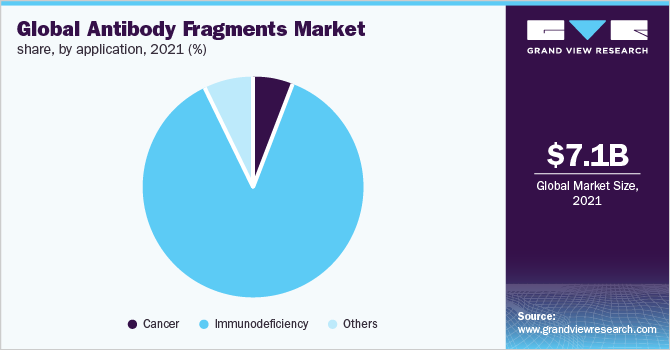

Application Insights

The immunodeficiency segment held the largest revenue share of over 85.0% in 2021 owing to the increasing prevalence of the disease globally. According to the National Organization for Rare Disorders (NORD), this disease affects around 200,000 Americans. Furthermore, increasing partnerships and collaborations for the development of novel therapies for immunocompromised patients are anticipated to support segment growth. For instance, in January 2020, Adaptimmune Therapeutics plc, a clinical-stage biopharmaceutical company, entered into a partnership agreement with Astellas Pharma Inc., a Japanese pharmaceutical company, to develop and commercialize TCR T cell therapies and stem-cell-derived allogeneic chimeric antigen receptor (CAR)-T to treat a huge patient population suffering from immunodeficiency induced from several forms of cancers, including solid tumors.

The cancer segment is expected to witness the fastest growth during the forecast period. The high prevalence of cancer globally is one of the major factors contributing to the growth of the market over the forecast period. The American Cancer Society estimated that in 2022, around 1.9 million new cases of cancer are to be reported in the U.S., and around 609,360 deaths are to be witnessed due to cancer. According to a report published by the International Agency for Research on Cancer, around 1 in 6 women and 1 in 5 men can develop cancer during their lifetime. Thus, such a high incidence of cancer is anticipated to boost the adoption of novel and efficient cancer diagnostic and therapeutic methods.

The others segment including chronic diseases such as age-related macular degeneration (AMD) and infectious diseases such as HIV/AIDS and influenza is anticipated to witness significant growth in the coming years. Moreover, key market players are engaged in developing antibody fragments for eye disorders that are in preclinical and clinical development stages. For instance, Lampalizumab, a Fab developed by Roche for geographic atrophy, is an advanced form of age-related macular degeneration (AMD).

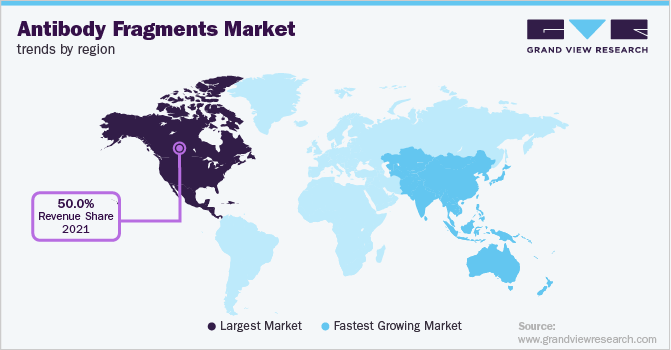

Regional Insights

North America dominated the market in 2021 with a revenue share of over 50.0% owing to the expansion of the regional pharmaceutical industries leading to the rising demand for antibody fragments. Moreover, the increasing prevalence of immunodeficiency diseases and cancer has led to the increasing demand for antibody fragments for research purposes.

Asia Pacific is anticipated to witness significant growth over the forecast period owing to the developing medical tourism market. India and China are anticipated to dominate the market owing to the growing focus on the biologics manufacturing sector. For instance, in May 2020, The Centre for Cellular and Molecular Biology and the University of Hyderabad entered into a collaboration with Vins Bioproducts Ltd. to develop immunotherapy based on antibody fragments that provide immediate treatment for COVID-19.

Key Companies & Market Share Insights

The leading market players are utilizing several strategies such as R&D investments, the adoption of cutting-edge methodologies, the introduction of new technologies, mergers, and acquisitions, and regional expansions to increase the revenue share. For instance, in March 2021, Amgen Inc. announced the acquisition of Five Prime Therapeutics, a clinical-stage biotechnology company, and its lead candidate, bemarituzumab, for gastric cancer, for USD 1.9 billion to expand the scope of targeted cancer therapies and immuno-oncology. Moreover, in March 2021, Amgen Inc. announced the acquisition of Rodeo Therapeutics, a privately held biopharmaceutical company, for USD 720 million to develop small-molecule therapies for the regeneration and repair of multiple tissues. Some prominent players in the global antibody fragments market include:

-

Pfizer Inc.

-

Albynx

-

Novartis AG

-

Genentech, Inc.

-

AbbVie Inc.

-

Bristol-Myers Squibb Company

-

Johnson & Johnson Private Limited

-

Lilly

Antibody Fragments Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 7.19 billion

Revenue forecast in 2030

USD 11.36 billion

Growth rate

CAGR of 5.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specificity, type, therapy, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Singapore, Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Pfizer Inc.; Ablynx; Novartis AG; Genentech, Inc.; AbbVie Inc.; Bristol-Myers Squibb Company; Johnson & Johnson Private Limited; Lilly

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

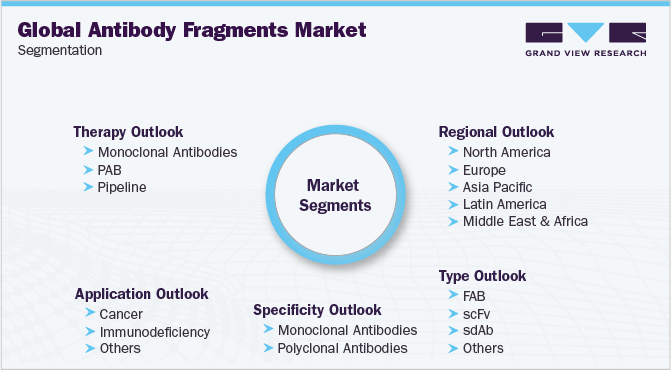

Global Antibody Fragments Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antibody fragments market report based on specificity, type, therapy, application, and region:

-

Specificity Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

FAB

-

scFv

-

sdAb

-

Others

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies

-

Praxbind (idarucizumab)

-

Ranibizumab (Lucentis)

-

Certolizumab pegol (Cimzia)

-

Iodine (1311) Metuximab/ Licartin

-

Beovu (brolucizumab-dbll)

-

Cablivi (caplacizumab-yhdp)

-

Blinatumomab/

-

-

PAB

-

CroFab

-

Anavip

-

Anascorp

-

Botulism Antitoxin Heptavalent (HBAT)

-

Digibind

-

DigiFab

-

-

Pipeline

-

AFM13

-

HPN-424

-

MGD007

-

Tebotelimab (MGD013)

-

Bentracimab (PB2452)

-

Flotetuzumab (MGD006)

-

AK104

-

Ozoralizumab

-

Sonelokimab (ALX0761)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Immunodeficiency

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global antibody fragments market size was estimated at USD 7.14 billion in 2021 and is expected to reach USD 7.19 billion in 2022.

b. The global antibody fragments market is expected to grow at a compound annual growth rate of 5.9% from 2021 to 2030 to reach USD 11.36 billion by 2030.

b. North America dominated the antibody fragments market with a share of 52.2% in 2021. This is attributable to the high adoption of novel therapies, increasing research and development investments, and favorable reimbursement scenario.

b. Some key players operating in the antibody fragments market include Boehringer Ingelheim Pharmaceuticals, Novartis International AG, F. Hoffmann-La Roche AG, Sanofi S.A., UCB, Amgen Inc., Chengdu Huasun Technology Group Inc., Affimed Therapeutics, Harpoon Therapeutics, Inc., MacroGenics, Inc., AstraZeneca plc, Akeso, Inc., Taisho Pharmaceutical Co., Ltd., Pfizer Inc.

b. Key factors that are driving the market growth include increasing prevalence of infectious and chronic diseases, antibody fragments are preference over other alternatives, increasing public-private investments for pharma and biotech research.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."