Anticoccidial Drugs Market Size & Trends

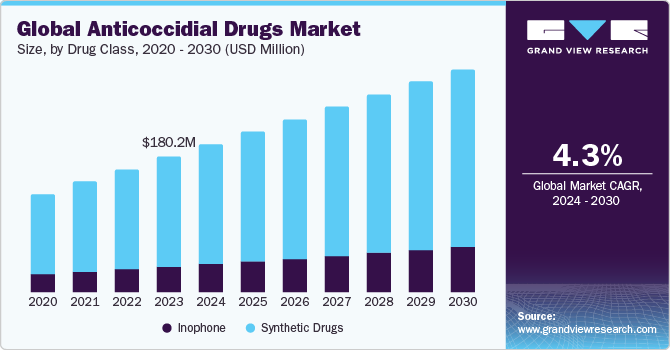

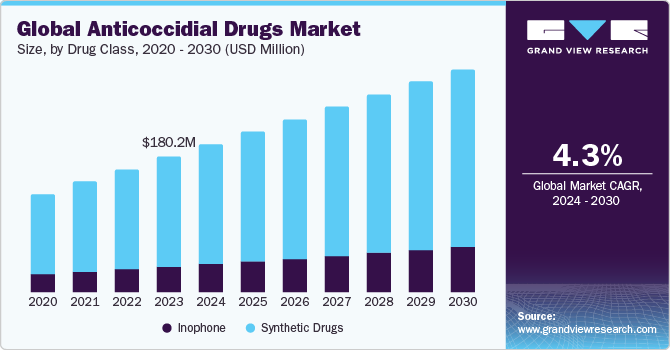

The global anticoccidial drugs market size was valued at USD 180.25 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. Growing poultry and livestock production, consumer awareness, and investment from government & non government organizations majorly drive the market.The substantial prevalence of coccidiosis in animals worldwide is anticipated to drive market growth. Coccidiosis stands as a major gastrointestinal issue within the poultry sector, with some of the most devastating outbreaks attributed to Eimeria tenella occurring during the initial phases of intensive chicken farming. Eimeria tenella, a type of coccidia, is responsible for causing severe hemorrhages and hypovolemic shock, both of which can prove fatal for infected birds.

The COVID-19 pandemic significantly impacted the veterinary eye care market. The COVID-19 pandemic initially disrupted global supply chains, affecting the production and distribution of various pharmaceutical products, including anticoccidial drugs. This disruption could have led to shortages and price fluctuations in the market. However, the pandemic heightened awareness of the importance of food safety and security, which could have contributed to increased demand for animal health products, including anticoccidial drugs. Consumers and producers became more focused on maintaining the health and well-being of livestock to ensure a stable food supply.

Additionally, Eimeria represents a genus of apicomplexan parasites, encompassing various species that can lead to coccidiosis in animals, including cattle, poultry, cats, dogs, and smaller ruminants such as goats and sheep. As per a research publication authored by Anthony Andrew in August 2022, nearly 20 or more Eimeria species have been identified in cattle feces worldwide. The article highlights that clinical infections typically commence at the age of 1-2 months, as coccidiosis rarely presents itself within the initial three weeks of life. Consequently, there is a heightened demand for anticoccidial drugs among these specific age groups of animals, which is expected to drive market growth during the analysis period.

Drug Class Insights

Based on the drug class, the anticoccidial drugs market is segmented into ionophore and

synthetic drugs. The synthetic drugs segment held the largest market share in 2023. Synthetic drugs are often designed to be highly effective in controlling coccidiosis, which is a common parasitic disease in poultry and livestock. These drugs are engineered to target specific coccidia species and offer rapid and reliable results in preventing and treating the disease.The growing utilization of synthetic medications for disease control and prevention, coupled with a rise in the incidence of coccidiosis-related illnesses drives the segment growth.

Drug Action Insights

On the basis of drug action, the market is segmented into coccidiocidal and coccidiostatic. Coccidiostatic dominated the drug action segment in 2023. The growing inclination toward anticoccidiosis drugs for treating the disease has also played a pivotal role in driving market growth. Moreover, the upsurge in the acceptance of coccidiostatic-mode drugs and an increase in research and development initiatives aimed at creating coccidiostatic medications have contributed to market expansion. Furthermore, pharmaceutical companies continually invest in research and development to manage and mitigate resistance to coccidiostatic drugs. This ensures that these drugs remain effective and continue to be the preferred choice for coccidiosis control.

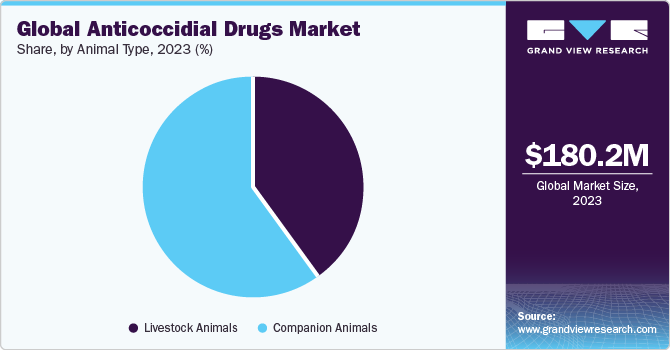

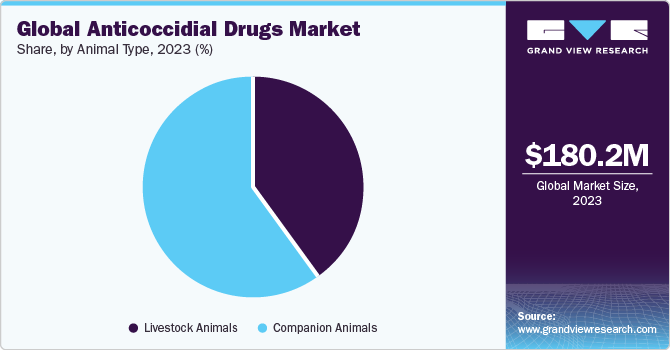

Animal Type Insights

Based on animal type, the anticoccidial drugs market is segmented into livestock animals and companion animals. The companion animal segment held a major market share in 2023. This is attributed to the rising popularity of companion animals that is driving this growth. Additionally, the region's well-developed healthcare infrastructure plays a significant role in boosting the market. The global increase in companion animal adoption is attributed to the well-recognized bond between humans and animals. This connection is considered an effective means to alleviate stress during times of uncertainty and help mitigate depression and anxiety associated with social isolation. These factors are expected to drive growth in this segment throughout the forecast period.

Regional Insights

North America dominated the market in 2023. This is attributed to the high prevalence of coccidiosis, a growing number of market participants, and an increase in the population of meat producers in the region. Moreover, the rising trend of adopting pets in the U.S. is expected to drive market growth.As per the 2021-2022 National Pet Owners Survey conducted by the American Pet Products Association, approximately 90.5 million families in the U.S., accounting for 70% of the total, own pets. This marks a significant increase from the initial survey in 1988 when only 56% of U.S. households had pets, and a growth from 67% in 2019.

Key Companies & Market Share Insights

Key players operating in the market are Bayer AG, Ceva sante animale, Huvepharma EOOD, Merck & Co., Inc., Vetoquinol SA, Virbac SA, Boehringer Ingelheim International GmbH, Dosh Pharmaceuticals Private Limited, Venkateshwara hatcheries Private Limited, and Zoetis Inc. The key players in the market undertake various strategic initiatives, such as new product launches, partnerships, mergers, and acquisitions.

-

In May 2023, Amlan International successfully finalized its purchase of the outstanding non-controlling interest in Agromex Importaciones, S.A. de C.V. As a result, Amlan now possesses complete ownership, 100%, of its subsidiary in Mexico, strengthening its presence in the Mexican market.

-

In February 2021, Merck Animal Health made a public announcement about its purchase of PrognostiX Poultry Limited, which works under the name Poultry Sense Ltd., from its initial owners. Poultry Sense Ltd. is well known for its groundbreaking efforts in delivering specialized environmental and health monitoring solutions designed specifically for the poultry sector.