- Home

- »

- Pharmaceuticals

- »

-

Antiemetics Drugs Market Size & Share Analysis Report 2030GVR Report cover

![Antiemetics Drugs Market Size, Share & Trends Report]()

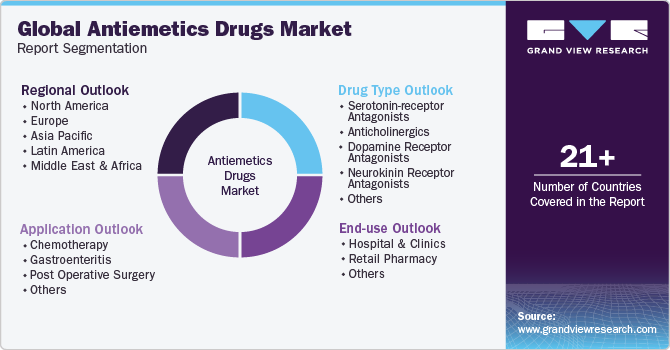

Antiemetics Drugs Market Size, Share & Trends Analysis Report By Drug Type (Serotonin-receptor Antagonists, Dopamine Receptor Antagonists), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-165-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Antiemetics Drugs Market Size & Trends

The global antiemetics drugs market size was valued at USD 7.49 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.98% from 2024 to 2030. Antiemetic medications or drugs are used to treat and prevent conditions such as vomiting and nausea. Growth of the market can be attributed to rising incidences of gastroenteritis & cancer and growing research & development activities. Moreover, the surge in the launches of generic substitutes is another factor influencing the market demand.

The rising incidences of diseases such as gastroenteritis & cancer which induce nausea and vomiting are projected to increase the demand. Cancer therapies and treatments such as chemotherapy and gastroenteritis treatments have witnessed several adverse effects of nausea and vomiting. Antiemetic drugs are useful to control such side effects during treatments. Thus, demand is anticipated to boost with the rising prevalence of cancer and gastroenteritis.

According to the American Cancer Society, in 2023, around 609,820 cancer deaths and 1,958,310 new cancer cases are estimated to occur in the U.S. Furthermore, a study published by NCBI in January 2019 found that the rotavirus gastroenteritis is highly prevalent in India. Thus, the prevalence of such diseases causing vomiting and nausea is anticipated to propel the market growth over the forecast period.

Furthermore, growing drug approvals and research activities are likely to facilitate market expansion. Various industry participants are researching, developing, and receiving approvals for antiemetic drugs, which is expected to contribute to the market growth. For instance, in March 2022, Taiho Pharmaceutical Co., Ltd. received authorization to market and manufacture Arokaris, a selective NK1 receptor antagonist antiemetic drug for gastrointestinal symptoms associated with cancer chemotherapy. Such product introductions and approvals are anticipated to drive market growth over the forecast period.

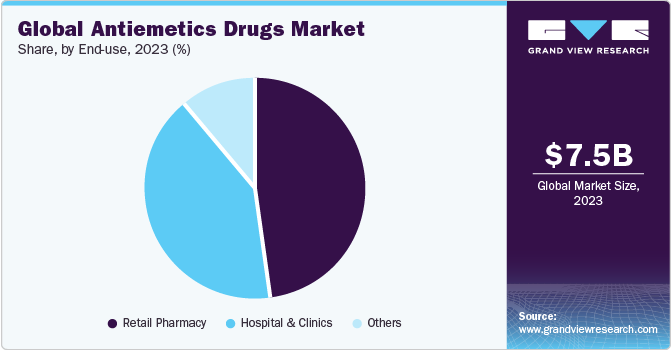

End-use Insights

The retail pharmacies segment dominated the market in 2023 with a revenue share of 47.91%. Product availability and convenience offered by retail pharmacies are projected to drive the segment growth. Furthermore, the presence of various retail pharmacy chains like CVS Pharmacy, Walgreens Boots Alliance, and Rite Aid across the globe is anticipated to drive the demand for these medicines over the forecast period.

On the contrary, the other segment which includes purchasing drugs from online platforms or e-commerce is projected to register the fastest CAGR over the forecast period. The growth of this segment can be attributed to the increasing penetration of smartphones and the internet across the globe, rising awareness about online pharmacies, and the growing focus of industry players to strengthen their online distribution networks. According to the study published by Frontiers in December 2022, around 92.8% of study respondents knew they could purchase medicines online.

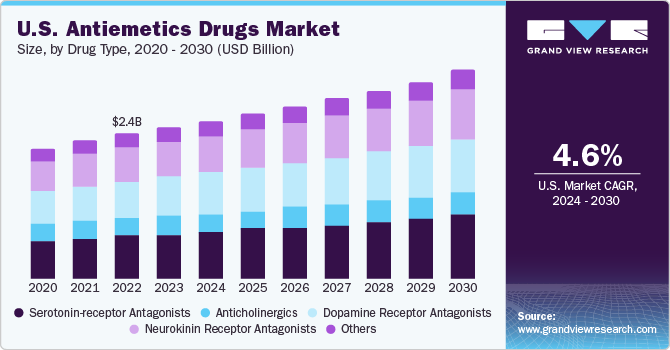

Drug Type Insights

Serotonin-receptor antagonists segment accounted for the largest market share of 29.71% in 2023 and is expected to witness the fastest growth during the forecast period. This segment includes drugs like Ondansetron (Zofran), Dolasetron (Anzemet), and Granisetron (Kytril). These drugs are available in injections and oral pill formulations. The higher revenue share and growth of this segment can be attributed to the increasing use of serotonin-receptor antagonist drugs to prevent nausea and vomiting associated with chemotherapy, radiation therapy, and anesthesia, coupled with the rising prevalence of cancer across the globe.

The dopamine receptor antagonist drugs segment held the second-largest market share. Some of the drugs in this category include Barhemsys, Inapsine, Haldol, Reglan, Gimoti, and Thorazine. The growth of this segment can be attributed to the rising approvals for these drugs from the regulatory authorities. For instance, in February 2020, BARHEMSYS, an antiemetic drug, received FDA approval to prevent or treat postoperative nausea and vomiting.

Regional Insights

North America dominated the market with a share of 36.52% in 2023. Presence of key players like Pfizer and GSk plc is likely to contribute a higher revenue share of the region. In addition, rising approvals for antiemetics drugs in the region are anticipated to propel regional expansion. For instance, according to the article published by the Canadian Institutes of Health Research in May 2022, Ondansetron, a 5-HT3 antagonist approved in Canada as an antiemetic. This drug is used for nausea and vomiting associated with chemotherapy and post-operation.

The Asia Pacific market is expected to grow at a significant CAGR from 2024 to 2030. Rising incidences of cancer and gastroenteritis across the region and the growing availability of various antiemetics medications are expected to support the regional market. According to the study published by the National Library Of Medicine in November 2022, number of cancer cases in India is projected to increase by 12.8% within five years from 2020 to 2025. Thus, rising incidences of cancer coupled with the growing chemotherapy is anticipated to drive regional growth over the forecast period.

Application Insights

The chemotherapy segment dominated the application segment in 2023 with a market share of 45.70%. The higher revenue share of the segment is attributed to the increasing use of antiemetics drugs to treat the nausea and vomiting associated with chemotherapy and rising product launches in this segment. For instance, in May 2018, in Brazil, Helsinn, a Swiss pharmaceutical company, and Mundipharma introduced the hard capsule AKYNZEO for oral use. This drug is used to treat the nausea and vomiting induced by acute and delayed chemotherapy.

Postoperative surgery is projected to register the fastest CAGR from 2024 to 2030. The rising utility of antiemetics drugs to avoid postoperative vomiting and nausea is expected to boost segment growth over the forecast period. Moreover, the high prevalence of adverse effects like nausea and vomiting due to anesthesia can drive the segment growth over the forecast period. According to the article published by the Association of Anesthetists in November 2020, around 30% of the general surgical population and about 80% of high-risk patients suffer from postoperative vomiting and nausea.

Key Companies & Market Share Insights

-

Key players in the market are undertaking various strategic initiatives to maintain their market presence. In addition, various strategic initiatives help market players to bolster their business avenues.

-

In January 2023, Glenmark Pharmaceuticals Ltd launched AKYNZEO I.V., a unique I.V. injection formulation in India. The medication is useful to prevent chemotherapy-induced vomiting and nausea.

-

In October 2023, Astellas Pharma Inc. presented research results at the European Society for Medical Oncology (ESMO) Congress 2023. During this presentation, the company also presented an abstract focusing on the effects of antiemetics on gastric injury and emesis frequency in ferrets. Such presentations by key players are expected to increase awareness about the antiemetics drug, which can further help boost the growth of the market over the forecast period.

Key Antiemetics Drugs Companies:

- Pfizer Inc.

- Cipla Inc.

- Merck KGaA

- Eagle Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- GSK plc.

- Astellas Pharma Inc.

- GLENMARK PHARMACEUTICALS LTD.

- Viatris Inc.

- Baxter

Antiemetics Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.90 billion

Revenue forecast in 2030

USD 11.20 billion

Growth rate

CAGR of 5.98% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Pfizer Inc.; Cipla Inc.; Merck KGaA.; Inc., Eagle Pharmaceuticals, Inc.; Johnson & Johnson Services, Inc.; GSK plc.; Astellas Pharma Inc.; GLENMARK PHARMACEUTICALS LTD.; Viatris Inc.; Baxter

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Antiemetics Drugs Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antiemetics drugs market report based on drug type, application, end-use, and region.

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Serotonin-receptor Antagonists

-

Anticholinergics

-

Dopamine Receptor Antagonists

-

Neurokinin Receptor Antagonists

-

Others (Antihistamines, Cannabinoids)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Gastroenteritis

-

Post Operative Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital & Clinics

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antiemetics drugs market is expected to grow at a compound annual growth rate of 5.98% from 2024 to 2030 to reach USD 11.20 billion by 2030.

b. North America dominated the antiemetics drugs market with a share of 36.52% in 2023. This is attributable to rising approvals for antiemetics drugs and presence of key players like Pfizer and GSk plc.

b. Some key players operating in the antiemetics drugs market include Pfizer Inc., Cipla Inc., Merck & Co., Inc., Eagle Pharmaceuticals (Acacia Pharma Limited), Johnson & Johnson Services, Inc., GSK plc., Astellas Pharma Inc., GLENMARK PHARMACEUTICALS LTD., Viatris Inc., Baxter.

b. Key factors driving the market growth include rising incidences of gastroenteritis & cancer and growing research & development activities. Moreover, the surge in the launches of generic substitutes is another factor influencing the antiemetics drugs market demand.

b. The global antiemetics drugs market size was estimated at USD 7.49 billion in 2023 and is expected to reach USD 7.90 billion in 2024.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."