- Home

- »

- Medical Devices

- »

-

Antimicrobial Wound Care Dressings Market Size Report, 2030GVR Report cover

![Antimicrobial Wound Care Dressings Market Size, Share & Trends Report]()

Antimicrobial Wound Care Dressings Market Size, Share & Trends Analysis Report, By Product (Silver Dressings), By Application (Chronic Wounds), By End-use (Hospitals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-045-1

- Number of Report Pages: 97

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global antimicrobial wound care dressings market size was valued at USD 1.3 billion in 2022 and is projected to witness a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Antimicrobial wound care dressings are specialized wound dressings that contain agents or substances that help to prevent or treat infections in wounds. These dressings are designed to provide a barrier against bacteria, viruses, fungi, and other microorganisms that may enter the wound and cause infection. Increasing incidence of chronic and acute wounds, the growing geriatric population, and rise in number of surgical cases and traumatic wounds are expected to drive the market.

The increasing incidence of chronic wounds is one of the key drivers for the antimicrobial wound care dressings market. Antimicrobial wound care dressings contain agents or substances that have antimicrobial properties, such as silver, iodine, and PHMB. By providing a barrier against microorganisms, antimicrobial wound care dressings can reduce the risk of infection and promote healing. As the incidence of chronic wounds continues to rise globally, the demand for antimicrobial wound care dressings is expected to grow. For instance, as per ResearchGate, more than 13 million people globally experience chronic wounds every year. These dressings are particularly useful in the treatment of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, which are at high risk of infection. Therefore, an increasing number of chronic wounds is anticipated to drive the antimicrobial wound care market.

The growing geriatric population is another important factor that drives the antimicrobial wound care dressings market. For instance, according to WHO, as of 2019, the number of people aged above 60 was more than 1 billion. Moreover, as per a similar source, by 2030, one in every six people globally will be aged more than 60. The incidence of chronic wounds, such as pressure ulcers and venous leg ulcers, increases with the increasing elder population. Older adults are more susceptible to chronic wounds due to a variety of factors, including reduced mobility, impaired circulation, and comorbidities such as diabetes and cardiovascular disease. Therefore, increasing the use of antimicrobial wound care dressings.

Rising surgical procedures are further expected to increase the demand for antimicrobial wound care dressings during the forecast period. Surgical wounds are at risk of infection, and antimicrobial wound care dressings can help to prevent or treat these infections, promoting faster healing and reducing the risk of complications. Further surgical site infections (SII) are infections that patients acquire while receiving treatment in a healthcare setting during or after surgery. These infections can be caused by a variety of microorganisms, including bacteria, viruses, and fungi. The occurrence of SII is a major concern for healthcare providers and patients alike. Antimicrobial wound care dressings can be used in various surgical procedures, such as orthopedic, cardiovascular, and plastic surgeries, to reduce the risk of infection and promote faster healing. Thus, driving market growth.

Product Insights

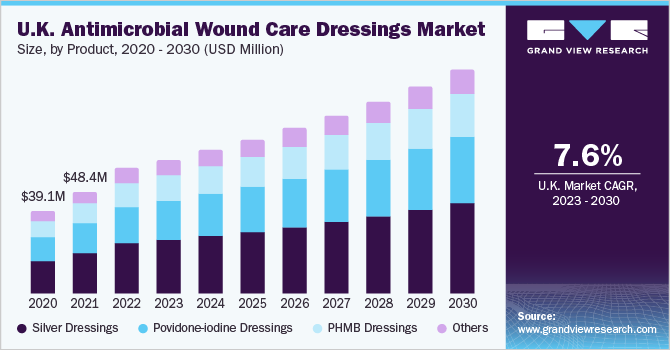

The silver wound dressings market is expected to capture 39.5% of the market share in 2022. Silver wound dressings are a type of antimicrobial wound care dressings that contain silver as the active ingredient. Silver wound dressings can come in various forms, including foam, gauze, hydrocolloid, and alginate dressings. The dressings work by releasing silver ions, which help to kill or inhibit the growth of microorganisms in the wound bed. Silver wound dressings are particularly useful in the treatment of chronic wounds, such as pressure ulcers and diabetic foot ulcers, which are at high risk of infection. They are also used in the treatment of surgical wounds to reduce the risk of infection and promote faster healing. For instance, as per ResearchGate, 266 million surgeries are performed globally every year, out of which around 0.5% to 3.0% of people may suffer from surgical site infections as per JAMA Network. Therefore, as silver dressings help in treating above mentioned infections and wounds, the demand for silver wound dressings may increase over the forecast period.

Povidone-iodine wound dressings segment is projected to witness a growth rate of 6.5% during the forecast years. These are broad-spectrum antimicrobial dressings that are effective against a wide range of microorganisms, including bacteria, viruses, and fungi. These are particularly useful in the treatment of infected wounds, such as surgical wounds, burns, and pressure ulcers. They are also used in the prevention of infections in clean surgical wounds. Hence, an increasing number of people suffering from chronic wounds such as pressure ulcers. For instance, as per Agency for Healthcare Research and Quality, every year more than 2.5 million people in the U.S. develop pressure ulcers. Moreover, as per Science Direct, the overall prevalence of pressure ulcers globally was calculated to be 12.7%. This is expected to increase the use of povidone-iodine dressings over the forecast period.

Application Insights

On the basis of application, the chronic wounds segment is anticipated to dominate the market with a market share of 59.8% in 2022. The dominance can be attributed to the rising number of people suffering from chronic wounds such as diabetic foot ulcers, venous leg ulcers, pressure ulcers, and other chronic wounds. For instance, as per InDependent Diabetes Trust, 115,000 people may develop diabetic foot ulcers in the UK at any given time. Moreover, as per a similar source, 27,000 people are treated with venous leg ulcers every year. Such wounds take a longer duration to heal and thus, may increase the use of antimicrobial wound care dressings, thereby, impelling the segment growth.

However, the acute wounds segment is projected to witness the fastest growth rate of 6.5% over the forecast duration. The growth rate can be credited to the increasing number of surgical cases, and the rising number of traumatic and burn events. Moreover, with an increasing number of surgeries is leading to increasing cases of surgical site infections. For instance, as per National Healthcare Safety Network, surgical site infections surveillance, in 2018, around 157,500 cases of SSI were reported in the U.S. As, antimicrobial wound care dressings helps in healing of such surgical site the demand for antimicrobial wound care dressings is expected to increase, thereby impelling the segment growth.

End-use Insights

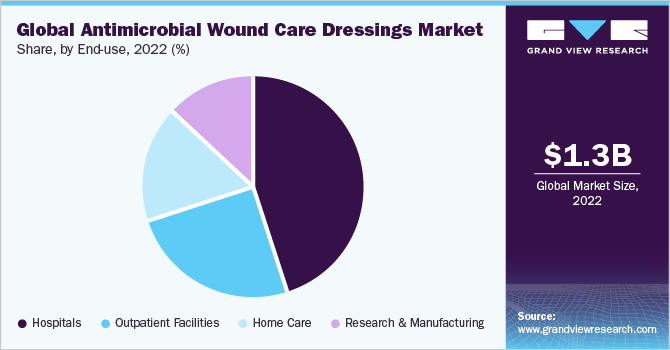

The hospital segment dominated the market with a market share of 45.2% in 2022. This can be ascribed to the expanding hospital sector, increased surgical rates, and an expanding patient base across all age categories. For instance, according to the India Brand Equity Foundation, the Indian hospital sector is expected to reach USD 132 billion by 2023, accounting for almost 80.0% of the country's overall healthcare market. With the increasing number of hospitals, the number of surgeries is also expected to increase. Moreover, surgical site infections may further boost the use of antimicrobial wound care dressings in a hospital setting, which may help the segment dominate the market over the forecast years.

The home care segment is projected to witness the fastest growth rate of 7.1% over the forecast period. In many countries, the number of home care settings has grown. Moreover, a prolonged recovery time from many surgical procedures requires many changes in the wound dressing. Further, the increasing number of geriatric and bariatric populations is expected to increase the demand for home care. For instance, according to statistics by WHO, world obesity has increased and has tripled since 1975. This may boost the demand for home care settings.

Regional Insights

North America is anticipated to dominate the antimicrobial wound care dressings market in 2022, with a market share of 45.4%. This can be attributed to the presence of major market players providers, a rising number of surgical procedures, and a growing number of the target population. For instance, according to a study by NCBI in 2020, approximately 40 - 50 million surgeries are performed in the U.S. each year. Moreover, the increase in cases of hospital acquired infections is further fostering market expansion.

Asia Pacific is projected to witness the fastest CAGR of 7.1% during the forecast period. The growth can be attributed to growing population, impelling medical tourism, and increasing cases of traumatic wounds. The use of antimicrobial wound care dressings may also rise as a result of increased chronic diseases and an increase in surgical cases in the Asia-Pacific area. For instance, 623,000 people from public hospitals’ waiting lists for elective surgery were admitted for surgery, according to the Australian Institute of Health and Welfare. The number of patients waiting for elective procedures increased by 784,000 as well. As a result, during the course of the forecast years, there will be greater demand for antimicrobial wound care dressings due to the rise in hospitalizations.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as geographic expansion, and partnerships to strengthen their foothold in the market for antimicrobial wound care dressings market. Some of the prominent players in the antimicrobial wound care dressings market include:

-

Convatec, Inc.

-

B. Braun SE

-

3M

-

Smith & Nephew

-

Cardinal Health

-

Coloplast Corp.

-

Paul Hartmann AG

-

Medline Industries

-

McKesson Corporation

-

Mölnlycke Health Care AB

Antimicrobial Wound Care Dressings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.4 billion

Revenue forecast in 2030

USD 2.1 billion

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Convatec, Inc., B. Braun SE, 3M, Smith & Nephew; Cardinal Health; Coloplast Corp.; Paul Hartmann AG, Medline Industries; McKesson Corporation; Mölnlycke Health Care AB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antimicrobial Wound Care Dressings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global antimicrobial wound care dressings market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Silver Dressings

-

Povidone-iodine Dressings

-

PHMB Dressings

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Venous Leg Ulcers

-

Pressure Ulcers

-

Others

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antimicrobial wound care dressing market size was estimated at USD 1.3 billion in 2022 and is expected to reach USD 1.4 billion in 2023.

b. The global antimicrobial wound care dressing market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 2.1 billion by 2030.

b. The silver dressings in product segment dominated the overall antimicrobial wound care dressing market, commanding over 39.5% revenue share in 2022.

b. Some key players operating in the wound dressing market include Convatec, Inc., B. Braun SE, 3M, Smith & Nephew, Cardinal Health, Coloplast Corp., Paul Hartmann AG, Medline Industries, and McKesson Corporation.

b. Key factors that are driving the antimicrobial wound care dressing market growth include the rising prevalence of conditions such as leg ulcers, venous stasis ulcers, pressure ulcers, and diabetic ulcers, which require lesion management, and are anticipated to boost the global wound dressing market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."