- Home

- »

- Beauty & Personal Care

- »

-

Antiseptic Bathing Products Market Size, Share Report, 2030GVR Report cover

![Antiseptic Bathing Products Market Size, Share & Trends Report]()

Antiseptic Bathing Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (CHG Bath Towels & Wipes, CHG Solutions, Antiseptics Bathing Solutions), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-228-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antiseptic Bathing Products Market Trends

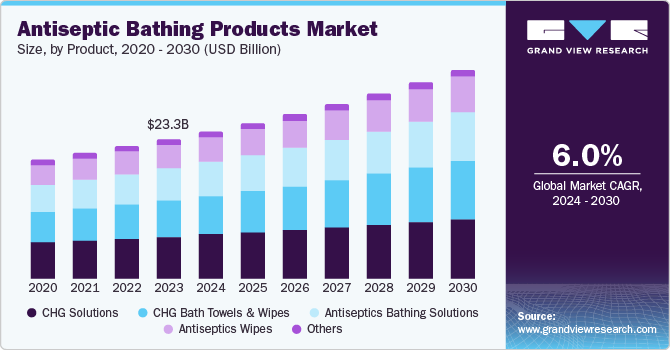

The global antiseptic bathing products market size was valued at USD 23.32 billion in 2023 and is projected to grow at a CAGR of 6.0% from 2024 to 2030. The key factors include rising awareness about the need for hygiene practices, growing infections originating from pathogens, open surgical sites, and infectious bacteria such as Clostridium difficile, which are expected to drive growth. Moreover, increasing concerns regarding HAIs (hospital-acquired infections) are anticipated to encourage the use of antiseptic bathing products, mainly for high-risk patients in medical settings.

Continuous investments by key companies in R&D activities encourage the development of novel antiseptic bathing products with improved efficiency and high convenience. Increasing adoption of antiseptic bathing products in healthcare institutions such as hospitals and long-term care facilities to minimize the occurrence of infections is contributing to the expansion of the market. According to the World Health Organization (WHO), numerous harmful effects of healthcare-associated infections and antimicrobial resistance affect people's lives. Every year, more than 24% of patients suffer from healthcare-associated sepsis, and about 52.3% of patients in the intensive care unit do not survive this infection.

To address the issue of growing infections, several governments worldwide are continuously focusing on implementing hygiene standards and regulations, such as the Infection Prevention and Control (IPC) program, promoting the application of these products to reduce the infection rate. In addition, governments are excessively investing in implementing strategies to reduce infectious diseases.

The growing prevalence of skin diseases worldwide has also contributed to the ever-increasing demand for antiseptic bathing products. For instance, in March 2023, the World Health Organization (WHO) estimated that skin conditions affect nearly 1.8 billion individuals across the world at any point in time. It has resulted in an alarming need for hygiene products developed with necessary ingredients such as chloroxylenol IP, chlorhexidine gluconate, sodium hydroxide, terpineol BP, cetrimide, and more.

Product Insights

The CHG solutions segment has dominated the global market and accounted for a revenue share of 30.4% in 2023. Rising utilization of antiseptic bathing products in surgical wards followed by Intensive Care Units (ICUs) is anticipated to boost the market demand during the forecast period. CHG solutions can also be used in daily baths to prevent the risk of HAIs and other infections such as Vancomycin-resistant Enterococcus (VRE), infections from central venous catheters, surgical sites, and diseases from ventilator use. CHG solutions are available in various concentrations, such as CHG 4% Solution, CHG 2% Solution, CHG 0.12% Solution, CHG 20% Solution, and others.

The CHG bath towels and wipes segment is expected to experience the fastest CAGR of 7.1% during the forecast period. The market is expected to expand due to the focus on reducing the risk of bloodstream fungal and bacterial infections. CGH bath towels and wipes are primarily utilized in ICUs to prevent skin infections and allergic responses. Some CHG bath towels and wipes include 3M Science Cavilon CHG Bathing & Cleansing Towels, Eco Bath Wipe, Sage 2% CHG Clothes, and others catering to a broad customer base.

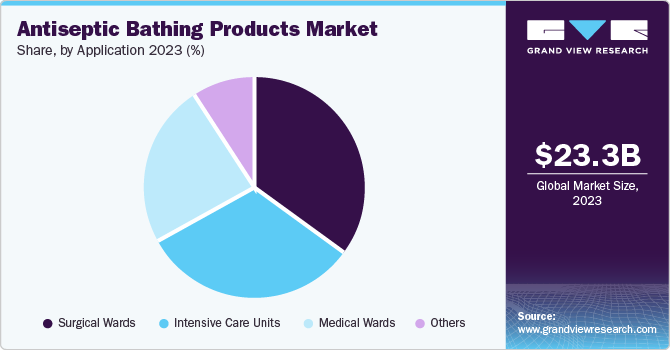

Application Insights

The surgical wards segment accounted for the largest revenue share in 2023. The increasing risk of getting infected by the instruments and environment during surgical operations drives the demand for CHG solutions in surgical wards. Skin antiseptics are utilized before surgical procedures and for bathing high-risk patients to decrease central line-associated infections and other healthcare-associated infections. According to the National Center of Biotechnology Information (NCBI), surgical site infection (SSI) is the third most prevalent type of healthcare-associated infection, affecting 15.7 % to 31.0 % of all healthcare-associated infections. These factors are expected to generate greater demand for this segment in the approaching years.

The medical wards segment is expected to experience the fastest CAGR during the forecast period. Bathing with chlorhexidine reduces the risk of pathogens on the skin. Research institutes have conducted several studies on chlorhexidine bathing, positively affecting skin contamination and other infections. Therefore, the demand for antiseptic bathing products is rising to reduce the prevalence of diseases such as HAI and infections from different injuries.

Regional Insights

The North America antiseptic bathing products market dominated the revenue share with 34.3% in 2023. The market is driven by intensified healthcare standards and the presence of prominent players in the region. Moreover, rising awareness of infections and the growing awareness regarding personal hygiene are contributing to the market expansion. The governments in the region are continuously focusing on implementing regulations and health standards to avoid the spread of infectious diseases and skin diseases.

U.S. Antiseptic Bathing Products Market Trends

The U.S. antiseptic bathing products market is expected to experience a significant CAGR during the forecast period. This market is primarily influenced by the increasing awareness regarding personal hygiene and its significance in overall health & well-being. Furthermore, the growing prevalence of skin diseases and the rising need for antiseptic bathing products in healthcare facilities are anticipated to increase demand for this market from 2024 to 2030.

Europe Antiseptic Bathing Products Market Trends

Europe antiseptic bathing products market was identified as a lucrative region in 2023. The rising focus of prominent companies to launch new products to cater to a wide range of consumer requirements is driving the market for antiseptic bathing products. Growing skin infections in the region have also contributed to the growth of this industry. According to the Burden of Skin Disease study, undertaken by The European Academy of Dermatology and Venereology, which included 27 European countries and nearly 44,689 adults, 43.4% of respondents reported at least one skin condition in the past 12 months of the study.

The antiseptic bathing products market in UK is expected to grow rapidly in the approaching years. The growing use of antiseptic bathing materials in healthcare facilities, increasing awareness regarding the prevention of skin diseases, and ease of availability associated with the products are expected to generate greater demand for this industry in the country from 2024 to 2030. The presence of key market companies from the domestic industry and the entry of global companies operating in the market have also contributed to the growth of this industry in recent years.

Asia Pacific Antiseptic Bathing Products Market Trends

Asia Pacific antiseptic bathing products market is anticipated to witness the fastest CAGR during the forecast period. This market is primarily influenced by unprecedented growth in awareness regarding personal hygiene, the increasing number of skin diseases identified in the region, growth in medical tourism, the rising number of surgeries performed for various treatments, and an increase in disposable income levels. Enhanced availability and accessibility through online platforms and effective retail distribution by key companies have also contributed to the growth of this regional industry.

The antiseptic bathing products market in China held a substantial market share in 2023. Growing skin infections in the country, unceasing urbanization coupled with pollution and other factors leading to enhanced risk of skin infections, the growing presence of international healthcare products companies, and growth in overall disposable income levels resulting in improved expenditure on health & well-being have contributed to the development of this market.

Key Antiseptic Bathing Products Company Insights

Some of the key companies in the antiseptic bathing products market include Ecolab, BD, 3M, The Clorox Company, Medline Industries, LP, Reckitt Benckiser Group PLC, and others. The key brands operating in the industry have adopted strategies such as increased investments in R&D activities, collaborations & partnerships, enhanced product portfolios, and effective distribution through both online and offline channels to attain competitive advantage over other market participants.

-

Medline Industries, LP, one of the prominent companies in the medical-surgical manufacturing, supply chain provisions, and clinical solutions industry, offers products associated with multiple domains including advanced wound care, apparel, bed & mattresses, central sterile, diagnostics, Durable Medical Equipment (DME), Environmental Services (EVS), equipment, foot & ankle, gloves, lab supplies, OR/surgery, urology, vascular access and more. One of the innovation-backed products offered by the company includes ReadyPrep CHG, a pre-saturated CHG cloth.

-

Reckitt Benckiser Group PLC, a large organization that runs more than many popular brands related to the health, nutrition and hygiene products market, offers a diverse range of products for individuals, families and communities across various domains. One of its health & hygiene-related brands that is used across multiple countries is Dettol.

Key Antiseptic Bathing Products Companies:

The following are the leading companies in the antiseptic bathing products market. These companies collectively hold the largest market share and dictate industry trends:

- Ecolab

- BD

- 3M

- The Clorox Company

- Medline Industries, LP.

- Reckitt Benckiser Group PLC

- Perrigo Company plc,

- Johnson & Johnson Services, Inc.

- KCWW

- Bio-Cide International, Inc. (Kemin Industries, Inc.)

Recent Developments

-

In July 2024, Ecolab launched Disinfectant 1 Wipe, the initial EPA-approved 100% Plastic-Free easily degradable disinfectant wipe with 1-minute hospital disinfection. The new product aids healthcare facilities in enhancing patient safety and reaching their sustainability objectives.

Antiseptic Bathing Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.61 Billion

Revenue forecast in 2030

USD 34.83 Billion

Growth Rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, and South Africa

Key companies profiled

Ecolab; BD; 3M; The Clorox Company; Medline Industries, LP; Reckitt Benckiser Group PLC; Perrigo Company plc,; Johnson & Johnson Services, Inc.; KCWW.; Bio-Cide International, Inc. (Kemin Industries, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antiseptic Bathing Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antiseptic bathing products market report based on product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

CHG Bath Towels and Wipes

-

CHG Solutions

-

Antiseptics Bathing Solutions

-

Antiseptics Wipes

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Intensive Care Units

-

Surgical Wards

-

Medical Wards

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.