- Home

- »

- Medical Devices

- »

-

Antiseptic And Disinfectant Market Size & Share Report 2030GVR Report cover

![Antiseptic And Disinfectant Market Size, Share & Trends Report]()

Antiseptic And Disinfectant Market Size, Share & Trends Analysis Report By Type (Quaternary Ammonium Compounds), By Product (Enzymatic Cleaners), By End-use, By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-789-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Antiseptic And Disinfectant Market Trends

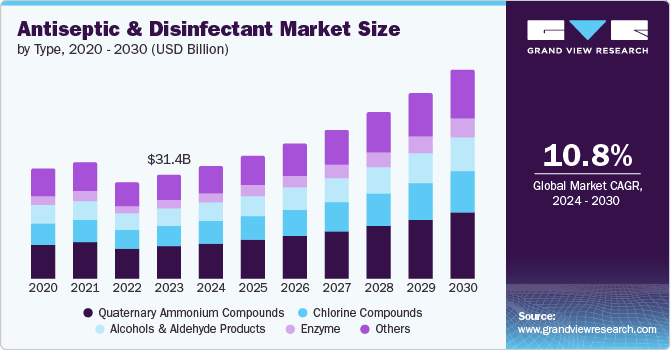

The global antiseptic and disinfectant market size was estimated at USD 31.4 billion in 2023 and is expected to grow at a CAGR of 10.8% from 2024 to 2030. An increase in the prevalence of diseases, such as typhoid, hepatitis A, cholera, and dengue, due to lack of home cleanliness and food poisoning is one of the major factors expected to drive the antiseptic & disinfectant market. For instance, according to the World Health Organization (WHO), as of April 2024, there were around 7.6 million dengue cases, with approximately 3.4 million confirmed cases and 3,000 deaths recorded in 2024. These diseases are mainly caused by viruses, bacteria, & germs, which thrive in unhealthy home environments and unhygienic toilets, latrines, & kitchens.

The application of antiseptic and disinfectant solutions is, therefore, an essential requirement to maintain home cleanliness. Such solutions prevent the growth of harmful bacteria and viruses, reducing the chance of acquiring these diseases. Hence, increased awareness about home cleanliness is anticipated to propel market growth over the forecast period. Furthermore, in January 2021, Health Canada added five SC Johnson home cleaning products to its list of effective disinfectants against SARS-CoV-2. SC Johnson's approval for these disinfectants, designed to eliminate the virus causing COVID-19 symptoms, underscored the positive impact of COVID-19 pandemic on the market, reflecting both past and ongoing advancements by various companies. The increasing incidence of Healthcare-associated Infections (HAIs) due to lack of precaution and sanitation is one of the leading factors contributing to market growth. As of May 2022, according to the WHO, approximately 15 out of 100 patients in low- and middle-income countries and 7 out of 100 in high-income countries developed HAIs during their acute care hospital stay.

Disinfectants offer general anti-contamination protection that helps reduce the incidence of HAIs. Moreover, they can restrict disease-carrying bacteria and microbes from entering the patient's body, which is further expected to boost market growth. Gastrointestinal (GI) endoscopy allows healthcare professionals to view the inner lining of the digestive tract and enable the diagnosis & treatment of several GI diseases. A GI endoscopy can be performed either in inpatient or outpatient settings. However, it can lead to several complications if the endoscopes are not properly reprocessed. In order to minimize the risk of spreading environmental or patient-borne pathogens among patients, it is crucial to follow infection-control protocols when reprocessing endoscopes. Therefore, proper application of disinfectants and antiseptic solutions is essential to prevent the transmission of infections.

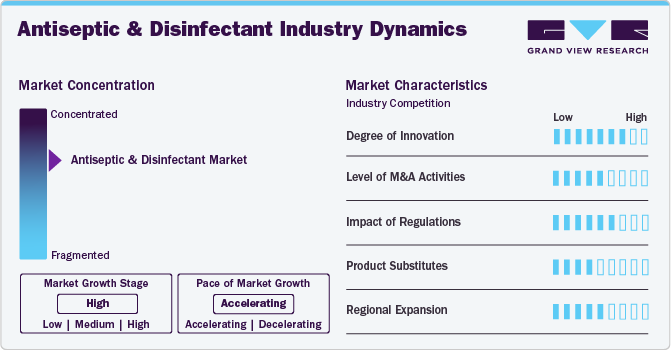

Market Concentration & Characteristics

The industry growth stage is high, and the pace of growth is accelerating. The market is characterized by rising awareness about hygiene & infection control, growing prevalence of HAIs, increasing healthcare expenditures, and stringent regulations, which mandate the use of antiseptics & disinfectants in all healthcare facilities for the safety of patients as well as healthcare professionals.

The industry exhibits a high degree of innovation, driven by the increasing efforts of market players to develop more effective & efficient solutions and their growing investments in R&D activities. For instance, in July 2024, Ecolab launched Disinfectant 1 Wipe, an EPA-registered, plastic-free, and degradable solution that helps in cleaning & disinfecting hospitals and healthcare facilities. This innovation is crucial for addressing the growing demand for antiseptics and disinfectants in the healthcare sector, where effective infection control is paramount.

Mergers and Acquisitions (M&A) in the antiseptic & disinfectant industry are increasing as companies seek to expand their market presence and product portfolio. For instance, in July 2022, Lanxess acquired the microbial control business unit of International Flavors & Fragrances. This acquisition expanded the company’s portfolio of antimicrobial active ingredients and formulations for disinfectants, material protection, & preservatives.

Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) ensure safety, efficacy, & proper use of these products. Compliance with these regulations is crucial for manufacturers, as it determines the approval and marketability of their products. Adhering to evolving regulatory requirements has driven companies to invest in R&D to develop innovative solutions that meet evolving standards.

The market faces moderate competition from substitutes. While alternative cleaning and sanitizing solutions are available, such as soap and water, hand sanitizers, & UV light disinfection systems, these are often used simultaneously with antiseptic and disinfectant products rather than as direct replacements. Moreover, the unique properties and antimicrobial activity offered by several antiseptic & disinfectant formulations make them essential for maintaining a clean & hygienic environment in healthcare settings.

The expansion strategies used by the players are driven by efforts to increase their geographical presence, grow their customer base, and take advantage of global opportunities in the healthcare sector. For instance, in September 2022, schülke Group acquired Vesismin Health, a Barcelona-based company specializing in infection control of the hospital sector, to expand its presence in Southern Europe. This acquisition strengthened the company’s mission to develop innovative disinfectants for the healthcare sector.

Type Insights

On the basis of type, quaternary ammonium compounds segment held the largest market share in 2023, with around 31.4%, and it is expected to experience significant growth over the forecast period. Quaternary ammonium compounds are widely used as surface disinfectants in hospitals and laboratories. These compounds aid in controlling the spread of HAIs in hospitals and clinics. In addition, it is used for disinfecting medical equipment that comes in direct contact with the skin. The rising incidence of HAIs globally and their adverse impact on patient’s health is expected to impact the segment growth positively. According to the WHO, in May 2022, around 24.0% of patients affected by healthcare-associated sepsis, when the body responds improperly to an infection, died each year.

The enzyme segment is anticipated to witness the fastest growth at a CAGR of 11.7% over the forecast period. Generally, enzyme-based antiseptics and disinfectants are used to control odors that are created by chemical processes. It is also commonly used in research facilities for cleaning catalyst-based or enzyme-based products. In addition, it is used to clean testing kits in hospitals and clinics. The demand for these items is anticipated to grow with the increasing number of research facilities because of rising R&D spending globally. For instance, according to Eurostat, the R&D spending in the EU in 2022 has witnessed a rise of 6.34% from 2021 and around 48.52% from 2012. This increasing R&D spending is expected to boost the number of research laboratories, propelling the segment growth over the forecast period.

Product Insights

The medical device disinfectants segment held the largest market share in 2023. Glutaraldehyde, phenol/phenate, hydrogen peroxide, and peracetic acid are some of the disinfectants used for reprocessing/disinfecting medical devices. Proper reprocessing of medical devices and endoscopes is essential as they transmit infection from one patient to another due to direct contact with skin. The increasing number of surgical procedures worldwide is also one of the reasons driving the segment over the forecast period. The enzymatic cleaner segment is anticipated to witness the fastest growth rate over the forecast period.

Enzymatic cleaners are more efficient on bacterial surfaces and are commonly used to avoid odor. It is commonly used to disinfect testing kits and surgical equipment in clinics & hospitals. The number of surgical procedures and the number of hospital-acquired illnesses are two important variables driving the market. Nonpathogenic beneficial microorganisms in enzyme cleaners are effective at displacing disease-causing germs without causing any adverse effects. The residue of certain antiseptics and disinfectants can sometimes cause harm to humans. In such cases, enzymatic cleaners are used. Hence, the segment is anticipated to grow over the forecast period.

Sales Channel Insights

The B2B segment held the largest market share in 2023. In B2B sales channels, companies directly sell their products to businesses, not consumers. Furthermore, it usually has longer sales cycles and higher order values. The B2B sales channel is expected to witness limited growth during the forecast period due to entry barriers in the B2B business, including a lack of investment to develop technologically advanced products and challenges pertaining to coordinating with various vendors. Medical device disinfectants, enzymatic cleaners, and surface disinfectants are major antiseptics & disinfectants marketed under the B2B sales channel. Hospitals, clinics, healthcare providers, and suppliers are major end users of the B2B sales channel.

The FMCG distribution channel comprises three major entities: agents, facilitators, & merchants. Agents, who can be members of the company or independent individuals, generally generate sales by promoting the products of the company. Facilitators are generally involved in the transportation of manufactured goods from one place to another. Warehouse owners, logistic services, and independent type are included under the facilitator’s category. Wholesalers and retailers are generally categorized under the merchant’s category. Consumers generally purchase FMCG products directly from retailers and wholesalers. Hand sanitizers, antiseptic topical creams, antiseptic washes, and antiseptic wipes are categorized under the FMCG product line. 3M, Lifebuoy, Dettol, and Purell are some of the notable brands of hand sanitizers. Furthermore, Nufree Finipil Pro Elec Antiseptic Cream, Tea Tree Therapy Antiseptic Cream, and Neosporin are some notable antiseptics topical cream brands marketed as FMCG products.

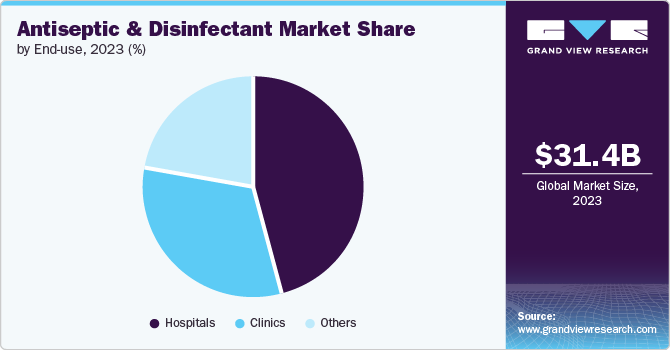

End-use Insights

The hospital segment dominated the market in 2023; the increasing incidence of HAIs globally is one of the major reasons for segment growth over the forecast period. According to the CDC, every day, around 1 out of every 31 hospital patients contracts a HAI. Thus, using appropriate disinfectants and antiseptics is critical in reducing the spread of illnesses. Furthermore, increasing healthcare expenditure in developed and developing countries is expected to increase the number of hospitals, due to which demand for antiseptics & disinfectants will likely increase.

For instance, as per the American Medical Association, healthcare spending in the U.S. has witnessed an increase of 4.1% to reach around USD 4.5 trillion in 2022. Such factors are expected to propel the segment growth over the forecast period. Over the forecast period, the increasing number of surgical procedures and hospitals is expected to drive the segment growth. To maintain a healthy atmosphere in the clinic, basic sanitation and hygiene are required. In addition, an increase in the number of HAIs may increase the demand for antiseptics and disinfectants. Thus, the segment is expected to grow over the forecast period.

Regional Insights

The antiseptic and disinfectant market in North America dominated the overall global market and accounted for 34.3% revenue share in 2023. The increasing number of surgeries is predicted to increase the demand for disinfectants and antiseptics in the region. Antiseptic & disinfectant solutions are necessary for surgical procedures & research as they limit the danger of contamination and infection transmission from one patient to the next. Furthermore, as doctors promote the use of disinfection treatments, an increase in the number of HAIs may lead to higher demand for such solutions. Consequently, these factors are projected to drive market expansion over the forecast period.

U.S. Antiseptic and Disinfectant Market Trends

The antiseptic and disinfectant market in the U.S. held a significant share of the North American region in 2023. This can be attributed to the growing concerns over HAIs, rising prevalence of chronic diseases, stringent regulatory landscape, and development of innovative solutions. The negligence of HAIs and inadequate use of disinfectants & antiseptics in healthcare facilities increases the risk for healthcare professionals and patients to develop infectious diseases. Around 2,400 patients at hospitals in Portland, Oregon, may have been at risk of contracting infectious diseases such as HIV, hepatitis B, and C due to the negligence toward infection control practices by a physician. Such incidents highlight the importance of strict infection control practices in the country and are expected to drive market growth.

Europe Antiseptic and Disinfectant Market Trends

The antiseptic and disinfectant market in Europeis witnessing significant growth, driven by the growing geriatric population with higher susceptibility to infections and stringent regulatory framework in the region. The demand for preventing the growth of microbes and other microorganisms in medical devices, testing kits, and surgical instruments has also contributed to the expansion of the market in the region. Moreover, the rising number of surgical procedures due to the surge in chronic and other diseases drives the need for effective antiseptic & disinfectant solutions.

The antiseptic and disinfectant market in the UK is witnessing significant growth due to increasing focus on reducing the prevalence of HAIs, growing geriatric population base that is vulnerable to infectious diseases, and increasing access to newly developed solutions. In November 2022, Reckitt and Essity launched a range of co-branded disinfection products. The new range was later made available in the UK from January 2023 for professional hygiene customers. The availability of novel solutions in the country is anticipated to increase their adoption, driving market growth.

The France antiseptic and disinfectant market is witnessing significant growth due to the increasing prevalence of infectious diseases and the need to sanitize surgical instruments & medical equipment to prevent disease transmission. This leads to a growing need for effective disinfectants.

The antiseptic and disinfectant market in Germany is experiencing notable growth due to the country’s developed healthcare infrastructure, stringent regulatory framework, and increasing number of surgical procedures. These factors, coupled with the country's focus on R&D initiatives and the implementation of government programs to promote the use of bio-based disinfectants, are expected to drive market growth.

Asia Pacific Antiseptic and Disinfectant Market Trends

The antiseptic and disinfectant market in Asia Pacificis expected to witness the fastest growth at a CAGR of 11.5%, driven by the growing geriatric population, rising healthcare expenditure, and increasing awareness of hygiene & infection control. Asia Pacific region is witnessing a demographic shift with the increasing geriatric population. According to WHO, the population of adults aged 60 years and above in China is expected to reach 28.0% of the total population in 2040, up from 12.4% in 2010. This growing geriatric population is more susceptible to infectious diseases, leading to an increased demand for antiseptics and disinfectants in the region over the forecast period.

The Japan antiseptic and disinfectant market is expected to witness significant growth due to the growing number of surgeries, awareness about the importance of antiseptics & disinfectants, the country’s aging population, and increasing availability of newly developed effective products. The country’s aging population is expected to increase the demand for better infectious disease prevention and care products, thereby fueling market growth.

The antiseptic and disinfectant market in China is expected to witness lucrative growth over the forecast period. This growth can be attributed to increasing number of HAIs, growing adoption of infection prevention guidelines & standards by healthcare facilities, and rising investment in the country’s healthcare infrastructure.

The India antiseptic and disinfectant market is fueled by rising awareness about the benefits of these products, the growing number of healthcare facilities, and the increasing development of new solutions. In December 2021, MedLife Formulations Pvt. Ltd. launched its new 4-in-1 antiseptic solution, Septicol Antiseptic Liquid. This solution can be used for both cleaning surfaces and first aid treatments. The development of such innovative solutions by market players, coupled with increasing access to such solutions, is driving the market growth in the country.

Latin America Antiseptic And Disinfectant Market Trends

The antiseptic and disinfectant market in Latin Americais fueled by the rising number of surgical procedures, increasing awareness about the importance of disinfectants & antiseptics in healthcare facilities, and government initiatives to advance healthcare facilities. In September 2023, the Brazilian government announced the National Development Strategy for the Health Economic-Industrial Complex (CEIS Development Strategy), which focuses on increasing the country’s capacity to develop essential products for its Unified Health System (SUS). Such advancements in the region’s healthcare sector are anticipated to drive market growth.

Middle East & Africa Antiseptic And Disinfectant Market Trends

The Middle East and Africa antiseptics and disinfectants market is anticipated to grow at a lucrative rate over the forecast period. Rising awareness about home cleanliness and increasing cases of food poisoning and cholera are some of the major factors expected to drive the market's growth over the forecast period. In addition, increasing healthcare expenditures by governments of MEA countries are expected to lead to the entry of several major players into the market, which is further anticipated to fuel the market growth.

The antiseptic and disinfectant market in Saudi Arabia is anticipated to expand over the forecast period. The growing prevalence of HAIs and the need to maintain proper hygiene and sanitation in medical settings are some of the major drivers of the market. The increasing use of surgical units and endoscope reprocessing has also contributed to the rising demand for skin antiseptic products. Moreover, the country’s aging population and the government’s focus on developing the country’s healthcare infrastructure are also expected to drive market growth over the forecast period.

Key Antiseptic And Disinfectant Company Insights

The antiseptic and disinfectant market is highly competitive, with key players such as 3M, Reckitt Benckiser, and Steris Plc. The major companies are undertaking various organic as well as inorganic strategies such as mergers & acquisitions, partnerships, expansion, and launching new products to serve the unmet needs of their customers.

Key Antiseptic And Disinfectant Companies:

The following are the leading companies in the antiseptic and disinfectant market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Reckitt Benckiser

- Steris Plc

- Kimberly-Clark Corporation

- Bio-Cide International, Inc.

- Cardinal Health

- BD

- Johnson & Johnson

Recent Developments

-

In March 2024, Novo Nordisk and Actylis, a U.S.-based raw material manufacturer and supplier for the pharmaceutical industry, announced a deal to supply the antiseptic & disinfectant benzalkonium chloride to Spain, Germany, Portugal, the UK, and Ireland.

-

In September 2023, Byotrol launched its new disinfectant range, Chemgene MedLab. This multi-surface disinfectant can be utilized to clean & disinfect surfaces, equipment, and instruments within laboratory environments.

Antiseptic And Disinfectant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.0 billion

Revenue forecast in 2030

USD 63.1 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, sales channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

3M; Reckitt Benckiser; Steris Plc; Kimberly-Clark Corporation; Bio-Cide International, Inc.; Cardinal Health; BD; Johnson & Johnson

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antiseptic And Disinfectant Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antiseptic and disinfectant market report based on type, product, sales channel, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Quaternary Ammonium Compounds

-

Chlorine Compounds

-

Alcohols & Aldehyde Products

-

Enzyme

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzymatic Cleaners

-

Medical Device Disinfectants

-

Surface Disinfectants

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

FMCG

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antiseptic and disinfectant market size was estimated at USD 31.4 billion in 2023 and is expected to reach USD 34.0 billion in 2024.

b. The global antiseptic and disinfectant market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 63.1 billion by 2030.

b. The medical device disinfectant segment held the largest share in 2023 with a market share of 45.68% among the other product over the forecast period owing to its increasing use across the globe.

b. Some key players operating in the antiseptic and disinfectant market include 3M, Reckitt Benckiser, STERIS plc, Kimberly, Clark Corporation, Bio-Cide International, Cardinal Health, BD, Johnson & Johnson.

b. Key factors that are driving the antiseptic and disinfectant market growth include the rising prevalence of hospital-acquired infections, the impact of Covid-19, growing awareness about home cleanliness and the need for disinfection, and increasing use of endoscope reprocesses and surgical units across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."