- Home

- »

- Medical Devices

- »

-

Aortic Aneurysm Market Size & Share, Industry Report, 2033GVR Report cover

![Aortic Aneurysm Market Size, Share & Trends Report]()

Aortic Aneurysm Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Thoracic Aortic Aneurysm, Abdominal Aortic Aneurysm), By Treatment (Open Surgical Repair, Hybrid procedures), By Product (Aortic Stent Grafts), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-043-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aortic Aneurysm Market Summary

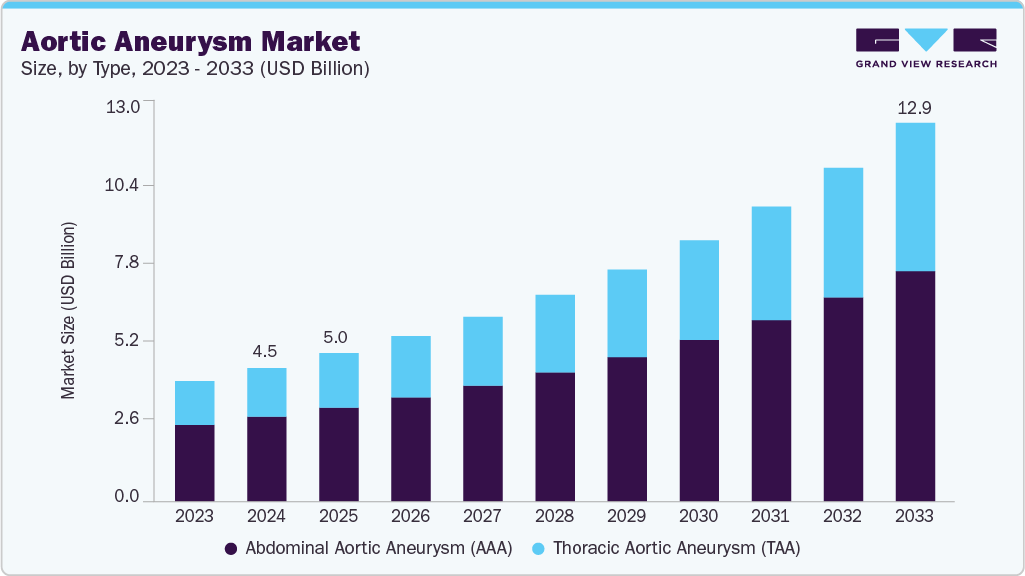

The global aortic aneurysm market size was estimated at USD 5.04 billion in 2025 and is projected to reach USD 12.87 billion by 2033, growing at a CAGR of 12.59% from 2026 to 2033. The market growth is driven by the increasing prevalence of aortic aneurysms, fueled by aging populations and common risk factors such as hypertension, smoking, and atherosclerosis.

Key Market Trends & Insights

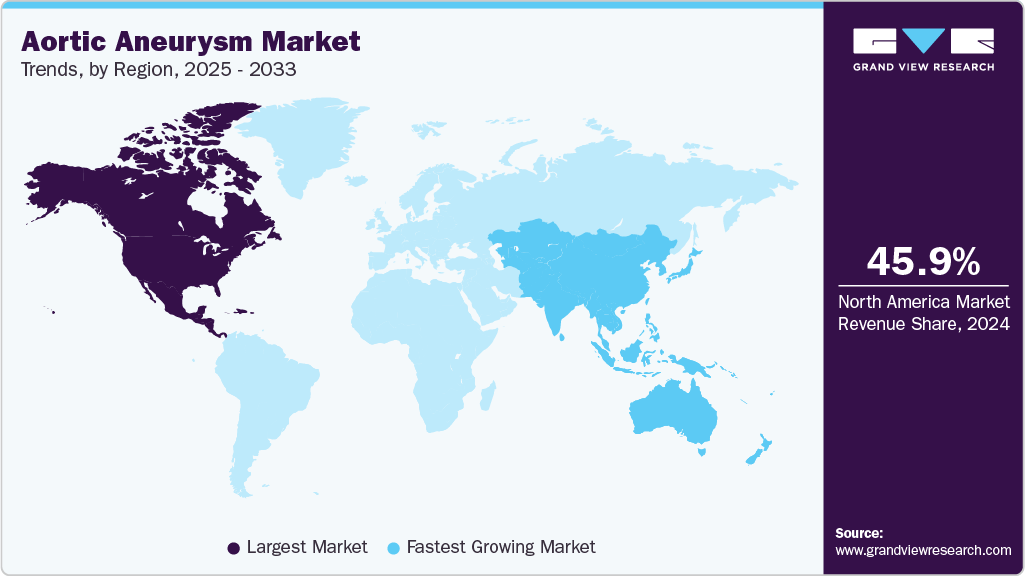

- The North America aortic aneurysm market accounted for the largest global revenue share of 46.04% in 2025.

- The U.S. aortic aneurysm industry is anticipated to register the fastest CAGR from 2026 to 2033.

- By type, the abdominal aortic aneurysm (AAA) segment held the largest revenue share in 2025.

- By treatment, the endovascular aneurysm repair (EVAR) segment held the largest revenue share in 2025.

- By product, the aortic stent grafts segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.04 Billion

- 2033 Projected Market Size: USD 12.87 Billion

- CAGR (2026-2033): 12.59%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

Additionally, the growing adoption of minimally invasive endovascular repair procedures, the expansion of screening programs for early detection, and continuous advancements in stent graft technologies are all accelerating market growth. In February 2025, Czechia launched a pilot abdominal aortic aneurysm screening programme for men aged 65-67, aiming to detect AAAs early and prevent up to 100 deaths annually.The increasing prevalence of cardiovascular disease among older populations drives demand in the aortic aneurysm industry. The incidence of abdominal aortic aneurysms (AAA) is increased by obesity, smoking, and high blood pressure. The need for endovascular and surgical procedures for screening, diagnosis, and intervention is increasing for healthcare systems. In September 2024, according to Medscape, AAA prevalence in the U.S. ranged from 0.5% to 3.2%, with ruptures causing approximately 15,000 deaths annually; globally.

Treatment options are being enhanced by developments in thoracic endovascular aneurysm repair (TEVAR) and endovascular aneurysm repair (EVAR). Flexibility, deployment precision, and compatibility with complex structures are all enhanced by new stent graft designs. Physician adoption of these devices is growing steadily, and they accelerate recovery and reduce complications. In November 2024, Bentley reported that its BeFlared bridging stent for FEVAR was effectively implanted, reducing procedure time and preserving artery blood flow.

Screening and prevention programs are increasing diagnosis rates. National AAA screening efforts in Europe and North America, combined with wider use of ultrasound and CT angiography, are enabling earlier detection in high-risk groups. This drives timely treatment, lowers rupture-related mortality, and sustains demand for surgical and endovascular solutions. In September 2025, using quick ultrasounds to identify aneurysms early, stop ruptures, and enhance outcomes for the 20,000 Canadians affected each year, Ontario started the country's first AAA screening program for people 65 and older.

Advances in Endovascular Aneurysm Repair Technology

New technologies for endovascular techniques for abdominal aortic aneurysm repair (EVAR) continue to be tested to enhance patient safety, lower complications, and lower the rate of reintervention. To enhance clinical results and supplement current endografts, innovations such as aneurysm sac sealing devices are being developed. In July 2024, Life Seal Vascular Inc. received an SBIR grant from the National Science Foundation for the research and development of an EVAR technology that can cover the aneurysmal sac, minimize endoleaks, and enhance the success of the procedure.

Expansion of Dedicated Aortic Care Facilities

Specialized centers for aortic disease are increasingly being established to address the growing burden of aneurysms, dissections, and related conditions. These centers improve early diagnosis and provide comprehensive surgical and endovascular treatment.

-

In September 2024, Fortis Escorts Heart Institute launched a dedicated Aorta Centre offering surgical, endovascular, and hybrid interventions, with OPD clinics operating thrice weekly to enhance access and care for patients with aortic disorders.

-

In March 2023, Ochsner Health launched The Ochsner Aortic Center in New Orleans, the only comprehensive aortic program in the Gulf South. The center adopted Cydar EV Maps, an AI-powered imaging platform that creates 3D surgical maps, reducing radiation exposure and operative time while supporting safer, minimally invasive procedures.

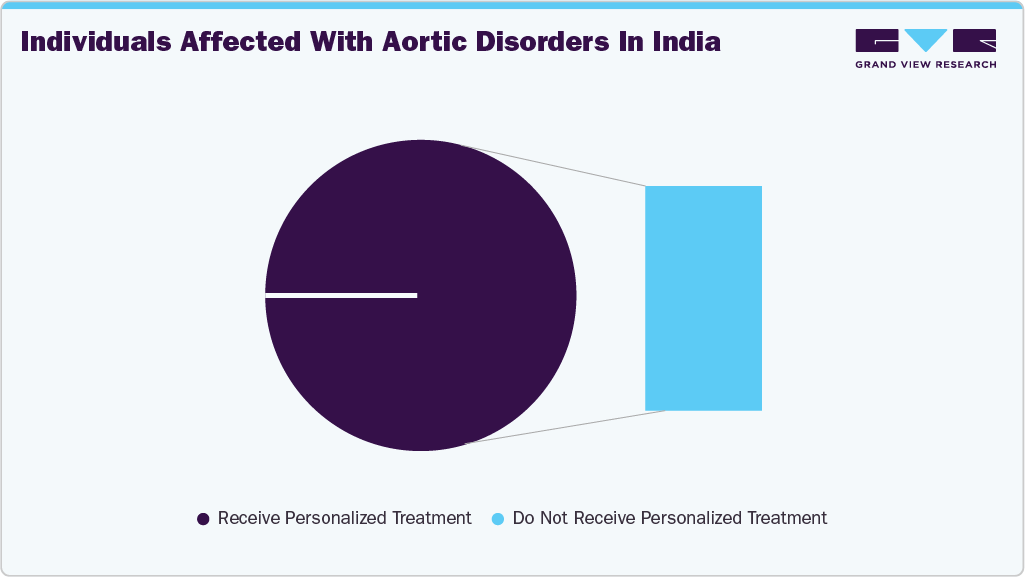

In September 2024, Fortis Escorts Heart Institute, Okhla, reported that around 300,000-400,000 individuals in India experience various aortic disorders annually, while only about 1,000 receive specialized treatment, emphasizing the importance of early diagnosis and timely intervention.

Selling Prices of Aortic Aneurysm Devices

Aortic device selling prices are affected by a variety of operational, clinical, and technological factors. For instance, endovascular stent grafts are more complex as they require specialized materials, precise engineering, and a substantial amount of research and development for designs that are branched, fenestrated, or patient-specific. Standardized, surgical grafts maintain a balance between durability, demonstrated clinical results, and cost-effectiveness.

Market factors, including supply chain concerns, legal compliance, and the cost of advanced manufacturing techniques, significantly influence price levels. In healthcare settings, procurement strategies and perceived value are influenced by clinical demand patterns, procedural volumes, and the rate at which minimally invasive techniques are adopted.

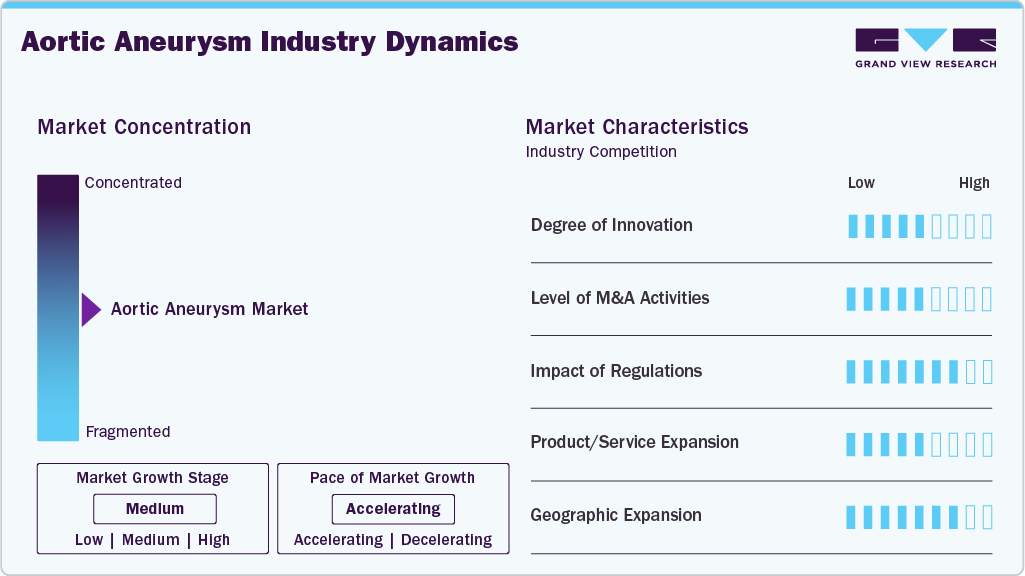

Market Concentration & Characteristics

The degree of innovation in the aortic aneurysm market is medium. Advances focus on fenestrated and branched grafts, improved sealing technologies, and imaging integration that expand eligibility and reduce complications. Progress is steady and impactful, but less disruptive compared to faster-evolving device markets. Companies prioritize customization and durability to enhance the long-term performance of their devices. Clinical results and not drastic changes serve as a framework for innovation. In September 2024, The FDA approved UC Davis Health's minimally invasive endovascular technique for treating complex thoracoabdominal aortic aneurysms, providing patients with an approach that is safer than open abdominal and chest surgery.

Mergers and acquisitions in the aortic aneurysm industry are at a moderate level. Targeted acquisitions of specialized graft developers or imaging solution providers, as compared to extensive consolidation, drive mergers in this industry. Without significantly altering the market structure, these agreements boost product portfolios and geographic presence. Buyers seek to integrate adjacent technologies to enhance procedural ecosystems. The trend reflects strategic selectivity instead of broad consolidation.

The impact of regulations on the market is high. Regulatory compliance is a key factor in determining product development timelines and commercial success as it involves stringent approval requirements, long-term durability data, and extensive post-market surveillance. Regulatory obstacles increase R&D and time-to-market expenses. Manufacturers must constantly adapt to new guidelines.

Product expansion within the aortic aneurysm market is medium. Companies are expanding their offerings with solutions for abdominal, thoracic, and complex anatomies, while also incorporating adjunctive tools for access and sealing. Expansion is steady, driven by clinical need, but less aggressive than in other cardiovascular segments. Differentiation relies on incremental upgrades to existing graft platforms. Portfolio breadth is now a competitive necessity rather than an optional strategy.

Regional expansion in the market is high. North America and Europe remain dominant, but manufacturers are rapidly expanding into the Asia-Pacific and Latin America regions, where rising healthcare investment and awareness are driving the adoption of screening and treatment solutions. Market penetration is supported by improved hospital infrastructure and training initiatives. Expansion into emerging economies offsets slower growth in mature regions.

Type Insights

The abdominal aortic aneurysm segment dominated the aortic aneurysm industry, with the largest revenue share of 63.28% in 2025. This dominance is driven by the higher prevalence of AAA compared to thoracic cases, widespread adoption of screening programs in older male populations, and well-established use of endovascular aneurysm repair as the standard of care. Strong diagnostic uptake and mature treatment infrastructure continue to anchor AAA as the largest revenue contributor. In July 2025, the Journal of Clinical Medicine published the Triple-A Barcelona Study (TABS), reporting that abdominal aortic aneurysms with baseline diameters ≥50 mm grew on average 4.12 mm/year, while those 30-40 mm expanded 0.78 mm/year, highlighting growth variability and factors influencing aneurysm progression in the Spanish population.

The thoracic aortic aneurysm (TAA) segment is anticipated to grow at the fastest CAGR over the forecast period. The surge is supported by increasing recognition of thoracic disease in high-risk patients, coupled with advancements in thoracic endovascular aneurysm repair (TEVAR) that expand treatment eligibility to more complex anatomies. Rising adoption of minimally invasive solutions and improving imaging capabilities are enabling earlier intervention, positioning TAA as the most dynamic growth area in the market. In April 2025, Gore & Associates gained FDA approval for four new large-diameter tapered configurations of its Gore TAG Conformable Thoracic Stent Graft with Active Control system. The expanded sizing options are intended to better accommodate diverse aortic anatomies, especially in patients with restricted true lumen dimensions.

Treatment Insights

The endovascular aneurysm repair segment dominated the aortic aneurysm market, with the largest revenue share of 54.73% in 2025. The widespread use of minimally invasive procedures, their demonstrated safety and effectiveness profiles, and their quicker recovery times are among the primary factors driving this dominance. In addition to its established device infrastructure and high level of clinical familiarity, EVAR is the recommended treatment option for the majority of abdominal and thoracic aneurysms. In August 2025, Cook Medical completed enrollment in the pivotal clinical study of its Zenith Fenestrated+ endovascular graft (ZFEN+) for complex abdominal aortic aneurysms, assessing safety and effectiveness in patients with involvement of one or more visceral arteries.

The fenestrated endovascular aneurysm repair (FEVAR) segment is anticipated to grow at the fastest CAGR over the forecast period. Developments in fenestrated graft designs, which made it possible to treat intricate branch vessel aneurysms that were previously difficult to treat with conventional EVAR, are driving growth. Expanding patient eligibility, enhanced imaging guidance, and growing physician expertise are driving higher adoption rates for FEVAR procedures. In November 2024, Bentley InnoMed received CE certification for its BeFlared, the first dedicated bridging stent for complex FEVAR procedures, and expanded indications for the BeGraft stent.

Product Insights

The aortic stent grafts segment dominated the aortic aneurysm industry with the largest revenue share of 80.09% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. The demand for this sector is driven by continued design improvements, the increasing adoption of minimally invasive treatments, and the growing use of EVAR procedures for the abdomen and thorax. Their strong market positions are strengthened by enhanced durability, enhanced closure mechanisms, and alignment with complex anatomy. In September 2023, MicroPort's Endovastec expanded its endovascular aortic intervention product line with FDA clearance in Thailand for its Castor Branched, Minos Abdominal, and Hercules LP Stent-Graft System.

The aortic repair accessory devices segment is anticipated to grow at the significant CAGR over the forecast period. The growing demand for complementary devices that improve procedural efficiency and results, such as delivery systems and sealing technologies, is driving this market. The need for these supplementary devices is also being driven by the growing number of complex endovascular repairs and the expansion of procedural volumes in various geographical areas. In June 2024, Medtronic launched the Steerant Aortic Guidewire for EVAR and TEVAR procedures, featuring a flexible tip and stiff body for precise catheter placement.

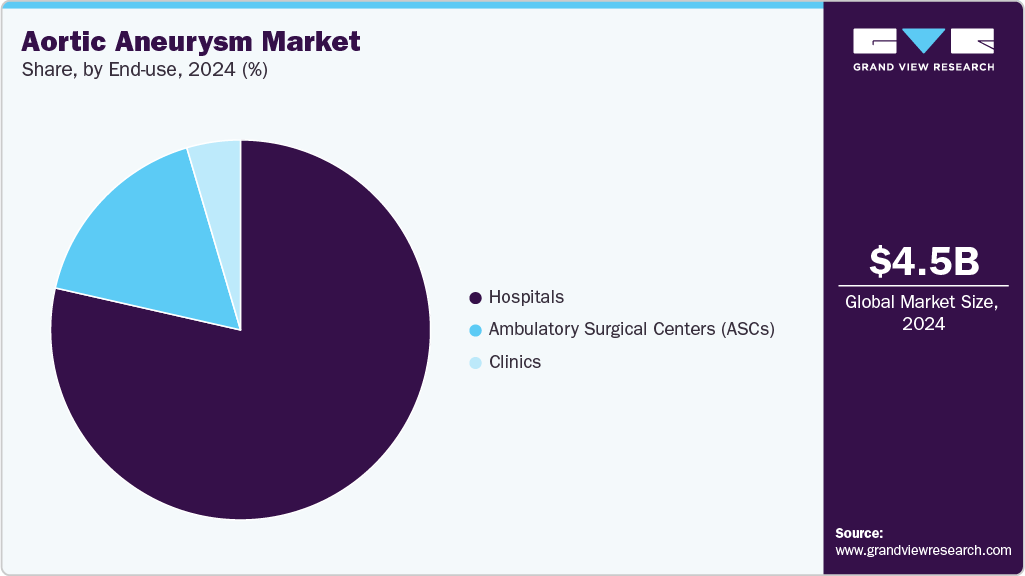

End Use Insights

The hospitals segment dominated the aortic aneurysm market, with a revenue share of 78.48% in 2025. This is attributed to hospitals having modern facilities, skilled surgical teams, and full support for patients from diagnosis through recovery. Hospitals remain the preferred setting for complex aneurysm repairs, including both EVAR and open surgical procedures, ensuring higher procedural volumes and revenue generation. In August 2025, UVA Health introduced Virginia’s first surgical system for treating thoracoabdominal aortic aneurysms, offering a minimally invasive surgical GPS that speeds recovery and enhances safety. The system positions UVA among the few U.S. centers delivering this advanced aortic care.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest rate during the forecast period. Growth is supported by the increasing shift toward minimally invasive endovascular procedures that can be safely performed in outpatient settings. Cost efficiency, shorter patient stays, and growing acceptance of EVAR and FEVAR procedures in ASCs are driving rapid adoption and expanding market presence. In July 2023, Adventist HealthCare opened a new Ambulatory Surgery Center offering multi-specialty outpatient care, including minimally invasive procedures for vascular conditions such as aortic aneurysms.

Regional Insights

North America dominated the aortic aneurysm market with a revenue share of 46.04% in 2025. This dominance is supported by advanced healthcare infrastructure, high awareness and screening rates, and wide spread adoption of minimally invasive aneurysm repair procedures. In March 2024, UC Davis Health initiated a first-of-its-kind clinical trial in Northern California to treat complex aortic aneurysms using physician-modified endovascular devices (PMEGs) under an FDA Investigational Device Exemption. The trial evaluates minimally invasive customized grafts for thoracoabdominal, paravisceral, and pararenal aneurysms, aiming to improve outcomes for patients ineligible for open surgery.

U.S. Aortic Aneurysm Market Trends

The U.S. aortic aneurysm industry dominated North America in 2025. It is driven by well-established endovascular treatment options, extensive hospital networks, and ongoing clinical research that supports procedural innovation and improved patient outcomes. In May 2023, a U.S.-approved low-profile device for TAAs, Terumo Aortic, demonstrated the RELAY Pro Thoracic Stent-Graft, which provides size selections, precision, and long-term reliability for successful TEVAR in smaller access vessels.

Europe Aortic Aneurysm Market Trends

The aortic aneurysm industry in Europe is expected to grow significantly over the forecast period. The increasing geriatric population, expanding adoption of endovascular solutions, and government-led screening programs are expected to drive market expansion across the region. In February 2025, Shape Memory Medical began enrolling European patients in the AAA-SHAPE pivotal trial at Elisabeth TweeSteden Hospital in the Netherlands, evaluating the Impede-FX RapidFill device to enhance post-EVAR aneurysm outcomes, as 60% of aneurysms either fail to shrink or continue expanding within a year after EVAR.

The UK aortic aneurysm market is expected to grow significantly during the forecast period, supported by national screening initiatives, rising awareness among high-risk populations, and growing investment in advanced aneurysm repair technologies. In October 2024, the NHS AAA screening programme covered 331,000 eligible men, screened 271,000, detected 2,004 aneurysms (810 needing intervention), and placed 15,300 under surveillance.

The aortic aneurysm market in Germany is expected to witness growth over the forecast period. Growth is supported by widespread adoption of advanced endovascular repair procedures and a strong healthcare infrastructure that facilitates early diagnosis and treatment. In July 2022, the durability and efficacy of Bentley InnoMed's BeGraft peripheral balloon-expandable covered stent for treating intricate aortic aneurysms via FEVAR were evaluated after the organization completed the registration of 100 research participants in Germany for the BGP Stent as a Bridging Stent in FEVAR trial.

Asia Pacific Aortic Aneurysm Market Trends

The Asia Pacific aortic aneurysm industry is expected to register the fastest growth rate over the forecast period. The region's growth is supported by increased healthcare investment and a rise in cardiovascular risk factors. The adoption of advanced endovascular technologies is also contributing to market expansion. In August 2024, Terumo India launched the TREO Abdominal Stent-Graft, an EVAR device for infrarenal aneurysms featuring adjustable limbs, strong sealing, and secure fixation, aiming for better outcomes.

The China aortic aneurysm market is anticipated to register considerable growth during the forecast period. Enhanced diagnostic capabilities, growing adoption of EVAR and FEVAR procedures, and increasing patient awareness are key contributors to market growth. In July 2025, MicroPort Endovastec performed the first commercial implantations of its Cratos Branched Aortic Stent Graft in Shanghai, China, successfully treating two patients with complex thoracic aortic conditions and achieving full lesion exclusion with no endoleaks.

The aortic aneurysm market in Japan is expected to witness rapid growth. A large aging population, well-developed healthcare infrastructure, and increasing adoption of minimally invasive aneurysm repair techniques are driving expansion. In March 2025, W. L. Gore & Associates completed the first human implantation in Japan of its new large-diameter tapered TAG Conformable Thoracic Stent Graft with ACTIVE CONTROL System, offering expanded options for treating descending thoracic aortic aneurysms and dissections.

Latin America Aortic Aneurysm Market Trends

The Latin America aortic aneurysm industry is anticipated to witness considerable growth over the forecast period. Rising healthcare expenditure, improving hospital infrastructure, and growing awareness of aneurysm risk among older populations are key factors. In June 2022, the World Journal of Surgery published a study of 13,506 AAA repairs performed in Brazil between 2008 and 2019. Endovascular and elective repairs were increasingly common and associated with lower in-hospital mortality. Specifically, for ruptured AAA, mortality rates were 13.8% for endovascular versus 52.1% for open repair, and for intact AAA, mortality rates were 3.8% versus 18.6%, respectively.

Brazil aortic aneurysm market is anticipated to register considerable growth during the forecast period. Greater access to endovascular treatments, increasing prevalence of cardiovascular risk factors, and supportive healthcare initiatives are driving market adoption. In October 2023, the Journal of Vascular Brasileiro published updated guidelines from the Brazilian Society of Angiology and Vascular Surgery on abdominal aortic aneurysms, offering evidence-based recommendations on diagnosis, treatment, and follow-up. The guidelines note that ruptured AAAs caused around 38,000 deaths in Brazil, representing 55 percent of all aortic aneurysm-related mortality.

Middle East & Africa Aortic Aneurysm Market Trends

The Middle East and Africa aortic aneurysm industry is anticipated to witness considerable growth over the forecast period. Improving healthcare infrastructure, the rising availability of advanced treatment options, and increased investment in cardiovascular care are all contributing to market growth. In April 2022, this was the first time an abdominal aortic aneurysm was successfully treated in Kuwait by Mubarak Al-Kabeer Hospital using internal ultrasound and not intravenous dye.

Saudi Arabia aortic aneurysm market is anticipated to register considerable growth during the forecast period. Government healthcare initiatives, enhanced patient awareness, and expanding adoption of endovascular procedures are key drivers of growth in this industry. In October 2024, to be able to minimize trauma and recovery time, King Faisal Specialist Hospital in Riyadh conducted the first branched stent repair of a ruptured abdominal aortic aneurysm in the Middle East.

Key Aortic Aneurysm Company Insights

Key participants in the aortic aneurysm industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, forming partnerships and collaborations, engaging in mergers and acquisitions, and expanding their business footprints.

Key Aortic Aneurysm Companies:

The following are the leading companies in the aortic aneurysm market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- W.L. Gore & Associates, Inc.

- Cook

- MicroPort Scientific Corporation

- Boston Scientific Corporation

- Artivion Inc.

- Cardiatis

- Endologix Inc.

- Braile Biomédica

- Lombard Medical

- INVAMED

Recent Developments

-

In July 2025, W. L. Gore & Associates, Inc. received CE Mark approval for its lower-profile GORE VIABAHN VBX Balloon Expandable Endoprosthesis, now compatible with a 6 Fr sheath. The device is approved as a bridging stent for FEVAR and BEVAR procedures.

-

In June 2025, Vivasure Medical received the approval for its PerQseal Elite, a fully bioresorbable, sutureless vascular closure device now approved for both arterial and venous large-bore procedures. The system enables streamlined, complication-reducing closure during interventions like EVAR, TAVR, TMVR, and TTVR, supporting safer and more efficient minimally invasive cardiovascular procedures in Europe.

-

In April 2025, the VIVA Foundation held a Vascular Leaders Forum in Washington, DC, focusing on EVAR for abdominal and thoracoabdominal aortic aneurysms, with discussions on new devices, regulatory challenges, and AI in surveillance. The forum highlighted issues such as terminology for endoleaks, the distinction between off-the-shelf and custom devices, and the standardization of outcome metrics across centers.

-

In July 2024, Endoron Medical secured USD 10 million in Series A funding to advance its catheter-based Aortoseal EndoStapling device for minimally invasive abdominal aortic aneurysm repair. The funding, led by Sofinnova Partners with support from the European Innovation Council, will enable early feasibility studies under an IDE to progress clinical development and expand access in Europe.

Aortic Aneurysm Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.61 billion

Revenue forecast in 2033

USD 12.87 billion

Growth rate

CAGR of 12.59% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; W.L. Gore & Associates, Inc.; Cook; MicroPort Scientific Corporation; Boston Scientific Corporation; Artivion Inc.; Cardiatis; Endologix Inc.; Braile Biomédica; Lombard Medical; INVAMED

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aortic Aneurysm Market Report Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global aortic aneurysm market report based on type, treatment, product, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Thoracic Aortic Aneurysm (TAA)

-

Abdominal Aortic Aneurysm (AAA)

-

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Open Surgical Repair (OSR)

-

Endovascular Aneurysm Repair (EVAR)

-

Thoracic Endovascular Aneurysm Repair (TEVAR)

-

Fenestrated Endovascular Aneurysm Repair (FEVAR)

-

Branched Endovascular Aneurysm Repair (BEVAR)

-

Hybrid procedures

-

-

Product Outlook (Unit Volume, Units; Average Selling Price, USD; Revenue, USD Million, 2021 - 2033)

-

Aortic Stent Grafts

-

Bifurcated Stent Grafts (Standard EVAR)

-

Straight Stent Grafts (Standard TEVAR)

-

Fenestrated Stent Grafts (FEVAR)

-

Branched Stent Grafts (BEVAR)

-

Hybrid Stent Grafts

-

-

Aortic Surgical Grafts

-

Aortic Repair Accessory Devices

-

Guidewires

-

Diagnostic Catheters

-

Sheaths

-

Guiding Catheters

-

Molding Balloons

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgery Centers (ASC)

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aortic aneurysm devices market is expected to grow at a compound annual growth rate of 12.59% from 2026 to 2033 to reach USD 12.87 billion by 2033.

b. North America dominated the aortic aneurysm market with a revenue share of 46.04% in 2025. This is attributable to strategic presence of prominent players, rapid adoption of latest technology, and favorable reimbursement coverage

b. Some key players operating in the aortic aneurysm market include Medtronic; W.L. Gore & Associates, Inc.; Cook; MicroPort Scientific Corporation; Boston Scientific Corporation; Artivion Inc.; Cardiatis; Endologix Inc.; Braile Biomédica; Lombard Medical; INVAMED

b. Key factors that are driving the market growth include a rising geriatric population (aged 65 & above) with weakened aortic walls, a growing number of chain smokers, and increasing adoption of minimally invasive endovascular procedures

b. The global aortic aneurysm devices market size was estimated at USD 5.04 billion in 2025 and is expected to reach USD 5.61 billion in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.