- Home

- »

- Next Generation Technologies

- »

-

Applicant Tracking System Market Size & Share Report, 2030GVR Report cover

![Applicant Tracking System Market Size, Share & Trends Report]()

Applicant Tracking System Market (2022 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-premise, Cloud), By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-955-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Applicant Tracking System Market Summary

The global applicant tracking system market size was estimated at USD 2.14 billion in 2021 and is anticipated to reach USD 3.71 billion by 2030, growing at a CAGR of 6.2% from 2022 to 2030. An applicant tracking system collects and stores candidates' resumes in its database to manage a company's recruitment and hiring process.

Key Market Trends & Insights

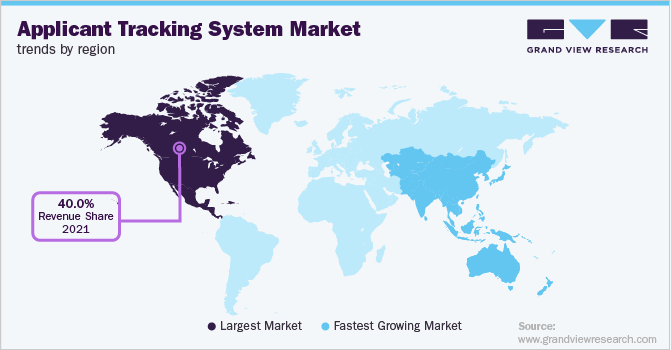

- North America dominated the market for applicant tracking systems in 2021 and accounted for a revenue share of over 40%.

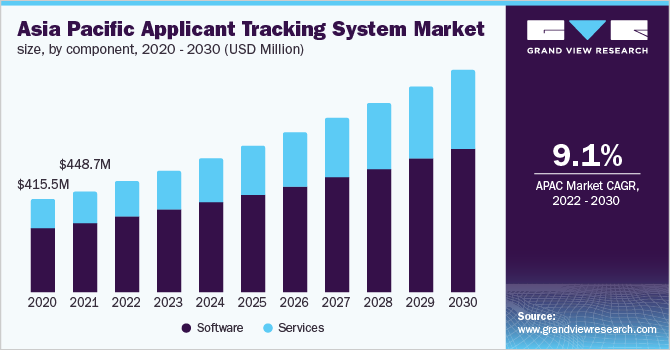

- Asia Pacific is expected to grow at the fastest CAGR of 9.1% over the forecast period.

- By deployment, the on-premises segment dominated the Applicant Tracking System (ATS) market in 2021 and accounted for a revenue share of over 60%.

- By organization size, the large enterprise segment dominated the market in 2021 and accounted for a revenue share of over 71%.

- By component, the software segment dominated the market in 2021 and accounted for a revenue share of over 67%.

Market Size & Forecast

- 2021 Market Size: USD 2.14 Billion

- 2030 Projected Market Size: USD 3.71 Billion

- CAGR (2022-2030): 6.2%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

After indexing and scanning, the system saves resumes in a database and gives recruiters an online glimpse of job seekers. Companies use ATS to hire employees more efficiently, post job openings on a job board or website, review resumes, and e-mail interview invitations to qualified applicants. The system is becoming increasingly popular among governments and corporations, owing to automation in recruiting. ATS automates screening and job application posting of applicants through various job boards; it reduces manual errors and bias by using natural language processing and data mining. The convergence of different technology in applicant tracking system market trends has enabled software to become commercially available. These trends include adopting Artificial Intelligence (AI) and cloud-based computing.

For instance, in March 2022, Modern Hire., a hiring platform for pre-hire assessments, video interviewing, and an applicant tracking software provider, launched an AI-driven Automated Interview Creator (AIC). The platform would help recruiters and HR enhance their relevancy and accuracy in their work. Further, this latest technology would help recruiters hire ethically and make the interview process engaging for candidates.

Large enterprises are opting for acquiring, collaborating, and partnering with ATS providers to enable secure data and support the movement from one system to another. For instance, in October 2021, Infinite Computer Solutions Limited, a business technology service provider, acquired the International Business Machines Corporation talent acquisition suite, a software for recruitment and onboarding candidates. This acquisition would benefit Infinite Computer Solutions Limited to offer their customer base a SaaS-based platform to source and attract top talent candidates and optimize the end-to-end hiring process.

Besides, in May 2022, Talroo, Inc., an ATS platform that helps companies hire their essential workforces, partnered with JobSync LLC., a recruitment platform provider. The partnership would let Talroo, Inc. easily insert complete applications in the ATS, convert candidates, and allow employers to obtain several quick applications. Further, the candidates would easily apply for jobs they want, and the recruiters can also revert quickly to their applications, thus enhancing the experience for everyone.

Large organizations are deploying ATS and expanding their businesses through applicants and job openings, identifying specific abilities and skills that correspond with their aims and values. These enterprises require a support structure to help them with the employment process, and an ATS can make it simple to receive, store, and handle applications. For instance, in April 2022, G/O Media Inc., a U.S.-based media holding company, stated that 75% of recruiters use ATS for the hiring process, and 99% of large enterprises also use ATS to stand out from the rest of the job applicants, allowing the resume to pass through the ATS and into the hands of a human recruiter.

Besides, in May 2022, HireLogic, an AI-powered hiring software platform provider, raised USD 4 million in seed funding to scale its business in the recruitment platform capabilities. The company would include an applicant tracking system and video conferencing platforms, which would benefit large enterprises to run structured interviews, data-driven hiring decisions, and rank candidate resumes.

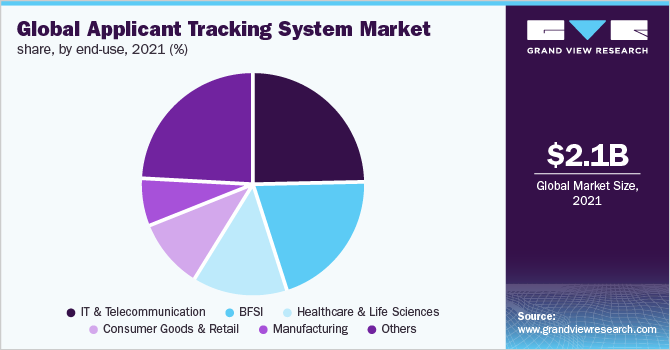

The market growth can be attributed to software used in various industries, such as BFSI, manufacturing, telecom & information technology, consumer goods & retail, healthcare & life sciences, energy & utilities, transportation & logistics, and others. The increased demand for automation in various industries is the key factor driving the need for ATS. It can reduce labor and increase the chances of hiring talented employees. It is challenging for a recruiter to manually maintain records of all the applicants in spreadsheets. Still, with the help of ATS, it can quickly process applications through a large amount of data with a combination of database apps and workflow software.

For instance, in December 2021, SmartSearch, an applicant tracking system software provider, partnered with JobRobotix, a data automation software technology company, to optimize recruitment. This partnership would benefit the customers of SmartSearch to utilize the automated platform and replace manual data entry, and hours spent on administration tasks would be reduced. Further, it would let users enhance their ability to recruit smarter and faster, eliminate redundant data entry, and improve recruitment ROI.

Deployment Insights

The on-premises segment dominated the Applicant Tracking System (ATS) market in 2021 and accounted for a revenue share of over 60%. The need to deploy low-cost ATS for on-premises infrastructures drives the market's development, including software infrastructure, deployment permit communication, and maintenance within the corporate sector.

For instance, in February 2022, Crelate, a recruitment software provider, announced the updated version of their on-premises platform, crelate omni with a vendor management system (VMS) to allow staffing professionals and recruiters to improve their overall recruitment process. With the help of the updated feature in the software, one can spend less time updating records manually and focusing on candidates

The cloud segment is expected to foresee significant growth in the forthcoming years, attributed to the enhanced integration capability with the cloud's assistance, enabling ATS to be modified and evolved. Furthermore, functionalities can now be added, more tasks can be achieved, and multiple communication channels can be streamlined with the help of the cloud. With the combination of cloud services, ATS allows the work to be continued with the help of an active internet connection and a computation device.

The use of the cloud service benefits the users to retrieve and access information anytime and anywhere. For instance, in April 2022, Oracle, a recruitment platform provider for hiring management, launched oracle ME (my experience), a cloud HCM suite to help recruiters or HR easily hire candidates. The platform is made for HR and hiring managers to quickly make changes and access candidates' details without requiring help from the IT team.

Organization Size Insights

The large enterprise segment dominated the market in 2021 and accounted for a revenue share of over 71%. Large enterprises have a huge number of job openings and hiring stress, requiring a support system to lower their hiring pressure; hence, the ATS solutions make processing, receiving, and storing applications easy. These solutions keep hiring staff up-to-date with applicable laws and support compliance across multiple countries.

The ATS easily automates recruitment by organizing and tracking candidates in one database. For instance, in December 2021, Onboard IQ (Fountain) launched a fully automated ATS process of instant interview and instant hire for large enterprises. The solution would let organizations create a dynamic and fast application journey, removing barriers for hourly hiring employees. The instant interview and instant hire would benefit enterprises by reducing application costs, improving applicant experience, and saving time.

The Small Medium Enterprises (SME) segment acquired a significant market share in 2021. The SMEs look to reduce costs and avoid operating on a large budget, saving money and time. It also improves the communication between candidates and hiring managers and performs tasks efficiently which can't be done effectively with manual systems. For instance, in October 2021, Trakstar, a cloud-based hiring platform, stated that in small and medium enterprises with less than 100 employees, 60% have planned to invest in ATS software to benefit HR or the recruitment team from the technology and save money and time.

Component Insights

The software segment dominated the market in 2021 and accounted for a revenue share of over 67%. The growth can be attributed to the ATS software's ability to be customized and meet the need of End-uses. The software collects and store resumes in its database for recruiters to access quickly. Although the software is tailored for businesses, ATS allows organizations to modify it to the demands of its end-use.

For instance, in April 2021, iCIMS, a cloud-based recruiting software platform, announced its partnership with UKG Inc, a U.S.-based recruiting company. The partnership would let iCIMS improve accuracy & data quality, store employee data, make faster decisions, and simplify the process of internal mobility. The company's ATS software would let the hiring managers and recruiters send new hires insights, automatically synchronizing the employee data to optimize the re-hire, new engagement, and transfer workflows.

The service segment is anticipated to witness significant growth over the forecast period. Services include training, support & maintenance, consulting, integration & implementation, which are used at different stages from pre-sales to post-sales task execution, thus assisting clients in achieving maximum ROI. Services are essential in imparting training, handling and maintaining the software, and deploying the solution onboard.

The ATS services help resume tracking, deal with candidate sourcing, and onboard the selected candidates. For instance, in March 2022, Onboard IQ (Fountain), a hiring platform, announced the launch of the fountain source applicant tracking system, a full suite of sourcing products to help organizations in easy candidate sourcing and resume tracking. Further, it would optimize and automate their sourcing and let the organizations solve the problem of high-volume hiring.

End-use Insights

The IT & telecommunications segment dominated the market in 2021 and accounted for a revenue share of over 24.0%. The high strength of candidates and increased demand for talent across the globe are driving the segment's growth. The employment opportunities in IT & telecommunication are growing due to the continuous need for skilled and qualified candidates and fast-changing technologies. To meet the growing employment demand, IT & telecommunication solution providers are deploying ATS software to fill the skill gap.

The BFSI segment is presumed to grab a significant share over the forecast period accounting for a revenue share of over 20.2% in 2021. The growth can be attributed to an increase in competition and cutting down expenses to increase the profits for the business. For instance, in May 2021, Asian Development Bank, a regional bank located in Manila, Philippines, stated that after the covid-19 pandemic, finance industries are shifting toward digital recruitment using ATS software. The countries like India and China are growing by 10% and 8% respectively. The heightened customer expectations and increased competition significantly impact the growth.

The consumer goods and retail segment is expected to grow at the fastest CAGR of 8.5% from 2022 to 2030. The development is anticipated due to growing employment opportunities, technological changes, and customer needs. Retailers need to gain control and complete visibility over the mixed workforce's recruitment process, including field service providers and in-store employees, which are challenging to attract manually in a few regions. Due to this challenge, consumer goods and retail segments shift towards ATS.

The healthcare and life sciences segment is expected to showcase significant CAGR over the forecast period. The high growth can be attributed to ease in hiring without reviewing each candidate and keeping people's operations organized without wasting hours manually reviewing the resumes. For instance, in May 2022, Trinity Health, a non-profit healthcare system, adopted iCIMS, a cloud-based recruiting platform that helped hire professionals easily without wasting hours reviewing their resumes.

Further adopting the iCIMS ATS tool helped Trinity Health's HR team get all their work done in one platform, including pulling certifications and licenses, uploading documents, and creating badge photos. It also benefitted the new hires as it helped them complete the training and the assigned tasks efficiently.

Regional Insights

North America dominated the market for applicant tracking systems in 2021 and accounted for a revenue share of over 40%. Developed countries like Canada and the U.S. drive the market's growth. With the increased adoption of digital strategies, North America is moving towards upgraded and new technologies. It also invests more in advanced technologies to enhance operations and gain a competitive advantage.

For instance, in March 2022, iCIMS, a U.S.-based recruiting software company, acquired Candidate.ID provides an applicant tracking system to let clients better qualify and know their talent with lead scoring. Further, this acquisition would allow iCIMS to expand its customer base and scale its business in the U.S. with ATS offerings.

Asia Pacific is expected to grow at the fastest CAGR of 9.1% over the forecast period. The increase in partnerships and digitalization by enterprises is driving the regional market growth. Significant growth in business with the U.S.in the past decade has led to the high adoption of ATS software in the region. The rising impact of economic importance has directly impacted the growth of ATS in the region.

For instance, in May 2022, Viventis, a human capital consulting firm in Asia, announced its partnership with LiveHire Limited, an ATS software provider and a recruitment firm. The partnership aims to transform the acquisition strategy for Viventis and reinforce its business in the region. Further, it would help the company improve its recruitment offerings and services portfolio and build an insight-driven and robust relationship with the clients.

Key Companies & Market Share Insights

Key players pursue product development and strategic alliances to extend their product portfolios and achieve a strong foothold in the global market. To expand their offers in the market, ATS solution suppliers have used various inorganic and organic growth tactics, such as product upgrades, new product launches, agreements and partnerships, business expansions, and mergers and acquisitions.

Increasing collaborations and mergers & acquisitions are expected to maximize the environmental and economic benefits for the market players by enabling them to share ideas and enhance their technologies and internal skills. For instance, in March 2022, Cornerstone, a recruiting software company, acquired EdCast, a SaaS platform provider for career mobility, learning, and skilling employees. The acquisition would grow the company's presence in the market as leading talent management in the SaaS platform, further scaling its business and increasing its customer base. Some prominent players in the global Applicant Tracking System (ATS) market include:

-

International Business Machines Corporation (IBM)

-

iCIMS

-

Oracle

-

PeopleFluent

-

Cornerstone

-

Workday

-

Bullhorn, Inc.

-

UKG Inc.

-

ADP, Inc

-

SAP

Applicant Tracking System Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.29 billion

Revenue forecast in 2030

USD 3.71 billion

Growth Rate

CAGR of 6.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

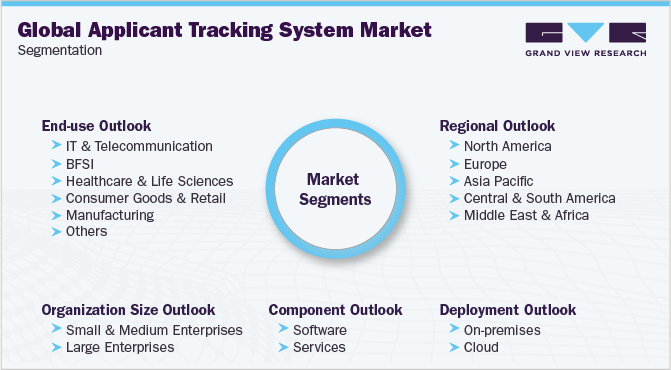

Segments covered

Component, deployment, organization size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Brazil

Key companies profiled

International Business Machines Corporation (IBM); iCIMS; Oracle; PeopleFluent; Cornerstone; Workday; Bullhorn, Inc.; UKG Inc.; ADP, Inc.; SAP

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Applicant Tracking System Market Segmentation

This report provides forecasts for revenue growth at the global, regional, and country levels and an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Applicant Tracking System (ATS) market report based on component, deployment, organization size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

Training, Support & Maintenance

-

Integration & Implementation

-

Consulting

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

IT & Telecommunication

-

BFSI

-

Healthcare & Life Sciences

-

Consumer Goods & Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global applicant tracking system market size was estimated at USD 2.14 billion in 2021 and is expected to reach USD 2.29 billion in 2022

b. The global applicant tracking system market is expected to grow at a compound annual growth rate of 6.2% from 2022 to 2030 to reach USD 3.71 billion by 2030.

b. North America dominated the applicant tracking system market with a share of 40.3% in 2021. This is attributable with the increased adoption of digital strategies, by developed countries like Canada and U.S.

b. Some key players operating in the applicant tracking system market include International Business Machines Corporation (IBM), iCIMS, Oracle, PeopleFluent, Cornerstone, Workday, Bullhorn, Inc., UKG Inc., ADP, Inc, and SAP.

b. Key factors that are driving the applicant tracking system market growth include growing need for improved candidate experience through a dedicated process and demand for automation in the recruitment and hiring process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.