- Home

- »

- Biotechnology

- »

-

Aptamers Market Size, Share & Trends Analysis Report 2030GVR Report cover

![Aptamers Market Size, Share & Trends Report]()

Aptamers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Nucleic Acid, Peptide), By Application (Diagnostics, Therapeutics, Research & Developments, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-483-3

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aptamers Market Summary

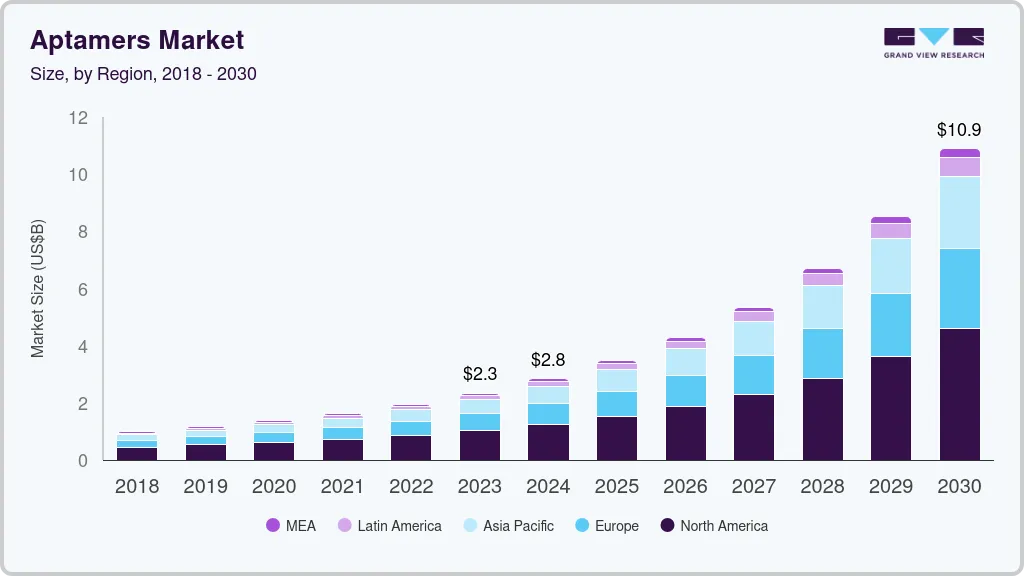

The global aptamers market size was estimated at USD 2.34 billion in 2023 and is projected to reach USD 10.88 billion by 2030, growing at a CAGR of 24.5% from 2024 to 2030. Recent advancements in the generation, purification, and drug delivery for killing target cells have attracted the attention of many researchers towards aptamers due to the competitive advantages associated with them.

Key Market Trends & Insights

- North America dominated the global aptamers market with the largest revenue share of 44.48% in 2022.

- By type, the nucleic acid segment accounted for the largest revenue share of over 78.19% in 2022.

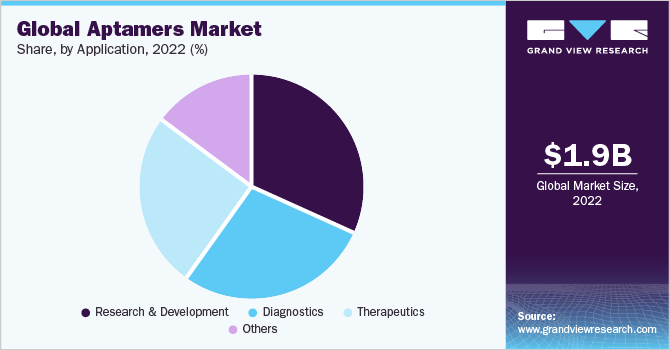

- By application, the research & development segment held the dominant position in the market and accounted for the leading revenue share of 31.38% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 2.34 Billion

- 2030 Projected Market Size: USD 10.88 Billion

- CAGR (2024-2030): 24.5%

- North America: Largest market in 2022

Some of the advantages include small molecular size, low immunogenicity, low cost of manufacturing, and lesser side effects compared to antibodies; may fuel the R&D of novel aptamers, thereby driving market growth. Despite significant efforts, there are currently no highly effective treatments available against COVID-19 infections due to a large number of genetic mutations. However, biotechnological approaches appear to be promising in the treatment of COVID-19.Consequently, nucleic-acid based aptamers & peptide aptamers might be effective against treating COVID-19 infection. Thus, various initiatives are being undertaken by the government to boost the R&D of novel treatment for COVID-19. For instance, in September 2020, the Department of Community & Economic Development awarded a contract of USD 320,000 to Aptagen LLC for the research and development of novel treatment for the COVID-19.

The aptamers based diagnostic kits and assays developed by using SELEX technology have the ability to develop high-affinity neutralizers and bioprobes for monitoring SARS-COV-2 & COVID-19 biomarkers. Therefore, the introduction of diagnostic kits in the market for disease diagnosis is projected to drive market growth. For instance, in December 2021, Achiko AG received approval from the Ministry of Health of the Republic of Indonesia for Aptamex, a COVID-19 diagnostic kit. Aptamex is a second-generation diagnostic kit developed by using DNA aptamer-based technology that is a cost-effective, chemically synthesized, and emerging diagnostic kit for healthcare.

Aptamers based diagnostic products are the preferred choice among diagnostic and pathology labs for the diagnosis of disease at the cellular level due to their small size, high specificity, selectivity, and efficacy. Thus, increasing the prevalence of diseases such as cancer, CVD, and AMD may increase the footfall of patients in labs for the diagnosis of these diseases, consequently, increasing demand for aptamer based diagnostic products. According to Cancer Research UK estimates, around 27.5 million people are expected to be diagnosed with cancer by 2040.

In March 2022, SomaLogic announced the initiation of assaying samples using SomaScan Assay for the European Prospective Investigation into Cancer and Nutrition (EPIC) study by analyzing 210 million protein measurements from 30,000 samples. This will help researchers in predicting cancer by better understanding its nature, which in turn may contribute in market growth by addressing the increased demand

As of now, Macugen developed by Eyetech Pharmaceuticals, Inc., (currently commercialized by Bausch Health Companies Inc.) is only the U.S. FDA approved (2004) therapeutic aptamer available in the market. It is used for the treatment of age-related muscular degeneration disorder (AMD). Technological advancements in research encourage scientists’ attention towards the development of novel aptamer based therapeutic drugs for the treatment of various diseases. Currently, there are a number of products under different clinical trials including Zimura developed by IVERIC Bio, Inc., for the treatment of patients with drug AMD. Thus, expected approval of this drug may boost the growth of the market over the period.

Type Insights

Based on type, aptamers market is segmented into nucleic acid aptamers and peptide aptamers. Nucleic acid segment held the highest market share of 78.19% in 2022 and is expected to witness the highest growth during the forecast period. At present, many companies are investigating the mechanism of action of nucleic acid aptamers for the treatment of various disorders including age related muscular degeneration (AMD). For instance, in June 2021, the U.S. Food and Drug Administration (FDA) granted written agreement under Special Protocol Assessment (SPA) to IVERIC BIO (formerly known as Ophthotech Corporation) for the design of GATHER2 phase 3 clinical trial of Zimura for treatment of patients with GA secondary to AMD. This approval is expected to boost the segment growth.

Peptide aptamer segment is expected to witness lucrative market growth at a CAGR of 22.77% from 2023 to 2030 owing to the large application base for diagnostic and therapeutic purpose. For instance, in August 2021, scientists from the Engineering Center for Microtechnology and Diagnostics developed a novel biosensor for the multiparametric express testing in preclinical diagnostics of cardiovascular disease. Next-generation biochips have been developed for this testing based on the peptide aptamer marker system & molecular recognition. For this, researchers have designed peptide aptamers using data from Data Bank and Protein 3D software. Hence, the introduction of such products in the market may boost utilization of peptide aptamers.

Application Insights

Based on application, the aptamers market is segmented into diagnostics, therapeutics development, research and development, and others. The research & development segment held the highest market share of 31.38% in 2022. The growth of segment is attributed to the rising demand for aptamers coupled with increasing research activities in this field have paved the way for aptamers demand in research and development field. There are various strategic initiatives undertaken by key players like collaborations, partnerships, & agreements for R&D of novel aptamers based diagnostic and therapeutic products. For instance, in June 2021, SomaLogic and Ixaka Ltd entered into a research collaboration with an aim to support the discovery and development of aptamers based bispecific therapeutics. This collaboration evaluates the safety and efficacy of antigen specific SOMAmer reagents. Such an initiative is expected to boost the segment growth.

Therapeutics segment is expected to exhibit lucrative market growth at a CAGR of 26.08% from 2023 to 2030 owing to the ability to design antidotes rationally (which is tough with antibody) and is considered to be the better alternative related to protein therapeutics in terms of synthetic accessibility, size and modification by medicinal chemistry. These all facts collectively help therapeutics segment to build a strong market presence during the future period. However, nuclease resistance is a major threat associated with therapeutic aptamers, which may restrain the segment growth.

Regional Insights

North America region dominated the aptamers market with a share of 44.48% in 2022. The rising prevalence of chronic diseases, strong healthcare infrastructure, and growing interest of research laboratories in aptamer field are some of the major factors for the dominance of the region. Furthermore, in April 2022, Noxxon Pharma announced that it will present top line result data for its NOX-A12 GLORIA trial in brain cancer at the 2022 American Society of Clinical Oncology annual meeting.

Asia Pacific aptamers market is expected to grow at the fastest CAGR of 26.18% during the forecast period. The growth of region is attributable to the approval of new aptamer-based products in the region.For instance, in April 2020, Achiko AG entered into agreement with the Pengurus Wilayah Nahdlatul Ulama DKI, a Jakarta based world's largest Islamic association for marketing & sales of aptamer based COVID-19 diagnostic kit AptameX. This organization has 90 million registered members in Indonesia.

Key Companies & Market Share Insights

Major players are adopting strategies such as modification in the existing product, approval of new products, and mergers & acquisitions for product enhancements and regional expansion to attain a greater market share. For instance, in January 2023, Aptamer Group collaborated with BaseCure Therapeutics for the development of Optimer-targeted therapies. Such initiatives can open new avenues of growth for applications of aptamers in therapeutics. Some of the prominent players in the global aptamers market include:

-

SomaLogic

-

Aptamer Group

-

Aptadel Therapeutics

-

Base Pair Biotechnologies

-

Noxxon Pharma

-

Vivonics Inc.

-

Aptagen, LLC

-

TriLink Biotechnologies

-

Altermune LLC

-

AM Biotechnologies

Aptamers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.84 billion

Revenue forecast in 2030

USD 10.88 billion

Growth rate

CAGR of 24.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2023

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Application, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

SomaLogic; Aptamer Group; Aptadel Therapeutics; Base Pair Biotechnologies; Noxxon Pharma; Vivonics Inc.; Aptagen, LLC; TriLink Biotechnologies; Altermune LLC; AM Biotechnologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aptamers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the market trends in each of the sub-markets from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the aptamers market on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Nucleic Acid Aptamer

-

Peptide Aptamer

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Diagnostics

-

Therapeutics

-

Research & Development

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aptamers market size was estimated at USD 1.94 billion in 2022 and is expected to reach USD 2.34 billion in 2023.

b. The global aptamers market is expected to witness a compound annual growth rate of 24.54% from 2023 to 2030 to reach USD 10.88 billion in 2030.

b. Based on type, the nucleic acid segment held the largest share of 78.19% in 2022, owing to the rising demand for aptamers coupled with increasing initiatives undertaken by the major players in this field.

b. Some key players operating in the aptamers market include SomaLogic; Aptamer Group; Aptadel Therapeutics; Base Pair Biotechnologies; Noxxon Pharma; Vivonics Inc.; Aptagen, LLC; TriLink Biotechnologies; Altermune LLC; AM Biotechnologies

b. Key factors driving the aptamers market growth include high advantage of aptamers compared to antibodies, advancements in the field of aptamer development technologies, growing interest of many companies to invest in aptamers market, and promising pipeline therapeutics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.