- Home

- »

- Homecare & Decor

- »

-

Aqua Gym Equipment Market Size And Share Report, 2030GVR Report cover

![Aqua Gym Equipment Market Size, Share & Trends Report]()

Aqua Gym Equipment Market Size, Share & Trends Analysis Report By Product (Cardiovascular, Strength Training), By Distribution Channel (Online, Specialty Store), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-076-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Aqua Gym Equipment Market Size & Trends

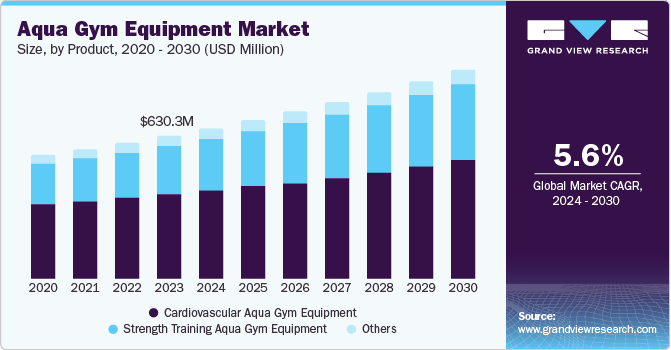

The global aqua gym equipment market size was valued at USD 630.3 million in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. Rapidly increasing awareness among consumers regarding the significance of following health and fitness routines and growing pace of innovative advancements concerning aqua gym equipment have acted as primary factors driving market expansion. Aqua gym equipment manufacturers are striving to address the changing demands of customers, leading to market expansion.

These types of equipment, also called water fitness or aquatic exercise equipment, have become increasingly popular as an efficient method to maintain a fit and active lifestyle. These accessories are made for use in facilities such as swimming pools or other aquatic environments. Aqua gym equipment provides a variety of advantages, including gentle exercises suitable for every fitness level and uses in rehabilitation and physical therapy.

Innovative technologies, such as the use of tracking devices, smart sensors, and digital interfaces, have helped improve the user experience while also broadening the functionalities of aquatic workouts. Furthermore, the increasing demand for aqua gym equipment and accessories is largely fueled by the strong growth of the overall fitness equipment sector. With a sharp rise in focus on health and fitness, people are looking for adaptable and gentle workout choices that prioritize their overall health. Aqua gym equipment, which forms a part of the fitness equipment industry, effectively addresses these changing fitness trends. It provides an opportunity for individuals of every age group and physical ability to participate in beneficial exercise sessions in a comfortable aquatic setting.

In addition, manufacturers are increasingly working with healthcare professionals, rehab facilities, and physical therapists to help incorporate aqua fitness equipment into their treatment plans and therapeutic programs, offering significant avenues for business growth. Promoting water exercises as a useful technique to treat chronic illnesses, recover from injuries, and enhance overall health is expected to heighten interest about these products in the healthcare industry. In this regard, a study published in 2023 in the BMJ Open Sport and Exercise Medicine journal found that people suffering from chronic health conditions stand to benefit from high-intensity interval training routines done in swimming pools. Significantly, the rise of online shopping platforms offers aqua gym equipment companies a chance to connect with a wider group of customers and expand their client base. Manufacturers can boost their reach, focus on specific markets, and provide customized shopping experiences by investing in e-commerce infrastructure.

Product Insights

Cardiovascular aqua gym equipment dominated the market with a revenue share of 59.0% in 2023. Aqua gym equipment designed for cardiovascular exercises help in reducing calories and fats, aiding in faster and more efficient weight loss. In addition, these types of apparatus assist in lowering blood pressure by pushing blood towards the veins, while also strengthening the heart and improving its efficiency in pumping blood. Health experts have further stated that utilizing cardiovascular aqua gym equipment enhances a person's lung capacity, resulting in better respiratory health. Hence, individuals with heart conditions often choose aqua gym equipment, typically based on advice from their doctors.

The strength training aqua gym equipment segment is expected to register the fastest CAGR of 6.7% during the forecast period. Water provides natural resistance to the human body, allowing for effective strength training without putting any strain on joints that is commonly associated with conventional weightlifting techniques. As per an article in the Training & Conditioning magazine, the lack of gravitational forces in water result in a 30-minute workout giving similar results to a 2-hour land-based routine. Aquatic exercises help build lean muscle mass and improve muscle tone, as well as improving muscle endurance that helps in lessening fatigue. In addition, water-based resistance training exercises can improve flexibility and balance of individuals, reducing the risk of falls. Some common exercises included for strength training in water include triceps dips, incline push-ups, heel clicks, and tire runs, among others.

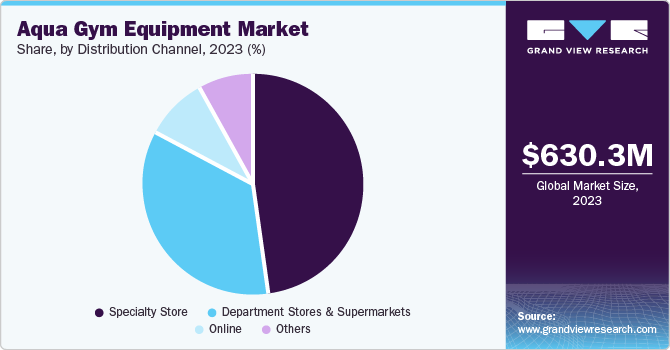

Distribution Channel Insights

In terms of distribution channel, specialty stores accounted for the largest market revenue share of 48.2% in 2023. These stores offer a comprehensive range of aqua gym equipment, ensuring that customers are able to conveniently find products suited to their requirements. In addition, the presence of a professional staff in such outlets helps in imparting proper guidance to customers, as they possess in-depth knowledge regarding how to set up and use aqua gym equipment, their frequency of usage, and benefits for health and fitness. Specialty stores generally provide tailored recommendations and after-sales support, enhancing customer satisfaction. Moreover, they also offer several promotional offers and discounts throughout the year, ensuring a constant footfall of customers.

The online segment is projected to expand at the fastest CAGR of 7.3% over the forecast period. Online platforms showcase a broader selection of aqua gym equipment, compared to physical stores. Moreover, this mode of distribution eliminates geographical limitations, reaching a wider customer base. Customers can easily compare prices across different online platforms, resulting in more knowledgeable product selection without the need to visit stores physically. Online platforms also provide a comprehensive product description, along with their specifications and customer reviews, which helps audiences in making an informed decision. With the high proliferation rate of smartphones globally, manufacturers of such equipment have increased their focus on building a strong online presence to drive sales.

Regional Insights

North America aqua gym equipment market dominated the global market with a revenue share of 40.0% in 2023, as a substantial population in the region has made regular exercising a top priority to maintain a healthy lifestyle. Such a strong awareness regarding fitness has prompted the incorporation of different exercise techniques such as aqua fitness, driving the demand for specific equipment. In addition, the fitness sector in North America has a strong foundation, encompassing a substantial presence of fitness centers, gyms, and aquatic facilities that provide various workout programs and equipment. The existence of well-known fitness centers and water recreation amenities provides a notable opportunity to manufacturers aiming to enter this market. Furthermore, numerous aquatic facilities across this region, such as public pools, community centers, aquatic therapy clinics, and resort spas, are suited to conduct aqua fitness activities, driving market growth.

U.S. Aqua Gym Equipment Market Trends

The U.S. aqua gym equipment market held a substantial share in North America in 2023. The increasing adoption of aqua gym activities and equipment is growing in the country due to health- and fitness-related concerns. Health-conscious individuals in the U.S. are always seeking fresh exercise alternatives. Aqua gym equipment aligns with modern training trends and appeals to fitness enthusiasts seeking new options with diversity and effectiveness. Aqua gym equipment is frequently used in rehabilitation centers and physical therapy clinics across the country to aid patients in their recovery and accelerate this process.

Europe Aqua Gym Equipment Market Trends

The aqua gym equipment market in Europe was identified as a lucrative region, accounting for a revenue share of 27.2% in 2023. An increasing recognition of the significance of physical health and holistic wellness is fueling the need for various exercise choices, such as water-based fitness. Aquatic workouts are known for their advantages in treating major ailments such as arthritis, obesity, and heart conditions. Advancements in aqua gym equipment, such as the emergence of resistance bands, water bikes, and treadmills, are broadening the market's growth in this region.

Germany aqua gym equipment market is expected to advance substantially in the coming years. This is aided by the growing standard of living and an increasing health-conscious population in the country. With increased awareness regarding the therapeutic effects of aquatic exercises, more and more Germans are resorting to aqua gym equipment workouts to achieve fitness results. Improvements in product design and technology have further aided industry growth in the economy. The incorporation of smartphone applications and wearable devices have helped in ensuring a greater customer acceptance for this market in Germany.

Asia Pacific Aqua Gym Equipment Market Trends

The aqua gym equipment market in Asia Pacific is anticipated to witness significant growth in the coming years. This region is particularly famous for wellness tourism, thus witnessing a high influx of travelers needing to take a break and visit wellness resorts. Furthermore, health authorities across Asia Pacific economies are adopting various programs to encourage people to become physically active and move away from sedentary lifestyle practices, thus improving overall fitness levels of the population. Such factors have contributed to a strong market expansion in this region.

India aqua gym equipment market is expected to grow rapidly during the forecast period. Factors such as the rising need for cost-effective and portable equipment and increasing interest in aqua yoga and aqua Pilate sessions have highlighted the requirement for water-based gym accessories. In addition, broadening knowledge regarding the advantages of aquatic workouts for females and kids, along with a heightened emphasis on combating various wellbeing and lifestyle issues, are contributing to this industry’s expansion in India.

Key Aqua Gym Equipment Company Insights

Some key companies in the market include HYDRO-FIT, Hydroworx International, and Acquapole, among others. Organizations are prioritizing expanding their customer base to achieve a competitive advantage in the industry. Consequently, major participants are implementing strategic initiatives such as consolidations and partnerships with other leading firms to drive revenue and overall growth.

-

HYDRO-FIT creates, produces, and sells water-based health and fitness items. The company is involved in the development of products that provide improved floatation and additional durability for aquatic therapy, water aerobics, and water exercises.

-

Hydroworx International, Inc. is involved in the development of pools for aquatic therapies. The company creates and constructs rehab and fitness facilities, swim spas, plunge pools, and underwater treadmill pools for the sports and healthcare industries.

Key Aqua Gym Equipment Companies:

The following are the leading companies in the aqua gym equipment market. These companies collectively hold the largest market share and dictate industry trends.

- PlayCore, Inc.

- AquaJogger

- Acquapole S.a.s.

- TEXAS REC

- HYDRO-FIT, Inc.

- BECO-Beermann GmbH & Co. KG

- Be Aqua Pte. Ltd.

- HydroWorx International, Inc.

- Sprint Aquatics

Recent Developments

-

In December 2022, HydroWorx International introduced the ‘HydroWorx RISE’, a free-standing aquatic therapy solution. The underwater treadmill features a modular design that make it easy to configure in any position, and aims to be used extensively across smaller spaces in physical therapy clinics and schools.

Aqua Gym Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 663.2 million

Revenue forecast in 2030

USD 918.7 million

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Germany, UK, China, India

Key companies profiled

PlayCore, Inc.; AquaJogger; Acquapole S.a.s.; TEXAS REC; HYDRO-FIT, Inc.; BECO-Beermann GmbH & Co. KG; Be Aqua Pte. Ltd.; HydroWorx International, Inc.; Sprint Aquatics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aqua Gym Equipment Market Report Segmentation

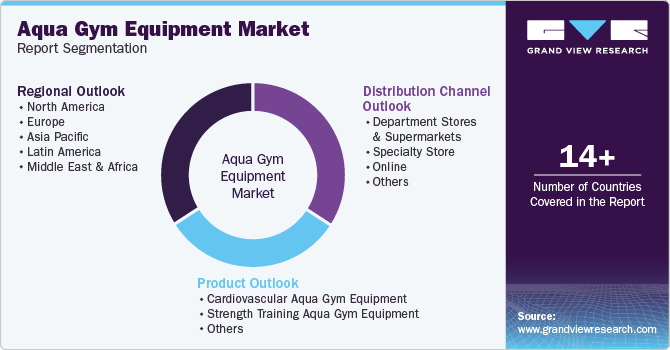

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aqua gym equipment market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Aqua Gym Equipment

-

Strength Training Aqua Gym Equipment

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Department Stores and Supermarkets

-

Specialty Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."