- Home

- »

- Food Additives & Nutricosmetics

- »

-

Arachidonic Acid Market Size, Share & Growth Report, 2030GVR Report cover

![Arachidonic Acid Market Size, Share & Trends Report]()

Arachidonic Acid Market (2022 - 2030) Size, Share & Trends Analysis Report By Form (Solid, Solvent), By Source (Plant, Animal), By Application (Infant Formula, Supplement), By Region (EU, APAC), And Segment Forecasts

- Report ID: GVR-3-68038-000-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global arachidonic acid market size was valued at USD 211.6 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2022 to 2030. ARA is a fatty acid that supports the development of an infant’s brain. The growing consumer awareness related to baby care products is driving the industry's growth. Moreover, increasing product demand to heal critical physical injuries is likely to support the growth. It helps in improving visual acuity, balances phosphate, and calcium levels, enhances neuron growth, and promotes cell survival in developing infants. The key product manufacturers are focusing on improving the in-house manufacturing techniques and R&D activities to enhance product quality and brand value. A rise in population, income, awareness, and development of innovative technologies is resulting in a reduction in the production cost of ARA. This is also likely to trigger industry growth in the coming years.

Arachidonic acid is one of the essential acids in the Omega-6 group. It is considered an essential acid because it is stored inside the cell membranes and directs signals of adaptive changes in the damage events. The deficiency of natural arachidonic acid in the body necessitates a separate intake of it in the form of injections, syrups, or tablets. The major raw materials used for the production of ARA comprise corn, glucose, soy, and yeast among others.

The key producers are engaged in product synthesis by altering mortierella alpine (M.alpine), which is the most proficient manufacturing process. There is an increasing preference among end-users to buy arachidonic acid directly from suppliers instead of producers owing to the ability of the former to offer the product in large volumes, which further results in reduced prices. The production plants are located near the end-users to lower transportation costs, procure local incentives, and minimize the exposure to currency fluctuations. The companies involved in the production of infant formula are making constant efforts to improve consumer awareness via several educational campaigns. All these factors are expected to contribute to the overall industry growth.

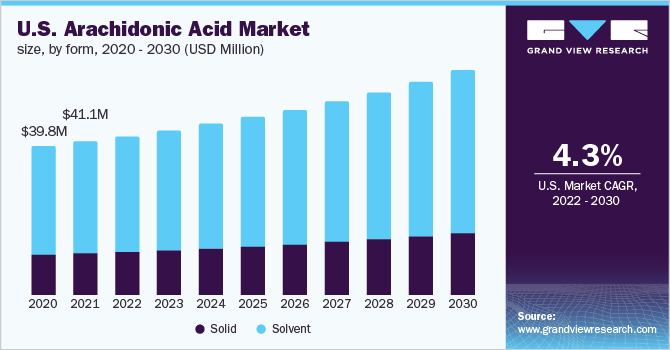

Form Insights

Based on forms, the global industry has been further categorized into solid and solvent. The solvent segment dominated the industry in 2021 and accounted for the highest share of more than 80.27% of the overall revenue. The high share of this segment can be attributed to the increased product use in infant formula and supplements globally. The prominent industry players are involved in the development of advanced solvent-based products as it has higher profit margins. Increasing application in sports supplements drives the product demand in this segment. There is a shift in the consumer preference towards ARA-induced supplements, thus, positively impacting the industry growth.

The rising spending costs on sports nutrition are further expected to boost product demand. Companies are involved in the production of nutritional products, which comply with global standards and help in the overall market development. The solvent form helps in maintaining the fluidity of the cell membrane. It also helps in treating brain diseases and depression by increasing the dopamine levels in an individual. Furthermore, prominent companies in the industry are focusing on the development of advanced products to improve their portfolio and increase their profit margins.

Source Insights

Based on sources, the global industry has been further categorized into animal and plant. The plant-based arachidonic acid segment dominated the global industry in 2021 and accounted for the highest share of more than 53.55% of the overall revenue. The high share of this segment can be attributed to the growing consumer demand for vegetarian or vegan products. It is also believed that a vegetarian diet can be beneficial for a patient suffering from chronic diseases. Seaweed is a prominent plant-based source of arachidonic acid.

Vegetarians and vegans can get ARA via linoleic acid. This acid can be easily found in nuts seeds, legumes, and grains. It helps in improving the immune, nervous, and skeletal systems of an individual. The growing consumer preference for natural products is driving the demand for plant-based ARA across the globe. The animal-based ARA is found in large quantities owing to its presence in various poultry animals, meat, eggs, and seafood among others. A single egg can even elevate the levels of arachidonic acid in the bloodstream of a human. In addition, the easy availability of animal sources is positively impacting its demand.

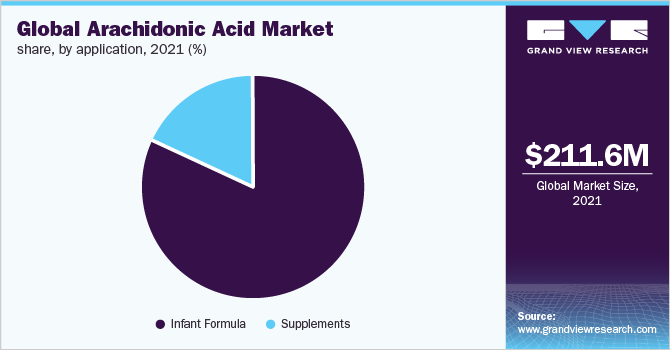

Application Insights

Infant formula dominated the market with the highest revenue share of 81.96% in 2021. Its high share is attributable to the increasing awareness concerning the benefits of ARA in infant brain development and rising spending on infant nutrition. In addition, the growing regulatory acceptance for oil-based ARA products in infant nutrition is positively impacting the demand.ARA is used to enhance a baby’s memory and eyesight. ARA-based supplements help in improving neural stem cell proliferation, which aids in the improvement of cognitive function among infants as well as adults. The growing consumer awareness related to the benefits of ARA in baby nutrition is projected to boost growth over the forecast period.

The daily consumption of ARA supplements has increased, especially among young individuals, as it helps in improving overall well-being and health. It works as an essential dietary part in the process of muscle hypertrophy owing to its ability to effectively repair skeletal muscle tissues. Furthermore, it also helps in increasing the overall body mass of an individual, in turn, making the person look more toned and fit. ARA contains muscle inflammation properties that result in speeding up the muscle gain process. The manufacturers are focusing on R&D for the development of new product applications, such as bodybuilding supplements and sports drinks. The growing demand for health supplements, especially in urban areas across regions is expected to create lucrative opportunities for industry growth.

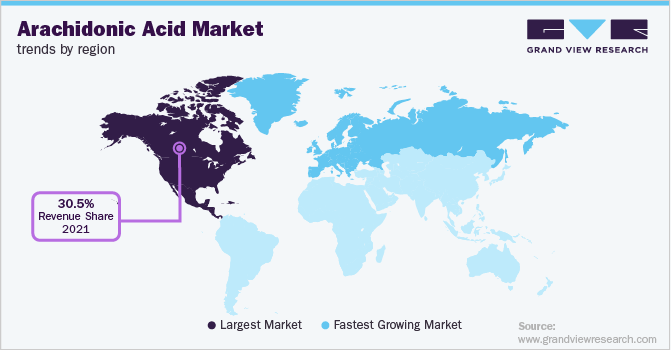

Regional Insights

North America dominated the global industry in 2021 and accounted for the highest share of 30.5% of the overall revenue. This is attributed to the presence of prominent companies in North America. The region is projected to expand further during the forecast years on account of the developed infant and sports nutrition industry, particularly in the U.S., and the high spending capacity of consumers. Europe is growing at a significant rate due to the early adoption of ARA in supplements and infant formula. The rising application of omega-6fatty acids in dietary supplements along with the favorable government regulations is positively impacting the demand.

Furthermore, factors, such as a well-developed sports nutrition market and a rising standard of living, are driving the regional industry. Asia Pacific is also expected to register a strong CAGR from 2022 to 2030 due to the emerging middle-class population, projected growth in the number of infants, and rapid urbanization across the region. The presence of emerging economies, such as India and China, and the availability of affordable raw materials and labor are influencing global manufacturers to expand their operations in the Asia Pacific region.

Key Companies & Market Share Insights

The industry is growing at a significant rate owing to the rising consumption in various end-use applications including supplements and infant formula. Outsourcing of manufacturing capabilities is expected to be the dominant trend in the market. Abbott Nutrition, Nestlé S.A., and Mead Johnson, prominent producers of infant formula and dietary supplements are some of the key end-users of the product. Some of the prominent players in the global arachidonic acid market include:

- Suntory Beverage & Food Ltd.

- Cayman Chemical Company

- Cargill, Inc.

- BASF SE

- CABIO Biotech (Wuhan) Co., Ltd.

- Guangdong Runke Bioengineering Co. Ltd.

- Koninklijke DSM N.V.

- Avanti Polar Lipids, Inc.

- Bio-Techne Corporation

- Merck KgaA

- A&Z Food Additives Co. Ltd.

Arachidonic Acid Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 218.5 million

Revenue forecast in 2030

USD 309.0 million

Growth rate

CAGR of 4.3 % from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in tons, revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Suntory Beverage & Food Ltd.; Cayman Chemical Company; Cargill, Inc.; CABIO Biotech (Wuhan) Co., Ltd.; Guangdong Runke Bioengineering Co. Ltd.; Koninklijke DSM N.V.; Avanti Polar Lipids, Inc.; Bio-Techne Corp.; Merck KgaA; A&Z Food Additives Co. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Arachidonic Acid Market Segmentation

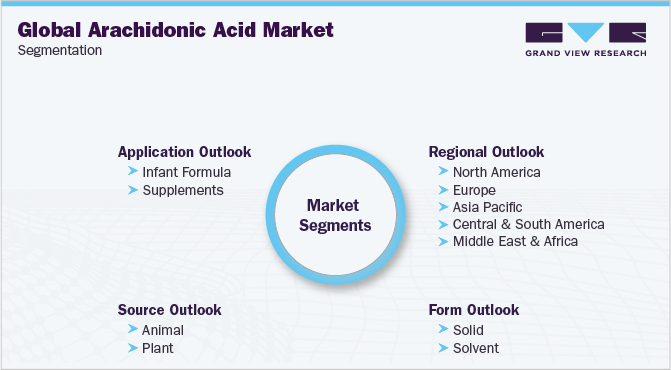

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global arachidonic acid market report based on form, source, application, and region:

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Solid

-

Solvent

-

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Animal

-

Plant

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Infant Formula

-

Supplements

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global arachidonic acid market size was estimated at USD 211.6 million in 2021 and is expected to reach USD 218.5 million in 2022

b. The global arachidonic acid market is expected to grow at a compound annual growth rate of 4.3% from 2022 to 2030 to reach USD 309 million by 2030.

b. North America dominated the arachidonic acid market with a share of 30.5% in 2021. This is attributable to prominent companies in the region, the developed sports, and infant nutrition industry, particularly in the U.S., and the high spending capacity of consumers.

b. Some key players operating in the arachidonic acid market include Suntory Beverage & Food Limited; Cayman Chemical Company; Cargill, Inc.; and BASF SE.

b. Key factors that are driving the market growth include the fact that arachidonic acid is a long-chain fatty acid, which along with Docosahexaenoic acid (DHA), supports the development of the infant’s brain. Increasing awareness regarding baby care products is among the primary factors driving industry growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.