- Home

- »

- Electronic Devices

- »

-

Arbitrary Waveform Generator Market, Industry Report, 2030GVR Report cover

![Arbitrary Waveform Generator Market Size, Share & Trends Report]()

Arbitrary Waveform Generator Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Technology (Direct Digital Synthesis, Variable-clock, Combined AWG), By Application (Telecommunications, Education), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-488-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Arbitrary Waveform Generator Market Summary

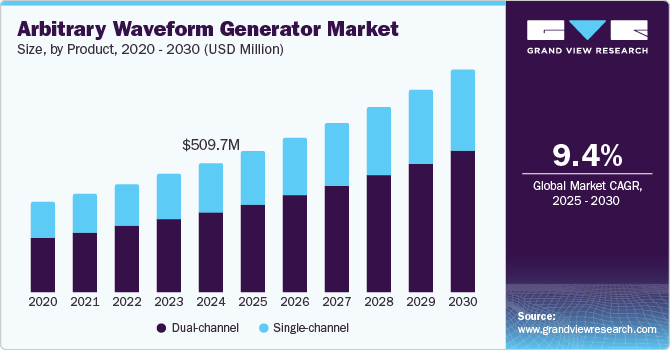

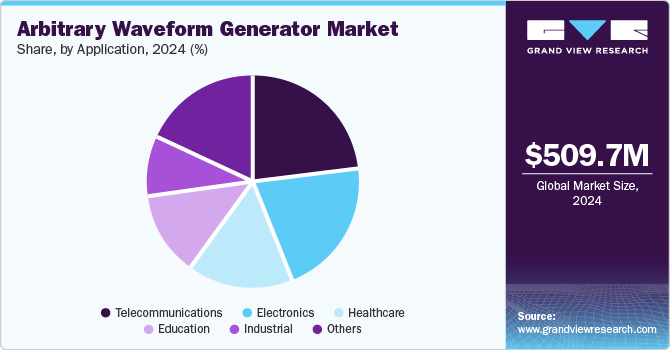

The global arbitrary waveform generator market size was valued at USD 509.7 million in 2024 and is projected to grow at a CAGR of 9.4% from 2025 to 2030. The continued growth in demand for advanced test and measurement equipment across various major industries such as healthcare, telecommunications, education, aerospace & defense, and consumer electronics has created substantial growth avenues for this market.

Key Market Trends & Insights

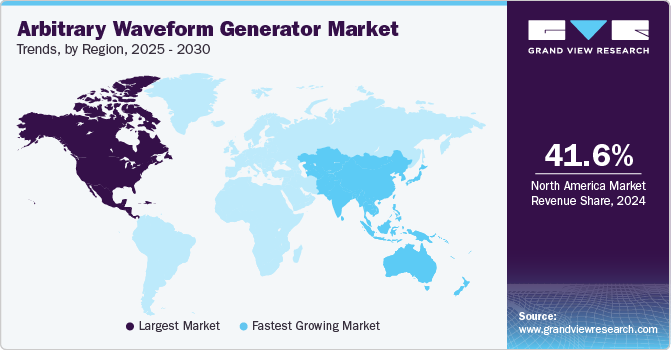

- North America arbitrary waveform generator market accounted for the largest global revenue share of 41.6% in 2024.

- By product, the dual-channel segment accounted for the largest revenue share of 62.2% in the global arbitrary waveform generator industry in 2024.

- By technology, the direct digital synthesis (DDS) technology accounted for the largest revenue share in the global AWG market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 509.7 Million

- 2030 Projected Market Size: USD 875.3 Million

- CAGR (2025-2030): 9.4%

- North America: Largest market in 2024

Arbitrary waveform generators (AWG) are extensively used in commercial applications owing to the superior integrity provided by direct digital synthesis (DDS) integrated circuits. Furthermore, the rapidly increasing Internet penetration across both developed and emerging economies and a sharp rise in demand for advanced communication technologies have further resulted in positive developments in the arbitrary waveform generator industry.

Sectors such as healthcare and aerospace & defense have witnessed significant investments in developing technologically advanced equipment to improve their operational efficiencies. Modern diagnostic equipment, including electrocardiograms (ECGs), ultrasound machines, and medical imaging systems, requires highly precise signal generation for calibration and performance testing. AWGs can simulate the complex electrical signals needed to test the accuracy and functionality of these devices. For example, AWGs generate electrical waveforms to simulate the heart's electrical activity for testing ECGs. The rapid growth of the wearables segment, which includes heart rate monitors, glucose sensors, and fitness trackers, has further highlighted the need for AWGs during their manufacturing. These devices often rely on sensors that need to be tested under various signal conditions to ensure they function accurately. These generators help simulate different physiological signals, such as heartbeats and blood pressure variations, to test the performance of wearable medical devices.

Growing competition in the manufacturing sector has led companies to adopt more automated systems in their production processes, with arbitrary waveform generators functioning as a vital tool for testing these systems. Automation relies heavily on precise control signals, and arbitrary waveform generators simulate various operating conditions to ensure that automated systems perform as expected. This is particularly important in automotive manufacturing, robotics, and industrial machinery sectors. The education & research sector presents another notable avenue for market expansion, with universities and research labs worldwide widely using advanced generators to simulate complex signals for experiments in critical fields such as physics, engineering, and material science. The ability to generate a wide variety of waveforms enables researchers to test and validate their hypotheses and designs.

The aerospace and defense sectors are among the largest consumers of arbitrary waveform generators globally. These sectors require precise control signals (AWG) to generate and simulate radar signals, communications, and electronic warfare scenarios. AWGs are crucial for testing radar systems, satellite communication devices, GPS systems, and missile defense technologies. These systems often operate in extreme environments, requiring highly precise signal generation and testing. With steadily increasing government spending on defense infrastructure across global economies, the need for these generators is expected to continue expanding in the coming years. The autonomous vehicles industry is another area witnessing increased application scope of this market. The sharp growth in popularity of these vehicles among consumers, particularly in developed economies, has boosted the use of tools and technologies to ensure the safety and reliability of components such as LiDAR, radar, and cameras. AWGs are used to simulate a variety of conditions and signal scenarios, such as road hazards, obstacles, or weather conditions, to validate the performance of sensors and other systems used in these vehicles.

Product Insights

The dual-channel segment accounted for the largest revenue share of 62.2% in the global arbitrary waveform generator industry in 2024 and is further expected to maintain its position during the forecast period. This type of signal generator can generate and output two independent waveforms simultaneously. This capability allows engineers and researchers to simulate complex signal scenarios and perform testing on devices that require multiple signals or waveforms for analysis, such as in communication systems, electronic device testing, and signal processing applications. Many dual-channel AWGs offer the ability to synchronize the two channels with a specific phase relationship or time offset. This feature is particularly valuable when testing systems where the interaction of multiple signals needs to be precisely controlled.

The single-channel AWG segment is expected to advance at a significant CAGR from 2025 to 2030. Features such as their cost-effectiveness compared to their dual-channel counterparts and user-friendly interface have created a strong demand for these products. Single-channel AWGs are ideal for less complex testing applications, where only one signal is needed for testing purposes. These include basic electronics testing, signal simulation, and simpler laboratory experiments. Moreover, they tend to be more compact and portable than their alternatives, making them suitable for fieldwork and environments where space is limited.

Technology Insights

The direct digital synthesis (DDS) technology accounted for the largest revenue share in the global AWG market in 2024. The technology provides high-frequency resolution, stability, and versatility by directly synthesizing signals in the digital domain and converting them to analog waveforms through a Digital-to-Analog Converter (DAC). AWGs leveraging this technology are widely used in applications requiring precise waveform generation, from research and development to product testing in telecommunications, aerospace, and industrial electronics. The system offers a very fine frequency resolution compared to analog signal generators because adjusting the phase increment can precisely control the frequency. This allows for generating signals with very small frequency steps, often in the range of MHz to Hz. These generators typically exhibit low phase noise, making them suitable for high-precision applications, such as RF signal generation for communication systems, testing radar systems, and scientific experiments.

The combined AWG segment, which involves DDS and variable-clock technologies, is expected to grow at the fastest CAGR from 2025 to 2030. This hybrid approach allows for precise, high-resolution waveform synthesis alongside adaptable frequency control, making it suitable for a wide range of applications in research, development, and testing. Combining DDS and a variable clock enables the generator to operate across a broader frequency range, from low frequencies to higher ones, without compromising precision. This is beneficial for applications requiring low-frequency testing (audio signals) and high-frequency testing (RF and communication systems). Furthermore, the combined technology allows the creation of complex, arbitrary waveforms that can change in frequency and time domain. This enables effective systems testing requiring real-time signal characteristics adjustments, such as automotive radar testing, medical device simulation, or communications systems.

Application Insights

The telecommunications segment accounted for the largest revenue share in the global arbitrary waveform generator industry in 2024. The global shift toward 5G technology is a key industry driver, as AWGs are essential tools for testing the components of 5G networks, including base stations, smartphones, and network equipment. Moreover, the need to ensure signal integrity due to the high data rates and low latency requirements of 5G technology has driven the use of these generators to develop complex test waveforms for testing network performance and quality. Additionally, telecom networks are adopting increasingly sophisticated modulation schemes, such as 256 QAM, 64 QAM, and higher-order schemes. AWGs are essential for generating the arbitrary waveforms required to test these complex modulations, ensuring the system can handle them efficiently without data loss or signal degradation.

The education segment is expected to advance at the fastest CAGR in the market from 2025 to 2030. The increasing need for advanced laboratory equipment to support modern curricula in electrical engineering, physics, telecommunications, and related fields is a primary factor aiding market expansion through this application area. Arbitrary waveform generators are important in enabling students and researchers to understand signal processing, communications, control systems, and other technical subjects. They are frequently used in academic research within universities and technical institutes, proving to be particularly valuable in research fields related to signal processing, radar systems, communications, RF design, and photonics. In these fields, custom waveform generation is often required to simulate real-world scenarios, including noise, interference, and channel distortions.

Regional Insights

The North America arbitrary waveform generator market accounted for the largest global revenue share of 41.6% in 2024. Continuous advancements in the region's well-established electronics and semiconductors industry, coupled with the presence of several major market players, have aided market growth. Innovations in electronic technologies, such as multiple-input multiple-output (MIMO) systems, have helped enhance the capabilities of AWGs, creating significant product awareness among consumers in regional economies. Manufacturers increasingly integrate features such as touch-screen interfaces and multi-channel handling to improve performance and user experience, creating a strong demand from end users.

U.S. Arbitrary Waveform Generator Market Trends

The U.S. accounted for a dominant revenue share in the regional market for AWG in 2024. The strong expansion of the economy's aerospace, automotive, and high-end industrial sectors, coupled with the increasing complexity of electronic systems in these areas, has necessitated precise and customizable signal generation. Additionally, the rapid emergence and adoption of advanced technologies such as 5G, autonomous vehicles, and AI-driven systems have heightened the need for precise signal generation to test complex electronic devices. The U.S. is one of the leaders in the rollout of 5G networks, with telecom giants such as Verizon, AT&T, and T-Mobile heavily investing in infrastructure. AWGs are vital in simulating real-world conditions for designing and testing components such as base stations and antennas, ensuring the functionality and reliability of these technologies.

Europe Arbitrary Waveform Generator Market Trends

Europe accounted for a substantial revenue share in the global arbitrary waveform generator industry in 2024. Significant investments in research and development across highly advanced sectors such as telecommunications, electronics, and aerospace are contributing to the regional market growth. These investments are driving the development of advanced Arbitrary Waveform Generator (AWG) technologies and expanding their applications across various industries. The ongoing development of next-generation communication technologies, particularly 5G networks, has spurred the demand for AWGs in economies such as Germany, the UK, and France. Furthermore, the need for higher data transmission speeds and more reliable networks in Europe leads to continuous testing and evaluation of new communication hardware. AWGs are used extensively to test and validate the performance of new telecom devices, amplifiers, and transceivers.

Asia Pacific Arbitrary Waveform Generator Market Trends

The Asia Pacific region is expected to advance at the highest CAGR in the global AWG market during the forecast period. The fast pace of growth of the electronics industry and the presence of several major electronics manufacturers in economies such as China, Japan, and South Korea have led to the growing usage of AWGs in testing and development procedures. Products such as mobile devices, wearables, and computing devices often incorporate complex waveforms for various functions, such as signal modulation and high-speed communication, necessitating AWGs to ensure quality and functionality. Moreover, the growing adoption of Internet of Things (IoT) devices across sectors such as healthcare, agriculture, smart cities, and manufacturing in the region has contributed to the increased demand for AWGs. IoT devices require several sensors and connectivity solutions, and AWGs are used to simulate various communication protocols, frequencies, and signal conditions.

China arbitrary waveform generators market accounted for the largest revenue share in the Asia Pacific market in 2024. The country is investing heavily in its semiconductor industry to reduce reliance on foreign technology, which is enabled by strong government support through various policies and incentives. AWGs are crucial in semiconductor R&D for testing chips and components used in various applications, including mobile phones, computers, automotive electronics, and IoT devices. As the demand for smaller, faster, and more efficient semiconductor devices grows, AWGs are required to simulate intricate electrical environments and assess chip performance during development. Moreover, the extensive demand for EVs in the country and the subsequent development of EV battery management systems have driven the use of AWGs for testing power electronics, battery chargers, and energy storage systems.

Key Arbitrary Waveform Generator Company Insights

Some major companies involved in the global arbitrary waveform generator industry include Tektronix, Fluke Corporation, and B&K Precision Corporation, among others.

-

Tektronix is an American company that manufactures test and measurement equipment, including probes and oscilloscopes, analyzers, signal generators, and digital multimeters. The company develops arbitrary waveform generators in the signal generator category, including the AWG5200 Arbitrary Waveform Generator and the AWG70000B Arbitrary Waveform Generator. The former has been designed for advanced research, electronic warfare system design and testing, and electronic test and radar; the latter is indicated for the design, testing, and operation of complex components, systems, and experiments.

-

B&K Precision Corporation develops test and measurement solutions for various applications, including design, research and development, product line testing, industrial maintenance, and electronic field service. The company's major products include power supplies, oscilloscopes, signal generators, multimeters, component testers, data acquisition recorders, frequency counters, battery testers, and others. Through the Function Arbitrary Waveform Generator category, the company offers the 4055B 60 MHz Dual Channel Function/Arbitrary Waveform Generator, the 4054B 30 MHz Dual Channel Function/Arbitrary Waveform Generator, and the 4053B 10 MHz Dual Channel Function/Arbitrary Waveform Generator.

Key Arbitrary Waveform Generator Companies:

The following are the leading companies in the arbitrary waveform generator market. These companies collectively hold the largest market share and dictate industry trends.

- TEKTRONIX, INC.

- Rohde & Schwarz

- NATIONAL INSTRUMENTS CORP.

- B&K Precision Corporation

- Fluke Corporation

- Teledyne Technologies Incorporated

- ANRITSU CORPORATION

- Signal Hound

- Focus Microwaves Inc.

- Agilent Technologies, Inc.

- Pico Technology Ltd.

- Keysight Technologies

Recent Developments

-

In November 2024, Rohde & Schwarz introduced the R&S RTB 2 base-level oscilloscope, an upgraded version of the company's R&S RTB2000 model. In addition to touchscreen capabilities and 10-bit vertical resolution features, the new solution has an integrated AWG, enabling users to emulate missing components or conduct simulations of circuit stimuli. The generator can generate signals up to 25 megahertz along with pattern speeds of up to 50 Mbits per second. Additionally, the solution supports waveforms imported from oscilloscope captures or CSV files and provides noise addition capability that can efficiently simulate real-world environments.

-

In September 2024, Pico Technology launched the Mixed-Signal Oscilloscope (MSO) versions of its PicoScope 3000E Series of products. The new models offer a bandwidth of 500 MHz, 10-bit resolution, and 5 GS/s sampling rate to enable signal capture with high fidelity in critical applications. They also feature a 200 MS per second 14-bit arbitrary waveform generator/function generator that can generate real-world waveforms for several applications, thus eliminating the requirement for any added external equipment. Other features include 16 digital channels, USB 3.0 Type-C connectivity, 40 serial decoders, and a Pico software development kit.

Arbitrary Waveform Generator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 557.8 million

Revenue forecast in 2030

USD 875.3 million

Growth Rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

TEKTRONIX, INC.; Rohde & Schwarz; NATIONAL INSTRUMENTS CORP.; B&K Precision Corporation; Fluke Corporation; Teledyne Technologies Incorporated; ANRITSU CORPORATION; Signal Hound; Focus Microwaves Inc.; Agilent Technologies, Inc.; Pico Technology Ltd.; Keysight Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arbitrary Waveform Generator Market Report Segmentation

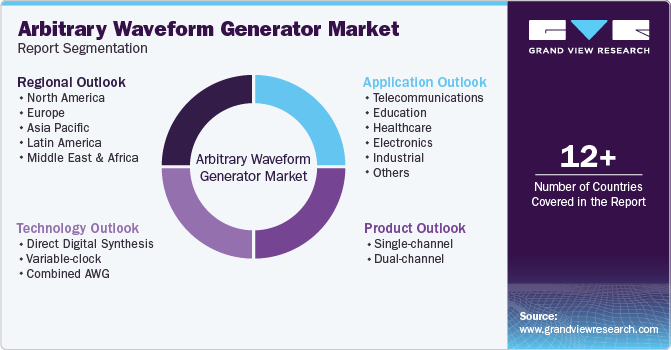

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global arbitrary waveform generator market report based on product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-channel

-

Dual-channel

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Digital Synthesis

-

Variable-clock

-

Combined AWG

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecommunications

-

Education

-

Healthcare

-

Electronics

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.