- Home

- »

- Next Generation Technologies

- »

-

Architectural Services Market Size & Share Report, 2030GVR Report cover

![Architectural Services Market Size, Share & Trends Report]()

Architectural Services Market Size, Share & Trends Analysis Report By Service Type (Architectural Advisory Services, Engineering Services, Urban Planning Services), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-064-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

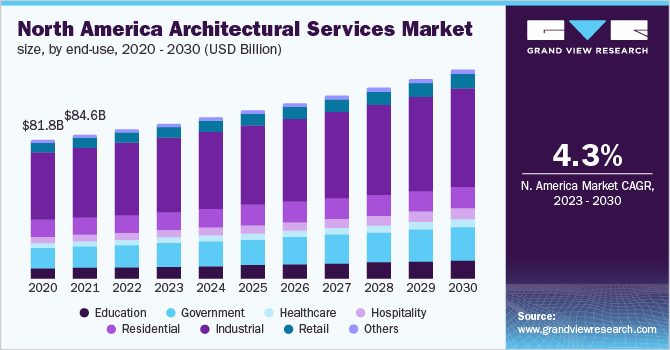

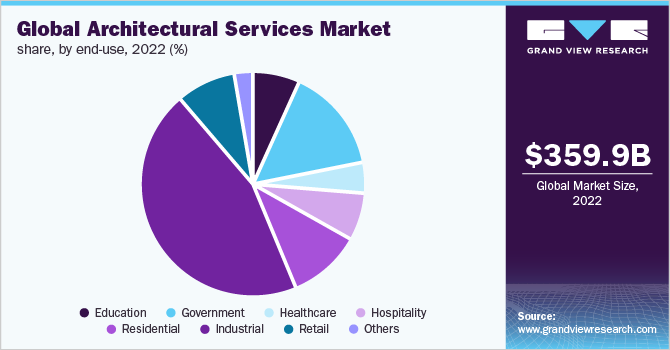

The global architectural services market was valued at USD 359.98 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. The demand for services can be attributed to the increasing construction activities across the globe. Rapid urbanization in developing countries, such as India and Brazil, is resulting in increasing residential and commercial construction activities. Moreover, governments are focused on introducing affordable home projects across various countries. This rise in construction activities is expected to support the demand for architectural services such as construction and project management services and urban planning, in turn, boosting the market growth.

The healthcare and hospitality sectors are witnessing rapid growth. In the healthcare sector, hospitals are focused on improving patient care through the establishment of new facilities and reorganizing existing spaces. This helps them improve patient outcomes, increase patient satisfaction, and optimize the building space to seamlessly treat patients. As a result, services such as construction and project management, and interior design are expected to witness significant demand. The hospitality sector is witnessing increasing tourism in developed and developing countries. Increased tourism has led to the development of new hotels, resorts, and restaurants at tourist locations.

Businesses are leaning towards architectural services such as schematic designs, space planning, and interior design which enables the organization to attract more clients and improve client experience. In addition, the focus of major players on enhancing their businesses and customer base through strategic partnerships is expected to augment market growth.

Architects often face challenges in communicating ideas and delivering complex designs. The deployment of VR technology in architectural designs enables architects to save time and money while delivering high precision in design. The increasing uptake of artificial intelligence and virtual reality in the architectural service landscape is expected to drive market growth. Although the market is expected to witness high growth, the high costs associated with architectural services are expected to pose a challenge for the market. In addition, the looming lack of skilled labor and adequate knowledge for design is hampering the market growth. In early 2020, the COVID-19 pandemic adversely impacted the global market. Stringent lockdowns and suspended operations throughout the global constriction industry induced a decline in demand for architectural services. However, during the second half of 2021, the construction industry started picking up growth with the introduction of new as well as redevelopment construction projects, thus creating a path for recovery of the market.

Service Type Insights

The construction and project management segment accounted for a revenue share exceeding 34.0% in 2022 and is expected to witness high growth over the coming years. Construction and project management are important aspects of a project. With increasing construction activities, the demand for construction and project management services is increasing for tasks such as project life cycle management, cost control, scheduling, and risk management.

The urban planning segment is expected to witness significant growth in the market, registering a CAGR of 6.4% over the forecast period. This can be attributed to increasing government initiatives for urban development. Moreover, the increasing number of residential projects and rising demand for smart solutions to manage and deliver efficient plans are expected to support segment growth.

End-use Insights

The industrial segment dominated the market and accounted for a revenue share of over 45.0% in 2022. This can be attributed to rapid industrialization across the globe, coupled with increasing acquisitions and new factory establishments carried out by business firms. In addition, the growing environmental concerns and initiatives carried out by business owners to construct green buildings are expected to contribute to the demand for architectural advisory and interior design services. This is expected to positively impact segment growth. Platforms to improve their market presence and carry out business operations seamlessly are expected to favor market growth.

The residential segment is expected to witness significant growth over the forecast period, Surge in disposable income coupled with lower housing interest rates in emerging economies is also expected to bode well for market growth over the forecast period. Additionally, rapid urbanization across tier-II cities in emerging economies is expected to drive the demand for architectural services over the forecast period. Moreover, the demand for services such as urban planning services and project management services is expected to increase among architects to better manage their smart city projects.

Regional Insights

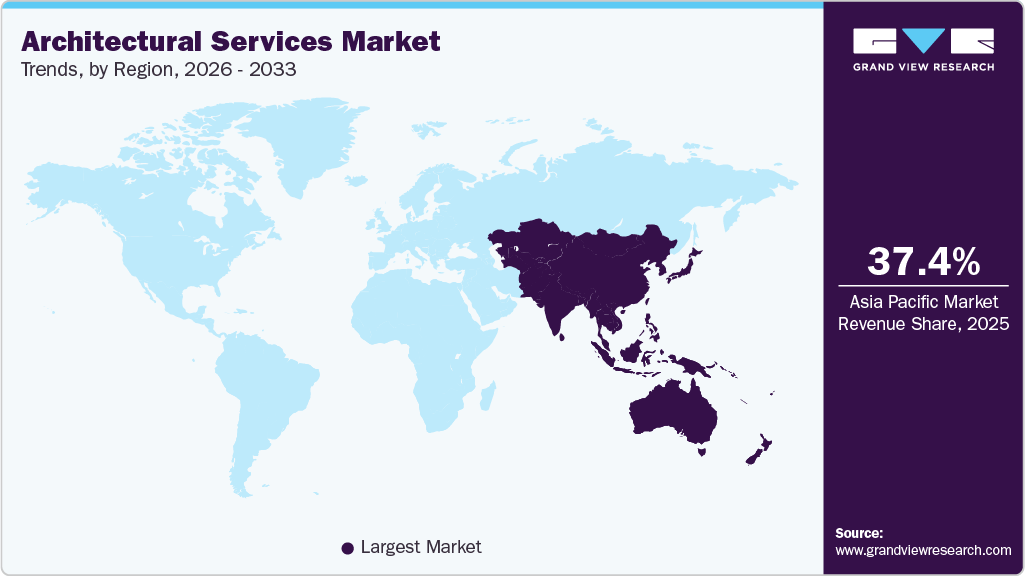

Asia Pacific dominated the market and accounted for the largest revenue share of over 36.0% in 2022. The segment is expected to grow steadily over the forecast period. The growth can be attributed to rapid urbanization, growing population, and increasing residential and industrial construction projects in this region. China dominated the market for architectural services owing to the presence of major manufacturers and their increasing efforts to establish new production plants.

Europe accounted for a significant revenue share in the market. The growth of this market can be attributed to the flourishing construction sector in the IT sector owing to rising investments and new infrastructure development projects. The gradual resumption of the construction of various data center facilities affected by temporary suspension due to the COVID-19 pandemic and the introduction of new IT projects are expected to induce the architectural service market over the forecast period.

Key Companies & Market Share Insights

New entrants backed by venture capital firms are entering the architectural services market with more innovative designs and advanced solutions. This is increasing competition in the market. Moreover, major players are focused on acquiring significant shares in the market by focusing on strategic acquisitions. For instance, IBI Group announced the acquisition of RLC Architects, a Florida-based architectural firm. The acquisition will enable to IBI group to leverage RLC Architects expertise in logistics, supply chain, and the real estate industry. Some of the prominent players in the global architectural services market include:

-

AECOM

-

Foster + Partners

-

Gensler

-

HDR

-

IBI Group

-

Jacobs Engineering Group

-

Nikken Sekkei Ltd.

-

Perkins Eastman

-

Perkins and Will

-

Stantec

Architectural Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 376.08 billion

Revenue forecast in 2030

USD 523.20 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany, Rest of Europe; China; India; Japan; South Korea; Singapore; Rest of APAC; Brazil; Mexico; Rest of Latin America; Middle East & Africa

Key companies profiled

AECOM; Foster + Partners; Gensler; HDR; IBI Group; Jacobs Engineering Group; Nikken Sekkei Ltd.; Perkins Eastman; Perkins and Will; Stantec

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Architectural Services Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global architectural services market report based on service type, end-use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Architectural Advisory Services

-

Construction And Project Management Services

-

Engineering Services

-

Interior Design Services

-

Urban Planning Services

-

Building Code Counseling And Interpretation Consulting Services

-

Legal Technical Requirement Compliance Counseling Services

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Education

-

Government

-

Healthcare

-

Hospitality

-

Residential

-

Industrial

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global architectural services market size was estimated at USD 359.98 billion in 2022 and is expected to reach USD 376.08 billion in 2023.

b. The global architectural services market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 523.20 billion by 2030.

b. The Asia Pacific region held the largest revenue share of more than 36.71% in 2022 in the architectural services market. Growth in the investment for smart city projects and rapid industrialization across the countries are some of the factors expected to favor regional growth.

b. Some key players operating in the architectural services market include AECOM, Aedas, DP Architects Pte Ltd, Foster + Partners, Gensler, HKS Inc.; PCL Constructors Inc.; HDR, HOK, and IBI Group.

b. Key factors that are driving the architectural services market growth include increasing investments in the construction market and a substantial increase in demand for design services, project management, and consultancy service.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."