- Home

- »

- Automotive & Transportation

- »

-

Armored Vehicle Market Size & Share, Industry Report, 2030GVR Report cover

![Armored Vehicle Market Size, Share & Trends Report]()

Armored Vehicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Combat Vehicles, Combat Support Vehicles), By Type, By Mobility (Wheeled, Tracked), By Mode Of Operation, By Point Of Sale, By System, By Region And Segment Forecasts

- Report ID: 978-1-68038-594-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Armored Vehicle Market Summary

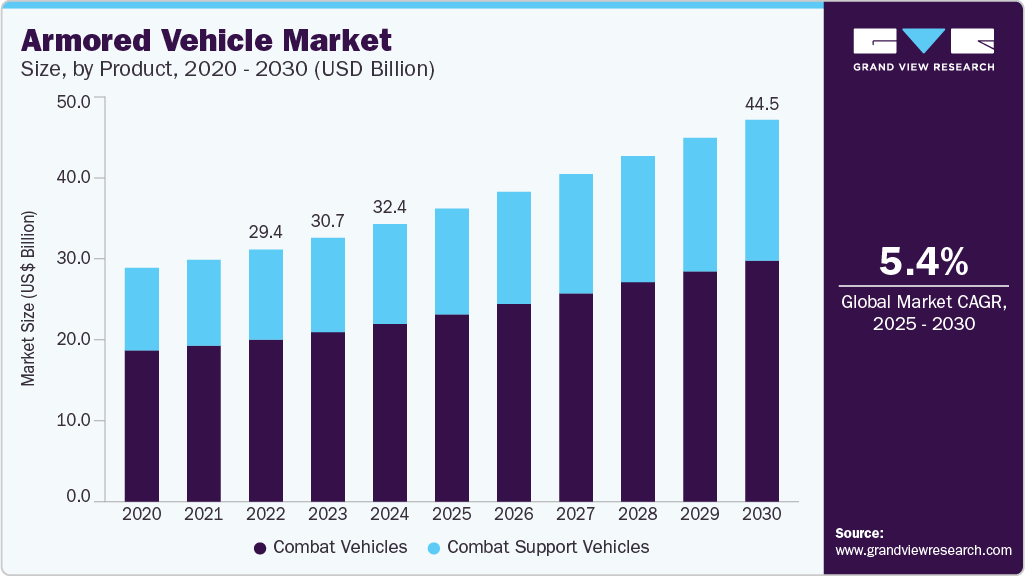

The global armored vehicle market size was estimated at USD 32.41 billion in 2024 and is projected to reach USD 44.56 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. Increasing geopolitical tensions and ongoing conflicts across various regions lead countries to allocate substantial budgets to defense, focusing on upgrading and expanding armored vehicle fleets to enhance border security and military capabilities.

Key Market Trends & Insights

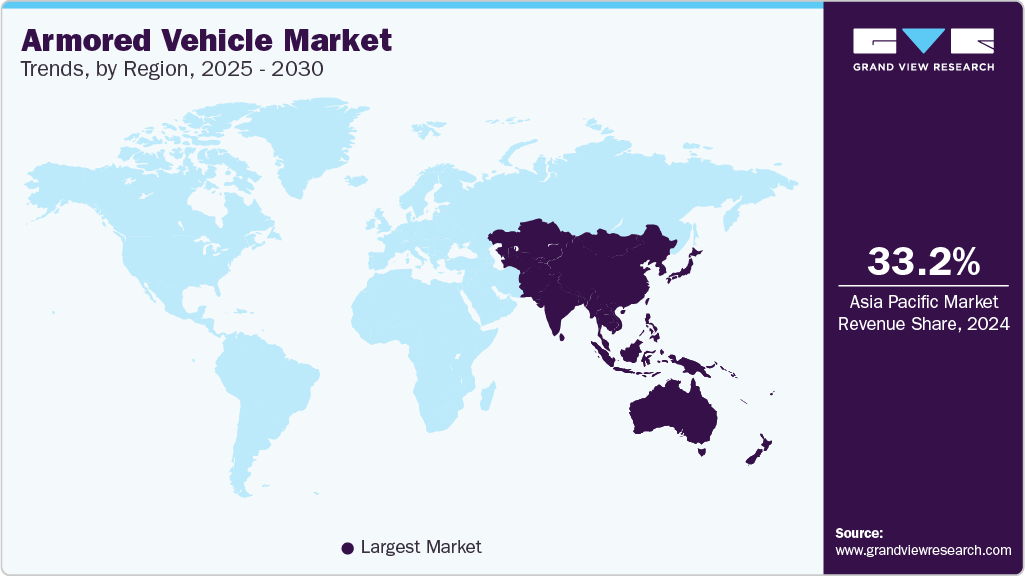

- Asia Pacific dominated with a revenue share of 33.2% in 2024.

- Based on product, combat vehicles dominated the market with the highest revenue share of over 63% in 2024.

- Based on type, the conventional armored vehicles segment witnessed the highest market share in 2024.

- Based on mode of operation, the manned armored vehicles segment held the largest revenue share in 2024.

- Based on point of sale, the OEM segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.41 Billion

- 2030 Projected Market Size: USD 44.56 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

The rise in terrorism, insurgency, and asymmetric warfare further drives demand for armored vehicles that provide protection in hostile environments. In addition, technological advancements such as composite armors, active protection systems, and improved weaponry contribute to market growth by enhancing vehicle survivability and operational effectiveness. The market growth is further supported by evolving defense strategies and emerging technological trends. Increasing investments in urban warfare capabilities, counter-terrorism operations, and peacekeeping missions sustain demand for versatile, multi-role armored vehicles. Innovations in modular armor, lighter materials, autonomous and unmanned vehicle features, and hybrid propulsion systems are anticipated to expand the market by improving crew safety, vehicle performance, and operational flexibility. The growing emphasis on cybersecurity and data protection in military vehicles also shapes future market dynamics.

The armored vehicle industry also benefits from ongoing collaborations between defense manufacturers and technology providers, driving the development of next-generation platforms. Rising interest in unmanned and remotely operated vehicles expands the market by introducing new capabilities and reducing risks to personnel. In addition, the demand for specialized vehicles for VIP protection and law enforcement continues to support market growth. These combined factors contribute to a steady market expansion over the coming years.

Product Insights

Combat vehicles dominated the market with the highest revenue share of over 63% in 2024. As the threat environment evolves, combat vehicles become more critical in military and security operations. It includes the development of new technologies and capabilities, such as advanced armor, weapons systems, and electronic warfare capabilities. Combat vehicles are also becoming increasingly versatile, with the ability to perform various missions and tasks. It includes the development of vehicles that can operate in multiple environments, such as amphibious vehicles that can operate on land and in water.

The combat support vehicles segment is estimated to grow significantly over the forecast period. Combat support vehicles include a wide range of vehicles, such as transport vehicles, fuel tankers, ammunition carriers, recovery vehicles, and medical evacuation vehicles. These vehicles are designed to operate in various environments, from harsh desert conditions to rugged mountain terrain. The growth of combat support vehicles is driven by the need to support modern military operations, technological advances, the expansion of military operations, and the replacement of aging fleets. As technology evolves, combat support vehicles will likely become even more advanced, providing troops with the support they need to carry out their missions effectively.

Type Insights

The conventional armored vehicles segment witnessed the highest market share in 2024. Many countries worldwide are increasing their military and security spending, and as a result, there has been a significant investment in conventional armored vehicles. This trend is particularly evident in regions facing security challenges or engaging in military conflicts. Countries such as Saudi Arabia, the UAE, and Qatar have immense military spending, mainly due to the conflicts in Syria and Yemen. These countries have invested heavily in conventional vehicles, such as tanks and armored personnel carriers, to protect their military personnel and equipment.

The electric armored vehicles segment is estimated to grow at the highest CAGR over the forecast period. As concerns over climate change and air pollution continue to grow, there is an increasing demand for environmentally friendly solutions across various industries, including the military and security sectors. Advances in battery technology have made it possible to develop armored electric vehicles with sufficient power and range to meet the needs of military and security applications. Over the long term, armored electric vehicles may offer cost savings over conventional armored vehicles due to lower operating costs and maintenance requirements.

Mode of Operation Insights

The manned armored vehicles segmentheld the largest revenue share in 2024. The high share can be attributed to their protection of the occupants inside. Armored vehicles are designed to protect against a wide range of threats, including small arms fire, explosive devices, and improvised explosive devices (IEDs), which makes them essential for personnel safety in high-risk environments. Armored vehicle manufacturers offer customization options to meet specific customer needs, making them attractive for government agencies, military forces, and private security firms, thus driving the growth in manned armored vehicles.

The unmanned armored vehicles segment is predicted to foresee significant growth in the forecast years. Unmanned armored vehicles, also known as unmanned ground vehicles (UGVs), are a type of armored vehicle that can operate without a human operator on board. These vehicles are remotely controlled or can operate autonomously. They are equipped with various sensors and other advanced technology that allows them to perform various tasks. These vehicles can perform various tasks, including reconnaissance, surveillance, logistics, and combat operations. Unmanned armored vehicles are designed to operate in a wide range of environments and conditions and can be customized to meet specific mission requirements. They offer several advantages, including reduced risk to personnel, increased efficiency and cost savings, and improved performance and capabilities.

Point of Sale Insights

The OEM segment held the largest revenue share in 2024. As the demand for armored vehicles increases, OEMs are seeing a growing opportunity to expand their product offerings and cater to customers in the military, security, and law enforcement sectors. OEMs are partnering with armored vehicle manufacturers to provide integrated solutions that meet the needs of military and security customers. These partnerships often involve the OEM providing specialized components optimized for use in armored vehicles, such as engines, transmissions, and braking systems. By partnering with armored vehicle manufacturers, OEMs can leverage their expertise in designing and manufacturing high-quality components to create integrated solutions with superior performance and reliability.

The retrofit segment is anticipated to grow at the highest CAGR during the forecast period. Retrofitting existing vehicles with armor is often a cost-effective way to add protection to a fleet of vehicles, particularly for customers who may need more money to purchase new armored vehicles outright. The growth in retrofit armored vehicles is driven by cost-effectiveness, flexibility, faster turnaround times, upgrading existing vehicles, and increased customer demand. As the demand for armored vehicles continues to grow, retrofitting existing vehicles is likely to remain a popular option for customers who need to add protection to their fleet of vehicles.

System Insights

The fire control systems (FCS) segment held the largest revenue share in 2024. Fire control systems are designed to assist operators in accurately targeting and engaging enemy targets, increasing the effectiveness and lethality of armored vehicles in combat situations. In addition, as the threat environment continues to evolve, armored vehicle manufacturers invest in developing new FCS technology to stay ahead of the curve. It incorporates advanced artificial intelligence and machine learning algorithms to improve target identification, engagement accuracy, and speed.

The navigation systems segment is predicted to foresee significant growth in the forecast years. The growth of navigation systems has played a critical role in the growth of armored vehicles, enabling operators to navigate the terrain and reach their destinations safely and efficiently. As technology evolves, navigation systems will likely become even more advanced, providing operators with the information they need to complete their missions. Navigation systems are also becoming more advanced, with features such as route planning, real-time traffic updates, and other features that can help operators optimize their routes and avoid potential hazards. These advanced systems are essential for military and security applications, where armored vehicles are often used in complex or hazardous environments.

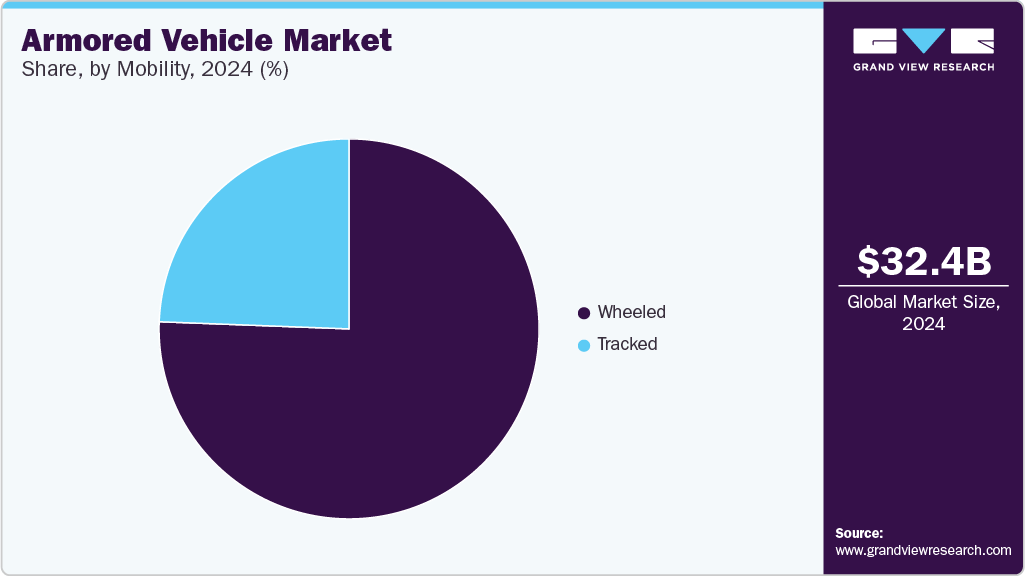

Mobility Insights

The wheeled segment held the largest revenue share in 2024. Wheeled armored vehicles offer greater mobility than tracked vehicles, particularly on roads and highways. This makes them ideal for rapid deployment in various environments, including urban areas. Wheeled armored vehicles typically have lower maintenance requirements than tracked vehicles, which can result in lower operating costs over the long term. As these vehicles evolve, they will become more advanced and capable, making them an increasingly important tool for military and security operations in various environments.

The tracked segment is predicted to foresee significant growth in the forecast years. These vehicles are typically used for military or security applications, such as combat operations, armored reconnaissance, and logistical support. Tracked vehicles are often designed to offer heavy armor protection, which makes them well-suited for combat operations and other high-risk situations. The tracks provide a low center of gravity, which improves stability and reduces the risk of tipping over. The heavy armor can protect the vehicle and its occupants from small arms fire, shrapnel, and other battlefield hazards. Tracked vehicles are a critical component of modern military and security operations, providing high mobility, protection, and firepower. Tracked vehicles will become even more capable and versatile as technology advances, allowing them to operate in a broader range of environments and conditions.

Regional Insights

North America armored vehicle industry accounted for a revenue share of over 25% in 2024 due to substantial military spending and strong demand from defense and homeland security agencies. The region’s focus on modernizing armored fleets, including upgrades to main battle tanks and combat vehicles, supports steady market expansion. Leading manufacturers such as General Dynamics, BAE Systems, and Oshkosh contribute advanced technologies and extensive production capabilities. High defense budgets ensure continuous procurement and development of next-generation armored vehicles.

U.S. Armored Vehicle Market Trends

The armored vehicle industry in the U.S. is expected to grow in 2024, driven by ongoing modernization programs targeting legacy platforms such as the M1 Abrams tank. The Department of Defense allocates significant funds for upgrading vehicle survivability, mobility, and firepower to meet future battlefield challenges. Expanding military operations and evolving security threats increase demand for advanced armored vehicles across various branches. Leading defense contractors invest heavily in research and development to deliver cutting-edge solutions.

Europe Armored Vehicle Market Trends

The armored vehicle market in Europe is expected to grow significantly over the forecast period due to increased defense budgets and modernization efforts across NATO member states. Countries such as Germany and France emphasize upgrading wheeled and tracked armored vehicles to enhance mobility and adaptability. Rising geopolitical tensions and the need for rapid deployment capabilities encourage investment in versatile military platforms. European manufacturers focus on integrating advanced protection systems and networked combat technologies.

Asia Pacific Armored Vehicle Market Trends

The armored vehicle industry in Asia Pacific dominated the market with revenue share of 33.2% in 2024 due to rising defense expenditures and growing indigenous production capabilities. Regional geopolitical tensions and modernization drives in countries like China, India, and Australia increase demand for advanced armored platforms. Joint ventures with global defense firms facilitate technology transfer and local manufacturing expansion. The large and diverse security environment fuels procurement across various vehicle types, including main battle tanks and armored personnel carriers.

Key Armored Vehicle Company Insights

Some key players in the armored vehicle industry, such as BAE Systems, BMW AG, and Daimler AG, are actively working to expand their customer base and gain a competitive advantage.

-

BAE Systems is a defense company specializing in designing, manufacturing, and supporting armored combat vehicles, including tracked, wheeled, and amphibious platforms. The U.S. Army's Armored Multi-Purpose Vehicle (AMPV) program replaces legacy vehicles like the M113. It complements the Bradley Fighting Vehicle, offering enhanced protection, mobility, and versatility across multiple mission roles. The AMPV family includes variants such as general purpose, mortar carrier, medical evacuation, and command vehicles, all designed to operate seamlessly within armored brigade combat teams.

-

Daimler AG develops and produces military commercial vehicles tailored for logistics and defense applications. Its portfolio includes rugged off-road vehicles like the Unimog and Zetros, designed to operate in challenging terrains with options for protected cabs and various configurations. Daimler emphasizes expanding its defense sector presence by broadening product offerings, enhancing sales and service networks, and forming strategic partnerships to meet diverse military requirements.

Key Armored Vehicle Companies:

The following are the leading companies in the armored vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- AE Systems

- BMW AG

- Daimler AG (Mercedes Benz)

- Elbit Systems

- Ford Motor Company

- General Dynamics Corporation

- INKAS Armored Vehicle OEM

- International Armored Group

- IVECO

- Krauss-Maffei Wegmann GmbH & Co. (KMW)

- Lenco Industries, Inc.

- Lockheed Martin Corporation

- Navistar, Inc.

- Oshkosh Defense, LLC

- Rheinmetall AG

- STAT, Inc.

- Textron, Inc.

- Thales Group.

Recent Developments

-

In May 2025, Arquus signed a deal to supply 12 Sherpa station wagon vehicles armed with Akeron missile launchers to the Cypriot National Guard. The contract follows successful 2022 trials in Cyprus testing the system's capabilities. The 11-ton Sherpa, configurable up to 6 meters long, can transport up to 10 personnel and is protected with NATO and EU-standard anti-communication Systems. It can be armed with a 12.7 mm machine gun or a 40 mm grenade launcher and is powered by a Euro 3 or Euro 5 engine delivering 215 horsepower, enabling a range of 900 km and a top speed of 120 km/h.

-

In February 2025, Tata Motors Limited introduced India’s first NATO-standard LAMV armored vehicle at the IDEX 2025 exhibition. This global launch marks a major milestone for India’s defense sector, showcasing its capabilities and boosting its position in the international armored vehicle market. Tata Motors Limited also announced plans to jointly produce vehicles in the UAE to expand its global footprint.

-

In April 2025, Axon Vision partnered with CZECHOSLOVAK GROUP a.s., through its subsidiary RETIA, a.s., to modernize European armored vehicle fleets. The collaboration began with integrating Axon Vision’s EdgeSA system into the PANDUR 8×8 EVO and expanded to other platforms, such as the TADEAS 6×6. The agreement signifies the beginning of a long-term strategic partnership focused on advancing armored vehicle capabilities and exploring broader defense opportunities across Europe.

Armored Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.21 billion

Revenue forecast in 2030

USD 44.56 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of operation, system, mobility, point of sale, product, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

BAE Systems; BMW AG; Daimler AG; Elbit Systems; Ford Motor Company; General Dynamics Corporation; INKAS Armored Vehicle OEM; International Armored Group; IVECO; Krauss-Maffei Wegmann GmbH & Co. (KMW); Lenco Industries, Inc.; Lockheed Martin Corporation; Navistar, Inc.; Oshkosh Defense, LLC; Rheinmetall AG; STAT, Inc.; Textron, Inc.; Thales Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Armored Vehicle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global armored vehicle market report based on product, type, mobility, mode of operation, point of sale, system, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Combat Vehicles

-

Armored Personnel Carrier (APC)

-

Infantry Fighting Vehicles (IFV)

-

Light Protected Vehicles (LPV)

-

Main Battle Tanks (MBT)

-

Mine-resistant Ambush Protected (MRAP)

-

Tactical Vehicle

-

Others

-

-

Combat Support Vehicles

-

Armored Supply Trucks

-

Armored Command & Control Vehicles

-

Repair & Recovery Vehicles

-

Unmanned Armored Ground Vehicles

-

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Electric Armored Vehicles

-

Conventional Armored Vehicles

-

-

Mobility Outlook (Revenue, USD Million, 2017 - 2030)

-

Wheeled

-

Tracked

-

-

Mode of Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Manned Armored Vehicles

-

Unmanned Armored Vehicles

-

-

Point of Sale Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Retrofit

-

-

System Outlook (Revenue, USD Million, 2017 - 2030)

-

Engines

-

Drive Systems

-

Communication Systems

-

Fire Control Systems (FCS)

-

Navigation Systems

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.