- Home

- »

- Next Generation Technologies

- »

-

Security Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Security Market Size, Share & Trends Report]()

Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (System, Service), By End-use (Commercial, Government, Industrial, Transportation, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-044-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Market Summary

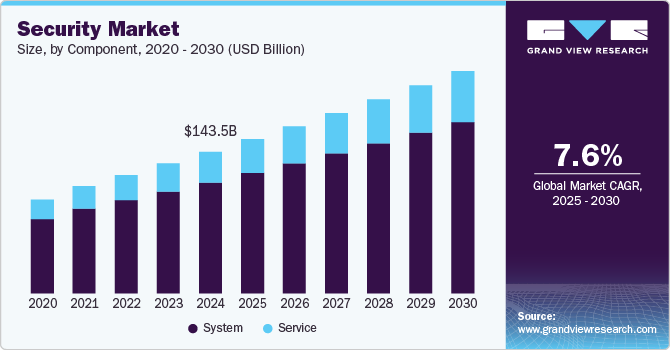

The global security market size was estimated at USD 143.55 billion in 2024 and is expected to reach USD 225.21 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. The increasing illegal events, terrorism, and fraudulent activities, across the globe and stringent government norms, has led to a rise in the adoption of security systems.

Key Market Trends & Insights

- North America security market dominated the industry with a revenue share of 32% in 2024.

- The security industry in the U.S. dominated the regional industry in 2024.

- On the basis of component, the system segment dominated the global market and accounted for a revenue share of over 77% in 2024.

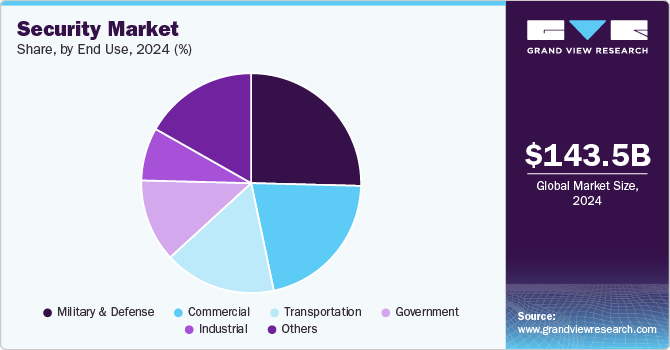

- On the basis of end-use, the military & defense segment dominated the global security market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 143.55 Billion

- 2030 Projected Market Size: USD 225.21 Billion

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2024

- Asia Pacific:Fastest growing market

The security systems offer several advantages such as maintaining records for information, monitoring activities in commercial & residential areas and empowering nations against terrorism & external threats at different locations. These systems have significant adoption rates in the military & defense end use industry, owing to the increased threat of terrorism and cross-border intrusions.

The security industry is a dynamic and rapidly expanding sector, driven by increasing concerns about physical safety, cybersecurity, and data privacy. As global economies become more interconnected and dependent on Component, the demand for advanced security solutions has surged across various domains, including residential, commercial, industrial, and governmental sectors. The market encompasses a wide range of products and services, such as surveillance systems, access control, cybersecurity tools, biometrics, and integrated solutions powered by artificial intelligence (AI) and Internet of Things (IoT) technologies. These innovations enhance real-time threat detection, streamline responses, and provide predictive analytics to prevent incidents before they occur.

Rapid technological advancements in the system such as use of security systems linked with internet, has enabled real-time surveillance at remote and critical locations with enhanced accuracy. Furthermore, it has increased the adoption rate of advanced security systems with better product features and improved performance. Also, the reduction of manpower involved in performing critical jobs at perilous locations, and replacing them with surveillance systems, is expected to fuel market growth.

Component Insights

The system segment dominated the global market and accounted for a revenue share of over 77% in 2024, primarily due to the widespread adoption of advanced surveillance, access control, and alarm systems across industries. These systems cater to rising security needs in residential, commercial, and industrial sectors, driven by increasing crime rates and regulatory mandates. Innovations such as AI-driven video analytics, biometric authentication, and IoT-enabled security devices have enhanced the effectiveness and efficiency of security solutions, further boosting demand. Additionally, the integration of cloud-based platforms for real-time monitoring and remote management has made these systems more accessible and scalable. The ongoing investment in smart infrastructure and urbanization projects has also significantly contributed to the segment's growth and prominence.

The service segment is expected to experience the fastest CAGR from 2025 to 2030. Organizations increasingly outsource security functions to specialized providers to address complex threats and reduce operational burdens. Services such as cybersecurity consulting, system integration, risk assessment, and 24/7 monitoring have become critical as businesses prioritize safeguarding digital and physical assets. The surge in cyberattacks, coupled with evolving regulatory requirements, has driven demand for incident response and compliance management services. Additionally, the adoption of subscription-based models for continuous support and updates has made security services more flexible and cost-effective.

End Use Insights

The military & defense segment dominated the global security market in 2024. Governments worldwide prioritized modernizing defense capabilities, including advanced surveillance, threat detection, and cybersecurity solutions, to address emerging challenges such as cyber warfare, terrorism, and border security. The integration of cutting-edge technologies like AI, unmanned aerial vehicles (UAVs), and space-based defense systems significantly enhanced operational efficiency and strategic decision-making. Additionally, increased spending on military-grade communication networks and missile defense systems bolstered the segment's growth. As nations focus on strengthening both conventional and hybrid warfare capabilities, the demand for robust, next-generation military and defense solutions continues to fuel this sector's prominence.

The transportation segment is expected to witness the fastest CAGR during the forecast period. Increasing threats of terrorism, smuggling, and unauthorized access to critical infrastructure spurred the adoption of advanced security technologies, including surveillance systems, biometric access control, and automated threat detection solutions. Governments and private operators invested heavily in upgrading transit hubs with AI-driven monitoring and integrated screening systems to ensure passenger safety and cargo integrity. The rise in global trade and travel further necessitated robust security protocols to prevent disruptions.

Regional Insights

North America security market dominated the industry with a revenue share of 32% in 2024 and is projected to grow at a significant CAGR over the forecast period, largely due to its advanced technological infrastructure and significant investments in security solutions. The U.S., in particular, leads the market with strong demand for both physical and cybersecurity systems across government, military, commercial, and industrial sectors. Increasing cyber threats, high-profile data breaches, and terrorism concerns have prompted businesses and governments to prioritize security. Furthermore, North America's adoption of cutting-edge technologies such as AI, IoT, and cloud-based security systems has driven innovation and the development of more sophisticated solutions.

U.S. Security Market Trends

The security industry in the U.S. dominated the regional industry in 2024. Rising concerns over cyberattacks, terrorism, and national security threats have driven significant investments in advanced security technologies, including AI-powered surveillance, biometric access control, and cybersecurity systems. The U.S. is also home to numerous leading security solution providers and has a strong focus on research and development, fostering innovation.

Europe Security Market Trends

The growing demand for security in Europe is attributed to regional businesses' strong focus on innovation, robust government support, and strategic initiatives to enhance technological infrastructure. With rising threats of cyberattacks, terrorism, and geopolitical instability, European nations have prioritized the adoption of advanced security technologies in both public and private sectors. The demand for surveillance systems, access control, and cybersecurity solutions is growing across industries such as banking, critical infrastructure, and transportation. Additionally, the European Union’s stringent data protection regulations, such as the GDPR, have further spurred investments in secure systems.

Asia Pacific Security Market Trends

The Asia Pacific security industry is expected to experience the fastest CAGR during the forecast period. As countries like China, India, and Japan invest heavily in infrastructure development, the demand for advanced security systems, including surveillance, access control, and cybersecurity solutions, has surged. The rise in digital transformation across businesses and government sectors in the region has further fueled the need for robust cybersecurity measures. Additionally, rising concerns about terrorism, political instability, and border security have led to greater adoption of both physical and digital security technologies. The rapid growth of smart cities and IoT integration also contributes to the region's substantial market share in security solutions.

Key Security Company Insights

Some key companies in the security industry include ASSA ABLOY; Apex Fabrication & Design, Inc.; and Apex Perimeter Protection.

-

ASSA ABLOY is a global leader in the security industry, specializing in access solutions, including locks, doors, and entrance systems. The company operates in more than 70 countries and is renowned for its innovative products in both physical and electronic security. ASSA ABLOY offers a wide range of solutions, from traditional mechanical locks to smart locks, access control systems, and key management solutions. The company serves various sectors, including residential, commercial, industrial, and institutional markets. With a strong emphasis on innovation and technology, ASSA ABLOY integrates IoT, cloud-based systems, and biometrics to provide secure, efficient, and scalable solutions.

-

Apex Perimeter Protection is a company specializing in advanced security solutions designed to protect the perimeters of critical infrastructure, properties, and high-security sites. The company focuses on providing robust physical security systems such as fencing, gates, barriers, and surveillance technologies to prevent unauthorized access and safeguard assets. Apex Perimeter Protection integrates cutting-edge technologies, including motion detection, video surveillance, and access control systems, to deliver comprehensive security solutions that can be tailored to various industries, including government, military, commercial, and residential sectors. Their services often include custom installations and ongoing maintenance, ensuring that perimeter security remains effective and adaptable to evolving threats. Apex's expertise in perimeter security solutions has established it as a key player in the global security industry.

Key Security Companies:

The following are the leading companies in the security market. These companies collectively hold the largest market share and dictate industry trends.

- ASSA ABLOY

- Apex Fabrication & Design, Inc.

- Apex Perimeter Protection

- Anixter Inc.

- Perimeter Protection Germany GmbH

- Johnson Controls

- Honeywell International, Inc.

- ZABAG Security Engineering GmbH

- Teledyne FLIR LLC

- Axis Communications AB

Recent Developments

-

In August 2024, Robert Bosch GmbH, a leading provider of innovative security and safety solutions, launched its India assembly line for video systems, featuring the FLEXIDOME IP Starlight 5000i cameras. This strategic initiative underscores Bosch India's commitment to localization and strengthens its position across various product verticals.

-

In May 2024, Hanwha VisionCo., Ltd. launched the AIB-800, an AI Box designed to transform any standard ONVIF-compatible video surveillance camera into an AI-powered analytics camera. The AI Box offers a cost-effective solution for businesses to upgrade their existing camera systems, allowing them to harness the advantages of AI without the need for system modifications or the complexities of full equipment replacement, according to the company.

-

In January 2024, Johnson Controls, the U.S.-based global leader in smart security solutions, launched its latest range of advanced security cameras, the Ilustra Standard Gen3. Designed and manufactured in India with over 75 percent localization, this new product line aligns with the company’s goal to fully produce its security solutions within the country in the coming years, supporting the government’s Make-in-India initiative.

Security Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 156.17 billion

Revenue forecast in 2030

USD 225.21 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ASSA ABLOY; Apex Fabrication & Design, Inc.; Apex Perimeter Protection; Anixter International, Inc.; Perimeter Protection Germany GmbH; Johnson Controls., Honeywell International, Inc.; ZABAG Security Engineering GmbH; Teledyne FLIR LLC; Axis Communications AB.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global security market report based on component, end use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

System

-

Access Control Systems

-

Alarm & Notification Systems

-

Intrusion Detection Systems

-

Video Surveillance Systems

-

Barrier Systems

-

Others

-

-

Service

-

System Integration & Consulting

-

Risk Assessment & Analysis

-

Managed Security Services

-

Maintenance & Support

-

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Government

-

Industrial

-

Military & Defense

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The increasing illegal events, terrorism, and fraudulent activities, across the globe and stringent government norms, has led to a rise in the adoption of security systems. Additionally, the rising number of smart cities has created the need for security systems.

b. The global security market size was estimated at USD 143.55 billion in 2024 and is expected to reach USD 156.17 billion in 2025.

b. The global security market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 225.21 billion by 2030.

b. Prominent players dominating the security market include ASSA ABLOY; Apex Fabrication & Design, Inc.; Apex Perimeter Protection; Anixter International, Inc.; Perimeter Protection Germany GmbH; Johnson Controls., Honeywell International, Inc.; ZABAG Security Engineering GmbH; Teledyne FLIR LLC; Axis Communications AB.

b. North America dominated the security market with a share of 32.6% in 2024, largely due to its advanced technological infrastructure and significant investments in security solutions. The U.S., in particular, leads the market with strong demand for both physical and cybersecurity systems across government, military, commercial, and industrial sectors. Increasing cyber threats, high-profile data breaches, and terrorism concerns have prompted businesses and governments to prioritize security.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.