- Home

- »

- Pharmaceuticals

- »

-

Artemisinin Combination Therapy Market Size Report, 2030GVR Report cover

![Artemisinin Combination Therapy Market Size, Share & Trends Report]()

Artemisinin Combination Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Artemether+Lumefantrine, Artesunate+Amodiaquine), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-592-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

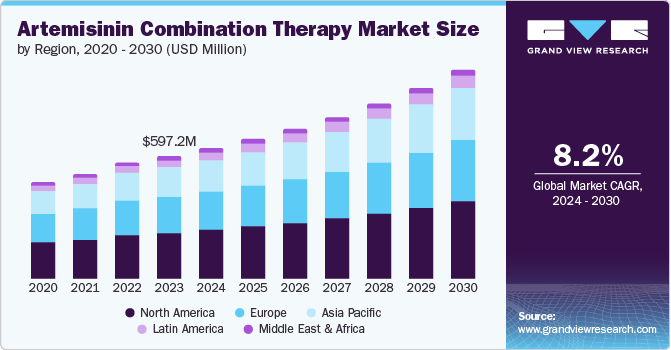

The global artemisinin combination therapy market size was valued at USD 597.2 million in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. It is attributed to the rising malaria in various regions. Malaria remains a significant public health challenge, with millions of cases reported annually. The increasing resistance of the malaria parasite, Plasmodium falciparum, to traditional monotherapies like chloroquine and sulfadoxine-pyrimethamine has necessitated the use of artemisinin combination therapy (ACT), which combines artemisinin with other antimalarial drugs to enhance efficacy and reduce the likelihood of resistance development.

Another factor driving the demand for ACT is its proven effectiveness in rapidly clearing parasitemia and reducing symptoms. Artemisinin, derived from the sweet wormwood plant (Artemisia annua), is a potent antimalarial compound that quickly reduces the parasite load in the patient's bloodstream. When combined with partner drugs, ACT increases treatment success rates and helps prevent the development of drug-resistant strains of malaria. The World Health Organization (WHO) recommends this combination therapy as the first-line treatment for uncomplicated P. falciparum malaria, further boosting its demand.

Additionally, global health initiatives and funding efforts have played a crucial role in increasing the accessibility and affordability of ACT. International organizations and governments have invested significantly in ensuring the widespread availability of ACT in malaria-endemic regions. Programs such as the Global Fund to Fight AIDS, tuberculosis, and malaria and partnerships with pharmaceutical companies have helped subsidize the cost of ACT, making it more accessible to those in need. These efforts, coupled with increasing public awareness and education about the benefits of ACT, have contributed to its growing demand worldwide.

Integrating ACT into national malaria control programs and guidelines has standardized its use across many countries. This formal endorsement and incorporation into public health strategies underscore the critical role of ACT in the ongoing fight against malaria. As countries strive to meet global malaria reduction and elimination targets, the reliance on effective treatments like ACT becomes even more pronounced, further driving up demand.

Type Trends

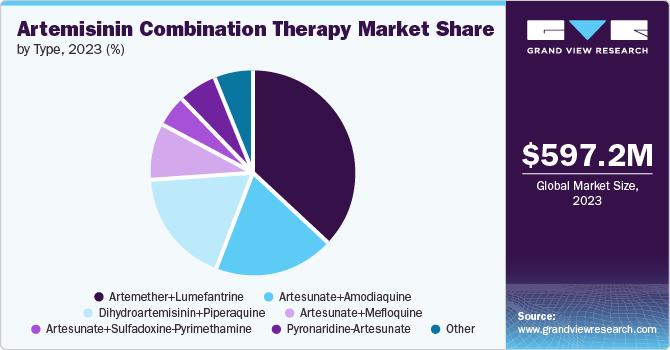

Artemether+Lumefantrine dominated the market and accounted for a share of 37.1% in 2023. The rising demand for Artemether+Lumefantrine can be attributed to its superior effectiveness and safety in treating uncomplicated malaria. The World Health Organization (WHO) highly recommends this combination therapy, and it is widely adopted in national malaria control strategies across endemic regions. Its ability to rapidly reduce the parasitic load and lower the risk of resistance development makes it a preferred choice over monotherapies. Additionally, the fixed-dose formulation of Artemether+Lumefantrine ensures consistent dosage and improves patient adherence, further boosting its popularity and usage in the market.

Pyronaridine-Artesunate segment is expected to grow at the fastest CAGR of 14.8% over the forecast period. The Pyronaridine-Artesunate segment is expected to see a rise in demand due to its effectiveness against uncomplicated and drug-resistant malaria strains. This combination therapy is gaining preference for its potent antimalarial properties and well-established safety profile, contributing to higher patient compliance. The ease of administration and a simplified dosing regimen make it an attractive option for large-scale malaria treatment programs. Furthermore, increased backing from global health organizations and national malaria control initiatives underscores its importance in combating malaria. As awareness and accessibility grow, the demand for Pyronaridine-Artesunate is set to increase, driven by the ongoing need to tackle drug resistance in malaria-endemic regions.

Regional Trends

North America artemisinin combination therapy market held the largest market revenue share of 37.7% in 2023. The increasing demand is primarily due to the rising number of imported malaria cases and the need for effective treatment options. As global travel and immigration continue to grow, more individuals are arriving in North America from regions where malaria is endemic. This has led to a higher incidence of malaria cases diagnosed in the region, often in travelers or immigrants. The increased awareness among healthcare providers and public health officials about the efficacy of ACT in treating malaria cases has further driven its demand.

U.S. Artemisinin Combination Therapy Market Trends

The U.S. artemisinin combination therapy market dominated the regional market in 2023, due to the increase in malaria cases among travelers and immigrants who have been exposed to the disease in endemic regions. The country's public health and healthcare systems also emphasize ensuring access to the best available treatments, further driving the demand for ACT.

Europe Artemisinin Combination Therapy Market Trends

Europe artemisinin combination therapy market was identified as a lucrative region in 2023. The demand for ACT in Europe is rising primarily due to the region's commitment to global malaria eradication efforts and the increased incidence of travel-related malaria cases. Furthermore, regulatory approvals and healthcare policies supporting antimalarial therapies further boost the market growth.

Germany artemisinin combination therapy market is expected to grow rapidly in the coming years. Germany's advanced healthcare system and commitment to global health standards ensure that ACT is readily available and recommended for treating malaria, further boosting its demand. Public health awareness campaigns and increased knowledge among healthcare professionals about the benefits of ACT in preventing drug resistance and providing effective treatment also contribute to its growing use in Germany.

Asia Pacific Artemisinin Combination Therapy Market Trends

Asia Pacific artemisinin combination therapy market is anticipated to grow at the fastest CAGR over the forecast period. The demand for artemisinin combination therapy (ACT) in the Asia-Pacific region is increasing due to the resurgence of malaria and the growing resistance to traditional antimalarial drugs. This region, particularly Southeast Asia, is a hotspot for multidrug-resistant malaria strains, necessitating more effective treatments.

India artemisinin combination therapy market held a substantial market share in 2023. The Indian government and health organizations have been actively promoting ACT as the first-line treatment for plasmodium falciparum malaria, the most dangerous strain. This therapy is highly effective, reducing parasite resistance and improving patient outcomes. The rising awareness about ACT's efficacy, supported by national malaria control programs and international health agencies, has also increased demand.

Key Artemisinin Combination Therapy Company Insights

Some of the key companies in the artemisinin combination therapy market include Novartis AG, Sanofi S.A., Cipla Ltd., are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Novartis AG is a multinational pharmaceutical company focusing on developing, manufacturing, and marketing wide range of healthcare products. Company offers innovative medicines and generics and eye care products. Novartis has been actively investing in cutting edge technologies such as cell and gene therapy.

-

Sanofi S.A. is a multinational pharmaceutical company which majorly focuses on diabetes, cardiovascular diseases, rare diseases, oncology, immunology and vaccines. Sanofi is a significant manufacturer in antimalarial drug artesunate-amodiaquine developed in partnership with drugs for neglected disease initiative.

Key Artemisinin Combination Therapy Companies:

The following are the leading companies in the artemisinin combination therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Sanofi S.A.

- Cipla Ltd.

- KPC Pharmaceuticals

- Fosun Pharmaceutical (Guilin Pharmaceutical)

- Ajanta Pharma

- Ipca Laboratories Ltd.

- Desano Inc.

- Hovid Berhad

- Mylan

Artemisinin Combination Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 635.0 million

Revenue forecast in 2030

USD 1,018.7 million

Growth Rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Norway,Sweden,Denmark, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, UAE, Kuwait, Saudi Arabia and South Africa

Key companies profiled

Novartis AG; Sanofi S.A.; Cipla Ltd.; KPC Pharmaceuticals; Fosun Pharmaceutical (Guilin Pharmaceutical); Ajanta Pharma; Ipca Laboratories Ltd.; Desano Inc.;Hovid Berhad; Mylan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artemisinin Combination Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the artemisinin combination therapy market report based on type and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Artemether+Lumefantrine

-

Artesunate+Amodiaquine

-

Dihydroartemisinin+Piperaquine

-

Artesunate+Mefloquine

-

Artesunate+Sulfadoxine-Pyrimethamine

-

Pyronaridine-Artesunate

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.