- Home

- »

- Medical Devices

- »

-

Arterial Cannula Market Size & Share, Industry Report, 2030GVR Report cover

![Arterial Cannula Market Size, Share & Trends Report]()

Arterial Cannula Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (ECMO, Cardiopulmonary Bypass Surgery), By Size (20-22 Fr, 35-36 Fr), By End-use (Hospitals, ASCs), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-996-9

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Arterial Cannula Market Size & Trends

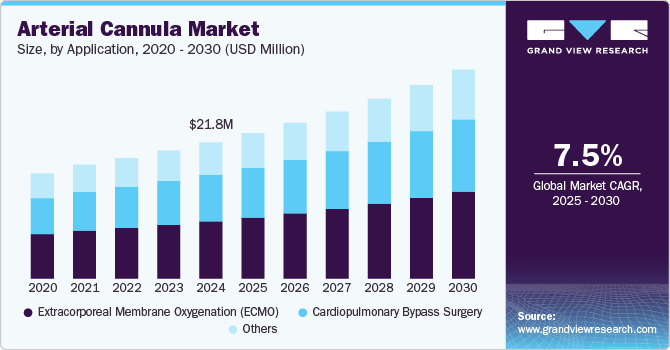

The global arterial cannula market size was estimated at USD 21.8 million in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. The growing incidence of chronic conditions necessitating procedures such as cardiopulmonary bypass surgery (CABG), dialysis, and Extracorporeal Membrane Oxygenation (ECMO) is a key factor driving arterial cannula demand. The preference for minimally invasive techniques is increasing due to benefits such as shorter recovery times and reduced pain. In addition, advancements in minimally invasive surgeries and the creation of innovative, biocompatible cannula materials further boost market growth.

The rising prevalence of cardiovascular diseases significantly fuels demand for arterial cannulas. Cardiovascular conditions remain the leading cause of mortality globally, accounting for nearly 18.6 million deaths annually, according to the World Health Organization (WHO). Procedures such as CABG and ECMO have become increasingly common to manage severe cardiac and respiratory conditions. The COVID-19 pandemic further highlighted the importance of ECMO therapy, leading to a surge in arterial cannula usage for critically ill patients. Dialysis also contributes to market growth, driven by the growing incidence of end-stage renal disease and chronic kidney conditions.

Minimally invasive techniques are gaining popularity due to their advantages, such as shorter recovery times, reduced scarring, and lower risks of complications. These procedures heavily depend on advanced arterial cannula designs, including biocompatible materials that minimize the risk of infection and enhance patient outcomes. Innovations in manufacturing have introduced arterial cannulas with improved flexibility and durability, further driving their adoption. Hospitals and cardiac care centers dominate the market as primary users, given the increasing number of surgeries and specialized care they provide.

According to a research study published in the European Journal of Preventive Cardiology, the official journal of the European Association of Preventive Cardiology, more than 90 percent of people with type 2 diabetes (T2D) are at high risk of fatal heart disease or stroke within 10 years. Thus, an increase in risk factors, such as diabetes and hypertension, is likely to lead to a rise in the prevalence of Cardiovascular Diseases (CVDs), which will boost the product demand over the forecast period. An increasing geriatric population that is highly vulnerable to developing chronic diseases is also contributing to the growth of industry. According to the U.S. Census Bureau, there were about 40.3 million U.S. residents aged 65 years and older in 2010 and the number rose to 54.1 million in July 2019.

Geographically, North America leads the arterial cannula market due to advanced healthcare infrastructure, high prevalence of chronic diseases, and widespread adoption of innovative medical technologies. The U.S., in particular, represents a significant share of the market, with over 500,000 CABG surgeries performed annually. Europe follows closely, driven by similar factors and a growing elderly population that demands cardiovascular interventions. Meanwhile, the Asia Pacific region is emerging as a lucrative market due to improving healthcare facilities, increasing medical tourism, and rising awareness of advanced surgical techniques. Countries such as India and China are witnessing rapid growth as they expand healthcare access to broader populations.

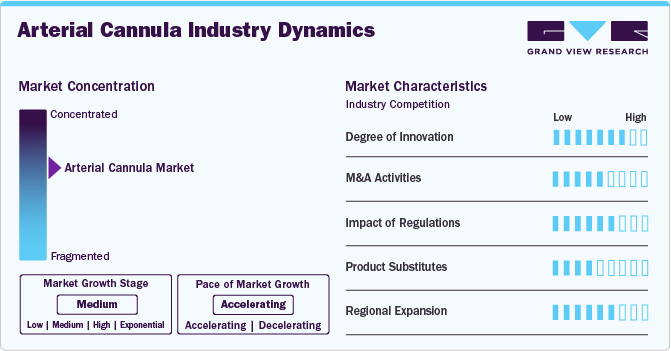

Market Concentration & Characteristics

The arterial cannula industry is moderately concentrated, with key players such as Medtronic, Terumo Corporation, and Edwards Lifesciences dominating the market. These companies focus on innovation, offering advanced biocompatible materials and minimally invasive designs to enhance patient outcomes. The industry is characterized by high regulatory standards, requiring rigorous testing for safety and efficacy. Technological advancements and strategic collaborations drive competition, while emerging players contribute to market diversity.

The arterial cannula industry demonstrates a high degree of innovation, driven by advancements in materials, designs, and manufacturing technologies. Biocompatible materials enhance patient safety, while innovations in minimally invasive cannulas improve procedural efficiency and recovery times. Companies invest heavily in R&D to develop flexible, durable, and precision-engineered products for specialized applications, such as ECMO and CABG procedures. The integration of advanced coatings to reduce infection risks and advancements in catheterization techniques further highlight the sector's innovation. Collaborative efforts among manufacturers, healthcare providers, and research institutions accelerate innovation, ensuring the industry meets evolving clinical demands and enhances patient outcomes globally.

Regulations significantly impact the arterial cannula industry by ensuring product safety, efficacy, and quality. Strict guidelines from agencies such as the FDA and European Medicines Agency (EMA) govern manufacturing, testing, and approval processes. Compliance with ISO standards for medical devices is essential, increasing production costs and timelines but enhancing reliability. Regulatory scrutiny over biocompatibility and infection risks drives innovation and improvements. Non-compliance can lead to recalls, impacting market reputation and revenue. Conversely, meeting regulatory requirements fosters consumer trust and global market access. Evolving healthcare policies and regional regulatory disparities present challenges, influencing market dynamics and driving continuous quality enhancement efforts.

The arterial cannula industry has witnessed a moderate level of mergers and acquisitions (M&A) activity, primarily driven by the need for market consolidation, technological advancements, and expansion of product portfolios. Leading players such as Medtronic and Edwards Lifesciences actively acquire smaller firms with innovative technologies to enhance their competitive edge. M&A activities enable companies to access advanced manufacturing capabilities, strengthen global distribution networks, and capitalize on emerging market opportunities.

In the arterial cannula industry, substitutes are limited but include alternative devices such as venous cannulas, percutaneous catheters, and advanced vascular access technologies. While these alternatives cater to specific procedures, they may lack the versatility and efficacy of arterial cannulas in critical applications such as ECMO, CABG, and dialysis. Emerging innovations, such as minimally invasive devices or bioengineered grafts, pose potential substitution threats but are not yet widely adopted. The preference for arterial cannulas remains strong due to their established clinical outcomes and compatibility with diverse procedures, limiting the impact of substitutes on market demand in the short to medium term.

The arterial cannula industry is expanding regionally, driven by rising healthcare investments and disease prevalence. In Asia Pacific, countries such as India and China see growing demand due to increasing cardiovascular and diabetes cases, alongside improving healthcare infrastructure. In Latin America, public health initiatives and access to advanced surgical tools fuel growth. Developed regions such as North America and Europe lead due to technological advancements and strong healthcare systems, while the Middle East sees demand rise from chronic disease management and healthcare modernization. Regional collaborations, favorable policies, and strategic market entries by global players further accelerate growth in emerging and underserved markets.

Application Insights

The ECMO segment dominated the global industry in 2024 and accounted for the maximum share of more than 42.0% of the overall revenue. This can be attributed to the high prevalence of cardiac diseases and lung failures. According to the American Lung Association’s estimated data in 2022, around 37 million Americans live with chronic lung disease such as COPD and asthma, which includes chronic bronchitis and emphysema. About 15 million American adults have been diagnosed with COPD, an obstructive lung disease that over time makes it harder to breathe.

This suggests that the increasing burden of respiratory diseases that may eventually result in lung failure is the major factor contributing to the dominance of the ECMO segment. On the other hand, cardiopulmonary bypass surgery is expected to be the fastest-growing segment over the forecast period. This is due to the rising prevalence of cardiac diseases that require cardiopulmonary bypass surgery. According to a research article, published by the National Centers for Biotechnology Information published in May 2022, almost 400,000 CABG surgeries are performed annually making it the most commonly performed major surgical procedure.

Size Insights

The 20-22 Fr size segment dominated the global industry in 2024 and accounted for the highest share of more than 23.1% of the overall revenue. The high share of the segment can be attributed to an increase in the adoption of cannulas of this size while carrying out ECMO procedures. The demand for these cannulas experienced a sudden rise during the pandemic as a higher number of patients required ECMO, especially those who were infected with the virus.

While selecting the size, the general rule that healthcare professionals need to abide by is to select the smallest possible size but the one which allows effective drainage. The 23-25 Fr size segment accounted for the second-highest revenue share of the global industry in 2024. This was due to the wide usage of these cannulas in cardiopulmonary bypass surgeries. On the other hand, the 35-36 Fr size segment is estimated to register the fastest growth rate during the forecast period.

End use Insights

The hospitals segment dominated the industry in 2024 and accounted for the highest share of more than 55.5% of the overall revenue. This was mainly attributed to a large number of surgeries being performed in these settings. In addition, the availability of all types of skilled professionals and surgical instruments is expected to fuel the segment's growth. The rising number of admissions due to an increasing number of chronic disorders is also expected to propel the segment growth over the forecast period.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to witness notable growth during the forecast period, driven by a rising preference for surgeries in ASCs. Key factors include lower overall costs and shorter post-surgery hospital stays. In addition, supportive government policies bolster this trend. For example, in early 2021, the Centers for Medicare and Medicaid Services expanded ASC coverage to include cardiac interventions such as endovenous ablation, catheterization, and pacemaker placements.

Regional Insights

The North American arterial cannula market dominated with a revenue share of 40.45% in 2024 due to advanced healthcare infrastructure, high surgical procedure rates, and a growing elderly population. Increasing adoption of minimally invasive surgeries and the prevalence of cardiovascular diseases have driven demand for arterial cannulas. The U.S. leads the market, supported by strong R&D investments and technological advancements. In addition, the presence of key manufacturers ensures innovation and accessibility. Favorable reimbursement policies and an emphasis on patient safety further enhance market growth. These factors position North America as a key player in the global arterial cannula market, maintaining its leadership in the segment.

U.S. Arterial Cannula Market Trends

The U.S. arterial cannula market held a significant share of North America's arterial cannula market in 2024. The U.S. arterial cannula market is one of the largest and fastest-growing segments within the global market, driven by the increasing prevalence of chronic conditions such as diabetes. According to the CDC, there were 7,433 dialysis facilities in the U.S. in 2018, with 518,749 patients undergoing dialysis, averaging about 70 per facility. In addition, pulmonary diseases such as COPD and asthma, which can lead to lung failure, are notably prevalent in the region, further contributing to the demand for arterial cannulas.

Europe Arterial Cannula Market Trends

Europe arterial cannula market dominates driven by advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and an aging population. With over 50 million people living with cardiovascular conditions in Europe, demand for arterial cannulas continues to rise.

The UK arterial cannula market is steadily growing, supported by government initiatives focused on investing in diabetes care and research to enhance treatment options for diabetic patients. The increasing number of diabetes cases in the region is a key factor driving market expansion. According to Diabetes UK, over 4.3 million people in the UK are affected by diabetes, with an additional 850,000 individuals potentially living undiagnosed.

The arterial cannula market in France is growing due to the rising prevalence of cardiovascular diseases and diabetes. Advancements in medical technologies and the increasing adoption of minimally invasive procedures further drive demand. In addition, France’s strong healthcare infrastructure and a focus on improving patient outcomes contribute to market expansion.

The German arterial cannula market is primarily driven by the growing prevalence of diabetes, with approximately 7.5 million people affected, according to the International Diabetes Federation. This increase in diabetic patients contributes to a higher demand for vascular procedures, boosting the need for arterial cannulas in medical treatments.

Asia Pacific Arterial Cannula Market Trends

The Asia Pacific arterial cannula market is expected to experience strong growth during the forecast period. Factors such as the rising prevalence of cardiovascular diseases, diabetes, and an aging population are driving demand for arterial cannulas. In addition, improving healthcare infrastructure, increasing access to advanced medical technologies, and a growing focus on minimally invasive procedures contribute to market expansion. Countries such as China, India, and Japan are witnessing significant adoption of arterial cannulas in both public and private healthcare sectors. The region's expanding healthcare access and rising awareness of advanced treatment options position it as a key growth area.

The arterial cannula market in Japan is experiencing growth, driven by continuous technological advancements in medical devices. Innovations in biocompatible materials and minimally invasive techniques enhance patient outcomes, while Japan's robust healthcare infrastructure and increasing demand for cardiovascular procedures further contribute to the market's expansion.

The arterial cannula market in China is anticipated to grow quickly, driven by the increasing number of diabetic patients in the region. According to the 2020 edition of the Guidelines for the Prevention and Treatment of Diabetes in China, the prevalence of diabetes among adults stands at 11.2%, with an estimated 141 million people affected. Furthermore, about 51.7% of these individuals remain undiagnosed. This growing diabetic population is a key factor fueling the expansion of the arterial cannula market in China.

India's arterial cannula market is growing significantly due to its high diabetes prevalence, with over 77 million affected individuals, ranking among the world's highest. This surge drives demand for vascular procedures, including arterial cannulation, supported by advancements in minimally invasive techniques and improving healthcare infrastructure across the country.

Latin America Arterial Cannula Market Trends

The Latin American arterial cannula market is growing rapidly, fueled by increasing diabetes prevalence, affecting nearly 32 million adults in the region (IDF, 2023). Diabetes-related complications drive demand for vascular procedures, including arterial cannulation, supported by expanding healthcare access and advancements in minimally invasive surgical techniques.

Middle East & Africa Arterial Cannula Market Trends

The arterial cannula market in the Middle East and Africa (MEA) is expected to grow significantly, driven by an increasing prevalence of chronic conditions such as cardiovascular diseases and diabetes. According to the International Diabetes Federation, the MEA region had 73 million adults living with diabetes in 2021, with numbers projected to rise. In addition, growing investments in healthcare infrastructure and the adoption of advanced medical technologies are supporting market growth. The demand for minimally invasive techniques further boosts the arterial cannula market in the region.

The arterial cannula market in Saudi Arabia is growing due to increasing cardiovascular disease prevalence, an aging population, and advancements in healthcare infrastructure. Rising adoption of minimally invasive surgeries and government investments in modern medical technologies further drive demand, positioning the country as a key market in the Middle East region.

Key Arterial Cannula Company Insights

The competitive scenario in the arterial cannula market is highly competitive, with key players such as Medtronic plc., Inc., Getinge AB and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Arterial Cannula Companies:

The following are the leading companies in the arterial cannula market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic, plc.

- LivaNova plc

- Edward Lifesciences

- Getinge AB

- Fresenius Medical Care

- BD

- Nipro Corp.

- Andocor

- Freelife Medical GmbH

- Surgical Holdings

- Kangxin Medical

Recent Developments

-

In September 2024, Shockwave Medical has expanded its U.S. peripheral intravascular lithotripsy (IVL) portfolio by introducing an enhanced catheter, designed for treating calcified arterial lesions. This advancement underscores the growing innovation in vascular care, directly benefiting arterial cannula applications by supporting procedures requiring precision and addressing complex vascular conditions effectively.

-

In April 2024, The FDA has announced a recall of Arrow QuickFlash Radial Artery Catheterization Kits due to potential device malfunctions that could pose safety risks. This highlights the importance of stringent quality standards in arterial cannula manufacturing to ensure reliability and safety in procedures like arterial line placement and catheterization.

Arterial Cannula Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.3 million

Revenue forecast in 2030

USD 33.4 million

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic, plc; LivaNova plc; Edward Lifesciences; Getinge AB; Fresenius Medical Care; BD; Nipro Corp.; Andocor; Freelife Medical GmbH; Surgical Holdings; Kangxin Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arterial Cannula Market Report Segmentation

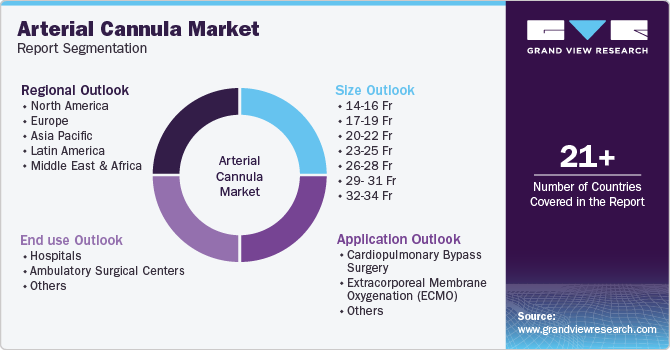

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global arterial cannula market report on the basis of application, size, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiopulmonary Bypass Surgery

-

Extracorporeal Membrane Oxygenation (ECMO)

-

Others

-

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

14-16 Fr

-

17-19 Fr

-

20-22 Fr

-

23-25 Fr

-

26-28 Fr

-

29- 31 Fr

-

32-34 Fr

-

35-36 Fr

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global arterial cannula market size was estimated at USD 21.8 million in 2024 and is expected to reach USD 23.3 million in 2025.

b. The global arterial cannula market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 33.4 million by 2030.

b. North America dominated the arterial cannula market with a share of 40.5% in 2024. This is attributable to the increasing prevalence of cardiac surgeries and chronic kidney diseases and increasing healthcare expenditure.

b. Some key players operating in the arterial cannula market include Medtronic, plc., LivaNova plc, Edward Lifesciences, Getinge AB, Fresenius Medical Care, BD, Nipro Corporation, Andocor, Freelife Medical GmbH, Surgical Holdings, and Kangxin Medical.

b. Key factors that are driving the arterial cannula market growth include an increasing number of surgical procedures, advancements in minimally invasive surgeries and increasing prevalence of chronic diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.