- Home

- »

- Medical Devices

- »

-

Artificial Corneal Implants Market Size & Share Report, 2030GVR Report cover

![Artificial Corneal Implants Market Size, Share & Trends Report]()

Artificial Corneal Implants Market (2023 - 2030) Size, Share & Trends Analysis Report By Transplant Type (Hard Keratoprosthesis, Soft Keratoprosthesis), By Indication (Ocular Burns, Keratoconus), By Implant Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-022-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Corneal Implants Market Summary

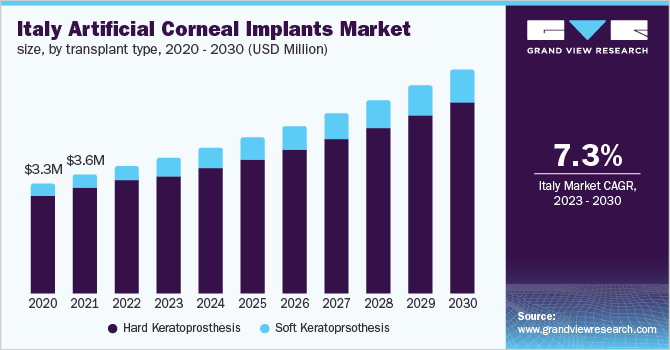

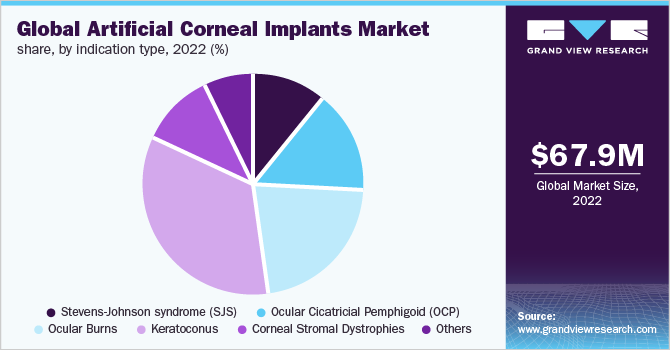

The global artificial corneal implants market size was estimated at USD 67.9 million in 2022 and is projected to reach USD 118.4 million by 2030, growing at a CAGR of 7.1% from 2023 to 2030. The increasing prevalence of corneal disorders, increasing demand for corneal transplants, and shortage of human corneas are significant factors driving the demand for the artificial corneal implants market.

Key Market Trends & Insights

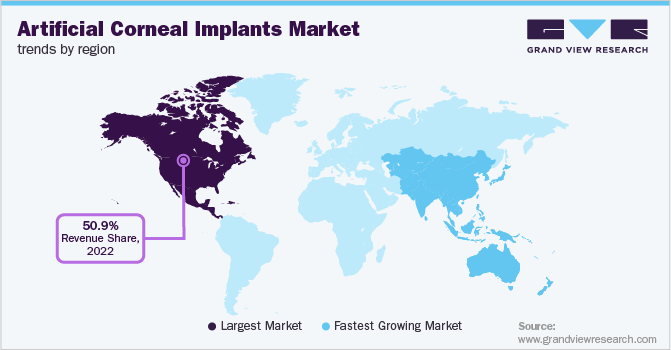

- North America dominated the artificial corneal implants market with the largest revenue share of 50.9% in 2022.

- Asia Pacific, the market is expected to experience maximum CAGR over the forecast period.

- By transplant, the hard keratoprosthesis segment dominated the market and accounted for a revenue share of 87.47% in 2022.

- By indication, In 2022, the keratoconus segment held the highest market share of 33.93%.

- By implant type, the synthetic segment dominated the market and accounted for a revenue share of 93.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 67.9 Million

- 2030 Projected Market Size: USD 118.4 Million

- CAGR (2023-2030): 7.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The COVID-19 pandemic had a significant negative impact on the artificial corneal implants market. The lockdowns and restrictions implemented by governments had a major impact on the market. With changes in healthcare priorities and the healthcare professionals dedicatedly working to treat and control the spread of the virus, elective surgeries were either canceled or postponed.

Moreover, in order to control the spread of the virus and as a preventive measure, many people avoided visits to hospitals or any other healthcare setting. This resulted in an overall drop in the number of corneal transplants that were carried out during the pandemic, which led to a negative impact on the market. However, due to the presence of a huge patient pool and a rising number of product launches, the artificial corneal implants market recovered at a great pace. In addition, with an increased focus on R&D in the healthcare sector by governments, the market is further expected to flourish over the forecast period.

The market is predominantly driven by a rise in the prevalence of eye disorders. An increase in the occurrence of eye-related disorders, such as keratoconus, ocular cicatricial pemphigoid, corneal stromal dystrophies, and infectious keratitis, is a major market driver. Studies suggest that Keratoconus affects approximately 50 to 200 per 100,000 individuals. In the U.S., the prevalence is about 54.5 per 100,000 individuals.

Corneal blindness is the third leading cause of blindness after glaucoma and cataract, affecting 10 million people globally. According to a research article published by the Eye Bank Association of America in 2021, an estimated 200,000 corneal implant procedures are performed annually. Artificial corneal implantation typically applies to patients who are not suited for a living corneal transplant from a human donor to regain their vision.

According to an article from Harvard Medical School, about 12.7 million individuals worldwide are waiting for corneal transplants, implying that only 1 in every 70 persons in need of a transplant is treated. Significant attempts have been made to create alternatives to human donor corneas to address the scarcity of donor tissue and the problems associated with corneal donor transplantation, thus augmenting the adoption of artificial corneal implants.

Furthermore, in low-risk patients with corneal blindness, corneal transplantation is successful, but it frequently fails in high-risk patients with recurring or chronic inflammatory disorders, as well as glaucoma. Another major factor driving the market growth is the large patient pool and limited supply of donors.

Transplant Type Insights

The hard keratoprosthesis segment dominated the market and accounted for a revenue share of 87.47% in 2022. This is due to the higher adoption of these products, especially Boston Kpro. It is the most widely used artificial cornea and continued advances in design and superior postoperative care have resulted in improved outcomes and an exponential increase in the use of the device in recent years. According to a research paper published in 2022 by the department of ophthalmology of Harvard Medical School, there have been more than 11,000 implantations to date in 66 countries by 598 surgeons using Boston Kpro.

However, the soft keratoprosthesis segment is expected to experience maximum growth over the forecast period owing to new product launches. For instance, in February 2020, EyeYon Medical Ltd. announced Breakthrough Status Designation from the U.S. Food and Drug Administration (FDA) for its EndoArt, Artificial Endothelial Layer Implant. The company received CE Mark as well for its EndoArt Implant to treat chronic corneal edema in June 2021.

Indication Insights

In 2022, the keratoconus segment held the highest market share of 33.93% owing to the increasing prevalence of keratoconus worldwide. According to the Cancer Research Foundation of America, 1 in 5 keratoconus patients progresses to a stage where a corneal implant is needed to restore normal vision. The rising usage of artificial corneal implants in patients with keratoconus is further expected to drive segment growth over the forecast period.

The Ocular Cicatricial Pemphigoid (OCP) segment is projected to undergo maximum growth over the forecast period. Growing awareness regarding eye disorders is the major factor driving the growth of the segment. The ocular burns segment is also expected to undergo significant growth over the forecast period due to the growing number of burn cases across different settings.

Implant Type Insights

The synthetic segment dominated the market and accounted for a revenue share of 93.7% in 2022. This is due to the higher presence of synthetic artificial corneal implants in the market as compared to biosynthetic products, thus leading to a higher adoption rate. Moreover, companies are focusing on developing artificial corneal implants that are synthetic. For instance, CorNeat Kpro, which is under clinical trials and is expected to launch in 2023, is a synthetic cornea, which provides a long-lasting medical solution for corneal blindness, pathology, and injury.

With an increasing number of manufacturers focusing on developing synthetic corneal implants and a strong product pipeline, the segment is expected to experience exponential growth as well. Moreover, due to this shift towards synthetic corneal implants, the biosynthetic segment is projected to experience limited growth over the forecast period.

End-use Insights

The hospital segment accounted for the highest revenue share of 57.5% in 2022 and is expected to register a lucrative CAGR over the forecast period. The presence of highly skilled surgeons and the rising number of patients are the factors expected to drive segment growth.

On the other hand, the ambulatory surgical center (ASC) segment is anticipated to register maximum growth over the forecast period. The growing popularity of Ambulatory Surgical Centers (ASCs) is expected to help the segment gain a significant share over the forecast period. Corneal implant procedures are performed on an outpatient basis in most care settings.

Regional Insights

North America dominated the artificial corneal implants market with the largest revenue share of 50.9% in 2022. The presence of a large patient pool, the availability of technologically advanced products that make the procedures simple, and a favorable reimbursement scenario are factors responsible for the dominance of the region in the global artificial corneal implants market. Moreover, the increasing focus of the regional governments on R&D activities is also significantly driving the growth of the market in this region. In addition, the shortage of human cornea despite having the highest number of donors in the U.S. is also expected to drive the artificial corneal implants market in this region.

In Asia Pacific, the market is expected to experience maximum CAGR over the forecast period. A large patient pool in countries like India and China, the presence of manufacturers, and the regional launch of products are factors driving the growth of the market in this region. Moreover, growing awareness regarding ocular disorders and increasing disposable income are also contributing to significant growth of the market.

Key Companies & Market Share Insights

In order to establish a strong position and strengthen their overall presence, manufacturers in the market are concentrating on carrying out various strategic initiatives. This includes partnerships & collaborations, acquisitions & mergers, expansions, and increasing investment in R&D.

Key players in the market are focusing on launching new products in the market and receiving regulatory approvals in different countries in order to expand the reach of their products and generate higher revenue. For instance, in June 2021, after clinical trials established the safety and efficacy for treating chronic corneal edema, EyeYon received CE Mark for its EndoArt, the world's first and only synthetic implant that replaces the human endothelium, which cannot be regenerated by the human body. Some of the prominent players in the global artificial corneal implants market include:

-

FCI Ophthalmics, Inc.

-

Beijing Microkpro Medical Instrument Co. Ltd.

-

DIOPTEX Medizinprodukte Forschungs

-

KeraMed, Inc.

-

EyeYon

Artificial Corneal Implants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 72.80 million

Revenue forecast in 2030

USD 118.4 million

Growth Rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transplant type, indication, implant type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; Japan; China; South Korea; Thailand; Australia; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

FCI Ophthalmics, Inc.; Beijing Microkpro Medical Instrument Co. Ltd.; DIOPTEX Medizinprodukte Forschungs; KeraMed, Inc.; and EyeYon

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Corneal Implants Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global artificial corneal implant market report on the basis of transplant type, indication, implant type, end-use, and region:

-

Transplant Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard Keratoprosthesis

-

Boston Kpro

-

Osteo-Odonto-Keratoprosthesis

-

-

Soft Keratoprosthesis

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Stevens-Johnson syndrome (SJS)

-

Ocular Cicatricial Pemphigoid (OCP)

-

Ocular burns

-

Keratoconus

-

Corneal stromal dystrophies

-

Others

-

-

Implant Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Biosynthetic

-

-

Implant End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Centers

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Thailand

-

Australia

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global artificial corneal implants market size was estimated at USD 67.9 million in 2022 and is expected to reach USD 72.80 million in 2023.

b. The global artificial corneal implants market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 118.4 million by 2030.

b. North America dominated the artificial corneal implants market with a share of 50.9% in 2022. This is attributable to the presence of large patient pool, availability of technologically advanced products and favorable reimbursement scenario.

b. Some key players operating in the artificial corneal implants market include FCI Ophthalmics, Inc., Beijing Microkpro Medical Instrument Co. Ltd., DIOPTEX Medizinprodukte Forschungs, KeraMed, Inc. and EyeYon.

b. Key factors that are driving the artificial corneal implants market growth include increasing prevalence of corneal disorders, increasing demand for corneal transplants and shortage of human corneas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.